Archive for September, 2010

-

Tomorrow’s GDP Report Isn’t Important

Eddy Elfenbein, September 29th, 2010 at 11:54 amThis going to be an interesting week for folks in the finance/econ stat biz. For one, Wall Street is about to close out its best September since 1939. Personally, I can do without the starting of major world wars.

I’m happy to say that the Buy List is also wrapping up a great month. Through yesterday’s close, we’re up nearly 13% for September and we hit our highest close in four-and-a-half months.

Tomorrow, the final GDP report comes out for the second quarter. This usually gets more attention than it deserves. The report will cover a period that began six months ago and ended three months later. The stock market usually focuses slightly forward, perhaps three to eight months ahead.

On Friday, we’ll get the ISM index for September. Here’s the odd thing: There’s a decent correlation between ISM level and GDP growth so we might get a glimpse at Q3 growth. The correlation is around 40% which is far from perfect but it’s worth paying attention to.

The past few quarters, however, have been a bit off-key. GDP growth has decelerated, meaning it’s still growing but the rate of growth has dropped over the last two quarters. That’s been one of the main drivers of the “Double Dip” thesis. I think the economy was impacted by problems in Europe much harder than people expected. The ISM has been fairly steady in the mid- to upper-50s. Normally, that signals growth of around 4%.

If the economy has been growing that quickly, then we would now see some evidence in the jobs market. Unfortunately, that evidence has been sorely lacking. While there’s been some growth in jobs, it’s nowhere close to the kind of growth we normally see coming out of a recession. During the 1990’s, the economy regularly created huge amounts of jobs each month. We’ll get a look at the jobs market next Friday when the Labor Department releases its jobs report for September.

Soon after that, earnings season will start. On October 7, Alcoa (AA) will be the first major company to report earnings. According to estimates, this earnings season will show a slight sequential decline from last quarter (meaning, Q3 earnings will be below Q2 earnings). I think estimates are just a bit too low, so that may mean there won’t be a sequential decline, but it’s hard to say right now.

-

Morning News: September 29, 2010

Eddy Elfenbein, September 29th, 2010 at 7:25 amSavers Told to Stop Moaning and Start Spending

After Recalls of Drugs, a Congressional Spotlight on J.& J.’s Chief

BP to Create New Safety Division in Wake of Spill

Stock Futures Point to Lower Open on Wall Street

European Economic Confidence Unexpectedly Improves

Barrick Says Gold Could “Easily” Exceed $1,500/oz

Asian Shares End Mostly Higher; Tankan Survey Lifts Tokyo

Food is the New Pharma: Nestlé Aims to Enter the Functional Foods Market -

Costco Hits New 52-Week High

Eddy Elfenbein, September 28th, 2010 at 12:49 pmHats off to Costco (COST). The stock just broke out to a fresh 52-week high this morning.

I think the stock has its pre-crash high of $75.23 (from May 14, 2008) in its sights, although it’s not easy to decipher what inanimate objects are thinking.

There’s always a weird period when investing in Costco. They reported Q3 earnings on May 27, but the Q4 report won’t come out until mid-October. That’s 4-1/2 months without knowing how the business is doing.

The last earnings report was in line with forecasts; the one before that missed by two cents and the one before that was in line. This tells me that the Street is seeing COST as a value play, not an emerging growth story.

-

US Economic and Equity Outlook from Goldman Sachs

Eddy Elfenbein, September 28th, 2010 at 11:43 am(Via: ZeroHedge).

-

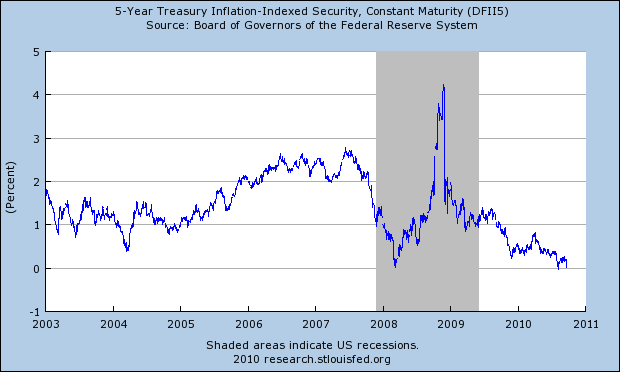

5-Year TIPs Back Near 0%

Eddy Elfenbein, September 28th, 2010 at 11:24 amHere’s an eye-opening chart. This shows the yield on the 5-year Inflation-protected Treasury bond. During the crisis, the yield shot up over 4% as there was a rush to liquidity.

