Archive for July, 2013

-

Morning News: July 30, 2013

Eddy Elfenbein, July 30th, 2013 at 6:59 amWe Don’t Know Where Larry Summers Stands On The Most Important Issue Facing The Fed

Barclays to Raise $12 Billion in New Capital

Fiat Profit Rises as Spending Cuts Narrow European Losses

JPMorgan Accused of Gaming Energy Bids as FERC Deal Looms

Sony Earnings Face Setback as Loeb Criticizes Movie Unit

BP Profit Misses Estimates as Gulf Spill Estimate Raised

UBS Profit Rose 32% in Second Quarter

Alcatel Posts Strong Second-Quarter, Signs Qualcomm Partnership

Pfizer Earnings Beat Forecasts As Drugmaker Plans Split

Hudson’s Bay Buying Saks for About $2.4 Billion

7-Eleven Adds Bento Rigor to Slurpee Appeal in U.S. Push

Icahn Rips Apart Dell’s Push For Deal Changes In Open Letter

Jeff Carter: Who Raises Their Standard of Living in the Sharing Economy?

Joshua Brown: Remember When Sequestration Was Going To Crush The Defense Stocks?

Be sure to follow me on Twitter.

-

The NIPA Revisions

Eddy Elfenbein, July 29th, 2013 at 1:03 pmThis week, the government will revise the entire NIPA dataset which includes GDP. The GDP figures will be revised about 3% higher. Of course, it’s just on paper but it reflects how we think about the economy.

Good news, Americans—you’re about to get richer.

Well, not you, personally. But you in your capacity as a citizen of the mightiest economic empire the world has ever known. The Commerce Department’s Bureau of Economic Analysis is prepared to announce that America’s gross domestic product is 3 percent larger than previously estimated—about $1,500 extra worth of goods and services per person. What did we do to get so lucky?

Nothing. We did nothing. But we’re getting richer anyway. As Robin Harding first reported over the weekend, we’re getting richer on paper because the BEA is changing how it calculates the national income and product accounts (NIPA) to bring it into line with recommendations promulgated by the United Nations back in 2008. The main idea is that in an economy that increasingly depends on the production of intangible goods, we need to recognize that the production of ideas is an important form of investment. So in the future, the BEA is going to count a company’s research and development as a form of investment just like the purchase of a new office building. And the creation of a durable work of art—a film, a season of television—that can be sold year after year will, likewise, be treated as a capital investment. These new calculations will also be applied retroactively, and thus, like magic, we’ll all be richer. Or, at a minimum, learn that we’ve been richer all along.

-

Banks Are Powering Earnings Growth

Eddy Elfenbein, July 29th, 2013 at 10:41 amThe stock market is down slightly in early trading this week. There isn’t much movement on the Buy List so far, except that Nicholas Financial ($NICK) has given back a big chunk of its Friday surge. NICK closed last week at $15.94. Interestingly, that was on very heavy volume. There’s only been 800 shares today, but the last trade went off at $15.29.

On Thursday, Ford Motor ($F) lost a big part of its Wednesday rally. But the stock is currently back above $17 per share. We have a bunch more earnings this week, plus a Fed meeting and a jobs report. The government will also revised the entire set of its NIPA data. This means we will have entirely new numbers for the GDP data series. There’s nothing so surprising as the past.

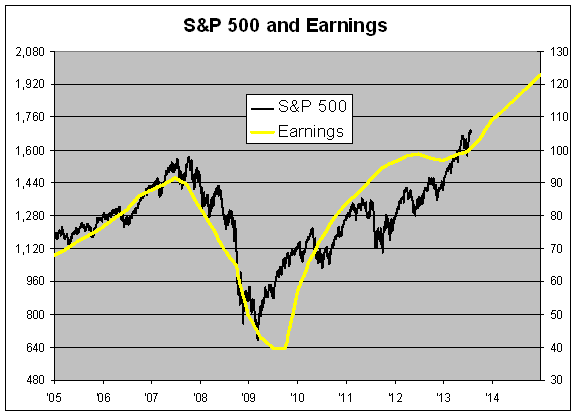

The latest numbers show that 265 companies in the S&P 500 have reported Q2 earnings so far. Of that, 73% have beaten on earnings and 56% have beaten on sales. That’s not bad. Of course, banks have been doing the heavy lifting:

Earnings for companies in the S&P 500 are projected to climb 3.3 percent, led by a 27 percent increase in bank profits, based on more than 11,000 analyst projections compiled by Bloomberg. Without the financial industry, S&P 500 income would contract 1.2 percent.

