Archive for August, 2012

-

Still Staying Away from Dell

Eddy Elfenbein, August 22nd, 2012 at 12:37 pmI wish I could like Dell ($DELL) more than I do. The cheap price is tempting and I wouldn’t be surprised to see the shares rally from here. The problem for me is that by buying Dell here, I’m taking on more risk than I need to. One of my fundamental rules of investing is to never take risks that I don’t need to. Last month, I said I was staying away from Dell and that’s how I feel today.

Warren Buffett said, “I don’t look to jump over 7-foot bars: I look around for 1-foot bars that I can step over.” That’s my thought about Dell. The company just beat earnings by five cents per share. This is a good example of the quarterly earnings report not meaning much. The big news was that Dell said it expects earnings for the year of $1.70 per share which is down from the previous forecast of $2.13 per share they gave in February.

Earnings downgrades are like cockroaches: there are usually a few more for every one you see. Companies aren’t like athletes who may go into a slump or have an “off day.” If a company lowers its guidance by a lot, there’s probably a major reason why, and that reason isn’t easily fixed.

Dell, once the world’s top personal computer maker and a pioneer in computer supply chain management, is struggling to defend its market share against Asian rivals like Acer and Lenovo and consumers’ fast-growing adoption of tablets like Apple’s iPad in place of PCs.

Dell forecast that its revenue would slide 2 percent to 5 percent in its fiscal third quarter from the second, to $13.8 billion to $14.2 billion. Wall Street had been expecting third-quarter revenue of $14.85 billion.

It is predicting earnings of “at least” $1.70 a share for fiscal 2013, compared with a previous forecast for more than $2.13 a share.

“People had already expected them to take down numbers, but I think the level to which they are taking down numbers is pretty severe compared to expectations,” said Shannon Cross, an analyst at Cross Research.

Dell’s chief financial officer, Brian Gladden, said in an interview that the company had tempered its outlook for the fiscal third quarter partly because it expected distributors to hold off on buying new computers before the late October release of the latest version of Microsoft’s Windows operating system.

Using $1.70 or earnings compared to the new stock price of $11.50 makes Dell appears attractive. But I’m not convinced. I just don’t see much coming out of Dell in the way of growth. Until I’m convinced that Dell can increase its earnings at a stable rate, I don’t see much value in the shares.

-

The Beatles 50 Years Ago Today

Eddy Elfenbein, August 22nd, 2012 at 10:56 amThis is the first real video of the Beatles from 50 years ago today. Ringo Starr had just replaced Peter Best as drummer. You can even hear someone shout at the very end, “We want Pete!”

-

Morning News: August 22, 2012

Eddy Elfenbein, August 22nd, 2012 at 8:03 amAsian Stocks Decline on Japan’s Trade Deficit, Greek Bailout

Spain Deficit Goals at Risk as Cuts Consensus Fades

China To Spend $372 Billion On Cutting Energy Use, Pollution

China Raises Rare-Earth Export Quota

RBS Probed Over Possible Iran Sanctions Violations

U.S. Companies Worry About Effect of Russia Joining W.T.O.

Dell Outlook Gloomy as PCs Slump

Nokia’s $39 Phone Rebound Wins More Time for Comeback Bid

Apple Breaks A Record, Facebook Breaks Its Fall

Best Buy Net Sinks as Turmoil Builds

Strong Revenue Boosts Toll Brothers’ Net Profit

Jeff Carter: When Insiders Sell An IPO is it “Bad”?

Pragmatic Capitalism: No Recession Now, But When?

Be sure to follow me on Twitter.

-

Medtronic’s CEO on CNBC

Eddy Elfenbein, August 21st, 2012 at 2:43 pmHere’s Omar Ishrak, CEO of Medtronic, on CNBC earlier today.

-

Medtronic Earns 85 Cents Per Share

Eddy Elfenbein, August 21st, 2012 at 11:36 amNot much of a surprise from Medtronic ($MDT) this morning. The company reported fiscal Q1 earnings of 85 cents per share which matched Wall Street’s forecast. I was expecting a little more but I’m not at all disappointed by these results. Revenues were up 1.6% to $4.01 billion..

