Archive for February, 2008

-

RIP: William F. Buckley

Eddy Elfenbein, February 27th, 2008 at 11:48 am

From the New York Times:William F. Buckley Jr., who marshaled polysyllabic exuberance, famously arched eyebrows and a refined, perspicacious mind to elevate conservatism to the center of American political discourse, died Wednesday at his home in Stamford, Conn.

Readers’ Comments

Mr Buckley, 82, suffered from diabetes and emphysema, his son Christopher said, although the exact cause of death was not immediately known. He was found at his desk in the study of his home, his son said. “He might have been working on a column,” Mr. Buckley said.

Mr. Buckley’s winningly capricious personality, replete with ten-dollar words and a darting tongue writers loved to compare with an anteater’s, hosted one of television’s longest-running programs, “Firing Line,” and founded and shepherded the influential conservative magazine, “National Review.”

He also found time to write 45 books, ranging from sailing odysseys to spy novels to celebrations of his own dashing daily life, and edit five more. Two more books, one a political novel, and the other a history of the magazine called “Cancel Your Own Goddam Subscription” are scheduled to be published in 2007.

The more than 4.5 million words of his 5,600 biweekly newspaper columns, “On the Right,” would fill 45 more medium-sized books.My favorite Buckleyism came in the letters section of the National Review. A woman wrote in to say that she was fed up — she could no longer stand Buckley’s use of big words and Latin phrases. She said that by the time she finished one of his columns, she didn’t know if he was “for or against.”

Buckley wrote: “Madam, I am against. Sincerely – WFB”

In a more civilized time, here’s Buckley threatening to punch Gore Vidal.

-

The Dollar Falls to $1.50 Against the Euro

Eddy Elfenbein, February 27th, 2008 at 10:08 amBen Bernanke is speaking again today on Capitol Hill. This is the start of his big semi-annual testimony before the House and Senate.

I’ve gone to the previous few hearings (even snagging the seat right behind Ben), but honestly, it’s not that interesting in person. The room is almost completely empty, and the questions from members of Congress are a bit embarrassing.

Yesterday, the U.S. dollar, for the first time, traded below $1.50 to the Euro.The U.S. currency slumped against 15 of the 16 most-active counterparts after Fed Vice Chairman Donald Kohn said turmoil in credit markets and the possibility of slower economic growth pose a “greater threat” than inflation.

Kohn’s comment “confirmed the Fed will keep cutting interest rates,” said Adam Boyton, a senior currency strategist in New York at Deutsche Bank AG, the world’s biggest currency trader. “That brought more downward pressure on the dollar.”

The dollar fell to $1.5047 per euro before trading at $1.5017 at 7:47 a.m. in Tokyo from $1.4979 yesterday in late New York. The U.S. currency traded at 107.24 yen, following a 0.7 percent decline yesterday.

Boyton forecasts a dollar drop to $1.55 per euro in the next three months. He’s more bearish than the consensus. The dollar will rebound to $1.48 per euro by the end of March and to $1.40 by year-end, according to the median forecast in a Bloomberg News survey of 41 analysts.

The U.S. currency has lost about a quarter of its value in the past five years, according to the Fed’s U.S. Trade Weighted Major Currency Dollar index, which comprises seven currencies of U.S. trading partners. The weaker dollar has made U.S. goods cheaper abroad, boosting exports to a record and shrinking the nation’s trade deficit last year for the first time since 2001.Here’s Bernanke’s entire testimony. This is a sample:

As part of its ongoing commitment to improving the accountability and public understanding of monetary policy making, the Federal Open Market Committee (FOMC) recently increased the frequency and expanded the content of the economic projections made by Federal Reserve Board members and Reserve Bank presidents and released to the public. The latest economic projections, which were submitted in conjunction with the FOMC meeting at the end of January and which are based on each participant’s assessment of appropriate monetary policy, show that real GDP was expected to grow only sluggishly in the next few quarters and that the unemployment rate was seen as likely to increase somewhat. In particular, the central tendency of the projections was for real GDP to grow between 1.3 percent and 2.0 percent in 2008, down from 2-1/2 percent to 2-3/4 percent projected in our report last July. FOMC participants’ projections for the unemployment rate in the fourth quarter of 2008 have a central tendency of 5.2 percent to 5.3 percent, up from the level of about 4-3/4 percent projected last July for the same period. The downgrade in our projections for economic activity in 2008 since our report last July reflects the effects of the financial turmoil on real activity and a housing contraction that has been more severe than previously expected. By 2010, our most recent projections show output growth picking up to rates close to or a little above its longer-term trend and the unemployment rate edging lower; the improvement reflects the effects of policy stimulus and an anticipated moderation of the contraction in housing and the strains in financial and credit markets. The incoming information since our January meeting continues to suggest sluggish economic activity in the near term.

