Archive for January, 2015

-

Syriza Wins in Greece

Eddy Elfenbein, January 25th, 2015 at 6:47 pmExpect the U.S. stock market to open lower tomorrow morning. The far-Left Syriza has won the elections in Greece. That means austerity is gone, and with it, perhaps EU money. It’s hard to say at this point.

I would like to think that Greece and the EU will reach some sort of deal to restructure Greece’s debt. No one wants to see the euro go down because of Greece.

Syriza leader Alexis Tsipras said that Greece’s era of bowing to international creditors is over, as he celebrated his party’s victory in Greek elections dominated by a public backlash against years of budget cuts.

Tsipras, addressing supporters in central Athens Sunday night after Prime Minister Antonis Samaras conceded defeat, said that Greece is turning a page and putting austerity behind it. The Syriza government’s priority “will be for Greece and its people to regain their lost dignity,” he said.

“There will neither be a catastrophic clash nor will continued kowtowing be accepted,” said Tsipras, 40. “We are fully aware that the Greek people hasn’t given us carte blanche but a mandate for national revival.”

While Syriza’s victory was more decisive than polls had predicted, it remains unclear whether the party will be able to govern alone. Even with a razor-thin majority or in a fragile coalition, the result hands Tsipras a clear mandate to confront Greece’s program of austerity imposed in return for pledges of 240 billion euros ($269 billion) in aid since May 2010. The challenge for him now is to strike a balance between keeping his election pledges including a writedown of Greek debt and avoiding what Samaras repeatedly warned was the risk of an accidental exit from the euro.

I’m reminded of François Mitterrand’s stunning election victory in 1981. At the time, it was seen as a dramatic turn to the left for France. But once the franc started to plunge, the government quickly reversed course. The world that is has a nasty habit of beating the world that ought to be.

-

Signature Bank: “We don’t even have a line item in our budget for advertising.”

Eddy Elfenbein, January 23rd, 2015 at 3:44 pmVery nice article on Signature Bank ($SBNY):

With just 0.1 percent of Signature’s loan portfolio listed as “nonperforming,” meaning that the debtor has not made scheduled payments on the loan for 90 or more days, it would be easy to assume there was some secret formula to how the bank finds solid borrowers. But DePaolo chalks the bank’s loan portfolio success up to its niche in the market, targeting privately held businesses valued between $20 million and $100 million.

“For the most part, either we know the client or prospect, or they were referred by an existing client that’s well-known to us,” DePaolo said.

The chief executive said that Signature, nestled in the largest financial market in the country, is well-positioned to siphon off business in that privately held business market from the big banks, a pull that those banks likely have noticed.

“We have a lot of opportunity to take business away from them,” DePaolo said. “I’m not sure that they want to admit it to anyone, but they’re worried about us.”

(…)

With $26 billion in assets and a market capitalization of approximately $6.09 billion, Signature Bank has branches in New Rochelle and White Plains, another branch soon to open in Greenwich, Conn., and about 30 total locations in the New York metropolitan area.

But those locations, DePaolo said, aren’t as visible as those of the big banks, by design. They are often on the upper floors of office buildings, near the action, but somewhat hidden in plain sight.

Each morning, when DePaolo gets off that 5:45 a.m. Metro-North train from New Rochelle, he walks by the brightly lit big bank signs to lead a bank that takes a different approach.

“That’s just not us,” DePaolo said of the flashy advertising. “We don’t even have a line item in our budget for advertising.”

-

Swiss 50-Year Bonds

Eddy Elfenbein, January 23rd, 2015 at 9:35 amThe 50-year bonds in Switzerland now yield 22.35%.

That’s not annualized — that’s the whole darn thing.

-

Bigfoot IPO

Eddy Elfenbein, January 23rd, 2015 at 9:33 amFrom the WSJ:

Startups are famous for setting big, hairy goals. Carmine “Tom” Biscardi wants to catch Sasquatch—and is planning an initial public offering to fund the hunt.

Mr. Biscardi and his partners hope to raise as much as $3 million by selling stock in Bigfoot Project Investments. They plan to spend the money making movies and selling DVDs, but are also budgeting $113,805 a year for expeditions to find the beast. Among the company’s goals, according to its filings with the Securities and Exchange Commission: “capture the creature known as Bigfoot.”

Investment advisers caution that this IPO may not be for everyone. For starters, it involves DVDs, a dying technology, said Kathy Boyle, president at Chapin Hill Advisors. Then there is the Sasquatch issue. She reckons only true believers would be interested in such a speculative venture.