The world’s biggest medical device maker said sales of coronary and vascular devices and structural heart products all improved. Medtronic said revenue from implantable devices like pacemakers and defibrillators decreased, although it said U.S. sales of implantable defibrillators are holding steady.

Bone graft revenue decreased in the wake of safety concerns and a shareholder lawsuit, and revenue from diabetes and surgical technology and other devices increased.

The earnings-per-share figure got a boost thanks to 3% fewer shares outstanding.

Medtronic said revenue from coronary products increased 11 percent to $433 million. Sales of structural heart devices like artificial valves rose 2 percent to $280 million and endovascular revenue, which includes stents, increased 12 percent to $209 million.

Revenue from the company’s restorative therapy business, which makes surgical devices and products used to treat diabetes, nerve disorders, and other conditions rose 3 percent to $1.89 billion. Medtronic said most of its businesses reported better sales than a year ago, but sales of its Infuse bone graft shrank 19 percent to $141 million during the quarter.

In 2011, a medical journal said Medtronic understated the risks of Infuse and did not disclose payments to the authors of studies on the product. In March 2012, Medtronic agreed to pay $85 million to resolve a federal lawsuit brought by shareholders. The U.S. government closed an investigation into Infuse in May. The product contains a genetically engineered protein that can stimulate bone growth. It is approved for use in spinal, oral and dental graft procedures, and it was frequently used in neck surgeries and other procedures.

The most important news is that Medtronic is reaffirming its full-year earnings forecast of $3.62 to $3.70 per share. Earlier today, the shares got to a new 52-week high.

-

Apple’s Gained 1% a Week, On Average, for 10 Years

Eddy Elfenbein, August 21st, 2012 at 10:57 amShares of Apple ($AAPL) are up again today making the company not only the most valuable company in the world, but also the company valuable company that’s ever been.

A few days ago, I tweeted that Apple has gained an average of 1% a week for the last ten years. The key word here is on “average.”

Let’s check the math. On April 17, 2003, Apple closed at $13.12. Adjusted for splits, that comes to $6.56. Tomorrow will mark 488 weeks which is roughly nine years and four months.

Going by today’s high of $674.88, Apple is up over 102-fold since April 17, 2003. Compounded per week, that works out to 0.954%. That also doesn’t include the dividend which Apple recently instituted.

-

Is Your Credit-Card Company Secretly Screwing You Over?

Eddy Elfenbein, August 21st, 2012 at 9:23 amMost credit-card holders don’t realize this, but there’s an easy way to lower your card’s interest rate:

Just ask your provider to do it.

No joke. Just call them up and say in your nicest voice that you’d like your APR lowered. Don’t be rash and threaten to leave or exhibit any histrionics like that. Just say that you’ve been a cardholder for such-and-such period and you’d like to have a lower rate. If you’ve been a good customer, they won’t want you to go.

Surprising? Well, if you’re like most American consumers, and even many financial professionals, there’s a lot about credit cards you don’t know. And it’s exactly this lack of knowledge that has allowed the banks who are in the card business to siphon money out of your pockets for the purpose of lining their own.

Of the approximately 120 million households in the U.S. today, some 47% carry a monthly card balance. On average, that balance totals $14,517—which is actually a significant drop from the five-year high of nearly $18,000 back in 2008. So let’s do the math. Assuming an APR of 20% (which for many cardholders is generously low), after one year that balance is up to $17,420. After another year, it’s at $20,904. Twelve months later, it’s at a whopping $25,084.

If only the S&P index funds performed like that.

So what can you do to avoid getting gutted by the purveyors of plastic? The list is quite simple:

- The best advice is the most obvious: Don’t carry a balance in the first place. The credit-card companies have a name for customers like this: bums. These people are basically getting a service—the convenience of not having to carry cash—for free. Plus your credit score goes up if you consistently pay off your cards in full. Put the cards to work for you.

- Be very, very suspicious of rewards programs. Those bonus points and free air miles that look so appealing in the card company’s brochures frequently don’t add up to much; many of them have hidden fees and blackout dates, and often the range of merchandise you can redeem them for is very limited. If the bargain-hunter in you is too strong and you just can’t resist enrolling, be sure to check the program’s online reviews beforehand, as well as the websites of the airlines you plan on using.

