CWS Market Review – November 13, 2015

“We’re blind to our blindness. We have very little idea of how little we know.

We’re not designed to know how little we know.” – Daniel Kahneman

Last week’s jobs report was, to put it mildly, a huge honking deal. The U.S. economy created 271,000 net new jobs last month. That’s the most this year, and it demolished expectations. Unemployment is down to 5.0%, which is a seven-year low.

Mind you, there are still weak spots, like the participation rate and sluggish wage growth, but the key takeaway for investors is that the Federal Reserve has the cover it needs to start raising interest rates next month. Think about that: For the first time in nearly a decade, rates will be going up.

If you recall, the Fed said that it will base a December rate hike on several factors, but we all know what they meant: more jobs. The stock market has shifted to reflect these new expectations. This is very important, and I want you to understand what it means. In this issue of CWS Market Review, I’ll cover the details.

I’ll also cover the recent Buy List earnings report from Moog (MOG-A). The stock is up 17% from its September low. I’ll also highlight upcoming earnings reports from Ross Stores (ROST).

Also this week, we got a nice 15% dividend increase from Snap-on (SNA). The stock then broke out to a fresh 52-week high. I love those steady winners. I’ll have all the details in a bit. But first, let’s take a closer look at the jobs report and how it’s altered the investment outlook for next year.

A Worldwide Commodity Crackup

Two weeks ago, I said that if the October and November job reports average 180,000, the Federal Reserve will go ahead with a rate increase in December. Well, the October report of 271,000 jobs is a darn good indicator that we’ll cover that.

According to bets placed in the futures market, there’s a 70% chance that the Fed will raise rates at their meeting scheduled for December 15-16. Watch for that to gradually increase. Interestingly, the futures market is pretty gun shy about rate increases after that. This supports my “one-and-wait” theory. I don’t think the Fed can make any more moves until there’s more evidence of inflation.

Investors reacted to the new expectations, but the initial results aren’t in the stock market. At Thursday’s close, the six-month Treasury got up to 0.35% and the one-year is up to 0.51%. Of course, those are still very low yields, but it’s the highest we’ve seen in a long, long time. The long-end of the market has also been impacted as the 10-year yield just crossed over 2.3%.

What’s happening is that the U.S. economy is out of sync with much of the world. We’re doing better while they’re stuck in neutral. That’s why the dollar has been doing so well. In fact, some folks are talking about the dollar soon reaching parity with the euro. That hasn’t happened in 13 years. Of course, we’ve seen the impact of the strong dollar on the earnings reports of several of our stocks, even ones you wouldn’t normally think of as having forex exposure.

Overall, our Buy List has not been as severely impacted by the strong dollar as other areas. In particular, I’m thinking of commodity-related areas. Copper, for example, just fell to a six-year low. Copper is often jokingly referred to as having a Ph.D. in economics. The metal’s movements have been a much better indicator of the world economy than many highly-paid forecasters’ calls. With the case of copper, it’s probably not signaling weakness here but rather in China. The world’s largest country consumes about 45% of the world’s copper output.

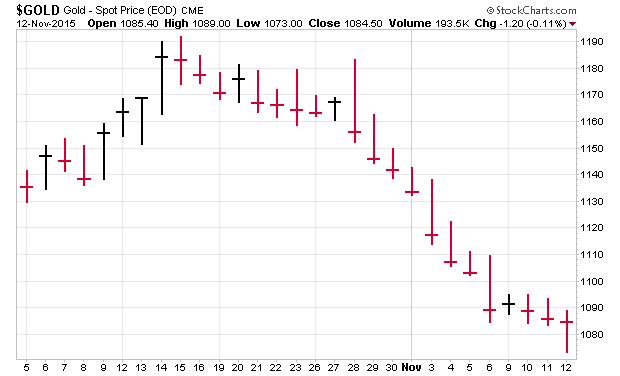

That’s not the only the commodity feeling the heat. Gold has dropped 17 times in the last 20 sessions (see below). Gold is now at a six-year low and platinum is at a seven-year low. Those guys are actually doing well compared with silver. Silver has fallen for the last 12 days in a row. We’re witnessing a worldwide commodity crackup.

Defensive areas of the stock market like utilities and healthcare haven’t done very well. More aggressive sectors like tech have been out in front, and consumer discretionary stocks have been rock stars.

We’re soon going to get a better view of the holiday shopping season. This is a vital time for many businesses. It’s true that more people are working, but we want to see more people buying.

I want to caution investors against feeling the need to gobble up any stock that’s had a bad day. Be patient and focus on superior companies. I especially like stocks that pay solid dividends. Investors just got a nice pay raise from Snap-on (SNA). I expect we’ll get one from Stryker (SYK) soon. Some of the best names on our Buy List are Cognizant (CTSH), Express Scripts (ESRX) and Wabtec (WAB). Now let’s look at the final earnings report for Q3.

Moog Is a Buy up to $64 per Share

Last Friday, we got our final Buy List earnings report for Q3. Moog (MOG-A) reported earnings of 75 cents per share (this was for the fourth quarter of their fiscal year). That was well below the company’s guidance of 91 cents per share and Wall Street’s consensus of 92 cents per share.

But once we dig into the details of the report, Moog said they lost 13 cents per share due to “incremental restructuring and impairment costs.” The company also said that they were hit by four cents due to a higher-than-expected tax bill.

Overall, this was a tough year for Moog.

Fiscal ’15 was a challenging year for our company across multiple fronts,” said John Scannell, Chairman and CEO. “In the face of these challenges, we delivered solid earnings and record cash flow. We are projecting a stronger fiscal ’16 with earnings per share of $4.00, up 19% on sales growth of about 2%.”