“This would be the kind of thing where if you believed in Bigfoot, or you thought there really was a Bigfoot and you actually had some money to burn and wanted to play with this, then go for it,” Ms. Boyle said. A lot of ifs.

Bigfoot couldn’t be reached for comment.

Honestly, this idea should have been Sasquashed early on.

-

CWS Market Review – January 23, 2015

Eddy Elfenbein, January 23rd, 2015 at 7:08 am“There are two kinds of people who lose money: those who know

nothing and those who know everything.” – Henry KaufmanWe’re now heading into the thick of earnings season, and the stock market’s mood is much brighter. The S&P 500 has rallied for four days in a row, and we just closed at a new high for the year.

The earnings reports for our Buy List stocks are looking especially good. On Thursday, shares of eBay ($EBAY) jumped 7% after the company beat earnings and hinted that another spinoff could be on its way. I’ll have more details in a bit. Also on Thursday, shares of Signature Bank ($SBNY), one of our new Buy List members, jumped 5.7% after a very good earnings report. It was their 21st-straight record earnings report.

Next week is going to be a busy one for us; six of our Buy List stocks are due to report earnings. Later on, I’ll give you a preview of what to expect. We also have another Federal Reserve meeting scheduled for next week. Plus, the government will give us our first report on Q4 GDP. The reports for Q2 and Q3 were pretty good.

The stock market also got a boost this week thanks to Mario Draghi. The head of the ECB announced a bold plan of buying at least 1.1 billion euros’ worth of bonds to help fight off deflation and get the European economy moving again. In response, the euro fell to an 11-year low. I’ll tell you what all this means. But first, let’s look at our earnings winners this earnings season.

Strong Earnings from eBay and Signature Bank

After the closing bell on Wednesday, eBay ($EBAY) reported Q4 earnings of 90 cents per share. That beat Wall Street’s forecast by a penny per share. In October, the online auction house said that Q4 earnings would range between 88 and 91 cents per share. At the time, this was considered a disappointment, as Wall Street had been expecting 91 cents per share. For all of 2014, eBay earned $2.95 per share. That compares with $2.71 per share in 2013.

Now the bad news. For Q1, eBay said they expect earnings to range between 66 and 71 cents per share. Wall Street had been expecting 76 cents per share. They expect full-year 2015 earnings of $3.05 to $3.15 per share. Frankly, I suspect eBay is low-balling us, but it’s too early to say for sure. I think the strong dollar is squeezing a lot of companies, so they figure it’s safest to put out modest forecasts. On the earnings call, CEO John Donahoe said that 2014 was a tough year: “quite frankly, we’re glad to see it come to an end.”

eBay also announced cuts of 2,400 jobs as they get ready for the PayPal spinoff, which should happen later this year. That’s about 7% of their workforce. The company had already said that job cuts were on the way, but now they’ve laid out the details. Once PayPal is spun off, it could be worth as much as $40 billion.

eBay also said it’s looking to sell or IPO its enterprise division, since it doesn’t really fit into eBay or PayPal. Shares of eBay jumped more than 7% on Thursday, and they’re not far from a fresh 52-week high. eBay also reached a deal with Carl Icahn. They added more people to eBay’s board, plus they added provisions which give investors a greater say in how PayPal would be run. I have to say that Icahn pushed hard for the PayPal spinoff, and he was exactly right.

Here’s my view: eBay’s core business is in a rough patch right now. They’re riding it out well, but they’re not quite through it just yet. The best part about this stock is PayPal and any other deal. eBay remains a very good buy up to $60 per share.

On Thursday morning, Signature Bank ($SBNY) reported Q4 earnings of $1.60 per share. That was four cents more than Wall Street’s forecast. The shares jumped 5.7% on Thursday. I should add that the stock had been weak going into its earnings report. This was their 21st record quarter in a row.

For all of 2014, Signature made $296.7 million, which comes to $5.95 per share. Total revenue was $836.1 million. The underlying numbers are very strong. Deposits grew 32.6% last year.

CEO Joseph J. DePaolo said, “2014 was another stellar year in which we continued to reap solid returns and deliver unprecedented results, including record deposit growth, record loan growth and the seventh consecutive year of record earnings. Moreover, it was also a year where we heavily invested in the future of our institution. This is evidenced by the successful public offering we completed this past summer, raising nearly $300 million in common stock to fuel the Bank’s continuing expansion, along with two business lines we added under Signature Financial, five new private client banking teams that joined the Bank and three Banking Group Directors that were appointed to existing teams.” Forbes recently named Signature as being the best bank in America.