- If you don’t like something, say so. If you’re a customer in good standing and one of your payments arrives a few days late, or your interest rate is too high, most likely you can get the bank to work with you. The intensity of the competition means the banks are eager to keep valued clients. Frequently they will forgive late charges, remove late-payment records from your credit history, drop annual fees, or lower your APR if you’ve shown them you’re a solid customer. Of course, normal rules of courtesy apply. Be polite, but firm.

- Do not, repeat, do not, exceed your credit limit. Oftentimes, when banks lower your limit, they set it at just a few dollars above the balance you’re currently carrying. Sneaky. If you then go over that magic number, not only will you have to pay a hefty over-the-limit fee, but your credit score will drop. Remember, your credit score depends in part on the percentage of your available credit that you use. Use it all, and you’ll be seen as a potential credit hazard by the good people at TRW, Experian, and the like.

- Avoid consumer-protection plans like the plague. These plans offer no benefits whatsoever to customers; if you find yourself out of a job, they freeze your account and charge you an interest rate on your outstanding balance, typically 1%. That’s on top of the ludicrous fees they charge you for this “service” in the first place.

- Be on the lookout for “overseas” charges. When the federal government tightened its credit-card regulations after the 2008 financial debacle, many banks raised their foreign-transaction fees to make up for lost revenue. Many of these rates now hover around 3%, and frequently they apply even when you, the customer, are not overseas. That is, they can be assessed even if you order from a foreign company from within the States, so check your statements carefully.

- Call out the banks on bogus charges. A friend of mine once was car shopping and noticed the abbreviation “ADM” on the list of features for a particular vehicle. When he asked the salesman about it, the latter smugly said it stood for “additional dealer markup.” Incredible, but most people would have been content to pay it, and banks are not above pulling the same scam. Many have teaser rates that suddenly go up at a mystery date that is buried in the cardholder agreement’s fine print, while others charge fees if your card doesn’t show a certain amount of activity per year. (The latter is a way of reinstating inactivity fees, which were technically outlawed by the CARD Act of 2009. Which is to say, the banks want you to pay something for nothing.) Also to be avoided are so-called “upfront processing fees,” which are frequently applied to low-credit-limit cards to get you closer to (and hopefully, over) that credit limit. Thereby incurring more fees, and…well, you get the idea.

Like so many financial organizations, the banks count on you to be ignorant, obedient, and passive. But at the end of the day, remember: they’re there for you, not you for them. There’s no reason for you to pay money you don’t have for services you don’t need to please people you’ve never met.

To paraphrase Gordon Gekko, getting back on track, credit-card-wise, will cure what ails not just your individual bank balance, but the balance sheet of that great malfunctioning financial-services provider that is the U.S.A.

-

Nike Is a Strong Sell

Eddy Elfenbein, August 21st, 2012 at 8:01 amAs far as its business goes, I like Nike ($NKE) a lot. In my mind, it’s a $70 stock. I wouldn’t mind buying it if it were at $60. Fifty dollars would be even better.

The problem is the stock’s at $95.

The normally solid company is also starting to show some cracks, and they may soon get much bigger. The last earnings report was a complete disaster. Revenue plunged 12% and Nike missed earnings by 20 cents per share.

Nike’s profit margins are getting squeezed, so their response is to raise prices even more. I think that’s a big mistake.

We’re going learn a lot more about this approach soon when Nike unveils its newest LeBron shoe which will retail for over $300.

Just to make this clear, that’s three hundred dollars of legal U.S. currency for a basketball shoe. Actually, the sneakerati thinks it will be $315.

I think this is emblematic of some of the larger forces at work in the broader economy. Companies have pushed their margins as far as they can go. Some feel the need to raise prices even more but their customer base is tapped out. It’s like a rubber band that’s been stretched to its breaking point. Something has to give.

It’s hard to imagine what you can do to a shoe to justify $315 dollars. By the way, did I mention the built-in electronics?

The coming $315 LeBron X Nike Plus, due in the fall, is expected to come embedded with motion sensors that can measure how high players jump. The LeBron 9 PS Elite basketball shoes, which currently retail for $250, feature Nike’s signature swoosh in metallic gold.

Nike, based in Beaverton, Ore., says it is passing along price increases because many key materials, such as cotton, have risen in price over the past 18 months. Prices did moderate somewhat in the past quarter.

