Archive for July, 2011

-

General Cannabis Joins OTCQX

Eddy Elfenbein, July 27th, 2011 at 3:38 pmToday’s best press release:

NEW YORK, July 26, 2011 /PRNewswire/ — OTC Markets Group Inc. (OTCQX: OTCM), the company that operates the world’s largest electronic marketplace for broker-dealers to trade unlisted stocks, today announced that General Cannabis, Inc. (OTCQX: CANA), a technology-based internet marketing services company, is now trading on the OTC market’s highest tier, OTCQX®.

(Logo: http://photos.prnewswire.com/prnh/20110118/MM31963LOGO )

General Cannabis began trading today on the OTC market’s prestigious tier, OTCQX U.S. Investors can find current financial disclosure and Real-Time Level 2 quotes for the Company on www.otcqx.com and www.otcmarkets.com.

“Investors prefer the quality-controlled admission process on OTCQX which identifies the segment of OTC companies focused on valuation and transparency,” said R. Cromwell Coulson, President and Chief Executive Officer of OTC Markets Group. “We are pleased to welcome General Cannabis to OTCQX.”

The Lebrecht Group, APLC will serve as General Cannabis’ Designated Advisor for Disclosure (“DAD”) on OTCQX, responsible for providing guidance on OTCQX requirements.

About General Cannabis, Inc.

General Cannabis, Inc. (OTCQX: CANA) trades in the United States on OTCQX under the symbol “CANA”. General Cannabis is a rapidly growing, technology driven company that is defining the multi-billion dollar cannabis industry. The wholly owned subsidiaries of General Cannabis include WeedMaps Media, Inc., General Health Solutions, Inc., General Merchant Solutions, Inc. and US Cannabis, Inc. Each subsidiary plays a vital role in the ongoing success of General Cannabis and the industry itself.

There shares are currently at $3. How many sell orders at $4.20 do you think there are?

-

More on NICK’s Earnings

Eddy Elfenbein, July 27th, 2011 at 1:18 pmThe press release is out on Nicholas Financial‘s ($NICK) earnings.

Nicholas Financial, Inc. announced that for the three months ended June 30, 2011 net earnings increased 48% to $5,303,000 as compared to $3,576,000 for the three months ended June 30, 2010. Per share diluted net earnings increased 47% to $0.44 as compared to $0.30 for the three months ended June 30, 2010. Revenue increased 11% to $16,634,000 for the three months ended June 30, 2011 as compared to $14,952,000 for the three months ended June 30, 2010.

“Our strong growth in earnings per share for the first quarter ended June 30, 2011 were favorably impacted by an increase in the average finance receivables and a reduction in the net charge-off rate,” stated Peter L. Vosotas, Chairman and CEO. “We recently opened our 57th branch location in Charleston, SC and continue to develop additional markets. The Company will also continue to evaluate new markets for future branch locations and we remain open to acquisitions should an opportunity present itself,” added Vosotas.

I’m glad to see that Vosotas is open to an acquisition. I agree, but in my view, nothing less than $17 is worthwhile.

This was a very good quarter for NICK. Here’s my spreadsheet with all the details. The company has nearly $270 million in receivables. Of that, their gross yield is 24.71%. Subtracting from that, interest expense was a little over $1.2 million. The borrowing rate was just 4.18% which is the lowest in the records I have.

The key metric to watch is provision for credit losses which was just $73,000 last quarter. That’s a drop of over 95% from a year ago. NICK’s net yield came in at 22.76% which is the highest level in five years. Operating expenses were fairly low.

Here’s a comparison to show you how profitable NICK is: Over the last year, interest expense has dropped by more than 20%. That’s over $300,000. Meanwhile, receivables are up by over $30 million. All these numbers add up to net income of $5.3 million which comes to 44.3 cents per share.

Since NICK’s fiscal year ends in March, this was the report for their fiscal Q1. For comparison’s sake, let’s look at how their calendar is going. For NICK’s March quarter, they earned 40 cents per share. That means the company has earned 84 cents per share for the first six months of 2011.

In the CWS Market Review from February 4th, I said that I wouldn’t be surprised if NICK earned $1.50 for the 2011 calendar year. That may have seemed wildly optimistic at the time, but now it looks pessimistic.

All NICK has to do is keep doing what they’re doing, and earnings will have a good shot of topping $1.70 per share for this calendar year. That means the stock is going for seven times this year’s earnings based on yesterday’s closing price.

One more thing to add: NICK’s low price from two-and-a-half years ago was $1.63 per share.

-

Nicholas Financial Earns 44 Cents Per Share

Eddy Elfenbein, July 27th, 2011 at 9:14 amAnother great quarter for Nicholas Financial ($NICK). The company pulled in 44 cents per share in the second quarter.

