Archive for March, 2007

-

A Stock, a Plan, a Short: Yahoo

Eddy Elfenbein, March 24th, 2007 at 7:46 pmNow that Yahoo’s Panama is showing early signs of success, Valleywag asks if it’s time to stop bashing the company:

It’s surely the best news for Yahoo in a while, and we’d love, in principle, to find another big company to prod. But it doesn’t change the basics: Yahoo makes less than half what Google produces in revenue for every search query; it needs much more than a one-off 10% lift in clickthroughs if it is to challenge Google’s strengthening grip on the search market.

The narrative remains the same. Yahoo wasted time schmoozing in Hollywood while allowing two Stanford students to build a better search engine. Google has eclipsed Yahoo. Terry Semel’s failure is not absolute: Yahoo is growing much more strongly than most media companies. But it is relative. Yahoo, not Google, should have owned the internet.Ouch. But it’s true. I don’t get how Yahoo is a $31 stock. I wouldn’t touch it for half that. Yahoo is going for 43 times 2008’s earnings; Google, just 25.

-

Myths About the Developing World

Eddy Elfenbein, March 24th, 2007 at 9:14 amFascinating presentation by Hans Rosling.

-

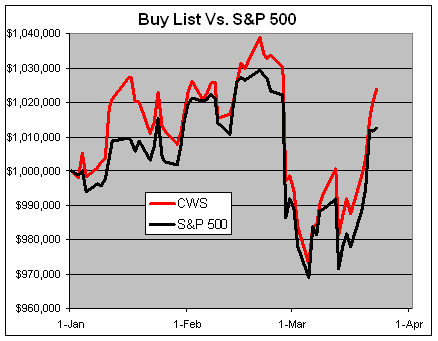

The Buy List So Far

Eddy Elfenbein, March 23rd, 2007 at 4:43 pmWith a week to go in the first quarter, the Buy List is up 2.39% compared with 1.26% for the S&P 500 (this doesn’t include dividends). The Buy List is a tiny bit less volatile than the S&P 500 (average daily swing of 0.781% compared with 0.785%).

Here’s the chart:

Here’s the stock-by-stock breakdown:

Jos. A Bank Clothiers (JOSB)……………………………………….21.12%

FactSet Research Systems (FDS)………………………………..16.22%

Respironics (RESP)…………………………………………………….10.94%

Bed Bath & Beyond (BBBY)………………………………………….8.14%

Amphenol (APH)…………………………………………………………6.68%

UnitedHealth Group (UNH)………………………………………….5.17%

Donaldson (DCI)………………………………………………………..4.18%

AFLAC (AFL)………………………………………………………………3.57%

Graco (GGG) ……………………………………………………………..2.88%

Biomet (BMET)……………………………………………………………2.74%

Fiserv (FISV)……………………………………………………………..2.04%

Nicholas Financial (NICK)…………………………………………..1.78%

Varian Medical Systems (VAR)……………………………………1.26%

SEI Investments (SEIC)……………………………………………..1.23%

Danaher (DHR)…………………………………………………………-0.23%

WR Berkley (BER)…………………………………………………….-4.38%

Fair Isaac (FIC)…………………………………………………………-5.31%

Medtronic (MDT)………………………………………………………..-6.71%

Sysco (SYY) …………………………………………………………….-10.34%

Harley-Davidson (HOG)…………………………………………….-13.15% -

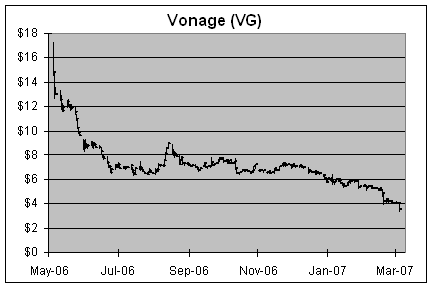

Bon Voyonage

Eddy Elfenbein, March 23rd, 2007 at 2:11 pmLast year I wrote about Vonage‘s (VG) impending IPO:

The offering is oversubscribed. But the price of voice-over-Internet protocol (VoIP) is plunging. And so will Vonage’s share price.

I was right. In ten months, the shares are down about 80%. As an experienced market professional, I know how to judge a company’s future profit potential. For example, if the company says that it may never be profitable, that’s usually a good sign. Meaning, a bad sign. Either way, that’s about the only thing Vonage has gotten right.

Now the company has been slapped with an injuction. It’s barred from using a patented technology from Verizon (VZ). One Wall Street firm just put a $1 target price on the shares. Why so optimistic?

