Archive for July, 2015

-

Morning News: July 27, 2015

Eddy Elfenbein, July 27th, 2015 at 7:08 amEurozone Recovery Continues as Bank Lending, Sentiment Rise

Chinese Shares Tumble 8.5% in Biggest One-Day Drop Since 2007

French Farmers Turn Back Trucks With Foreign Meat, Cheese

Puerto Rico Should Collect Unpaid Taxes, Hedge Fund-Backed Economists Say

Apple, Goldman Among Companies in $140 Billion Climate Pledge

Teva to Buy Allergan Generic Drug Unit

Philips’ US Performance Counters Emerging Markets Slowdown

Drahi Teams Up With Weill on $670 Million NextRadioTV Offer

UBS CEO Sergio Ermotti Says US Wealth Unit is Not Up For Sale

McGraw Hill Financial to Buy SNL Financial for $2.2 Billion

The Xbox One/PS4 Console War Officially Enters A Giant New Territory

Canon Cuts Outlook as Weak Camera Sales Hit Second-Quarter Profit

Draghi’s ‘Whatever It Takes’ Marks Three Years Proving Enough

Howard Lindzon: Amazon – The Largest Company in the World by 2020

Jeff Miller: What Is The Message of the Market?

Be sure to follow me on Twitter.

-

Good Day for Us

Eddy Elfenbein, July 25th, 2015 at 12:23 pmYesterday was an exceptionally good day for our Buy List. Or more accurately, yesterday was a bad day for the market, and our Buy List did significantly less badly.

Of course, we didn’t do quite as well as Jeff Bezos who made $7 billion in one hour. Of course, that’s pre-tax.

For the record, the S&P 500 dropped 1.07% on Friday while our Buy List lost 0.43%. That’s an outperformance of 64 basis points our second-best showing this year. Bear in mind that the daily correlation between the market and our Buy List is over 95%.

Sixteen of our 21 stocks beat the index yesterday. Our big winner was CR Bard (BCR), which gained 4.6% after its earnings report. Stryker (SYK) came in second place with a 2.8% gain. Nine of our 21 stocks now have double-digit gains for the year.

For the year, our Buy List is up 4.37%. The S&P 500 is up 1.01%. That lead of 336 basis points is the second-biggest all year. These numbers don’t include dividends.

-

Follow-up on CR Bard’s Earnings

Eddy Elfenbein, July 24th, 2015 at 10:11 amThis was too late for the newsletter, but here’s CR Bard‘s (BCR) guidance:

With regard to the full year, we now expect constant currency sales growth to be between 5% and 6%, and organic sales growth to be between 5.5% and 6.5%, which is a full 150 basis point improvement from our original guidance in January, and we now expect foreign exchange to reduce sales for both Q3 and the full year by about 350 basis points.

From an EPS standpoint, excluding items affecting comparability, we expect the third quarter in the range of $2.21 to $2.25 per share, reflecting a somewhat lower gross margin, and the higher R&D spend compared to Q2 in the prior year.

For the full year, we are increasing our adjusted EPS guidance by $0.05 to a range of $9 to $9.10. This higher range reflects modest dilution from our recent acquisition, and the increased investments we expect to make in SG&A and R&D during the second half of 2015.

In summary, the first half of the year has gone quite well, from both a sales and profitability perspective. As we now move to the second half, we remain focused on executing our investment plan and pursuing strategic opportunities, with a clear objective of driving attractive and sustainable revenue growth, profitability, and shareholder returns over the long-term.

The stock is up 5.5% today.

Here’s the CEO of Snap-on (SNA) saying that their U.S. business is going “gangbusters.”

-

CWS Market Review – July 24, 2015

Eddy Elfenbein, July 24th, 2015 at 7:08 am“Don’t confuse brains with a bull market.” – Humphrey B. Neill

Since the start of the year, the S&P 500 hasn’t had a year-to-date gain or loss of more than 3.5%. This is one of the narrowest ranges in market history. The S&P 500 has, with very few exceptions, spent 2015 locked between 2,080 and 2,120. The index hasn’t made a new high since May 21. That’s the longest stretch without a new high since 2013.