The National Association of Realtors said that pending home sales fell 1% in June. This is interesting to watch because rising mortgage rates have impacted the housing market, but I don’t think the damage will be long-lasting.

-

Morning News: July 29, 2013

Eddy Elfenbein, July 29th, 2013 at 6:30 amKuroda Sees Japan Economy Weathering Planned Sales-Tax Rise

China Orders Audit Of Local Government Debt

EU Resolves Solar-Panel Trade Dispute With China

Schaeuble Urges Pressure on Greece to Remain Before Vote

Wall Street Tempers M&A Outlook as CEOs Await Fed Shift

Obama Says He Has Narrowed Decision on Next Fed Chairman

Is The Publicis-Omnicom Merger A Sign Of Strength Or Weakness?

PC Industry Fights to Adapt as Tablets Muscle In

Perrigo to Buy Elan for $8.6 Billion, Get Irish Domicile

Apple-supplier Pegatron violates China workers’ rights: China Labor Watch

What Next For The ‘Wall Street Refiners’ As JPM Exits Physical Commodities?

Siemens Ousts Chief Over String of Setbacks

DEJA VU: People Are Using Borrowed Money To Buy Stock Like It’s 2007 And 1999

Howard Lindzon: Facebook Strikes Back, Apple Sells More Devices Than The Population Of 217 Countries

Jeff Miller: Weighing the Week Ahead: Are You Ready for Action?

Be sure to follow me on Twitter.

-

Q2 Earnings So Far

Eddy Elfenbein, July 26th, 2013 at 11:00 amWe’ve just crossed the halfway point of earnings season. The latest numbers from Bloomberg show that 260 of the 500 companies have reported so far. Of those, 73% have beaten earnings expectations and 57% have beaten on sales.

According to S&P, Q2 earnings are tracking at $26.66. (That’s an index-adjusted number. One point in the S&P 500 is worth about $9 billion.) That’s an increase of 4.84% over the Q2 from last year. Earnings for Q3 are projected to grow by 14.67%, and another 26.57% for Q4.

Wall Street currently expects full-year earnings for 2013 of $109.25. For 2014, the Street expects $122.74. That means the market is going for 13.66 times next year’s estimate.

-

Big Beat for Moog

Eddy Elfenbein, July 26th, 2013 at 8:40 amMoog ($MOG-A) just reported earnings of 90 cents per share (the June quarter is their fiscal third). Wall Street’s consensus was for 84 cents per share. Sales rose 10% to $671 million.

Moog Inc. announced today third quarter sales of $671 million, an increase of 10% over last year’s $611 million. Net earnings of $34 million and EPS of $.75 were both lower as a result of asset write-downs totaling $.15 per share in the quarter. Excluding the effect of the write-downs, adjusted net earnings of $41 million were up 7% from last year and adjusted earnings per share of $.90 were 6% higher.

And now for guidance:

The Company modified its earnings per share guidance to $3.25 for the year ending September 2013. This includes $.15 per share in restructuring charges and $.15 per share in asset write-downs described previously. Sales are now forecast at $2.58 billion, up 5% year over year, with net earnings of $149 million.

The Company also provided its initial projections for fiscal 2014 with sales of $2.67 billion and earnings per share in a range of $3.90 to $4.10, a 23% increase at the mid-point of the range.

“This quarter had many moving parts,” said John Scannell, CEO. “Our underlying operations were strong and our restructuring efforts are paying off. We had two asset write-downs in the quarter — one in Medical and one in Industrial. In addition, we announced a strategic review of our Medical Devices segment. For the full year 2013, we are expecting our underlying operations to deliver $3.55 per share — a respectable performance given the challenges we have faced. We will have $.15 per share in restructuring and $.15 per share in asset write-downs so our bottom line for the year will be $3.25 per share. As we look forward to fiscal 2014, we believe we will see much stronger operating performance. We’re projecting a narrow range of outcomes for earnings and EPS. The midpoint would be earnings of $185 million, or $4.00 per share, a 23% increase.”

