CWS Market Review – November 17, 2017

“I’m always fully invested. It’s a great feeling to be caught with your pants up.”

– Peter Lynch

Wall Street has been in a slightly sour mood lately. Of course, I mean this in a relative sense. Volatility is still low—very low, in fact.

Until last week, the S&P 500 had climbed for eight weeks in a row. So within that context, four daily drops in five days does seem to stand out. The damage was a little over 1%. Again, that’s barely a speck, but it seems like more when compared to the serene market we’ve had since late August. This week, the S&P 500 snaps a streak of 54 days in a row of closing within 1% of its all-time high. That was the longest such streak in half a century. That’s what investing is like in 2017.

More good news for our Buy List this week. We had a very good earnings report from Smucker. The jelly stock jumped nearly 10% on Thursday. We also had a very good earnings beat from Ross Stores. I don’t know yet how the shares opened on Friday, but ROST was up more than 7% in Thursday’s after-hours market.

I’ll run through both reports in just a bit, plus I’ll preview next week’s earnings report from Hormel Foods. The Spam stock has been hot lately (up 9.2% since October 30). I’ll also have some updates on our Buy List. But first, let’s look at some recent news on the economy.

Wall Street Wraps up Another Good Earnings Season

Overall, the third-quarter earnings season was a good one for Wall Street. This was the 23rd consecutive quarter that exceeded expectations. This earnings season was especially good for the tech sector. The Financial Times noted that four mega-cap tech stocks were responsible for half of the earnings beat for Q3. The big four are Apple, Alphabet, Facebook and our very own Microsoft. The tech sector has been such a big winner (+37% YTD) that it’s more than doubled the second-place sector (healthcare +18%).

The Federal Reserve will almost certainly raise interest rates next month, but what about after that? As I’ve said before, I’m not terribly worried about the first few rate increases, but I do think the Fed has less room to work with than they may realize. The futures market currently thinks another hike will happen by June (and possibly by March).

There continues to be little to worry about on the inflation front. This week, we learned that inflation was calm last month. The CPI rose by just 0.1%, and the “core rate,” which excludes food and energy prices, also rose by 0.1%. In the last year, core inflation is running at 1.8%. That’s still below the Fed’s target of 2%. Bottom line: I just don’t see what the Fed is so worried about. The jobs market is humming and prices are steady.

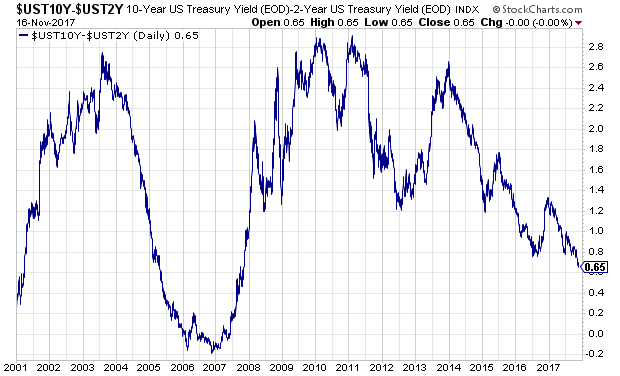

But here’s what worries me. The spread between the two- and 10-year Treasuries narrowed to just 65 basis points this week. The spread hasn’t been that narrow in ten years. I would expect to see the spread tighten after the rate increases. Historically, when the 2/10 spread gets to 0%, economic weakness isn’t far behind.

So any trouble is off in the distance, but it’s there. The overall market and economy are doing fairly well. For example, this week we learned that retail sales rose 0.2% in October. In the last year, they’re up 4.6%. Taking out gasoline, retail sales rose by 0.4% in last month. The industrial production report showed an increase of 0.9% for October. Economists had been expecting a rise of 0.5%.

I expect a calm market for the rest of the year. This is a good time for investors to make sure they’re well-diversified and that they hold high-quality stocks. As always, our Buy List is a great place to start. As a whole, our Buy List has been leading the market since late summer (we lagged during Q2 earnings season). Now let’s turn to this week’s strong earnings reports from our Buy List.

Smucker Soars 10% on Strong Earnings

On Thursday morning, JM Smucker (SJM) released a very positive earnings report. The jelly folks beat Wall Street’s consensus thanks to higher prices for several of their product lines. For their fiscal Q2, the company earned $2.02 per share last quarter, beating estimates by 12 cents per share.

“We are pleased with our second-quarter results, primarily driven by our pet-food business and the strong performance of a number of key brands across all our businesses,” said Mark Smucker, Chief Executive Officer. “This included double-digit sales increases for Nature’s Recipe® dog food, Dunkin’ Donuts® coffee, and Jif®peanut butter. We also experienced continued strong growth of our brands in e-commerce, as sales in this channel doubled in the quarter for our U.S. retail segments. We are confident in the ability of our brands to win in the rapidly changing retail environment. In addition, we remain focused on achieving sustainable cost reductions that both support the bottom line and fuel investments in future growth.”