That’s a fancy way of saying this has been a range-bound market with little direction either up or down. This was a big week for the market. About 25% of the S&P 500 reported earnings this week. It was an especially big week for our Buy List. Seven of our stocks reported earnings, and I’m happy to say that all seven beat Wall Street’s consensus. Adding in our two previous earnings reports, we’re a perfect 9-0 this earnings season.

While I’m pleased with our progress, I’m always leery of celebrating too soon. This is a tricky market, and it has an unpleasant habit of humbling the overconfident. We have another six earnings reports to come next week. In this week’s issue, I’ll go over this week’s earnings reports, and I’ll tell you what I liked and what I didn’t like. I’ll also preview next week’s report. We also have a new member on our Buy List in PayPal (PYPL). Before I get to that, let’s look at what’s been happening in the commodity pits.

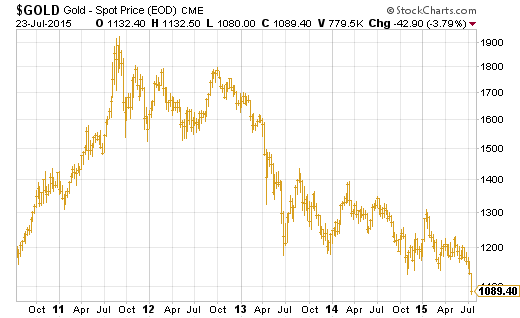

Gold Drops to Five-Year Low

For the last four years, the price of gold has steadily marched lower. Every rally has been turned back as the Midas metal has sunk lower and lower. Interestingly, China revealed this week that it’s been hoarding gold at a phenomenal pace. The Chinese Fed has been buying an average of 100 tonnes of gold per year for the last six years. Despite the buying, gold’s been a bust. It got especially bad this week as spot gold dropped below $1,100 per ounce to hit a five-year low. In 2011, gold peaked at over $1,900.

What’s the reason for the damage? (BTW, an asteroid just zoomed past earth that contained more than $5 trillion worth of platinum.) More likely, I think gold traders realize the Federal Reserve is serious this time—rates are going up soon. There have been a lot of false starts, but this time appears to be different. James Bullard, the top dog at the St. Louis Fed, recently said there’s a 50-50 chance rates will go up at the September meeting. I’m a doubter on September, but it won’t be far off. The futures market currently thinks there’s a 56% chance of a rate hike at the Fed’s December meeting.

More important than my opinion is the bond market’s. The one-year Treasury recently hit 0.34%. Of course, that’s puny, but amazingly, it’s the highest yield in five years. Meanwhile, the shorter yields have barely budged. In other words, the bond market expects higher rates. Not yet, but soon. In response, investors have naturally flocked to the higher-yielding currencies. The Dollar Index is at a three-month high, and the dollar made a five-year high against the Japanese yen (not good for our friends at AFLAC).

Of course, what happens depends on the economy. The Fed has consistently held the line that the economy is improving, and the sluggish numbers we saw at the start of the year were temporary. This has exposed the Fed to a lot of ridicule, but I think it’s basically right. This Thursday, we’re going to get the initial report on Q2 GDP, and I’m expecting a good report, perhaps 3.0% to 3.5%.

The recent inflation numbers have slowly heated up. Of course, energy prices crashed this winter, but “core inflation,” which excludes food and energy prices, has recently crept above 2%, which is the Fed’s target. The labor market is finally getting back on its feet. On Thursday, we got the best report for initial jobless claims in over 40 years. In two weeks, the government will release the July jobs report; if that and the GDP report are strong, Janet Yellen will look very prescient. We haven’t been able to say that about many central bankers lately. Until then, expect rates to rise.

Earnings from Microsoft, Signature Bank and Qualcomm

We’re about midway through earnings season, and the numbers are looking okay but not great. On July 10, the consensus on Wall Street was for an earnings decline of 6.4%. Now it’s up to a decline of 5.3%.

On Tuesday, Microsoft (MSFT) posted a gigantic loss for their fiscal Q4, but that was due to a $7.5 billion accounting charge related to Nokia’s handset business. Adjusting for those costs, Microsoft had a decent quarter. Wall Street had been expecting earnings of 56 cents per share. Last week, I told you I was expecting something close to 60 cents, and I was right. Microsoft earned 62 cents per share.

