The Small-Cap Cycle Could Be Over

I want to expand on something I mentioned in Friday’s newsletter. Since March 4, small-cap stocks have been lagging the overall market. This is notable because small-caps had been leading the S&P 500 for over 15 years. It’s been an extremely impressive run.

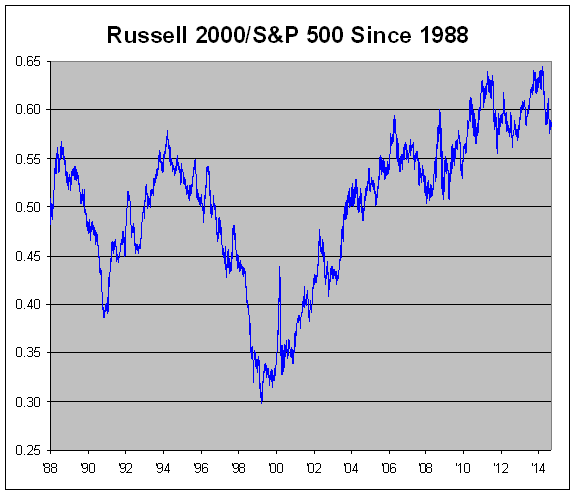

Let’s look at some numbers. The ratio of the Russell 2000 Index to the S&P 500 reached a low on April 8, 1999. Technical analysts will note that the trough ratio was just a hair below 0.3. Since then, small-caps have shined.

In fact, the impressive behavior of small-caps alters how we ought to look at the great stock bust-up of 2000 to 2009. While it’s certainly true that the S&P 500 reached a peak in March 2000—adjusted for inflation, we still haven’t topped it—but that’s not the whole picture.

The furious rally of the late 1990s was largely driven by tech stocks and large-cap techies in particular. If we exclude a small number of very big stocks, the market’s painful nine years wasn’t quite so painful. When looking at broad market indexes we should always be mindful that a small group can distort the larger picture. Sectors like small-cap value sector have actually done quite well.

That’s why I took notice when the Russell/S&P Ratio reached its last peak on March 4 of this year, almost 15 years to the day after the cycle low. In those 15 years, the Russell 2000 has gained 202% while the S&P 500 is up by just 39%. That’s a five-to-one pounding. But since March 4, the S&P 500 is up 6% while the Russell 2000 is down by 4%. That was enough to bring the ratio down from 0.6450 to 0.5758.

So is the small-cap cycle over? Unfortunately, I can’t say just yet. I thought the cycle had run its course a few times before. Shirley, small-caps couldn’t still lead the market, but they did. Sadly, we may not know if the cycle is truly over for years. It took 30 months for the Russell/S&P Ratio to beat its peak from April 2011. All we can say for certain is that the last six months have witnessed a sharp turn toward big-caps. Historically, once a new cycle starts, it often lasts for many years.

Posted by Eddy Elfenbein on August 25th, 2014 at 10:05 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His