This is very good news. The Street had been expecting $3.39 per share for this year and $3.90 next year.

Moog is our #1 performer this year with a 39.5% gain YTD.

-

CWS Market Review – July 26, 2013

Eddy Elfenbein, July 26th, 2013 at 7:38 am“The investor of today does not profit from yesterday’s growth.” – Warren Buffett

Second-quarter earnings season has been a big winner for us so far (although we had one major dud with Microsoft). In last week’s CWS Market Review, I told you that Ford Motor would easily beat its earnings estimate, and sure enough, that’s exactly what happened. Thanks to the great earnings report, Ford’s stock gapped up to another 52-week high, and it’s nearly doubled for us in the last year.

We also had strong earnings reports this week from CR Bard ($BCR) and CA Technologies ($CA). In this week’s CWS Market Review, I’ll highlight our recent Buy List earnings news, and I’ll preview what’s ahead next week (be sure to check out our Earnings Calendar). We have some important reports coming our way from Buy List stalwarts like AFLAC ($AFL), WEX Inc. ($WEX) and Fiserv ($FISV). Also next week, the Federal Reserve has a meeting, the government will provide its initial estimate of Q2 GDP on Wednesday and the big jobs report is on Friday. But first, let’s look at Ford’s blow-out earnings report.

Ford Smashes the Street—Again

In last week’s newsletter, I wrote:

Of all the companies reporting next week, I’m the most optimistic about Ford Motor (F). In April, the automaker earned 41 cents per share, which was four cents more than consensus. This time around, Wall Street again expects 37 cents per share. I think Ford will easily beat that.

I was right. Ford ($F) earned 45 cents per share, which was eight cents more than Wall Street’s consensus, and the stock surged as high as $17.68 per share. I’d like to say that this was due to magical predictive powers on my part. Alas, that’s not the case. Truthfully, it was nothing more than simple math. Yet it’s surprising how often that skill set is a major advantage in investing.

The facts are clear. Ford’s business is strong, and most of it is due to truck buyers in North America. Fusion has also been a key area of strength. Let’s run through some of the numbers. Ford’s net earnings surged 19% last quarter to $1.2 billion. Their revenues rose 15% to $38.1 billion. This was Ford’s 16th-straight profitable quarter. Furthermore, unlike some other American car companies I could name, Ford was not bailed out by Uncle Sam.

Ford made a cool $2.3 billion in North America. Sales of their F-Series trucks rose 26% to 198,643. I think this is closely tied to a lot of the emerging manufacturing rebound we’ve seen in some economic statistics. (By the way, the durable-goods report on Thursday was quite strong).

The problem child is still Europe. Ford had a pre-tax loss of $348 million in the Old World. Of course, a loss was expected. We know that Europe has been a drag on Ford, but they’re quickly working to economize their European operations. I think we’re going to see much better results in Europe in future quarters.

I was very pleased to hear that Ford offered improved guidance for the rest of the year. They now see pre-tax earnings clearing $8 billion for 2013. Before, they said they had expected to hit $8 billion. So far, they’ve made $4.7 billion in the first half of the year, so the new guidance seems quite reasonable. In Europe, Ford said they expect to lose $1.8 billion instead of the earlier projected $2 billion. That’s ugly, but not as ugly.

Ford also had a blow-out quarter in Asia. The company makes a big deal about this, but Asia is a very small part of their business. That could change. Ford plans to introduce 15 new vehicles in China by 2015. I’d like to see Ford raise its dividend by 20% to 25%. They can easily afford it. Ford remains an excellent buy up to $18 per share.

Strong Earnings from CR Bard and CA Technologies

After the closing bell on Tuesday, CR Bard ($BCR) announced Q2 earnings of $1.42 per share for Q2 which was four cents more than expectations. The medical-equipment company saw revenues rise by 2.3% to $759.9 million, beating expectations by $9.8 million. I was impressed by the turnaround in their oncology and surgery divisions.