-

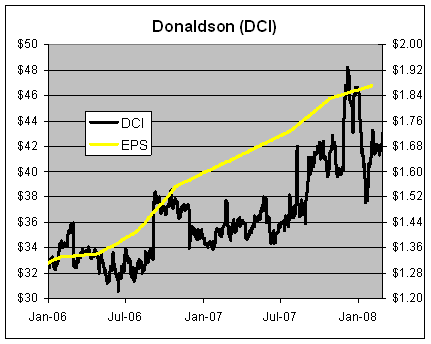

Donaldson Raises Forecasts Again

Eddy Elfenbein, February 26th, 2008 at 10:32 amDonaldson (DCI) reported earnings yesterday of 42 cents a share which was in line with forecasts. I was surprised to see the stock trading lower in the after-hours market yesterday, but that seems to have had little effect on DCI’s open today. The shares rallied over 3% yesterday and are so far trading modestly higher today.

I thought it was a pretty good quarter. This was Donaldson’s second quarter of their fiscal year, so for the first six months, the company’s earnings-per-share is 17% higher than last year. Sales are up 14%. This is from the company’s press release:“Our globally-diversified portfolio of filtration businesses provided the foundation to deliver another record quarter of sales and earnings,” said Bill Cook, Chairman, President and CEO. “Strength in our Engine Products businesses internationally plus continued growth in our international Industrial Products businesses, including Industrial Filtration Solutions and Special Applications Products, helped offset some of our weaker NAFTA markets.”

“Overall, we are on track with our business plan for the balance of fiscal 2008. We see sufficient strength across our Engine Products and Industrial Products businesses to increase our sales forecast for both segments and anticipate achieving our first $2 billion revenue year. In addition, we remain confident that we will deliver our 19th consecutive year of record earnings.”The company also said that it expects 2008 EPS of $2 to $2.10 a share. That’s higher than what they first projected in November when they forecast $1.97 to $2.07. This is the second time Donaldson has increased its projection. In September, the company expected EPS of $1.92 to $2.01.

Here’s a look at the stock (black line, left scale) and EPS (gold line, right scale).

-

Losing $100 Million a Day

Eddy Elfenbein, February 26th, 2008 at 9:49 amThe Wall Street Journal reports that traders at Citigroup lost over $100 million a day on 15 separate occasions last year.

“I think that the managements of many of the financial institutions simply didn’t have a clue of what was going on,” James D. Wolfensohn, a former World Bank president who now holds the title of “senior adviser” at Citigroup, said Sunday evening at a public event in Manhattan.

Mr. Wolfensohn said in an interview yesterday he was referring generally to Wall Street firms, not to Citigroup in particular.

Citigroup’s latest disclosures come as analysts and investors are clamoring for Vikram Pandit, Citigroup’s new chief executive, to unveil his widely anticipated turnaround plan. Mr. Pandit has been mum, but tonight he is hosting 15 to 20 Wall Street analysts in a private “meet and greet” cocktail hour at Citigroup headquarters. The gathering has irked some investors, who weren’t invited and who note that Citigroup hasn’t yet scheduled a public investor day since Mr. Pandit took over.

After sifting through the annual report, Oppenheimer analyst Meredith Whitney slashed her 2008 earnings estimate on Citigroup by more than 70% to 75 cents a share, cautioning that even the lowered projection “could still prove optimistic.” She said the bank’s suffering share price could fall below $16 — or to about 70% of its book value. That level was last seen “during the last credit cycle of 1990-1991,” she added.This seems to be a classic case of not knowing what you don’t know. Citigroup’s last annual report acknowledged that it’s holding about $20 billion worth of securities that are tied directly or indirectly to global real estate. That’s all it says. No details or nothing.