While Microsoft has been struggling with its phones, the company has been doing well in other areas. Xbox is strong. Their cloud revenue jumped 88% last quarter. Shares of MSFT dipped after the earnings report, but cooler heads came back, and the stock closed Thursday at $46.11 per share. This week, I’m lowering my Buy Below on Microsoft to $49 per share. I like MSFT and I’m sticking with Nadella.

Also on Tuesday, Signature Bank (SBNY) reported earnings of $1.77 per share. That was nine cents more than estimates. The numbers here were very good. Deposits are up 24% in the last year. SBNY’s net interest margin is 3.17%. That’s quite strong. These guys are doing banking right. I’m lifting my Buy Below on SBNY to $156 per share.

Now for Qualcomm (QCOM), our problem child, let’s start with the good news. Qualcomm reported quarterly earnings of 99 cents per share, which was four cents better than estimates. More good news is that Qualcomm said they’ll consider the activist proposals to split up the company. I’ve been urging them to do this. At this point, I can’t say if Qualcomm is seriously considering these ideas or is trying to placate shareholders. Either way, it’s out in the open now.

Now for some bad news. Qualcomm said they’re going to cut spending by $1.4 billion. This means paring down 15% of their full-time employees. This is painful news, but it’s necessary. The company now projects that it will sell between 19% and 28% fewer chips this quarter than the same quarter one year ago.

For this quarter, which is Qualcomm’s fiscal Q4, the company expects earnings to range between 75 and 95 cents per share. For the year, they expect earnings between $4.50 and $4.70 per share. The forecast in April was $4.60 to $5.00 per share. Qualcomm has obviously been a big disappointment this year. I’m keeping my Buy Below at $66 per share. On Thursday, QCOM dropped below $61 for the first time in two years. Ugh!

Thursday’s Big Earnings Parade

We had four Buy List earnings reports on Thursday. Before the opening bell, Wabtec (WAB) reported Q2 earnings of $1.04 per share. That was two cents better than estimates. That makes $2.03 per share for the first half. WAB reaffirmed guidance of “about $4.10″ for the full-year.

WAB’s CEO, Raymond T. Betler, said: “We had another strong operating quarter, with record sales, earnings and margins, driven by the performance of our Freight Group. We continue to execute our growth strategies and internal-improvement initiatives, and we’re optimistic about our future growth prospects, thanks to the diversity of our business model, continued global investment in transportation projects, and the power of our Wabtec Performance System.” I’m keeping my Buy Below at $103 per share.

Snap-on (SNA) reported Q2 earnings of $2.03 per share, which was three cents better than estimates. I thought there was a good chance they’d miss estimates. I always enjoy being insufficiently optimistic on one of our stocks. The CEO said, “We’re encouraged by the ongoing progress reflected in our second-quarter results, including 8.4% organic sales growth, a 17.7% operating margin before financial services, representing a 100 basis-point improvement, and a 12.8% increase in diluted earnings per share.” I don’t have much to say, except this was a good quarter all around for SNA. This has been a very good stock for us this year (see below). I’m raising my Buy Below on Snap-on to $169 per share.

After the closing bell, CR Bard (BCR) reported Q2 earnings of $2.27 per share. That was nine cents better than estimates. Sales rose 4%, but adjusted for currency, it would have been up 8%. Bard remains a solid stock up to $184 per share. Don’t chase this one.

Stryker (SYK) said it earned $1.20 per share for their Q2. That beat estimates by three cents per share. The company also had strong guidance for this quarter. SYK expects Q3 earnings to range between $1.20 and $1.25 per share.

For the entire year, Stryker expects earnings to range between $5.06 and $5.12 per share. The previous range was $4.95 to $5.10 per share. Notice that we’re in July, and Stryker has a very narrow range for their earnings guidance. Obviously, accountants can play with numbers, but I trust a company like Stryker, and you can see how stable their business is. Stryker is a buy up to $101 per share.

PayPal Joins Our Buy List

Before I get to next week’s earnings, let me address the issue of eBay (EBAY) and PayPal (PYPL). On Monday, shares of PayPal started trading for the first time.

With our Buy List, I always go out of my way to be as transparent as possible. For track-record purposes, I assume that the Buy List is a $1 million portfolio at the start of the year. The 20 positions are equally weighted, so that means $50,000 in each stock. As usual, I can’t make any changes throughout the year.