Wall Street currently expects 2015 earnings of $6.79 per share for SBNY. I think that might drift higher over the next few days. The shares are currently going for 18.3 times forward earnings, which is high but not unreasonable. Signature Bank is a very strong bank. For now, I’m keeping my Buy Below at $133 per share.

Draghi Goes Big

The investment world was on pins and needles waiting to hear the details of Mario Draghi’s stimulus plan for Europe. He decided to make it big. On Thursday, Draghi said that the European Central Bank will buy 60 billion euros’ worth of bonds every month through at least September of 2016. That’s huge. I think he wanted to go “all in” so he wouldn’t have to repeat his effort of building political support for buying bonds.

Essentially, Draghi has decided to follow Ben Bernanke and do a Quantitative Easing for Europe. The problem is that many politicians, particularly in Germany, have been against the idea from Day One. Slowly Draghi has prevailed. Honestly, this should have happened two years ago.

Personally, I was afraid that the plan wouldn’t be large enough, but thankfully, I was wrong. The equity markets celebrated, and the euro got punished. The euro fell to an 11-year low of $1.1318. One index of European stocks closed at a seven-year high. In the U.S., our Fed is thinking about when it will raise rates, but many other countries are going in the other direction. There was the surprise move in Switzerland last week. (It seems like these once-in-a-billion-year events now happen every few years.) Central banks in Denmark, Turkey, India, Canada and Peru have all cut rates as well.

One immediate effect of Draghi’s plan is that it strengthens the dollar (as if it really needed more help). This puts even more pressure on commodity prices. This week, we learned that China had its slowest quarterly GDP growth in 24 years. Of course, growth slowing down to 7.4% is still pretty impressive, but China’s woes are also putting pressure on commodities like copper.

The Federal Reserve meets again next week, and the super-strong dollar takes some of the heat off them to raise rates soon. While the central bank has made it clear that they’re on track to raise rates later this year, I’m starting to doubt that it will happen. Or it may happen towards the end of the year. The last inflation report showed deflation. The 30-year Treasury recently had its lowest yield since it was introduced in 1977. Plus, the last report on industrial production showed a small decline.

I’m not alone in my skepticism. At the start of the year, the futures market saw a 30% chance the Fed would raise rates by June. That’s now down to 15%. Draghi’s move only adds to this. Companies are already announcing how much the rising dollar is pinching their profits (see Stryker below). I think that’s part of the reason why eBay’s guidance was below expectations.

Analysts have been slashing their earnings-growth forecasts for this year. I think it’s likely we’ll see earnings growth around 3% to 6% for this year. With yields staying so low, investors should concentrate on high-quality stocks that pay good dividends. This means Buy List stocks like Microsoft, Ford and Wells Fargo, which has already released a good earnings report. Now here’s a look at our Buy List earnings for next week.

Six Buy List Earnings Reports Next Week

We have six earnings reports due next week. (By the way, you can see a complete calendar of our earnings season reports here.) On Monday, Microsoft is due to report. Stryker follows on Tuesday. Qualcomm is on Wednesday. CR Bard and Ford report on Thursday. Finally, Moog reports on Friday.

Microsoft ($MSFT) has really turned a corner. Not that long ago, it seemed the company could do nothing right. But the new CEO has brought renewed energy to the software giant. Their last earnings report was quite good; Microsoft beat by five cents per share, and revenue beat expectations by more than $1 billion.

Microsoft is doing well across the board, and their cloud business is doing especially well. Wall Street expects Q4 earnings of 71 cents per share, which seems quite reasonable. I’d like to see the stock make another run at $50 per share. The shares briefly pierced $50 in mid-November but pulled back. The all-time high of $59.97 was reached 15 years ago. Microsoft also pays a decent yield of 2.63% based on Thursday’s close. I currently rate Microsoft a buy up to $50 per share.

Stryker ($SYK) reports on Tuesday, but there’s not much drama here. The company already released a preliminary earnings report (dontcha love companies that are actually shareholder-friendly?) Stryker said that Q4 earnings came in between $1.43 and $1.45 per share. Like so many other companies, the strong dollar is impacting their profits. Previously, Stryker said the strong dollar would nick this year’s earnings by 10 to 12 cents per share. Now they say it will be 20 cents per share. Stryker is a buy any time the shares are below $98.