SJM’s coffee business is still struggling, but that’s not news. They raised coffee prices earlier this year, and that blew up in their face. What is new is the way the other divisions have picked up the slack. Smucker’s net income rose 10% to $194.6 million. I was pleased to see operating margins come in at 17.2%, compared with 15.8% last year.

This is a welcome earnings report because Smucker had been in a jam (Heh). They bombed their last earnings report, missing consensus by ten cents per share. This time, Smucker lowered the upper end of their full-year guidance by five cents per share. The company now expects full-year earnings of $7.75 to $7.90 per share. Smucker said that reflects higher anticipated freight cost for the rest of the fiscal year.

In Thursday trading, shares of SJM jumped 9.5% to close at $116.65 per share. The stock is still trying to make up for a lot of lost ground. Going on a simple valuation basis, the stock is trading for about 15 times earnings. JM Smucker remains a buy up to $118 per share.

Ross Stores Earns 72 Cents per Share

After the close on Thursday, Ross Stores (ROST) reported Q3 earnings of 72 cents per share. Previously, they gave us a range of 64 to 67 cents per share. Ross made 62 cents per share for Q3 last year.

Looking at the numbers, this was a solid quarter for Ross. Net sales rose 8% to $3.3 billion. Comparable-store sales rose 4%. That’s a key metric for retailers. Operating margins were 13.3%. That’s good for a retailer, especially for a deep discounter.

Barbara Rentler, Chief Executive Officer, commented, “Our third-quarter sales and earnings outperformed our expectations despite being up against our toughest prior-year comparisons and two major hurricanes during the quarter. We are pleased with these strong results, which reflect our continued market-share gains in a challenging retail environment. Operating margin of 13.3% was better than expected, mainly due to a combination of higher merchandise margin and leverage on above-plan sales.”

Now for guidance. A small note. Like other retailers, Ross uses 13-week quarters. That means, every so often, they’ll have a 14-week quarter and a 53-week fiscal year. Q4 happens to be a 14-weeker. For fiscal Q4, which ends on February 3, Ross expects earnings of 88 to 92 cents per share. That’s up from 77 cents for last year’s Q4, which was a 13-weeker. Ross estimates that the extra week for this quarter adds about eight cents per share. So even adjusting for that, Ross is growing nicely. Adding it all up, Ross expects to make between $3.24 and $3.28 per share for this fiscal year.

This was an excellent quarter for Ross. These numbers are especially good to see because ROST has had a tough time this year. From its December 2016 peak to its July 2017 trough, shares of ROST lost 24% even though nothing about the business changed. Folks are just scared of anything in retail not named Amazon. This week, I’m raising my Buy Below on Ross Stores to $73 per share.

Earnings Preview from Hormel Foods

Hormel Foods (HRL) is another stock that hasn’t joined in on the fun this year. In fact, though it’s been up lately, HRL is still down 5.4% this year. Consumer-staple stocks have been lagging the market badly since February 2016. These are classic defensive stocks which means they do well when things aren’t going well. The downside is that they lag when things are going well, like now.

It’s best to avoid trying to guess when these cycles change. Instead, investors should understand that every so often, good stocks fall out of style. The crowd always loves to follow the next big thing. Sometimes you’re surprised to find out that you already own it!

Hormel will report their fiscal Q4 earnings on Tuesday, November 21. Like Smucker, Hormel’s last earnings report wasn’t a great one. They made 34 cents per share which missed by three cents. So what caused the miss? The problem is that there’s been a surge in demand for bacon. Normally, that’s a good thing, but Hormel hasn’t been able to catch up with the cost change. Their CEO said that since April, pork-belly prices have doubled. Hormel said they probably will not be able to raise prices until October. As a result, the company’s profit margins got squeezed hard.

That’s not all. Hormel also had a poor quarter from their Muscle Milk unit which they’ve spent heavily on. Plus, their turkey unit continues to see poor sales. The silver lining is that Hormel’s grocery-store biz, with brands like Skippy Peanut Butter, is doing well. (By the way, Smucker owns Jif, so we have maximum peanut-butter exposure in our Buy List.)

In August, Hormel lowered its full-year guidance range to $1.54 to $1.58 per share from the previous range of $1.65 to $1.71 per share. For the first three quarters, Hormel made $1.17 per share, so their guidance means a Q4 range of 37 to 41 cents per share. Wall Street expects 40 cents per share.

Buy List Updates

In last week’s issue, I mentioned the good earnings report from Continental Building Products (CBPX). The stock reacted well to the earnings news (as we know, that doesn’t always happen). I’m lifting our Buy Below on CBPX to $29 per share.

Shares of Ingredion (INGR) got a big lift on Wednesday. The shares touched a new high of $134.03 after the stock was upgraded by some Wall Street firms. The company also gave a business overview. Ingredion got clobbered earlier this year, but it’s gradually fought its way back and is now a 6.4% gainer for us YTD.

That’s all for now. There will be no newsletter next week. I’m taking my traditional Thanksgiving break. The U.S. stock market will be closed on Thursday for Thanksgiving, and it will close at 1 pm on Friday, November 24. There’s not much in the way of economic news next week. We’ll get the existing-home sales report on Tuesday and durable goods on Wednesday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on November 17th, 2017 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His