Bard’s CEO said, “Our operating results this quarter exceeded our expectations. We continue to focus on the execution of our investment plan, which we believe will shift the mix of our portfolio to faster-growing products and geographies and contribute to long-term sustainable leadership positions in our markets.”

For Q3, Bard sees earnings between $1.37 and $1.41 per share. This is a quiet, steady winner. Bard may not make the headlines, but they do deliver results. Bard remains a solid buy up to $115 per share.

After the bell on Wednesday, CA Technologies ($CA) reported Q2 earnings of 78 cents per share, which was also four cents better than Wall Street’s consensus. I was really impressed by this report. CA’s results are a nice improvement from the 63 cents per share they earned a year ago (technically, the June quarter is their fiscal first quarter).

CA’s CEO said, “We did better than expected on the revenue line and were able to capitalize on organizational efficiencies, expense management and a tax benefit to drive earnings growth. Our cash flow from operations was down, but that was expected and we are confident in meeting our full-year outlook in all areas.”

For the full year, CA expects earnings to range between $2.90 and $3.00 per share. Wall Street had been expecting $2.99 per share. On Thursday, the stock got as high as $30.30 per share, which is a new 52-week high. CA is now a 35% winner on the year for us. CA Technologies is a very good buy up to $31 per share.

More Earnings Coming Next Week

We have five more earnings reports due next week. We may have a sixth in Nicholas Financial ($NICK), but I haven’t heard back from them yet. Last year, NICK’s earnings report came on August 2nd, so I expect it around then this year.

NICK’s last earnings report was a bit low, but I’m not at all worried. I’m expecting earnings to range somewhere between 40 and 45 cents per share. If there’s any news about the buyout offer, I expect that it’s been rejected. In August, NICK will hold its annual meeting, and I think there’s a good chance we’ll get another dividend increase. I think the board can go as high as 15 cents per share, which would most likely give the stock a nice shot in the arm. Nicholas Financial is a great buy up to $16 per share.

On Tuesday, AFLAC ($AFL), Fiserv ($FISV) and Harris ($HRS) are due to report. AFLAC has been heating up recently. The stock broke $61 per share. The last earnings report was very good. AFLAC earned $1.69 per share, which was seven cents better than estimates. The stock has rallied more than 17% since then. For Q2, AFLAC said it expect earnings to range between $1.41 and $1.56 per share. While the falling yen has cramped some of AFLAC’s earnings, much of the yen’s damage has receded. The company may update its full-year guidance as well. AFLAC is still going for less than 10 times this year’s expected earnings. AFLAC remains a very good buy up to $63 per share.

Fiserv’s ($FISV) earnings are like clockwork. In fact, the last earnings report was a big surprise because they missed expectations by a single penny per share. The stock gapped since the news was so unexpected. Nevertheless, Fiserv made up everything it lost and this week hit a new 52-week high. Fiserv’s most recent full-year guidance was for EPS growth of 15% to 19%, which translates to a range between $5.84 and $6.03. FISV is a buy up to $95 per share.

Business at Harris ($HRS) has been impacted by the government sequester, but overall business is still strong. The Street expects $1.15 for Q2. In April, Harris said to expect full-year earnings between $4.60 and $4.70 per share. Harris is boring, which is why I like it. HRS is a good buy up to $53. The stock has trended above my Buy Below price recently, so don’t chase it.

On Wednesday, WEX Inc. ($WEX) is due to report. Three months ago, WEX beat estimates by two cents per share, but the full-year guidance was well below the Street. The stock got clobbered for a 10% loss that day. The lower guidance caught me off guard, but not as much as what happened next—WEX went on a furious rally! Measuring from the post-earnings crush to Thursday’s close, WEX has jumped more than 30%. Three months ago, the company said to expect 98 cents to $1.04 per share for Q2. Don’t chase WEX. It’s a good buy up to $86 per share.