Nike is also faces rising labor costs in China, where it manufactures a third of its products.

Are electronics really needed for this? How about the old school approach—try to touch this rim? If you can, then that’s pretty good. If you can’t, then keep working at it. No electronics needed.

I think Nike is making a big mistake here. I wouldn’t be surprised to see the LeBron fall way short of expectations. You can tell when an industry is tired—there’s no real innovation, just larger tailfins. That’s what’s going on now.

I don’t see how Nike can come close to being worth $95. Avoid this stock.

-

Morning News: August 21, 2012

Eddy Elfenbein, August 21st, 2012 at 7:58 amGerman Bunds Fall as Portuguese, Irish Debt Rallies

Correlation Analysis Suggests Losses for Euro

China Oil Company Cuts Dividend After First-Half Profit Falls 20%

Iraqis Wait To See Gains From Country’s Oil Boom

Tianjin Sets $236 Billion Investment Target as China Slows

Wall Street Leaderless in Rules Fight as Dimon Diminished

Samsung to Spend $4 Billion to Boost Texas Chip Output

UBS Seeing Moat of Secrecy Run Dry Vows Results

Facebook’s Ambition Collides With Harsh Market

What Does Groupon’s Collapse Mean for Tech Stocks? How About: Nothing

Shell Plans At Least $1 Billion A Year China Shale Gas Investment

KKR Buys Into Novo, Bets On China Youth Apparel Market

Soros Reveals Stake In Manchester United

Joshua Brown: The Silliness Ceiling Officially Breached

Be sure to follow me on Twitter.

-

What If the Stock Market Turned Out to Be Lower in 2042 than It Is Today?

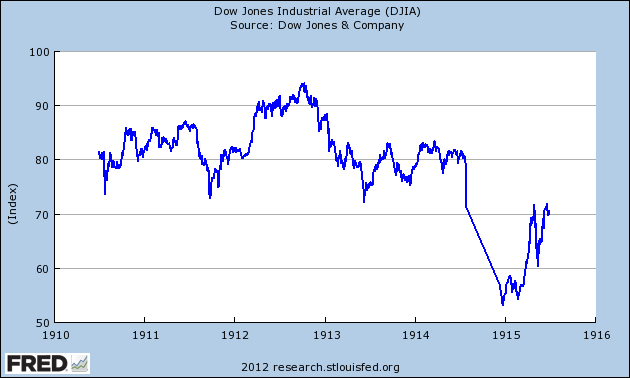

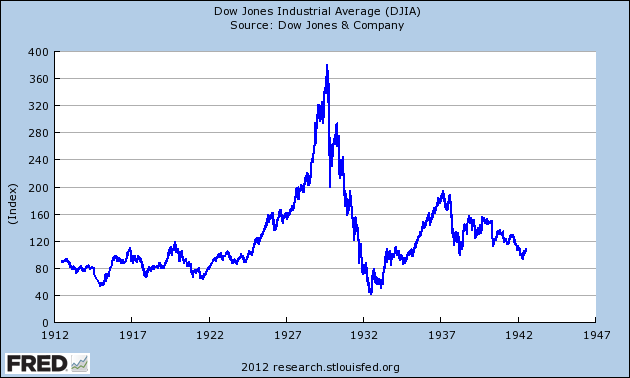

Eddy Elfenbein, August 20th, 2012 at 11:10 amWhat if I told you that the stock market would be lower 30 years from today? It’s sounds implausible but that’s what happened 100 years ago.

The Dow Jones had been rallying during the summer of 1912. The Olympics had just been held in Stockholm, and the Democrats were preparing to retake the White House for the first time in 20 years.

The Dow Jones Industrial Average peaked at 94.15 on September 30, 1912. That was the highest point the market had been in two-and-a-half years. It was also to be the highest point the market would be for another three years. The onset of World War I was not good for stocks.

But what I find most interesting, and most frightening, is a fact that all investors need to understand: The Dow didn’t finally shake its 1912 high until 1942. That’s right, thirty years later. On April 28, 1942, the Dow bottomed out at 92.92.

Dividends, of course, helped out a lot. But remember that the “stocks for the long run” thesis is based on several decades worth of data.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His