Now, thanks to a lifeless recovery, the yield is back near 0% again. That means that in real terms, you’re not making a profit by lending money to the government.

-

Hirsch: Dow to 38,820 By 2025

Eddy Elfenbein, September 28th, 2010 at 10:32 amOne of the more bizarre predictions to hit Wall Street of late is Jeffrey Hirsch’s call for the Dow to reach 38,820 by 2025. What makes this forecast especially unusual—besides the suspiciously-precise target—is that according to Hirsch, the market won’t start its “Super Boom” until 2017.

But after looking at some numbers, perhaps his target isn’t so outrageous. (I’m not endorsing it; I’m merely saying it really isn’t that crazy.) The stock market closed 1999 at 11,497.12. Assuming a 5% growth rate for 25 years would bring the index to 38,933. Of course, that assumes a heck of a lot of mean reversion until then.

Is a 5% trend a reasonable assumption? I think so. That could be 2% fellatio inflation and 3% real GDP growth. Unfortunately, once this awful patch of slow growth finally ends, I have my doubts about how contained inflation will be.

Ultimately, let me remind individual investors that these types of predictions don’t matter. They’re fun parlor games but they shouldn’t play a role in your investing strategy. One of the best parts of investing is that you don’t need to predict the future. If you stick with high-quality stocks for the long-term, you’ll do well.

-

Morning News: September 28, 2010

Eddy Elfenbein, September 28th, 2010 at 8:05 amTroubling Trades Found Ahead of Flash Crash

The Value of a Piece of Facebook

Stock Buybacks Are for Dummies Except Right Now: David Pauly

Home Prices Probably Cooled, U.S. Consumer Sentiment Off

Apple May Unveil Next iPad by June 2011, Goldman Says

JPMorgan May Pursue FDIC Funds for WaMu Claims

Facebook IPO Likely After Late 2012: Board Member

-

Fact-Checking the Simpsons

Eddy Elfenbein, September 28th, 2010 at 12:18 amI was watching the season premiere of “The Simpsons” at the Fox website. During the episode, Kent Brockman referred to Gandhi as being a winner of the Nobel Peace Prize.

For the record, Nobel Peace Prize winners have included Yasser Arafat, Kofi Annan, Mikhail Gorbachev, Anwar Sadat, Lê Ðức Thọ and Wangari “AIDS was created by the West” Maathai.

But no Gandhi.

-

The World’s Best Stock Market — Mongolia??

Eddy Elfenbein, September 27th, 2010 at 10:37 pmWhere’s the world’s best stock market not only this year, but for the past decade? I’ll give you a hint: Mongolia!

Odd as it may sound, the stock market in Mongolia is up an amazing 1,600% over the past decade. Now don’t get too carried away; this is hardly a developed market. The market cap of the entire stock market is just $500 million.

The good news is that the emergence of a class of investors is helping economic reforms:

And the index and volumes are likely to go higher now that the government is making serious noise about finally cleaning up the exchange. In one of his first speeches, Prime Minister Sukhbaataryn Batbold highlighted the need to develop an equity market and the government is keen to encourage domestic listing, according to Roland Nash, head of research at Renaissance Capital.

And change will come sooner, rather than later. The MSE is currently considering bids by the London Stock Exchange, Sweden’s OMX HEX and South Korea’s main exchange to provide management services for the national exchange and supply it with new trading technology. A decision on the winner is expected before the end of the year. “We are offering them technology as well as business development,” says Jon Edwards, who spearheads the LSE’s business in Eastern Europe. “The market is small and the listings needs to be cleaned up, but the potential is phenomenal. Mongolia could do better than Kazakhstan if they can put all the pieces in place.”

Edwards says the MSE is right at the very beginning of the process, but if it follows the experience of other countries in the region that have attempted equity market reforms, the size of the market should go up by an order of magnitude.

-

Karl Pilkington on Dolphins with Rifles

Eddy Elfenbein, September 27th, 2010 at 5:59 pm

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His