On Thursday, DirecTV ($DTV) will report. The satellite-TV company had great reports for Q1 and Q4 before that, and the stock has responded very well. I’m not expecting a huge beat like before, but I think DTV can top Wall Street’s current estimate of $1.33 per share. The secret here is that Latam business. DirecTV is a buy anytime you see it below $67 per share.

Before I go, I want to lower my Buy Below price on Microsoft ($MSFT) to $35 per share. I still like MSFT, but we have to face facts that last week’s earnings report was a major dud. But remember how quickly high-quality stocks can bounce back. We’ve seen that many times with our Buy List stocks, most recently Cognizant Technology ($CTSH) and WEX Inc. ($WEX) I also think we’ll see a nice dividend increase from Microsoft later this year.

That’s all for now. Next week will be a very busy news week. Of course, there are still more earnings coming our way. Also, the Fed meets again, and the policy statement will come out Wednesday afternoon. That morning, the government will give us their first estimate of Q2 GDP growth. Plus, the government plans to completely revise all the historical GDP numbers. If that’s not enough, Friday is the big jobs report. Expect jittery traders to be even more jittery. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: July 26, 2013

Eddy Elfenbein, July 26th, 2013 at 7:11 amDraghi Pledge One Year On Rescues Bonds Not Economy

Japanese Prices Rise, Signaling Rebound

World Energy Consumption to Increase 56% by 2040 Led by Asia

Senate Democrats Ready Letter Urging Yellen as Fed Chief

U.S. Indicts Hackers In Biggest Cyber Fraud Case In History

SAC Case Threatens a Wall St. Cash Cow

Activision Becomes Independent With Buyout of Vivendi

Halliburton Pleads Guilty to Destroying Evidence After Gulf Spill

Facebook Offers the Dummy’s Guide to Mobile Advertising

Amazon Reports Small Loss as It Focuses on Investments

Samsung’s Profit Rises, but So Does the Competition

Starbucks Profit Up, U.S. Sales Surprisingly Strong

UBS to Pay $885 Million to Settle U.S. Mortgage Suit

John Hempton: Good and Bad MLMs: Pampered Chef, Herbalife, and Nuskin

Roger Nusbaum: Woe is the Asset Allocator?

Be sure to follow me on Twitter.

-

Strong Durable Goods Report for June

Eddy Elfenbein, July 25th, 2013 at 10:32 amMore slow trading today. Medtronic ($MDT), Harris ($HRS) and WEX Inc. ($WEX) have touched new 52- week highs this morning. Some of our hot stocks like Ford ($F) and AFLAC ($AFL) are resting today. AFLAC has commented that they have no comment on media reports that there will be an alliance between them and Japan Post.

This morning, the government reported that weekly jobless claims rose by 7,000 last week to 343,000. We’re still near multi-year lows. We also had a very good report on durable goods. Orders rose 4.2% last month which was three times the rate of what economists had been expecting.

Facebook ($FB) is soaring today on its earnings report. Stay away. The stock is way, way too expensive. Facebook is currently up 25% today. The stock is going for more than 40 times next year’s earnings estimate. The stock is right around $33 today, the IPO price was $38.

-

Morning News: July 25, 2013

Eddy Elfenbein, July 25th, 2013 at 6:35 amSpain’s Unemployment Rate Falls

Polar Thaw Opens Shortcut for Russian Natural Gas

Obama Says Budget Debate a Battle for Middle Class Future

Banks Said to Weigh Suspending Dealings With SAC as Charges Loom

Facebook Shares Skyrocket as Social Giant Hits Mobile Stride

Michael Dell Bets on Rule Change in Final Push for Deal Approval

$1.9 Billion Baidu Acquisition: Qihoo’s Zhou Says ‘I Did That’

Boeing Profit Jumps 13% In Second Quarter, Beating Estimates

Investment Banking Lifts Credit Suisse Profit

Unilever Says Emerging Markets Slow as Sales Miss Estimates

Visa Beats Estimates as Card Spending Grows

Hyundai’s 2Q Profit Down on Lower South Korean Sales

Credit Writedowns: Anatomy of a Bank Run

Phil Pearlman: U.S. Energy Revolution is Helping Drive the Recovery

Be sure to follow me on Twitter.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His