Archive for May, 2012

-

Moody’s Raises Ford to Investment Grade

Eddy Elfenbein, May 23rd, 2012 at 10:31 amFirst Fitch raised Ford‘s ($F) debt to investment grade, now Moody’s has followed.

The upgrade allows Ford to enjoy lower borrowing costs and expands the number of potential buyers for its bonds.

It also represents a symbolic win for Ford, which nearly collapsed six years ago before mortgaging most of its assets to borrow $23.5 billion to finance a restructuring. Ford continued to use the Blue Oval icon and the other assets. The icon is stamped on the grill of Ford’s cars and trucks.

(…)

Moody’s cited Ford’s improved lineup of cars and trucks, limited use of incentives to spur sales, and much lower break-even point in North America for its decision.

In 2009, Ford could break even in North America if it sold 3.4 million cars and trucks. Now, that level has dropped 45 percent to 1.8 million in sales, according to Moody’s.

“We concluded that the improvements Ford has made are likely to be lasting,” said Moody’s analyst Bruce Clark.

Ford wants to cut its automotive debt to $10 billion by the middle of the decade as well as reduce the risk posed by its pension obligations.

Ford’s automotive debt was $13.7 billion in the first quarter. Last month, Ford said it would offer lump-sum pension buyouts to current white-collar retirees, a move that may lower its U.S. pension obligation by one-third.

-

Nigel Farge: Greece Should Leave the Euro

Eddy Elfenbein, May 23rd, 2012 at 8:43 am -

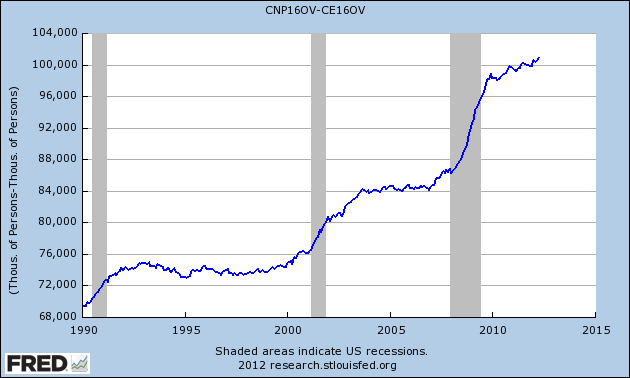

100 Million Americans Without Jobs

Eddy Elfenbein, May 23rd, 2012 at 7:41 amThe national unemployment rate gets lots of attention, and lately more attention has been paid to the workforce participation rate since more Americans have given up looking for a job, but we can also see that an astounding 100 million Americans don’t have jobs.

Specifically, these are people who are part of the civilian over-16 non-institutional population who are either unemployed or not part of the workforce. According to the April jobs report, the number of jobless American stood at 100.9 million.

That’s an all-time record and it’s an increase of 26.2 million over the last 12 years. It’s as if we absorbed the entire adult population of Canada and not a single person had a job.

The numbers are staggering. The jobs-to-population ratio peaked 12 years ago. If we were to have the same ratio today, we would need 15.3 million more jobs, or 23.7 million fewer people.

(Note: The chart above is the Civilian Over-16 Non-Institutional Population minus the seasonally adjusted Civilian Workforce.)

-

Morning News: May 23, 2012

Eddy Elfenbein, May 23rd, 2012 at 7:14 amU.S. Stock Futures Slide; CBO Warns Of Possible Recession

Germany Sells 2-Year, 0% Bonds Amid Greek Anxiety

Regulators, Investors Turn Up Heat Over Facebook IPO

Burberry Plans Retail Space Expansion As Profit Grows

US Stock Futures Drop Ahead Of Europe Summit

Lenovo 4th Quarter Profit Up 59%; Outpaces Industry Growth

Toll Brothers Swings To 2Q Profit On Fewer Writedowns, More Deliveries

Euro Drops to 21-month Low as Break Up Risks Mount

Guessing Game Begins Over Next Treasury Chief

-

“It’s Like Buying $1 For $1.98”

Eddy Elfenbein, May 22nd, 2012 at 7:30 pmRodrigo Campos of Reuters writes:

Investor confidence in the shares has been damaged after Reuters reported lead underwriter Morgan Stanley cut its revenue forecasts for Facebook in the days before the offering, in part because of comments from Facebook on mobile usage.

After pricing at $38, far more than the first estimate of $28 the company gave investors, shares have been sliding – at one point as much as 31 percent from the $45 peak hit shortly after it started trading Friday.

“Facebook right now is going for far more than what it’s worth, it’s like buying $1 for $1.98, it just doesn’t make sense at this price,” said Eddy Elfenbein, widely followed blogger and editor at Crossing Wall Street.

Starmine’s analysis of Google Inc’s value puts that stock at $680, assuming a growth rate of 10.1 percent for the next 10 years. That makes the Internet giant undervalued at $599 a share.

“Just from basic modeling the stock should be around $17 to $20 dollars, and that is with a lot of variables,” Elfenbein said. “I would call that an ideal price. I would be interested in buying and I think that is a good deal for investors.”

