Archive for June, 2011

-

Morning News: June 24, 2011

Eddy Elfenbein, June 24th, 2011 at 6:27 amDraghi Appointed to Succeed Trichet as ECB President

Banks, Officials Nearing Greek Bond Plan

EU Vows to Rescue Greece in Exchange for Cuts

As Greece Ponders Default, Lessons From Argentina

Asian Nations Welcome Oil Reserves Release

China Blocks Multi-billion Dollar Airbus Order

China Accounting Scandals Put Big Four Auditors on Red

Americans See Debt Threat, Reject Tax ‘Scare’

Used Gas Sippers, Keeping That New-Car Value

Buffett Closes ‘Backdoor’ to Berkshire

Apple Gets U.S. Antitrust Approval to Bid for Nortel Assets

Why is there so much Bad Consumer Investment Advice?

Joshua Brown: Nice Work…If You Can Get It.

Howard Lindzon: Google and The Government…Google should have Drilled For Oil

Be sure to follow me on Twitter.

-

Oracle’s Q1 Guidance

Eddy Elfenbein, June 23rd, 2011 at 10:59 pmAfter today’s close, Oracle ($ORCL) held a conference call. For Q1, the company sees earnings ranging between 45 cents and 48 cents per share. Wall Street’s estimate was 46 cents per share.

The stock dropped about 7% in the after-hours market. I strongly suspect this will fade at tomorrow’s open. Here’s what the company had to say:

For the year, our operating income grew 27% and even with the Sun Hardware business included in our results for the full year, we delivered non-GAAP operating margins of only 2% — 2 points below our all-time high. The non-GAAP tax rate for the quarter was 23.3% due to several favorable nonrecurring items including agreements with worldwide taxing authorities. EPS grew 25% to $0.75 on a non-GAAP basis.

The fact that we were able to put up these top line and bottom line results given our size, once again, demonstrates the strength of our diversified portfolio of enterprise products and the breadth and loyalty of our huge customer base and the strength of our operating model.

We now have $29 billion in cash and marketable securities and operating cash flow increased to a record $11.2 billion. For the year, all free cash flow increased to $10.8 billion. As we’ve always said, we’re committed to returning value to our shareholders through technical innovation, strategic acquisition, stock repurchases, prudent use of debt and a dividend. In this quarter, we repurchased 12.5 million shares for a total of a $422 million. For the full year, we repurchased 40.4 million shares for a total of approximately $1.2 billion. And the board again declared a dividend of $0.06.

Now the guidance. As you remember, we had a spectacular Q1 last year with New License up 25%, non-GAAP EPS up 38% and GAAP EPS up 20%. So assuming exchange rates remain at current levels, which is right now a positive 5% currency impact on license and revenue growth rates, our guidance for Q1 is as follows: New Software Licenses revenue growth is expected to range from 10% to 20%; Hardware Product revenue growth is expected to range from negative 5 to positive 5 and of course, that does not include the Hardware Support revenue; total revenue on a non-GAAP basis is expected to range from 9% to 12%; on a GAAP basis, we expect total revenue growth from 10% to 13%. Non-GAAP EPS is expected to be $0.45 to $0.48; GAAP EPS is expected to be $0.33 to $0.36. Now this guidance assumes a GAAP tax rate of 29% and non-GAAP tax rate of 28.5%, which is nearly 4 points higher than our tax rate in the previous year. Now, of course, this may end up being different.

Oracle is a cash flow machine. It’s truly astounding how much money they generate. They’re now sitting on $29 billion in cash. For the last fiscal year, Oracle made $2.22 per share. Based on the most recent after-hours trade, the stock is going for just under 14 times trailing earnings.

-

Oracle Earns 75 Cents Per Share

Eddy Elfenbein, June 23rd, 2011 at 4:07 pmOracle ($ORCL) just reported earnings of 75 cents per share which beat the Street by four cents. Revenue came inline at $10.8 billion which Wall Street won’t like. The shares are down about 6% after-hours which probably won’t last until tomorrow’s open.

