Archive for March, 2011

-

Morning News: March 25, 2011

Eddy Elfenbein, March 25th, 2011 at 7:00 amPortuguese Yields at Record Highs During EU Summit

Euro Rallies Versus Dollar on Summit Views, ECB Rate Increase Speculation

German Bonds Drop as Stocks Advance, EU Leaders Meet to Tackle Debt Crisis

Japanese Government Bond Buying to Fund Financial Firms

Oil Trades Near Two-Week High on Libya Conflict; JPMorgan Raises Forecast

Gold Trades Near Record on Europe Debt Risk; Silver Reaches 31-Year Peak

Fed’s Clash With Bank of America Raises Questions

U.S. Stock Futures Signal Gains; Techs in Focus

Fed Governor Duke Says Recovery May Be Slower on Households’ Caution

S.&P. Warns About ‘Excessive’ Bank Dividends

Research In Motion 4Q Profit Beats Forecasts; Outlook Falls Short

Toyota, Struggling With Part Shortages, to Restart Car Lines

G.E.’s Strategies Let It Avoid Taxes Altogether

Paul Kedrosky: Frothy Talk in Startup Land: Groupon, Color, Y-Combinator, Etc.

Joshua Brown: Bill Clinton, the Fee-Based Model and Me

James Altucher: 8 Unusual Things I Learned From Warren Buffett

-

Oracle Earns 54 Cents Per Share, Ups Dividend By 20%

Eddy Elfenbein, March 24th, 2011 at 4:16 pmEvery so often, I get one right! Oracle ($ORCL) just reported earnings of 54 cents per share.

The company also raised its teeny quarterly dividend from five cents to six cents per share (hey, that’s 20%!).

Check out these numbers. Oracle had a great quarter.

Oracle Corporation today announced fiscal 2011 Q3 GAAP total revenues were up 37% to $8.8 billion, while non-GAAP total revenues were up 36% to $8.8 billion. Both GAAP and non-GAAP new software license revenues were up 29% to $2.2 billion. GAAP software license updates and product support revenues were up 13% to $3.7 billion, while non-GAAP software license updates and product support revenues were up 13% to $3.8 billion. Both GAAP and non-GAAP hardware systems products revenues were $1.0 billion. GAAP operating income was up 62% to $3.0 billion, and GAAP operating margin was 34%. Non-GAAP operating income was up 35% to $3.9 billion, and non-GAAP operating margin was 44%. GAAP net income was up 78% to $2.1 billion, while non-GAAP net income was up 42% to $2.8 billion. GAAP earnings per share were $0.41, up 75% compared to last year while non-GAAP earnings per share were up 40% to $0.54. GAAP operating cash flow on a trailing twelve-month basis was $9.9 billion.

“Strong revenue growth coupled with disciplined business management enabled an increase in non-GAAP operating margin to 44% and earnings per share to $0.54,” said Oracle President, Safra Catz. “Our hardware product gross margins increased to 55% in the quarter so we are now completely confident that we will exceed the $1.5 billion profit goal we set for the overall Sun business for the current fiscal year.”

“Q3 performance was broad based with all geographies reporting revenue growth of 30% or higher,” said Oracle President, Mark Hurd. “The sequential revenue growth for Exadata and Exalogic was up over 50%. And we expect to see an even higher growth rate for these two game changing technologies in Q4.”

“In Q3 we signed several large hardware and software deals with some of the biggest names in cloud computing,” said Oracle CEO, Larry Ellison. “For example, Salesforce.com’s new multi-year contract enables them to continue building virtually all of their cloud services on top of the Oracle database and Oracle middleware. Oracle is the technology that powers the cloud.”

In addition, Oracle also announced that its Board of Directors declared a quarterly cash dividend of $0.06 per share of outstanding common stock, reflecting a 20% increase over the previous quarter’s dividend of $0.05. This increased dividend will be paid to stockholders of record as of the close of business on April 13, 2011, with a payment date of May 4, 2011.

The stock closed that day at $32.14. It’s hard to believe this stock was below $30 last week. I expect to see a new 52-week high soon.

-

The S&P 500 Is Over Its 50-DMA

Eddy Elfenbein, March 24th, 2011 at 12:04 pmThat didn’t take long!

-

Oracle’s Earnings Preview

Eddy Elfenbein, March 24th, 2011 at 11:18 amAfter the closing bell, Oracle ($ORCL) is due to report its fiscal Q3 earnings. This is for the quarter that ended on February 28th.