Qualcomm ($QCOM) was our earnings dud last earnings season, but they crushed earnings for Q2. The big headache for Qualcomm is their conflict with the Chinese government, and there’s not much the company can do. My guess is that the Chinese government will level a big fine on them, and they’ll have to pay it and move on. Qualcomm also disclosed that it’s facing anti-trust investigations by the FTC and by the EU.

For this current fiscal year (ending September 2015), Qualcomm expects earnings between $5.05 and $5.35 per share, and revenue between $26.8 billion and $28.8 billion. Let’s remember that Qualcomm has tons of cash, no debt and strong free cash flow. They’re not going broke anytime soon. Buy up to $76.

CR Bard ($BCR) continues to be a rock star for us. It’s already our top performer on the year, with a 7.18% YTD gain. The shares just hit a new 52-week high. The medical-equipment company has said they expect Q4 earnings between $2.22 and $2.26 per share. That’s very strong growth. The shares have spiked 26% from the October low. Don’t chase Bard. My Buy Below is $175 per share.

There’s not much more to say about Ford Motor ($F) at the moment. The automaker is in the midst of a bold transition. As a result, next week’s earnings report won’t be so important, but the ones after that will be critical. I was very impressed with Ford’s recent 20% dividend increase. That’s a strong sign from management. Wall Street expects Q4 earnings of 23 cents per share. The stock is currently going for just over nine times this year’s earnings estimate. Going by Thursday’s close, Ford yields just under 4%. Ford is a buy up to $17 per share.

I always feel bad about poor little Moog ($MOG-A). It’s the smallest stock on our Buy List, and they always report earnings on a Friday, just after CWS Market Review goes out. But Moog has been a very good stock for us. For the last fiscal year (through September), Moog earned $3.52 per share, which is an increase from $3.26 the year before. Moog expects to make another $4.25 per share this coming year. Wall Street expects earnings of 86 cents per share. Buy it up to $78.

That’s all for now. More earnings reports to come next week. The Federal Reserve meets on Tuesday and Wednesday. The policy statement will come out on Wednesday afternoon. On Friday morning, we’ll get our first look at Q4 GDP. The reports for Q2 and Q3 were quite good, so it will be interesting to see if the trend is intact. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: January 23, 2015

Eddy Elfenbein, January 23rd, 2015 at 6:40 amEurozone Nations Face Stronger Pressures to Lift Economies

Europe Puts Its Money on the Table

Stimulus for Eurozone, But It May Be Too Little or Too Late

Saudi Arabia’s New King Probably Will Not Change Current Oil Policy

Putin Said to Shrink Inner Circle as Hawks Beat Billionaires

China January Factory Growth Stalls, Deflation Pressures Build, Bad Debt Rises

Three Owner Agrees to Buy O2 For £10.25 Billion

Uber’s Study Stirs Debate: Just How Good Are These Jobs?

Box Inc. IPO Prices At $14 Per Share

Airline Stocks Soar On Lower Fuel Cost Outlooks From United Continental, Southwest

Adidas Sells Rockport Footwear Brand in Step Toward Revival

Winklevoss Twins Aim to Take Bitcoin Mainstream With a Regulated Exchange

Starbucks Americas Traffic Ticks Up In Holiday Quarter, New COO Named

Jeff Carter: What To Do About Dead Equity on the Cap Table

Cullen Roche: More on Falling Global Income Inequality

Be sure to follow me on Twitter.

-

The Long View for Stocks

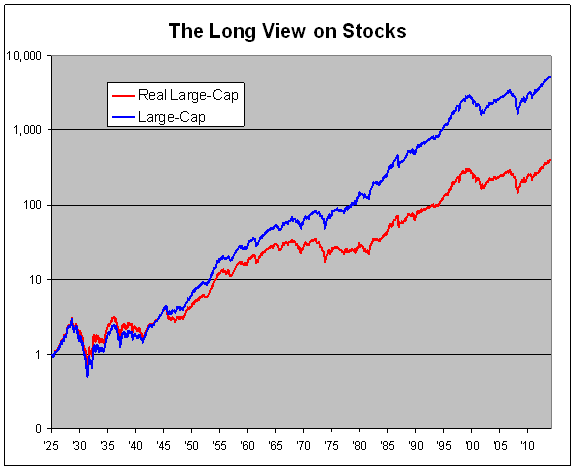

Eddy Elfenbein, January 22nd, 2015 at 1:21 pmIbbotson Associates is known for their collection of long-term financial returns data. Their latest yearbook isn’t out yet, but I was able to bring the data up to date by using numbers from Standard and Poor’s.