For the fiscal year, Moog earned $3.35 per share which is down from $3.52 last year. Annual sales fell 4.6% to $2.53 billion. I’m pleased to see Moog forecasting earnings of $4 per share for FY 2015.

Technically the report counts as an earnings miss, but traders were hardly bothered. Actually, Moog has been behaving well lately. The shares bounced off a low of $52.33 in late September and have been rallying ever since. This week, the stock broke briefly above $64 per share. I’m raising my Buy Below to $64 per share.

Earnings Preview for Ross Stores

I’m a big fan of Ross Stores (ROST). Some investors are put off by companies that cater to “low-end” consumers. That’s silly. Ross has served its customers well, and it’s been a winner for us this year.

That’s why I was puzzled by the tepid guidance the company gave after its last earnings report. Ross is due to report earnings again on Thursday, November 19. For fiscal Q3, which ended in October, Ross sees earnings ranging between 48 and 50 cents per share. That’s barely above the 47 cents per share they made in last year’s Q3.

Ross said they see same-store sales rising by 1% to 2%. Perhaps they’re low-balling us; it wouldn’t be the first time. For Q4, which is the big holiday quarter, Ross sees earnings between 60 and 63 cents per share with same-store sales growth of 0% to 1%.

Those numbers just don’t make sense. What’s going on? Barbara Rentler, the CEO, explained the guidance: “While we hope to do better, we are maintaining a cautious outlook for the second half, when we face more challenging sales and earnings comparisons. In addition, the macroeconomic and retail landscapes remain uncertain.” That doesn’t tell us much.

Adding it all up, Ross sees earnings this year coming in between $2.40 and $2.45 per share. They made $2.21 per share last year.

In August, the stock got nailed after the weak guidance. Ross got hit again this week when Macy’s (M) reported lousy results. That’s standard thinking on Wall Street: “if one company in a sector is doing poorly, then they all must be.” Another Buy List stock, Bed Bath & Beyond (BBBY), was dragged down as well. But Macy’s is a very different store from ROST or BBBY. In fact, next week, I think Ross will bump up its guidance for Q4.

Snap-on Raises Dividend by 15.1%

On Monday, Snap-on (SNA) announced it’s raising its quarterly dividend from 53 to 61 cents per share. That’s an increase of 15.1%. Snap-on has paid quarterly dividends without interruption since 1939.

I like this company a lot. Last month, Snap-on gave us another solid earnings report. For Q3, they earned $1.98 per share which was four cents better than expectations.

Annually, the new dividend comes to $2.44 per share which gives SNA a yield of 1.46% based on Thursday’s close. This year, Snap-on should earn about $8.06 per share, give or take. That’s up from the $7.11 per share they made last year, which keeps their payout ratio around 30%. This week, I’m raising my Buy Below on Snap-on to $175 per share.

The 2016 Buy List Will Be Unveiled on December 18

Circle December 18 on your calendars. That’s when I’ll unveil the 2016 Buy List. The new Buy List will take effect on January 4, 2016, the first day of trading in the new year. Once the names are out, the Buy List is locked and sealed, and I can’t make any changes for the next 12 months.

I like to reveal the new names early so no one can claim I’m somehow manipulating the stocks. I also want to show investors that there’s no need to rush out and madly buy up a stock.

Thanks to the PayPal (PYPL) spin-off, there are now 21 Buy List stocks. So this year, I’ll be deleting six names and adding our usual five. I always feel that if I’m doing the newsletter right, the decisions I make shouldn’t be a big surprise to readers.

I can tell you now that some stocks in my doghouse include Oracle (ORCL), Qualcomm (QCOM) and Ball (BLL). That’s not a promise. I still have time to change my mind, but I want to let you know what I am thinking. It looks like our Buy List is on its way towards beating the S&P 500 for the eighth time in the last nine years.

Buy List Updates

Signature Bank (SBNY) has responded very well to the prospect of higher interest rates. The stock got dinged toward the end of the summer for reasons I don’t get. No matter: SBNY recovered all of its loss. The stock recently touched another new high. This week, I’m raising my Buy Below on Signature Bank to $160 per share.

Shares of Express Scripts (ESRX) got dinged for 4% on Wednesday after the company cut its ties with Horizon Pharma (HZNP). Specifically, Express sent a termination letter to Linden Care, which is claimed to be a “captive” pharmacy of Horizon. Linden responded by suing Express.

This is part of the fallout from the mess at Valeant (VRX). No one wants to do business with these mail-order dispensaries, and I don’t blame them. On Wednesday, shares of Horizon plunged 20%. Don’t worry about ESRX. They made the right decision.

Shares of PayPal (PYPL) dropped late Wednesday and into Thursday after news broke that Apple (AAPL) is talking with some banks about setting up their own payment service. The service would let folks zap money from their bank account simply by using their iPhone. PayPal is already doing this with their Venmo platform.

There are no details on this story outside of Apple being “in talks.” I hardly think this is any of type of PayPal killer. I do think it’s part of a longer trend towards a cashless society. A PayPal spokesman said, “We welcome any development that encourages people to address the awkwardness of dealing with cash when paying friends or family back.”

That’s all for now. There are a few key economic reports coming our way next week. On Tuesday, the government will report on consumer inflation for October. I’m not expecting much, but if there’s any indication of incipient inflation, it will be more evidence for the monetary “hawks” to go ahead with a rate increase. On Tuesday, we’ll get a look at the minutes from the Fed’s recent meeting. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on November 13th, 2015 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His