When the very-strong second-quarter earnings report came out in December, the company said to expect EPS for Q3 to be between 48 cents and 50 cents. Wall Street had only been expecting 44 cents per share, and a year ago Oracle released earnings of 38 cents per share. For Q3, the company said that revenue growth will be between 31% and 35%.

Personally, I think the company is low-balling the Street which is understandable. Remember that for Q2, Oracle said to expect EPS between 46 and 48 cents. Instead, they earned 51 cents per share.

My estimate is that Oracle will report earnings of 53 cents per share. I’ll also be curious to hear what they have to say about Q4. A year ago, Oracle earned 60 cents per share. Wall Street currently expects 66 cents per share for this year’s fourth quarter. I strongly doubt Oracle will only grow its earnings by 10%.

Even if the company low-balls the Street again, which it will, I still think they can offer guidance of 70 cents per share. We can also expect to hear some strong words from Mr. Ellison:

This quarter, some analysts expect brash talk about Hewlett-Packard, which under new Chief Executive Leo Apotheker is set to focus more on services and software, which will bring it directly into competition with Oracle in some core markets.

Oracle, headed by outspoken and combative Silicon Valley billionaire Larry Ellison, is likely to shoot back on Thursday.

“I’d be very surprised if you don’t get some very competitive talk about HP’s plans,” said Michael Yoshikami at YCMNET Advisors, noting that Oracle has a history of colorful remarks about beating its competitors, such as Germany’s SAP and International Business Machines Corp .

Like IBM and Cisco Systems Inc , Oracle and Hewlett-Packard are aiming to provide the infrastructure for companies to move toward “cloud computing,” where data is handled remotely in datacenters rather than on premises.

The looming battle between Oracle and Hewlett-Packard is given spice by the fact that HP’s former chief executive Mark Hurd — who left last year after a flap over inaccurate expense reports and a questionable relationship with a female contractor — now works at Oracle.

Wall Street expects Oracle’s fiscal third-quarter profit excluding one-time items to jump to 50 cents per share, according to Thomson Reuters I/B/E/S, up from 38 cents a year ago. The company itself said in December it expected between 48 cents and 50 cents.

Analysts have forecast $8.7 billion in revenue, up from $6.5 billion a year ago, although that quarter only included one month of hardware sales from the Sun acquisition, which closed in January 2010.

Some analysts warn that Oracle’s new exposure to hardware, through the Sun deal, means it may suffer from supply chain problems caused by Japan’s earthquake, which has constrained production of key computer components.

Oracle may also see some weakening of demand for its software in Japan, which accounted for 5 percent of sales last fiscal year, but analysts do not expect that to offset industry growth.

“Unless one wants to make a more aggressive assertion that either whole companies will cease to exist or the world is headed back into another Great Recession,” said Richard Davis, an analyst at Canaccord Genuity, “we side with the view of every software company with whom we have spoken — that they do not expect a material negative impact to underlying, almost universally favorable, demand trends.”

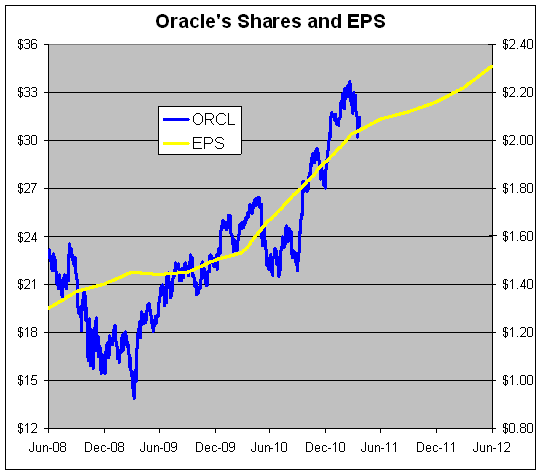

Here’s a look at Oracle’s stock and earnings. The stock is the blue line (left scale) and the EPS is the gold line (right scale). The two lines are scaled at a ratio of 15-to-1.

You can see that the earnings line was barely impacted by the recession. The future part of the gold line is based on Wall Street’s consensus which I think is too low.

If Oracle earns $2.31 for next fiscal year, which Wall Street expects, at a multiple of 16, that comes to nearly $37. If Oracle can earn $2.50, which isn’t out of the question, that’s a share price of $40.