Here’s what the chart looks like of long-term stock returns from December 31, 1925 to December 31, 2014.

The blue line is stocks and dividends but is not adjusted for inflation. Starting with $1, it turns into $5,300 by the end of 2014. That’s an annualized total return of 10.12%.

The red line is the blue line adjusted for inflation. Stocks have averaged a total real return of 6.98% annualized over the last 89 years. That’s roughly stocks doubling in real value every decade.

Of course, there’s a lot of variation in that. Over the last 15 years, real stock returns have averaged less than 2% per year.

Jeremy Siegel often talks about how stocks have returned 7% in real terms over the long haul. I’ve even heard this referred to as the Siegel Constant.

Personally, I don’t think investors should expect 7% real returns going forward. The problem with this past data is that it’s based on the American Century. I’m still a long-term bull but we can’t replicate the success of 20th Century America.

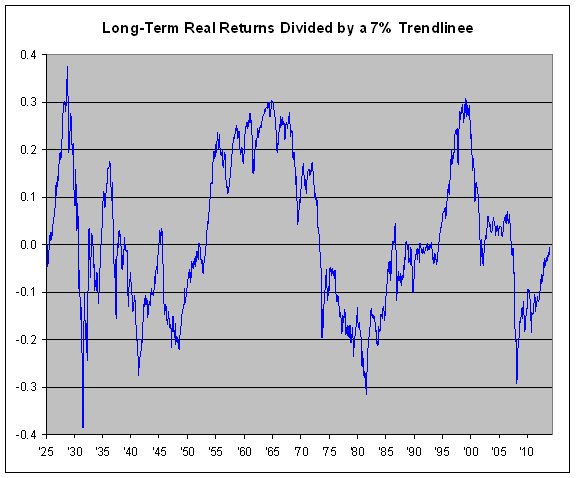

Now let’s have more fun with the data. I took the red line and divided it by a 7% trend line, meaning a line that just rises by 7% per year, every year. So when we divide the two, it means that whenever the line is rising, stocks are outperforming their long-term average. When it’s falling, they’re trailing it. (Even a mildly declining line is still making money for you.) I then made it a logarithm chart so it would be easier to read. Here’s what I got:

A few thoughts: First, notice how cyclical the chart is. Stocks don’t return 7% per year consistently. Rather there are long periods of outperformance followed by long stretches of underperformance.

Second, the 1949 to 1956 bull market was one of the greatest in history. No one talks about that one. I think it’s because it never crashed.

Third, the 1929, mid-1960s and 2000 peaks are all roughly similar. The mid-1960s peak was a rolling one. Things didn’t really fall apart until the 1973-74 crash.

Similarly, the 1932, 1982 and 2009 troughs aren’t too far apart.

Fourth, 1929 to 1932 sucked. Seriously.

Fifth, as strong as the last six years have been for stocks, we’re merely back to our long-term average. Actually, we’re still a bit short of it. Stocks would have to gain about 20% in 2015 for us to be back at the mid-point.

Finally, if you use a little imagination, this chart somewhat resembles the long-term chart of P/E Ratios. This makes sense since earnings have tended to increase at a fairly steady pace over the long haul. Not quite like a 7% trend line, but not too far off, either.

-

Morning News: January 22, 2015

Eddy Elfenbein, January 22nd, 2015 at 7:14 amDavos 2015: Banks Call For Free Rein to Fight Cyber Crime

Draghi Is Pushing Boundaries of Euro Region with QE Program

The Drivers And Implications Of The Bank Of Canada’s Oil-Driven Rate Cut

Fed Officials Reassess U.S. Outlook Amid Global Weakness

Speculators Looking for Havens from Slowing Growth are Piling Into Silver

Talk of Wealth Gap Prods the G.O.P. to Refocus

‘Fast Money’ Recap: eBay Could Be Undervalued but Not After PayPal Spinoff

American Express To Slash 4,000 Jobs On Heels Of Strong Quarter

Kinder Morgan: A Splendid Quarter To Kick Off A New Era

Uber Raises Another $1.6 Billion With Convertible Debt Sale

Netflix Soars Most Since April 2013 on Profit Talk, Rollout

Hyundai Motor’s Biggest-Ever Dividend Greeted With Outlook Concern

EBay’s Breakup Plans May Open Door for e-Commerce M&A

Joshua Brown: The Riskalyze Report: Advisors Spread the Wealth

Jeff Carter: What To Do About Dead Equity On The Cap Table

Be sure to follow me on Twitter.