The company’s book value is $22.74 a share. Last May, the stock was going for over $55 a share. -

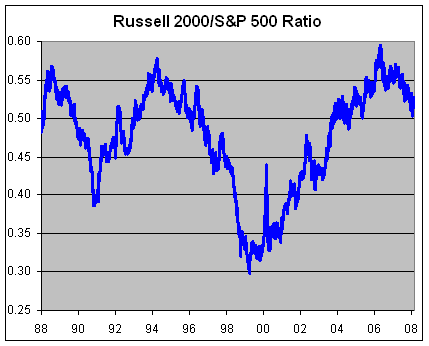

The End of the Small-Cap Cycle?

Eddy Elfenbein, February 25th, 2008 at 3:04 pmOne of the market anomalies that can’t be easily explained by the Efficient Market Hypothesis is the out-performance of small-cap stocks.

Still, I’m not much of a believer in the small-cap effect. The data is clear that it exists, but I suspect that much of the out-performance is simply a matter of liquidity. Also, the out-performance is very small and highly volatile. Small-cap stocks, as a whole, can lag the overall market for many years. In fact, the small-cap cycle has historically run about five to seven years. That’s a bit long to base a trading strategy on.

The graph below is a good proxy for the small-cap cycle; it shows the Russell 2000 divided by the S&P 500.

The small-cap cycle peaked on March 25, 1994, after which, small-cap issues declined until April 8, 1999. Notice that this happened while the rest of the market was still climbing.

From that low, small-caps have had a great run, but that run could be over. The ratio hasn’t been able to surpass its high reached on April 19, 2006. This has now been almost two years. Of course, we never exactly know when a cycle has reached a turning point, but it’s perfectly obvious in hindsight.

I suspect that the cycle has turned in favor of large-caps. A major reason is that larger stocks offer more safety and that’s definitely on investors’ minds. Naturally, some of the worst abusers of the sub-prime mess have been large-cap stocks. Or at least, they used to be large-cap stocks. -

More on Momentum Stocks

Eddy Elfenbein, February 25th, 2008 at 11:56 amI’m afraid I’m becoming a momentum stock bore on this site, but it’s a subject that continually amazes me. The London Business School has done some more research:

“Momentum, or the tendency for stock returns to trend in the same direction, is a major puzzle,” the LBS three comment.

“In well-functioning markets, it should not be possible to make money from the naïve strategy of simply buying winners and selling losers. Yet there is extensive evidence that momentum profits have been large and pervasive”.

The numbers certainly back up the claim. In one of LBS’s studies, which analysed all fully-listed stocks between 1955 and 2007, the shares which had outperformed the market most in the previous 12 months went on to generate an annualised return of 18.3pc while the market’s worst laggards rose by 6.8pc on average.

Over that period the market as a whole rose by 13.5pc a year.

Arguably, those figures, impressive as they are, are conservative. That’s because the portfolios created were weighted by company size (like FTSE’s indices). Using an equally weighted portfolio in which smaller companies have the same impact as bigger ones resulted in a 25.6pc rise for last year’s winners and a 12.2pc rise for the losers.

To make sure that the results were not just a by-product of this smaller company effect, Dimson et al re-ran the study using only the 100 biggest companies.

Even restricting the universe to the blue-chips, the method worked well.

The previous year’s out-performers went on to give a 16.5pc return while the losers rose by 8.9pc. -

Great Moments in Public Relations

Eddy Elfenbein, February 25th, 2008 at 10:51 am“I’m fairly confident that we’re not going to do anything stupid. We have a history of not doing anything stupid.” Angelo Mozilo, CEO of Countrywide Financial

Countrywide Financial (CFC) had a rough 2007 with the stock being down by 78% and all. So what should a company do? Celebrate, of course!

Countrywide Financial Corp., the nation’s largest mortgage lender by loan volume, will host about 30 representatives of smaller mortgage banks for three nights next week at the Ritz-Carlton Bachelor Gulch ski resort in Avon. At one of the country’s most-glamorous skiing spots, a regular room on a weekday starts at $750.

The first items on the agenda for guests arriving Monday evening are cocktails and ski fittings. Next is dinner at the Spago restaurant, whose menu includes Kobe steak with wasabi potato puree for $105. (For the budget-minded, pan-roasted buffalo filet with Kabocha pumpkin flan is $54.)Since July, Countrywide has laid off 11,000 people. The company has now said that the ski trip is off.