-

Morning News: March 24, 2011

Eddy Elfenbein, March 24th, 2011 at 6:44 amPortugal Yield Soars to 12-Year High as Socrates Quits; Irish Bonds Tumble

Thai Exim Bank To Aid Exporters Hurt By Japan, Middle East Woes

BOC Hong Kong 2010 Net Profit Up 16% At HK$16.20 Billion

Egypt Shares Extend Drop, Led by Banks; Orascom Telecom Gains

Greece’s Piraeus Bank Posts Loss as Provisions Rise

Gold Steady In Asia, But Gains Likely Ahead

36 South to Revive Black Swan Bet After Fund Climbs 234% on Global Events

Colgate Buys Unilever Business for $940 Million

Sprint Cheaper Than 99% of S&P 500 as Below-Book Signals Merger: Real M&A

Groupon Now: Future of Mobile Marketing for Small Business

Sales of Luxe Doomsday Bunkers Up 1,000%

Joshua Brown: What Are Sprint’s Options?

Paul Kedrosky: Life According to Lloyd Blankfein: We Generally Make Money

-

International Flavors & Fragrances

Eddy Elfenbein, March 23rd, 2011 at 4:59 pmHere’s another entry in my continuing series: boring stocks but great investments. International Flavors & Fragrances ($IFF) is a $5 billion market cap company. It’s not in any of the major indexes but it’s been a strong performer over the years.

Here’s a company description from Hoovers:

If you’ve got a taste for the sweet and the salty, then International Flavors & Fragrances (IFF) is your kind of company. One of the world’s leading creators and manufacturers of artificial and natural aromas and flavors, IFF produces fragrances used in the manufacture of perfumes, cosmetics, soaps, and other personal care and household products. The company has about a 17% share of the world market and is among the top four companies in its industry. IFF sells its flavors principally to makers of prepared foods, dairy foods, beverages, confections, and pharmaceuticals. The company sells its fragrances and flavors in solid and liquid forms in amounts that range from a few pounds to several tons.

International Flavors & Fragrances soundly beat the market from the early 1980s to 1995. Then in the late-1990s, IFF lagged the market.

The company had a 39-year run of raising its dividend every year but that came to an end in 2000 when they slashed the dividend from 38 cents per share to 15 cents per share.

Perhaps this was a smart move. Since 2000, the stock has done very well. Measuring from October 25, 2000, IFF is up nearly 300% while the S&P 500 is down over 5%.

-

The Triangle Fire—100 Years Ago

Eddy Elfenbein, March 23rd, 2011 at 11:41 amThe year 1911 was an interesting year for the American economy. This was probably the high-tide of a fast-growing American Socialist movement.

The year saw a few important events which galvanized a lot of public opinion against capitalism. In May, the Supreme Court ruled against John D. Rockefeller’s mammoth Standard Oil trust. As a result, the company was broken up into 34 “Baby Standards.” Compare that to AT&T, which Judge Greene broke up into just seven companies.

(The major Standard Oil company lived on as Standard Oil of New Jersey. Their filling stations were known as Esso which came from the S.O. for Standard Oil. The courts allowed them to use Esso but only in certain states in the West and in Canada. The company finally got tired of the restrictions and changed their name to Exxon.)

Standard Oil had been on the defensive for a few years especially after Ida Tarbell wrote The History of the Standard Oil Company in 1904. Rockefeller got the last laugh. After the company was broken up, the stock prices soared and his net worth shot up to $900 million.

Another major 1911 event happened 100 years ago this Friday. The Triangle Shirtwaist Factory fire in lower Manhattan killed 146 garment workers. Most of the victims were young immigrant women (and girls) from Europe. The public found out that the working conditions were terrible. The managers had locked the doors to the stairwells and the fire department’s ladders weren’t long enough to reach the upper floors. Many of the girls jumped out the windows similar to what happened on 9/11. The piles of bodies also made it difficult for the fire department to get close enough to the building.

Even today, the Triangle Fire still ranks as the deadliest industrial accident in American history. The two owners were able to flee to safety. They were later tried for manslaughter and they won. They later lost a civil trial and had to pay a sum for each death.

That sum: $75.

The fire prompted a flurry of legislation requiring better working conditions. I highly recommend David Von Drehle’s Triangle: The Fire The Changed America.