July 27, 2011 – Clearwater, Florida – Nicholas Financial, Inc. (NASDAQ: NICK) announced that for the three months ended June 30, 2011 net earnings increased 48% to $5,303,000 as compared to $3,576,000 for the three months ended June 30, 2010. Per share diluted net earnings increased 47% to $0.44 as compared to $0.30 for the three months ended June 30, 2010. Revenue increased 11% to $16,634,000 for the three months ended June 30, 2011 as compared to $14,952,000 for the three months ended June 30, 2010.

This is very good news. I’ll have more details as soon as they’re available.

-

Earnings from Fiserv and Gilead Sciences

Eddy Elfenbein, July 27th, 2011 at 8:47 amAfter the closing bell yesterday, Fiserv ($FISV) reported second-quarter earnings of $1.13 per share which was five cents more than expectations. For the same quarter one year ago, the company earned $1.00 per share.

I really like this stock. Fiserv also reiterated its full-year forecast of $4.42 to $4.54 per share. The stock is up about $1 today and is close to the all-time high price reached earlier this month.

I was nervous about Gilead Sciences ($GILD) because it had a very bad earnings report last time. This time around, wasn’t so bad. Gilead netted $1.00 per share which was one penny better than expectations.

Sales of Atripla, which combines Gilead’s Truvada with Bristol-Myers Squibb Co’s Sustiva into a single pill, rose 15 percent to $822 million, topping analysts’ forecasts of between $810 million and $812 million.

Sales of Truvada rose 11 percent to $711.3 million, also exceeding Wall Street estimates of about $708 million.

First-quarter sales of the two drugs had missed analysts’ estimates as they were hit by temporary cutbacks in state-funded AIDS drug assistance programs in Florida and Texas.

Gilead is expected to unveil key data on its Quad HIV pill later this quarter and said it plans to file its application seeking U.S. approval in the first quarter of 2012.

Quad, which will combine four medicines, is considered to be Gilead’s most important future growth driver by many analysts.

The company said it is also planning to seek U.S. Food and Drug Administration approval to amend the Truvada label to include data from recent studies showing the drug can help prevent new HIV infections.

-

Morning News: July 27, 2011

Eddy Elfenbein, July 27th, 2011 at 7:55 amBoehner Fights Internal Party Strife on Debt Plan

On All Levels of the Economy, Concern About the Impasse

Home Sales, Prices Reflect Malaise

As US Debt Impasse Continues, Risks Loom In Repo Market

Treasuries Gain as Debt-Accord Speculation Boosts Demand at Two-Year Sale

WellPoint Tops Estimates as Expenses Fall

Nissan 1Q Net Profit Drops 20% As Yen, Quake Offset Sales Growth

Moody’s Downgrades Nokia Citing Weaker Market Position

Santander Profit Tumbles On UK Charge; Delays IPOs

Dow Profit Tops Estimates on Plastics, Chemicals

Nasdaq OMX Profit Dips in Q2, Beats Estimates

Dunkin’ Brands Raises $422.8 Million in IPO

Soros to End Four-Decade Hedge-Fund Career

Howard Lindzon: Should You Paper Trade?

Paul Kedrosky: Hey, It’s Like Selling Stocks to Koreans

Be sure to follow me on Twitter.

-

Cyclicals Continue to Lag

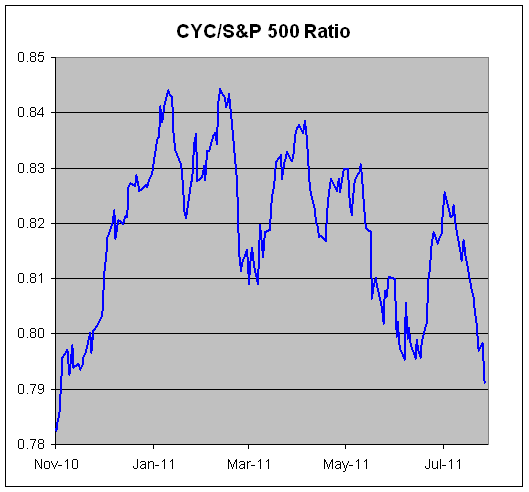

Eddy Elfenbein, July 26th, 2011 at 10:24 pmI’ve warned investors that cyclical stocks are poised for a period of under-performing the market. These are stocks whose business fortune is more closely tied to the ups and downs of the economy.

The shorthand I like to use in following the cyclical sector is the ratio of the Morgan Stanley Cyclical Index (^CYC) to the S&P 500. That ratio reached an all-time high on February 11th and has gradually dropped ever since. Since the beginning of July, the ratio has really started to head south. From July 1st to July 26th, the S&P 500 is down just 0.58% while the cyclicals are off by 4.73%.