For the 2015 Buy List, here are the numbers of shares for each stock to four decimal places. Since eBay shareholders got one share of PayPal for each eBay share they owned, the same holds true for our Buy List. In the $1 million portfolio, eBay had 890.9480 shares at $56.12 per share. So PayPal will also get 890.9480 shares. For cost-basis purposes, the ratio is 0.579122 for PYPL and 0.420878 for EBAY. I have more details here.

Six Earnings Reports Next Week

Next week, Tuesday will be the big day. That’s when AFLAC, Ford Motor and Express Scripts are due to report.

Ford Motor (F) will be the most interesting, and it’s the one I’m most optimistic about. The stock has done poorly, but the company has stuck by its full-year forecast. Investors got nervous recently when they saw that Ford is already offering big discounts for their new F-150. I think it’s way too soon to say that Ford’s in trouble. The company has been plagued by a lot of bad news lately, but I still believe the stock offers a good value. Wall Street currently expects Q2 earnings of 37 cents per share.

AFLAC (AFL) has also been in a difficult position. The company is doing well, but it’s been hurt by a world of low rates and a weak Japanese yen. Earnings will largely flatline for a bit, but don’t let that fool you: AFLAC is a very well-run outfit. The consensus on the Street is for Q2 operating earnings of $1.52 per share.

Express Scripts (ESRX) is a steady stock. Three months ago, they narrowed their full-year range to $5.37 to $5.47 per share. That translates to a growth rate of 10% to 12%. That’s not bad, especially in this environment. For Q2, ESRX expects earnings of $1.39 to $1.43 per share. Look for good news here.

Fiserv (FISV) is one of my favorite stocks. The company is due to report on Wednesday. This could be their 30th year in a row of double-digit growth. Fiserv currently expects EPS this year to range between $3.73 and $3.83. That’s growth of 11% to 14%. For Q2, Wall Street expects 94 cents per share. I’ll probably raise my Buy Below on Fiserv next week, but I want to see the earnings numbers first.

Shares of Ball Corp. (BLL) took a hit this week after the EU said it’s looking into their acquisition of Rexam. They’re right that the combination of these two would hold a dominating market position, but I can’t say if it would be an illegal dominance. I would assume the authorities will make the companies sell off certain assets. Ball badly missed earnings last earnings season, but the details weren’t so bad. Ball reports on Thursday. For Q2, Wall Street expects earnings of 94 cents per share. The lower share price makes Ball a good value.

Moog (MOG-A) always likes to sneak their earnings report in on a Friday. The company has already lowered their full-year guidance twice this year. They’ve been upfront about the issues facing them, but this is proving to be a difficult year for Moog. I’m not ready to give up on them. It’s a good outfit. Wall Street expect earnings of 94 cents per share. (That’s right, the estimate is for 94 cents for Fiserv, Ball and Moog.)

That’s all for now. Lots more earnings next week. The Federal Reserve meets again next week. Don’t expect any rate decision. The key econ report will come on Thursday when the government reports on Q2 GDP. This could (finally) be a good one. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: July 24, 2015

Eddy Elfenbein, July 24th, 2015 at 7:03 amLagarde Push for Greece Debt Relief Challenges Merkel

Murder, Poisoning, Raids: It’s Election Season in Russia

China’s Global Ambitions, With Loans and Strings Attached

Abenomics Needs To Be ‘Reloaded’, Warns IMF

WTO Seals Breakthrough IT Trade Deal

Amazon Profit Beats Estimates, Stocks Soar

Anthem to Buy Cigna in Deal Valued at $54.2 Billion

Google Has Way to Unclog Drone-Filled Skies Like It Did the Web

American Airlines Group Reports Highest Quarterly Profit In Company History

Ferrari’s Testarossa May Be a Better Investment Than Its IPO

Drug Testing is Coming to E-Gaming

Nikkei Vows to Respect FT Independence After $1.3 Billion Buyout

European Commission Clears Nokia’s Acquisition of Alcatel-Lucent

Edward Harrison: Did Lending By Foreign Banks Really Cause the Greek Debt Crisis?

Joshua Brown: NJ Pension Officials Don’t Understand the Relationship Between Risk and Reward

Be sure to follow me on Twitter.

-

Earnings from CR Bard and Stryker

Eddy Elfenbein, July 23rd, 2015 at 4:13 pmCR Bard (BCR) earned $2.27 per share which beat estimates of $2.18 per share.