I say that 1911 was probably the high-tide of the socialist movement in America because a lot of the legislative reforms took the energy out of the movement. In 1912, we got the Pujo Committee and the election of Woodrow Wilson (Eugene Debs, the Socialist candidate, got nearly one million votes or 5.99%). The following year, we got the Federal Reserve Act and the 16th Amendment which allows for an income tax.

The Socialist party also lost a lot of its popularity when it came out against America’s entry in World War I. It even got Debs arrested and he ran in the 1920 president election from his prison cell. Interestingly, all the Socialist parties in Europe voted for war. This was directly opposed to prevailing Socialist doctrine (“the proletariat has no fatherland”). A young Italian fascist, Benito Mussolini took note and decided it was better to organize workers by race instead of class.

What I find interesting is that before the Russian Revolution, socialism wasn’t seen as being in any way un-American. In fact, the areas where Socialists were the strongest are today some of the reddest states in the Union. The Socialist newspaper, An Appeal to Reason, was published in Girard, Kansas.

The most left-wing state of all was probably Oklahoma! The state gave Debs 16% of its vote in 1912. The mayor of Oklahoma City was a socialist and the state sent six Socialists to the state legislature. How times have changed! Oklahoma was McCain’s single-best state in 2008.

On one final note, ExxonMobil ($XOM) was formed in 1999 when Exxon merged with Mobil. Both companies were Baby Standards.

-

BofA’s Dividend Plan Shot Down

Eddy Elfenbein, March 23rd, 2011 at 9:56 amThe Federal Reserve recently gave the all-clear sign for banks to raise their dividends. Well, not totally all-clear. The dividend increases still need to be approved by the Fed. After all, you can’t have public money being shoveled right to shareholders. The government wants them to make a profit first. So I was happy to see that JPMorgan Chase ($JPM), a member of our Buy List, was allowed to raise its dividend from five cents per share to 25 cents per share.

Yesterday we learned that Citigroup ($C) was allowed to pay a teeny, tiny 0.1-cent dividend meaning a 1-cent dividend after 1-for-10 reverse stock split.

I thought the Fed was going to be pretty liberal. Apparently not because Bank of America’s ($BAC) dividend plan just got shot down. In the regulatory filing, BAC didn’t say how much the increase was outside of being a “modest” one.

So if Citi was allowed an extremely minor dividend increase, what does the Fed think of BAC?

-

Morning News: March 23, 2011

Eddy Elfenbein, March 23rd, 2011 at 6:43 amEurope’s Banks Would Need $355 Billion in S&P Stress Scenario

Disruption in Japan Slows Rise in Oil Price

Japan’s Quake Damage May Swell to $309 Billion, Four Katrinas

F.D.A. Bans Some Food Imports From Japan

Bank of England Voted 6-3 to Hold Rate to Assess Impact of Increase in Oil

Reinsuring Giant Munich Re Falls After Scrapping Profit Target on Japan Claims

Coal Leases in Wyoming May Raise $21.3 Billion, U.S. Says

Crude Futures Flat; Mideast Turmoil in Focus

Fed Profit Rose Sharply To $82 Billion Last Year

Judge Rejects Google’s Deal to Digitize Books

Buffett, India’s Insurance Salesman

Aflac Seeks New Voice For Its Duck

Paul Kedrosky: U.S. vs World Gas Prices

-

The Fed Publishes Its Annual Financial Statements

Eddy Elfenbein, March 22nd, 2011 at 11:52 amFrom the central bank itself:

Total Reserve Bank assets as of December 31, 2010, were $2.428 trillion, which represents an increase of $193 billion from the previous year. The composition of the balance sheet changed notably. Holdings of U.S. Treasury securities increased $261 billion and holdings of federal agency and government-sponsored enterprise (GSE) mortgage-backed securities (MBS) increased $86 billion. These increases were partly offset by a $96 billion decrease in loans to depository institutions and a $23 billion decrease in loans extended under the Term Asset-Backed Securities Loan Facility, largely due to early repayments by borrowers.

The Reserve Banks’ comprehensive income increased $28 billion over the previous year to $82 billion for the year ended December 31, 2010. The increase was primarily attributable to an increase of $24 billion in interest earnings on the federal agency and GSE MBS holdings.

The Reserve Banks transferred $79 billion of their $82 billion in comprehensive income to the U.S. Treasury in 2010, a $32 billion increase from the amount transferred in 2009.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His