On Friday we’re going to get our first peek at how well the economy did during the second three months of the year. The report will most likely be depressing. While the economy is indeed growing, it’s not growing at the speed needed to put people back to work. As long as the economy remains sluggish, cyclical stocks will continue to do poorly. Outside of a few exceptions, I urge investors to steer clear of cyclicals.

-

Netflix Poised to Plunge

Eddy Elfenbein, July 26th, 2011 at 9:28 amOne of the of the things about having a blog is that I can’t hide my awful market calls. A little over a year ago, I called Netflix ($NFLX) “the absolute worst stock to buy right now.” I even got a snarky email from the CEO. The stock has jumped about $200 since then.

Sure, it’s embarrassing. But I’ve consistently believed that Netflix was absurdly overpriced. As it climbed higher, I thought it was just becoming even more and more overpriced.

Netflix just reported second-quarter earnings of $1.26 per share which was 14 cents more than expectations. Yet NFLX said to expect Q3 sales of $780 million to $805 million where Wall Street was expecting $845.3 million. The early indications are that the stock will open down about $25 per share.

I think Netflix’s decision to raise its prices has struck a nerve among its customers and some investors. Just as the stock’s price rise was in no way close to the earnings increase, so too is today’s sell-out matched by the poor sales forecast. When a stock plunges 10% on news that really isn’t that bad, you know something was wrong to begin with.

-

Ford Earns 65 Cents Per Share

Eddy Elfenbein, July 26th, 2011 at 8:47 amToday is a huge day for earnings for our Buy List. Ford ($F) kicked things off by reporting adjusted earnings of 65 cents per share. Wall Street was expecting 60 cents per share although I thought it could have been as high as 70 cents per share.

Ford also said it is spending more to increase production because of rising post-recession demand. U.S. consumers are expected to buy nearly 2 million more cars this year than they did last year. Dealers say they are selling some Ford Focus sedans hours after they hit the lot. Earlier this month, Ford held a lottery to fill 1,800 jobs at its Louisville Assembly Plant after nearly 17,000 people applied.

Ford projects that annual U.S. sales will be in the lower end of its 13 million to 13.5 million forecast.

U.S. auto sales stumbled in the quarter, losing the momentum they had before the March 11 earthquake in Japan. Some buyers turned to Ford and other brands when Japanese cars were in short supply. But others seem determined to wait until later this year, when Japanese supplies will be replenished and prices are expected to fall.

Ford was able to command higher prices for its cars and trucks in the U.S., partly because of tight supplies of vehicles after the earthquake.

For the second quarter, revenue rose 13 percent to $35.5 billion. Analysts polled by FactSet had forecast revenue of $32.15 billion.

Ford paid off $2.6 billion in debt during the quarter. The company now has $14 billion in debt, down from $16.6 billion in the same quarter a year ago, a legacy of its 2006 decision to borrow $23 billion to restructure the business. Ford hopes its steady reduction in debt will convince ratings agencies to return the company to investment-grade status, which would make it cheaper to borrow money.

Booth said ratings agencies aren’t expected to act until after the company completes contract talks with the United Auto Workers union. Ford and the UAW are expected to kick off negotiations on a new contract this Friday.

The stock looks to open higher this morning.

-

Morning News: July 26, 2011

Eddy Elfenbein, July 26th, 2011 at 8:05 amMoody’s Again Reduces Greece’s Credit Rating

Greece Expects Bond Swap in August

Deutsche Bank Slashes Peripheral Europe Risk

Beef Tainted by Radiation to Be Recalled in Japan as Contamination Widens

Spanish, Italian Borrowing Costs Soar

Manufactured Goods Lead Surge in Indian Exports

Pox on Dollar, Euro Makes Swissie Good as Gold

Obama Presses for Debt Ceiling Deal

Republican Leaders Voted for Drivers of U.S. Debt They Now Blame on Obama

Treasurys Weaken on Debt Impasse

Baidu Profit Jumps on Customer Growth

Ford Second-Quarter Profit Beats Estimates

UBS Scraps Earnings Goal After Profit Falls 49%

Need a Light Bulb? Uncle Sam Gets to Choose: Virginia Postrel

Joshua Brown: The Law of Unintended Consequences, Part 657

Brian Shannon: Webinar Recording & Trade Ideas for 7/26

Be sure to follow me on Twitter.

-

Sector Performance Since June 20

Eddy Elfenbein, July 25th, 2011 at 6:10 pmHere’s a look at how the different S&P 500 sectors have performed since June 20th. What’s interesting is how wide the spread is. A rising tide has not lifted all boats.

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His