-

Blogroll

Eddy Elfenbein, March 23rd, 2007 at 10:22 amIf you haven’t had a chance, please check out my blogroll. I’ve added some new names in the past few weeks like Bill Rempel, Matthew Ash, Brett Steenbarger, Yaser Anwar and Maoxian.

-

Wallstrip Promo’d on Fast Money

Eddy Elfenbein, March 23rd, 2007 at 8:30 am

Here’s the show with DR himself. -

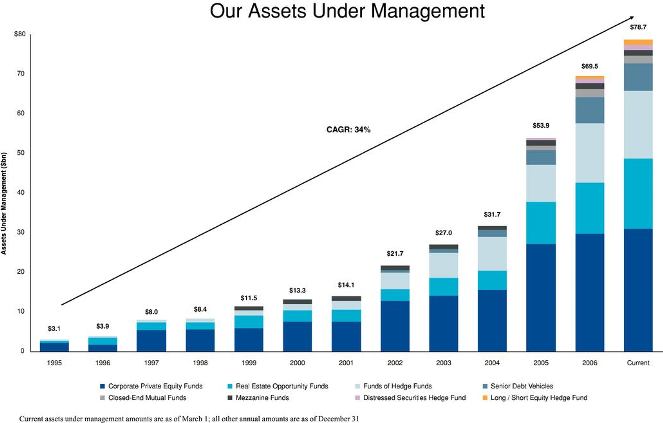

The Blackstone Group’s Prospectus

Eddy Elfenbein, March 22nd, 2007 at 4:13 pmFrom the SEC’s Web site. Here’s a sample:

Our Growth Strategy

We intend to create value for our common unitholders by:

•generating superior investment performance across our asset management platform;

•growing the assets under management in our existing investment fund operations;

•expanding our asset management base by raising new investment funds;

•increasing our investment of our own capital in our funds;

•expanding our advisory business; and

•entering into complementary new businesses.

Why We Are Going Public

We have decided to become a public company:

•to access new sources of permanent capital that we can use to invest in our existing businesses, to expand into complementary new businesses and to further strengthen our development as an enduring institution;

•to enhance our firm’s valuable brand;

•to provide us with a publicly-traded equity currency and to enhance our flexibility in pursuing future strategic acquisitions;

•to expand the range of financial and retention incentives that we can provide to our existing and future employees through the issuance of equity-related securities representing an interest in the value and performance of our firm as a whole; and

•to permit the realization over time of the value of our equity held by our existing owners.

-

This Just In…

Eddy Elfenbein, March 22nd, 2007 at 11:09 am -

Applying Warren Buffett’s Investing Philosophy to Basketball

Eddy Elfenbein, March 22nd, 2007 at 10:54 amCourtesy of Heat coach Pat Riley:

Coach Pat Riley said he would be surprised if his players weren’t keeping an eye on the standings.

“I think there’s no doubt that this week or the next two weeks are going to determine a lot of positioning,” he said. “So, it’s like looking at the stock market every day.

“We can’t get preoccupied with it, because sometimes that gets in the way of playing games.” -

The Impact of Interest Rates on Equities

Eddy Elfenbein, March 22nd, 2007 at 8:32 amNow that the Federal Reserve has lifted its tightening bias, I wanted to take a look at the impact of lower interest rates on the stock market.

Since 1962, there have been 11,250 days when stocks and bonds have traded on the same day. The yield on the 90-day Treasury rose on 4,845 days, fell on 4,925 days and stayed the same on 1480 days.

On all the days when the T-Bill yield rose, the S&P 500 lost a combined 61.9%. Annualized, that works out to a rate of -4.9% (just capital gains, not dividends).

On the days when the T-Bill yield fell, the S&P gained a combined 1,739.1%, or 16.1% a year.

Interestingly, the market did the best when rates stayed the same. The S&P gained 182.3%, or 19.4% a year.

With long-term rates (10-year T-Bond), the impact is much more dramatic.

The 10-year yield rose on 4,885 days for a combined S&P loss of 98.8%, or -20.5% a year. That’s basically a bear market.

The yield stayed the same on 1529 days for a combined S&P gain of 89.4%, or 11.1% a year.

But here’s the kicker: When the 10-year yield fell (4,836 days), and long-term bonds rallied, the S&P 500 gained an amazing 86,631%, or 42.5% a year.

Probably the most fascinating stat is that all of the stock market’s net capital gains have come when the 10-year yield is 65 or more basis points above the 90-day yield (that happens about 70% of the time). The yield curve hasn’t been that positive in 15 months.

Anything less than 65 basis points, including a negative yield curve, works out to a net equity return of a Blutarsky. Zero Point Zero.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His