Yes, hardware sales dropped by 6% but that makes up about one-tenth of Oracle’s overall business.

Let’s remember that Wall Street was originally expecting 66 cents per share. Only after the company gave us guidance of 69 cents to 73 cents did the Street go up to 71 cents. And we learned today that the company delivered 75 cents per share. Folks, this was a good report.

Oracle Corporation today announced fiscal 2011 Q4 GAAP total revenues were up 13% to $10.8 billion, while non-GAAP total revenues were up 12% to $10.8 billion. Both GAAP and non-GAAP new software license revenues were up 19% to $3.7 billion. Both GAAP and non-GAAP software license updates and product support revenues were up 15% to $4.0 billion. Both GAAP and non-GAAP hardware systems products revenues were down 6% to $1.2 billion. GAAP operating income was up 32% to $4.4 billion, and GAAP operating margin was 40%. Non-GAAP operating income was up 19% to $5.2 billion, and non-GAAP operating margin was 48%. GAAP net income was up 36% to $3.2 billion, while non-GAAP net income was up 27% to $3.9 billion. GAAP earnings per share were $0.62, up 34% compared to last year while non-GAAP earnings per share were up 25% to $0.75. GAAP operating cash flow on a trailing twelve-month basis was $11.2 billion.

For fiscal year 2011, GAAP total revenues were up 33% to $35.6 billion, while non-GAAP total revenues were up 33% to $35.9 billion. Both GAAP and non-GAAP new software license revenues were up 23% to $9.2 billion. GAAP software license updates and product support revenues were up 13% to $14.8 billion, while non-GAAP software license updates and product support revenues were up 13% to $14.9 billion. Both GAAP and non-GAAP hardware systems products revenues were $4.4 billion. GAAP operating income was up 33% to $12.0 billion, and GAAP operating margin was 34%. Non-GAAP operating income was up 27% to $15.9 billion, and non-GAAP operating margin was 44%. GAAP net income was up 39% to $8.5 billion, while non-GAAP net income was up 34% to $11.4 billion. GAAP earnings per share were $1.67, up 38% compared to last year while non-GAAP earnings per share were up 33% to $2.22.

“In Q4, we achieved a 19% new software license growth rate with almost no help from acquisitions,” said Oracle President and CFO, Safra Catz. “This strong organic growth combined with continuously improving operational efficiencies enabled us to deliver a 48% operating margin in the quarter. As our results reflect, we clearly exceeded even our own high expectations for Sun’s business.”

-

Medtronic Raises Dividend By 8%

Eddy Elfenbein, June 23rd, 2011 at 12:56 pmFor the 34th year in a row, Medtronic ($MDT) is raising its quarterly dividend. The company is increasing it from 22.5 cents per share to 24.25 cents. That’s an 8% increase. Annualized, the dividend rises from 90 cents per share to 97 cents per share.

Going by the price as of 1 pm today, that comes to a yield of 2.56%.

Last month, MDT told us to expect earnings for this year between $3.43 per share and $3.50 per share. Their fiscal year ends in April. This means the stock is going for 11 times the low-end of the company’s own forecast.

-

Google Still Goes Lower

Eddy Elfenbein, June 23rd, 2011 at 11:57 amLast month, I asked the question, “How much is Google really worth?”

So how much should Google be worth? That’s hard to say. Let’s take a very basic look. Wall Street currently expects Google to earn $33.90 per share this year.

The S&P 500 is currently trading at 13.85 times this year’s earnings estimate. If Google were carrying that multiple, it would be about $470 per share.

However, Google is projected to grow its earnings faster than the overall market. Wall Street currently expects Google to earn $39.49 per share in 2012. The S&P 500 is going for 12.2 times next year’s estimate. So if Google carried that multiple, it would be $481 per share.

When I wrote that GOOG was at $535. Today it’s at $476.