-

eBay Earned of 90 Cents per Share

Eddy Elfenbein, January 21st, 2015 at 4:54 pmAfter the closing bell, eBay ($EBAY) reported Q4 earnings of 90 cents per share. That was one penny better than expectations. Three months ago, eBay said that Q4 earnings would range between 88 and 91 cents per share. For all of 2014, eBay earned $2.95 per share. That compares with $2.71 per share in 2013.

Now the bad news. For Q1, eBay said they expect earnings to range between 66 and 71 cents per share. Wall Street had been expecting 76 cents per share. They expect full-year 2015 earnings of $3.05 to $3.15 per share.

The stock is up a bit after hours. Why? The company announced layoffs of 2,400 jobs in order to get ready for the PayPal spinoff. This isn’t really news since the company had already said that layoffs were planned. Today is the day we got the details. But eBay had other news:

EBay also said it would be exploring strategic options for eBay Enterprise, including a sale or initial public offering.

“Enterprise is a strong business,” the company said, but “it has become clear that it has limited synergies with either business and a separation will allow both to focus exclusively on their core markets.”

The company also announced today that it has entered into a standstill agreement with investor Carl Icahn , the company’s largest active shareholder. In addition to certain corporate governance provisions to be adopted by PayPal as an independent company at the time of its spin-off from eBay, the agreement also appointed Icahn Capital executive Jonathan Christodoro to eBay’s current board.

Mr. Icahn, in a statement on its website, said the corporate governance provisions includes limits on any so-called poison pills and prevents a staggered board at PayPal. The provisions were aimed at giving shareholders a greater ability to weigh in on any offers made for the company.

“In the end, it should be the shareholders’ decision. This fundamental belief was the underlying philosophy of many of the corporate governance principles for which we advocated at PayPal,” Mr. Icahn said. “We applaud eBay’s board for making this agreement possible.”

Icahn pushed for this spinoff and he was right. eBay is up 2.66% in after-hours trading.

-

The Super Bowl Indicator

Eddy Elfenbein, January 21st, 2015 at 2:21 pmFrom Gary Alexander at Navellier Market Mail:

Will Seattle Save the Stock Market Again This Year?

Last January, the S&P fell 3.56%, but then Seattle saved the market. On Sunday, February 2, the Seattle Seahawks (the NFC Super Bowl team) thrashed Denver (the AFC team), 43-8. The market immediately turned around. The S&P gained 4.31% in February, erasing all of its January losses, eventually delivering double-digit gains for all of 2014. From Super Bowl Sunday to New Year’s Eve, the S&P gained 15.5%!

The Super Bowl Indicator basically says that the market will go down in a year in which the AFC team wins, and it will go up if an “old-line NFL” team wins. Being from Seattle, I hope our team wins the first back-to-back Super Bowl victories in a decade (since New England turned the trick in 2004-5 – which were both good market years, by the way). But I know better than to mix football and stock analysis.

The first problem with the Super Bowl Indicator is the squishy term “old line NFL.” Seattle is in the NFC now, but it was in the AFC for most of its tortured path to football supremacy. Seattle joined the National football conference in 1976, but then it struggled in the AFC from 1977 to 2001 before rejoining the NFC.

This kind of tortured team history is now common in the NFL. Some other recent Super Bowl winners are currently aligned with the AFC but they are also old-line NFL teams: The Indianapolis Colts (2007 winners) were once the Baltimore Colts, while the Baltimore Ravens (the 2013 champs) were once the Cleveland Browns. The Pittsburgh Steelers (winners in 2006 and 2012) are also from the old-line NFL.

The statistical secret of this correlation is that the stock market goes up more than it goes down. Since 1967 (Super Bowl 1), the Dow has risen in 35 of 48 years. In the first 48 Super Bowls, an “old-line NFL” team won 34 contests, so there is bound to be a lot of overlap. But the statistical reality is that if a coin comes up heads 30 of 31 times, the chances it will come up heads on the next toss will always be…50%.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His