Timothy M. Ring, chairman and chief executive officer, commented, “We are pleased with the strong start to 2015, which, as we’ve said, is an important year of execution for us. More than two years ago, we introduced our strategic investment plan designed to accelerate the growth rate of the company and put us in a position to provide revenue growth in the mid-to-high single digits with attractive returns for shareholders. We are pleased with the results to date and we remain focused on that objective.”

Stryker (SYK) earned $1.20 per share, three cents more than estimates.

“We continue to execute well across our businesses and delivered organic sales growth of approximately 7% in the second quarter,” said Kevin A. Lobo, Chairman and Chief Executive Officer. “Our strong first half performance and positive momentum is reflected in our raised guidance and underscores the strength of our people and diversified portfolio.”

Now for guidance. Stryker expects Q3 to range between $1.20 and $1.25 per share. They see full-year between $5.06 and $5.12 per share.

-

The One-Year Yield Creeps Higher

Eddy Elfenbein, July 23rd, 2015 at 3:51 pmThe yield on the one-year Treasury isn’t very high, about 0.34%. But that’s the highest it’s been in five years. Check out the one-year’s climb compared with the subdued six-month rate.

In other words, the market sees interest rates going higher — not yet, but soon.

-

Earnings from Wabtec and Snap-on

Eddy Elfenbein, July 23rd, 2015 at 10:42 amToday’s a big day for Buy List earnings; two before the bell and two more after.

This morning, Wabtec (WAB) reported Q2 earnings of $1.04 per share. That was two cents better than estimates. That makes $2.03 per share for the first half. WAB reaffirmed guidance of “about $4.10” for the full-year.

Raymond T. Betler, Wabtec’s president and chief executive officer, said: “We had another strong operating quarter, with record sales, earnings and margins, driven by the performance of our Freight Group. We continue to execute our growth strategies and internal improvement initiatives, and we’re optimistic about our future growth prospects, thanks to the diversity of our business model, continued global investment in transportation projects, and the power of our Wabtec Performance System.”

Solid company and solid quarter. The shares are up close to 2% today.

Snap-on (SNA) report Q2 earnings of $2.03 per share which was three cents better than estimates.

“We’re encouraged by the ongoing progress reflected in our second quarter results, including 8.4% organic sales growth, a 17.7% operating margin before financial services, representing a 100 basis point improvement, and a 12.8% increase in diluted earnings per share,” said Nick Pinchuk, Snap-on chairman and chief executive officer. “We believe these results once again validate Snap-on’s ability to build upon our unique combination of capabilities in serving serious professionals and to successfully navigate our runways for coherent growth and operating improvement in multiple industries across varied geographies. Finally, this continued progress is only possible as a result of the tremendous dedication, effort and skill across the Snap-on team. In that regard, I thank our franchisees and associates worldwide for their contributions, commitment and support.”

SNA is up close to 1% today.

-

Jobless Claims Fall to 42-Year Low

Eddy Elfenbein, July 23rd, 2015 at 10:20 amThis morning’s jobless claims report came in at 255,000. That’s the lowest print since November 24, 1973.

In honor of 1973:

-

Morning News: July 23, 2015

Eddy Elfenbein, July 23rd, 2015 at 7:13 amPersonalities Clashing Over How to Handle New Greek Bailout

Distressed-Debt Market Upended Amid Deepening Commodities Rout

Oil Warning: Crash Could Be Worst in More Than 45 Years

Drug Companies Pushed From Far And Wide to Explain High Prices

Tim Cook’s $181 Billion Headache: Apple’s Cash Held Overseas

Ford Seeks to Shake Stigma of Detroit’s Most Generous Automaker

Netmarble Takes Stake in SGN, Extending Asia’s Reach Into U.S. Mobile Games

Comcast Results Buoyed by Strong Performance in Film Division

GM Earnings More Than Double on U.S. Truck Demand, Shares Jump

Dow Chemical Profit Beats Estimates as Margins Continue to Expand

Financial Times Owner Pearson Nears Sale of Newspaper Group

Ferrari Files for Share Listing on New York Stock Exchange

6 Reasons Chipotle Bounced Back To A New All-Time High (With Carnitas)

Roger Nusbaum: Jason Zweig Is Wrong About Gold

Be sure to follow me on Twitter.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His