The earnings estimates are basically unchanged. For 2011, Wall Street expects earnings of $33.88 per share, and $39.47 for 2012.

Google is now going for 14.1 times this year’s earnings and 12.1 times next year’s earnings. Compared with the S&P 500, this represents a value premium of 8.8% and 6.5%, respectively.

-

Double Bounce!

Eddy Elfenbein, June 23rd, 2011 at 11:05 am -

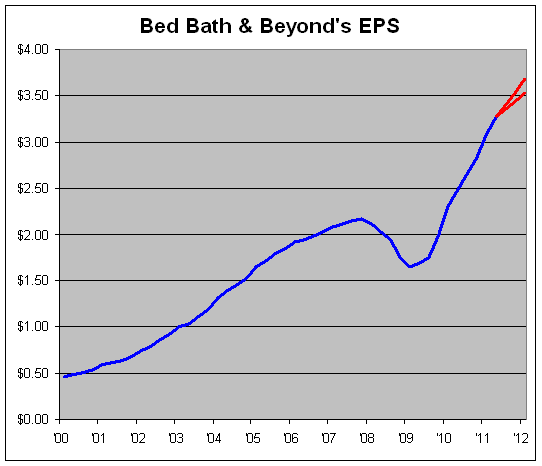

Bed Bath & Beyond’s Earnings Trend

Eddy Elfenbein, June 23rd, 2011 at 10:15 amShares of Bed Bath & Beyond ($BBBY) jumped as much as 5.4% this morning. Here’s a look at the company’s earnings trend along with their updated earnings forecast. Just by looking at the chart, you see that the upper-end of the forecast is still well within the recent trend.

Year-over-year net profit margins have now increased for nine-straight quarters. For the last four quarters, net margins are running at 9.3% which is closing in on the company’s peak of 10% reached in 2005.

Courtesy of Seeking Alpha, here’s part of yesterday’s earnings call where the company details its forecast for the rest of this year:

The following are our major planning assumptions for the remainder of fiscal 2011.

One, including the 12 stores open so far this year, we anticipate that the total number of new store openings will be approximately 40 to 45 stores across all of our concepts. Currently, we believe that fiscal 2011 store openings by concept will be substantially similar to fiscal 2010 with a slight shift to several more buybuy BABY stores and slightly fewer Bed Bath & Beyond stores. As the year progresses and we gain greater visibility, the total number of stores that we will open may be updated. We will continue to place Harmon Face Values health and beauty care offerings in stores across all of our concepts. As always, we remain flexible to take advantage of real estate opportunities that may arise.

Two, we expect to continue our program of expanding, renovating and/or relocating a number of our stores in fiscal 2011.

Three, we are modeling a 2 to 4 percentage increase in comparable store sales for the second quarter and full fiscal year.

Four, based on these comparable store sales assumptions, we are modeling consolidated net sales to increase by 5% to 7% in the second quarter and full year of fiscal 2011.

Five, assuming these sales levels, in addition to planning the continuation of the shift in the mix of merchandise sold to lower margin categories, we are modeling our operating profit to be in the range of flat to slightly leveraged for the fiscal second quarter and to be slightly leveraged for the full year.

Six, interest income is expected to be relatively flat versus fiscal 2010.

Seven, the second quarter and full year tax provision are estimated in the mid- to high-30s percent range with expected variability as taxable events occur.

Eight, capital expenditures for fiscal 2011, principally for new stores, existing store refurbishments, information technology enhancements, including increased spending on our interactive platforms and other projects, continue to be planned at approximately $250 million, which of course, remains subject to the timing of projects.

Nine, depreciation for fiscal 2011 is estimated to be approximately $190 million.

Ten, we expect to generate positive operating cash flow in fiscal 2011 and continue to fund operations entirely from internally generated sources.

Eleven, in the first quarter, we completed our $1 billion share repurchase program and, thereafter, began our $2 billion program authorized in December 2010, which we continue to model to be completed in approximately 2 years. Our share repurchase program may be influenced by several factors, including business and market conditions.