-

Junk-Grade Fed?

Eddy Elfenbein, February 25th, 2008 at 10:06 amHere’s an interesting editorial today from the New York Sun:

What caught our eye in the markets last week was the verdict by Grant’s Interest Rate Observer that, by its lights, the Federal Reserve Bank of New York was no longer a “presumptive triple-A” credit but rather one of “mid-grade junk” quality. This news didn’t exactly rock the financial world, as Grant’s is no kind of formal rating agency, even it if does have as elite and savvy a readership as any market newsletter could want. It wouldn’t surprise us, though, were people — including some in Congress — soon to sit up and take notice of a worrying set of facts.

Grant’s was reacting to the sudden appearance on the Federal Reserve’s balance sheet of $60 billion in lending under the new Term Auction Facility. The New York Fed’s share of that $60 billion is no less than $44.9 billion. The TAF is a credit facility. Its purpose is to lend to banks under stress in the sub-prime credit crisis. The banks front collateral against which the Fed advances money. “The rub,” Grant’s writes, “is the quality of the collateral.” It quotes a Financial Times interview with one financial strategist, Christopher Wood, as saying that banks “are increasingly giving the Fed the garbage collateral nobody else wants.”

The New York Fed doesn’t seem overly concerned about all this. When our Julie Satow called over to the fortress on Liberty Sreet a spokesman said the bank took the downgrading by Grant’s to be a form of humor. “Reserve banks operate under well-established guidelines regarding margining and collateral,” the spokesman said. However that may be, the Fed’s Web site invites would-be borrowers to submit collateral of decidedly low quality. Against this dubious stuff, the Fed stands ready to lend on highly generous terms — as much as 90 cents on the dollar against “private label” mortgage-backed securities. Unless we have been misreading the papers these past six months, the Fed is alone in assigning that much value to that particular class of mortgage asset.

It’s a little-noted irony that the Federal Reserve, the supposed conscience of the American banking system, is itself an exceedingly highly leveraged institution. At the latest weekly tallying up, $881 billion in assets rested on just $38.5 billion in capital, As for the New York branch office, $312 billion in assets (including those $44.9 billion in TAF credits) were balanced on a little less than $10 billion in capital. The scant showing of capital was of no especial concern when the Fed owned nothing but Treasury securities. But now that it’s in the business of lending against what may well be mongrel mortgages, that extreme leverage introduces real risks. As Grant’s points out, it’s not so farfetched to imagine the Fed itself needing a bailout one of these days. We wonder how a headline on the order of “Fed insolvency fears” would play in the already skittish world currency markets.

* * *

Why not let an independent auditor check up on the value of the collateral that the Fed is so willingly taking aboard? It would not be lost on such an auditor that the New York Fed is, as they say on Wall Street, a kind of “hidden asset story.” It carries slightly more than $4 billion of gold on its balance sheet at the early 1970s price of $42.22 an ounce. At today’s prices, that works out to more than $90 billion. On that basis, as the editor of Grants, James Grant, sketched it for us, “the hometown central bank would be in the clover, credit-wise.” He goes on to say that “the Fed is unlikely to acknowledge the great bull market in gold bullion for the obvious reason that it, itself, is largely the author of it.” Or, to put it another way, if the salvation of the Fed is all the gold it has in its basement, what does that tell us about the monetary system on which the rest of the world is relying? -

After Hours: The Carter Family – Are You Lonesome Tonight

Eddy Elfenbein, February 22nd, 2008 at 5:14 pm -

Hacking For Profits

Eddy Elfenbein, February 22nd, 2008 at 11:26 amHere’s a strange story. In October, Oleksandr Dorozhko hacked into IMS Health’s computers to get inside information which he used to load up on puts on the company’s stock. He made a killing, about $300,000 off a $41,000 investment.

The SEC tried to block him from taking his profits. A judge has ruled that what he did may be illegal but it’s not insider trading. Dorozhko may face more charges, but for now, he can keep his cash.The SEC argues that deception was involved in hacking into the computer system, which was designed to allow access only to authorized persons.

That view drew scorn from Charles Ross, Dorozhko’s lawyer, at the appellate court hearing Wednesday. “They want you to believe there is a deception of a computer,” he said. “All there is is a high-tech lock pick.”

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His