-

Medtronic’s Earnings Call

Eddy Elfenbein, May 22nd, 2012 at 3:48 pmFrom Seeking Alpha:

Let me conclude by providing our initial fiscal year 2013 revenue outlook and earnings per share guidance. While we believe our markets have improved modestly, we estimate market growth remains in the low single digits. Based on this, as well as the expected growth from recent product launches, we believe that constant currency revenue growth of 2% to 4% is reasonable for FY ’13 and would reflect improvement from our organic growth in FY ’12. While we cannot predict the impact of currency movements, to give you a sense of the FX impact and the exchange rates were to remain similar to yesterday for the remainder of the fiscal year, then our FY ’13 revenue will be negatively affected by approximately $330 million to $337 million, including a negative $100 million to $120 million impact in Q1.

Turning to guidance on the bottom line. Based on expected constant currency revenue growth of 2% to 4%, we believe it is reasonable to model earnings per share in the range of $3.62 to $3.70, which implies FY ’13 earnings per share growth of 5% to 7%. While we do not provide quarterly guidance, we would point out that the current consensus reflects Q1 earnings per share growth of 10%, which is outside our issued guidance, and therefore we would not be surprised to see some modest shifts — modest model shift a couple of pennies from Q1 to Q4. As in the past, my comments and guidance do not include any unusual charges or gains that might occur during the fiscal year, nor do they include the impact of the noncash charge for convertible debt interest expense.

-

Zuckerberg Has Lost $7 Billion in Four Days

Eddy Elfenbein, May 22nd, 2012 at 2:23 pmHey Zuck, congrats on your wedding! I hate to disturb your honeymoon, but your stock’s honeymoon is seriously over.

Measuring from Friday’s high to today’s low, you’re out $7 billion. LOLZ.

Anywho…have a great rest of the honeymoon!

-

Are Sweaty Brokers More Ethical?

Eddy Elfenbein, May 22nd, 2012 at 10:52 amIf you want to know how ethical your broker is, give them a moral dilemma and see how much they sweat before deciding what to do.

It’s quite a jump from the laboratory to real-world decisions about asset management but British researchers have found that gut feeling can override rational thought when people are faced with financial offers that look unfair.

Even when we could benefit, a physical response like sweating can make people reject a financial proposition they consider to be unjust. The key is how tuned in they are to their own bodies.Researchers from the University of Exeter, the Medical Research Council Cognition and Brain Sciences Unit and the University of Cambridge, gave 51 people a series of offers based on dividing 10 pounds ($16) between two people. They found that although an offer to split the money 50:50 was mostly accepted, an offer of less than a ‘fair share’ was often rejected, even though rejecting it left them with nothing.

The game, a version of a well-known psychological test called the Ultimatum Game, showed gut reactions, especially made under time pressure with incomplete information, can lead to decisions that are irrational from a purely economic perspective.

The researchers measured how much participants sweated through their fingertips and how much their heart rate changed.

Clinical psychologist Barney Dunn, who led the study, told Reuters that participants were also tested on how accurately they could monitor their physical responses by counting their own heartbeats. Those who were most accurate were more prone to having their bodies dictate their decisions in the game.

“It’s a bizarre finding but it’s very robust,” said Dunn.

-

Who’s To Blame for Facebook?

Eddy Elfenbein, May 22nd, 2012 at 10:32 amThe New York Times has an interesting article this morning: “As Facebook’s Stock Struggles, Fingers Start Pointing.”

Apparently, stocks are only allowed to go up, and if they don’t, it must be someone’s fault.

Wall Street is playing the Facebook blame game.

As shares of the social network tumbled in their second day of trading, bankers, investors and analysts wondered what had gone wrong with the initial public offering of Facebook, the most highly anticipated technology debut in years.

Some fingers are pointing at Morgan Stanley, the lead banker on the I.P.O., while others criticize Nasdaq and even Facebook itself. In the aftermath, critics contend that Facebook’s offering price was too high and too many shares were sold to the public, hurting the stock’s performance out of the gate.

So the media is asking if the blame should lie with the underwriter, the exchange or the company itself. My question is: What about the media?

-

Medtronic Earns 99 Cents Per Share

Eddy Elfenbein, May 22nd, 2012 at 9:47 amMedtronic ($MDT) is keeping it real. For its fiscal Q4, the company reported earnings of 99 cents per share. That’s a penny ahead of expectations and a 10% increase from a year ago. In February, the medical equipment company told us to expect Q4 earnings between 97 cents and $1 per share. Quarterly revenues rose 4% to 4.3 billion.

Demand for pacemakers and defibrillators, the company’s biggest product category, is starting to return, said Rick Wise, a Leerink Swann & Co. analyst in New York. U.S. approval of the Resolute Integrity stent in February to treat clogged heart arteries and the conclusion of a Justice Department investigation into the Infuse bone strengthening product should pave the way for faster growth next year, analysts said.

Now let’s look at the full-year numbers because this was a good year for Medtronic. Earnings rose from $3.37 to $3.46 per share. A year ago, they gave us full-year guidance of $3.43 to $3.50 per share which was dead on target. In 2010, Medtronic cut their forecast several times, but this year they held firm throughout the year.

For 2013, Medtronic sees earnings ranging between $3.62 and $3.70 per share. The Street was expecting $3.66 per share. Officially, that will be reported as “inline guidance” but I’m very pleased with it.

Sometime next month, I expect Medtronic will raise its quarterly dividend. The current payout is 24.25 cents per share which works out to a yearly dividend of 97 cents per share (or 2.57%). If I had to guess, I think it will be a modest increase — to 25 or 26 cents per share. This will mark their 35th-straight dividend increase.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His