Based on these and the other planning assumptions, we are modeling net earnings per diluted share to be in the range of approximately $0.77 to $0.82 for the fiscal second quarter of 2011. For all of fiscal 2011, we are modeling net earnings per diluted share to increase by approximately 15% to 20%.

-

Morning News: June 23, 2011

Eddy Elfenbein, June 23rd, 2011 at 8:05 amDerivatives Cloud the Possible Fallout From a Greek Default

Selling $50 Billion in Greek Assets Is Herculean Task

Group of 20 Agrees on Steps to Mitigate Food Price Swings

Biggest Banks May Get Boost From Basel

High-Speed Rail Poised to Alter China

Chinese PMI Is On The Verge Of Contraction

Bernanke Leaves Door Open to Further Easing

S.E.C. Approves New Reporting Requirements for Hedge Funds

London Stock Exchange Bid on Knife Edge as TMX Battle Heats Up

Hulu Seen at 50 Times Earnings in Sale Seeking Netflix Multiple

Lennar Net Slides 65% on Lower Home Deliveries

Nissan CEO: Aiming For 10% U.S. Market Share, Seek To Buy Stake In Avtovaz

Brian Shannon: Stock Trading Ideas for 6/23/11

Josh Brown: Pitching RIM to Warren Buffett

Be sure to follow me on Twitter.

-

Bed Bath & Beyond Raises Full-Year Forecast

Eddy Elfenbein, June 22nd, 2011 at 4:35 pmWowie! Bed Bath & Beyond ($BBBY) just had an outstanding earnings report for their fiscal Q1.

Let’s go over the numbers. For Q1, they earned 72 cents per share. When the last earnings report came out, they told us to expect earnings to range between 58 cents and 61 cents per share. I knew that was low and in last week’s CWS Market Review, I said I was expecting modest earnings of around 63 cents per share.

Turns out, I wasn’t optimistic enough. The shares are up about 2% after hours.

I also said that I was looking forward to Q2 guidance of 80 to 85 cents per share. They gave us guidance of 77 cents to 82 cents per share. So I was still in the ballpark.

This was a great earnings report. The best news of all is that the company also revised their full-year forecast higher. The numbers here aren’t as clear. At the start of the year, BBBY told us to expect an earnings increase for the entire year of 10% to 15%. For 2010, they earned $3.07 which came to $3.38 to $3.53 per share.

Now BBBY has upped that full-year forecast to 15% to 20%. That translates to a range of $3.53 to $3.68 per share.

Bed Bath & Beyond Inc. today reported net earnings of $.72 per diluted share ($180.6 million) in the fiscal first quarter ended May 28, 2011, an increase of approximately 38% versus net earnings of $.52 per diluted share ($137.6 million) in the same quarter a year ago. Net sales for the fiscal first quarter of 2011 were approximately $2.110 billion, an increase of approximately 9.7% from net sales of approximately $1.923 billion reported in the fiscal first quarter of 2010. Comparable store sales in the fiscal first quarter of 2011 increased by approximately 7.0%, compared with an increase of approximately 8.4% in last year’s fiscal first quarter.

During the fiscal first quarter of 2011, the Company repurchased approximately $245 million of its common stock representing approximately 4.8 million shares. This included the completion of the $1 billion share repurchase program authorized in 2007. As of May 28, 2011, the balance remaining of the share repurchase program authorized in December 2010 was approximately $1.892 billion dollars.

The Company is now modeling net earnings per diluted share to be approximately $.77 to $.82 for the fiscal second quarter of 2011 and to increase by approximately 15% to 20% for all of fiscal 2011.

Here’s a look at BBBY’s quarterly numbers for the past few years:

Quarter Sales Gross Profit Operating Profit Net Profit EPS May-99 $356,633 $146,214 $28,015 $17,883 $0.06 Aug-99 $451,715 $185,570 $53,580 $33,247 $0.12 Nov-00 $480,145 $196,784 $50,607 $31,707 $0.11 Feb-00 $569,012 $238,233 $77,138 $48,392 $0.17 May-00 $459,163 $187,293 $36,339 $23,364 $0.08 Aug-00 $589,381 $241,284 $70,009 $43,578 $0.15 Nov-01 $602,004 $246,080 $64,592 $40,665 $0.14 Feb-01 $746,107 $311,802 $101,898 $64,315 $0.22 May-01 $575,833 $234,959 $45,602 $30,007 $0.10 Aug-01 $713,636 $291,342 $84,672 $53,954 $0.18 Nov-02 $759,438 $311,030 $83,749 $52,964 $0.18 Feb-02 $879,055 $370,235 $132,077 $82,674 $0.28 May-02 $776,798 $318,362 $72,701 $46,299 $0.15 Aug-02 $903,044 $370,335 $119,687 $75,459 $0.25 Nov-03 $936,030 $386,224 $119,228 $75,112 $0.25 Feb-03 $1,049,292 $443,626 $168,441 $105,309 $0.35 May-03 $893,868 $367,180 $90,450 $57,508 $0.19 Aug-03 $1,111,445 $459,145 $155,867 $97,208 $0.32 Nov-04 $1,174,740 $486,987 $161,459 $100,506 $0.33 Feb-04 $1,297,928 $563,352 $231,567 $144,248 $0.47 May-04 $1,100,917 $456,774 $128,707 $82,049 $0.27 Aug-04 $1,273,960 $530,829 $189,108 $120,008 $0.39 Nov-05 $1,305,155 $548,152 $190,978 $121,927 $0.40 Feb-05 $1,467,646 $650,546 $283,621 $180,980 $0.59 May-05 $1,244,421 $520,781 $150,884 $98,903 $0.33 Aug-05 $1,431,182 $601,784 $217,877 $141,402 $0.47 Nov-06 $1,448,680 $615,363 $205,493 $134,620 $0.45 Feb-06 $1,685,279 $747,820 $304,917 $197,922 $0.67 May-06 $1,395,963 $590,098 $148,750 $100,431 $0.35 Aug-06 $1,607,239 $678,249 $219,622 $145,535 $0.51 Nov-07 $1,619,240 $704,073 $211,134 $142,436 $0.50 Feb-07 $1,994,987 $862,982 $309,895 $205,842 $0.72 May-07 $1,553,293 $646,109 $154,391 $104,647 $0.38 Aug-07 $1,767,716 $732,158 $211,037 $147,008 $0.55 Nov-08 $1,794,747 $747,866 $203,152 $138,232 $0.52 Feb-08 $1,933,186 $799,098 $259,442 $172,921 $0.66 May-08 $1,648,491 $656,000 $118,819 $76,777 $0.30 Aug-08 $1,853,892 $739,321 $187,421 $119,268 $0.46 Nov-08 $1,782,683 $692,857 $136,374 $87,700 $0.34 Feb-09 $1,923,274 $785,058 $231,282 $141,378 $0.55 May-09 $1,694,340 $666,818 $142,304 $87,172 $0.34 Aug-09 $1,914,909 $773,393 $222,031 $135,531 $0.52 Nov-09 $1,975,465 $812,412 $245,611 $151,288 $0.58 Feb-10 $2,244,079 $955,496 $370,741 $226,042 $0.86 May-10 $1,923,051 $775,036 $225,394 $137,553 $0.52 Aug-10 $2,136,730 $874,918 $296,902 $181,755 $0.70 Nov-10 $2,193,755 $896,508 $305,110 $188,574 $0.74 Feb-11 $2,504,967 $1,076,467 $461,052 $283,451 $1.12 May-11 $2,109,951 $857,572 $288,948 $180,578 $0.72 -

The Fed’s Projections

Eddy Elfenbein, June 22nd, 2011 at 2:19 pmHere are the new economic projections from the Fed.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His