Archive for December, 2015

-

Once Again…

Eddy Elfenbein, December 28th, 2015 at 3:14 pmHere’s the 2016 Crossing Wall Street Buy List. The list goes live at the opening bell next Monday.

AFLAC (AFL)

Alliance Data Systems (ADS)

Bed Bath & Beyond (BBBY)

Biogen (BIIB)

Cerner (CERN)

Cognizant Technology Solutions (CTSH)

CR Bard (BCR)

Express Scripts (ESRX)

Fiserv (FISV)

Ford (F)

HEICO (HEI)

Hormel Foods (HRL)

Microsoft (MSFT)

Ross Stores (ROST)

Signature Bank (SBNY)

Snap-on (SNA)

Stericycle (SRCL)

Stryker (SYK)

Wabtec (WAB)

Wells Fargo (WFC)

-

Overpaying for Low Probability

Eddy Elfenbein, December 28th, 2015 at 9:40 amIn Big Short, people betting on low probability events are geniuses. In reality, people do this all the time, generally overpaying.

— Eric Falkenstein (@egfalken) December 27, 2015

I posted this tweet from Eric Falkenstein because it’s one of the fundamental truths about investing. Markets are generally not very good judges of low-probability events.

One of the best examples of this comes from horse racing. Historically, the worst bet to make is to bet on the long shot. Why is that the case? I think it’s because a certain amount of people want to bet on the long shot precisely because it is the long shot.

Think of the guy who says, “Dude, that horse is 70-to-1! I’m betting $10 on it. How crazy would it be if he won?”

Not to get overly philosophical, but the price impacts the price. I’m sure you’ve heard stories of an art gallery owner who can’t move a painting. Then he triples the price and it sells the next day.

In stocks, this effect often happens with companies that are supposed to be the “next Apple” or “next Google.” Sure, it might work out, but the odds are against it. Some people just want to own for the big payoff, and that itself makes it overpriced.

I suspect that the historic outperformance of value stocks isn’t due to something within value stocks but rather it’s due to the underperformance of richly-valued growth stocks.

-

Morning News: December 28, 2015

Eddy Elfenbein, December 28th, 2015 at 7:13 amJapan Firms Cold on Abe’s Calls For Wage Hikes in 2016

Japan November Industrial Production Falls 1%

India Offers Atypical Video Challenges

Ruble Drops to 2015 Low on Year-End Budget Flows as Oil Tumbles

Prospects For The Oil Market – What Is Market Structure Telling Us As We Head Into 2016?

Shale’s Running Out of Survival Tricks as OPEC Ramps Up Pressure

Yellen Price-Quirk Focus Shows Confidence in Inflation Comeback

Are Democrats Crippling Obamacare?

Which Puerto Rico Bond Defaults Next? 42% Yields Provide a Clue

F.A.A. Drone Laws Start to Clash With Stricter Local Rules

Colorado Banking Case Tests Federal Drug Rules

China Telecom Falls After Chairman Becomes Target of Probe

Volkswagen’s Audi Tempers Spending Plans for 2016

Cullen Roche: The Importance of First Principle Thinking

Jeff Miller: 2015 in Review: Hi-Yo, Silver!

Be sure to follow me on Twitter.

-

Merry Everything

Eddy Elfenbein, December 25th, 2015 at 8:49 amI want to take this opportunity to wish everyone a Merry Christmas and a happy, healthy and profitable new year.

This has been a great year for Crossing Wall Street. Our Buy List is up again this year, and it looks like we’ll beat the market. Traffic to the blog continues to be strong, and the newsletter, CWS Market Review, has a record number of subscribers.

I want to thank Marcia Hippen for editing my posts and repairing my numerous typos. I also want to acknowledge some of my fellow financial bloggers Barry Ritholtz, Josh Brown, Morgan Housel, Howard Lindzon, Tadas Viskanta and many, many others for their continued support.

I’d also like to thank the people who follow and interact with me each day on Twitter. In particular, I want to call out George Acs, Zachary Shrier and Joseph Weisenthal. I now have over 22,000 Twitter followers.

Most of all, I want to thank all of my readers for your continued support.

Let’s hope 2016 brings us more success!

-

CWS Market Review – December 25, 2015

Eddy Elfenbein, December 25th, 2015 at 7:20 am“All men’s miseries derive from not being able to sit in a quiet room alone.”

– Blaise PascalMerry Christmas!

Last week, I unveiled our Buy List for 2016 (you can see the full list here). In this week’s CWS Market Review, I’ll go into more depth on our changes and why we’re making them. I’ll also update you on our Buy List for this year. With a week to go, we’re holding a nice lead over the S&P 500. This will be the eighth time in the last nine years that we’ve beaten the overall market. Once again, patience and prudent investing have served us well.

The stock market is closed today for Christmas. Next week will be the final trading week of the year. In next week’s issue, I’ll have a summary of the 2015 Buy List and the precise weightings for the 2016 Buy List.

As usual, the 20 stocks will be equally weighted, using the closing price on Thursday, December 31. For track-record purposes, I will assume the Buy List is a $1 million portfolio with $50,000 allocated to each of the 20 stocks. Also in next week’s issue, I’ll have the Buy Below prices for our five new stocks. Now let’s take a look at where the 2015 Buy List stands.

Another Market-Beating Year for Our Buy List

We’re wrapping up the tenth year of our Buy List. For the last decade, we’ve followed the exact same rules: 20 stocks, no trading and five changes each year.

We lost to the market in our first year but then beat it for the next seven years in a row. That streak came to an end last year when we lost to the S&P 500 by a little less than 2%. I’m happy to report that we’re back to our market-beating ways this year.

Through Thursday’s close, our Buy List is up 4.75% while the S&P 500 is up by 0.10%. (Hey, we’re beating the market nearly 50 to 1!) Once we include dividends, our Buy List is up 5.94% while the S&P 500 is up 2.20%. I always consider the final performance number to be the one with dividends included. As a very rough rule of thumb, the S&P 500 has yielded about 2% for the last few years while our Buy List has yielded about 1%.

Note how well we’ve done despite getting battered by stocks like Qualcomm and Bed Bath & Beyond (both are down over 33%). That’s because the Buy List is well diversified. This is an important lesson investors need to understand. The market gods are capricious and unforgiving. I certainly didn’t think a Spam stock was going to be a 53% winner this year. But that’s what happened. Every week or so, I’ll get an e-mail that says, “Eddy, if you could buy just one stock….” Sigh. Sometimes I think preaching sound investing is a losing battle.

Here’s an interesting fact: The daily changes of our Buy List correlate 96.5% with those of the S&P 500. That number would scare the bejeezus out of any hedge-fund manager. They spend lots of time and energy trying to zig when the market zags. But for us, that’s not so important. We’re not trying to get 500% a year. In fact, it’s the going-for-the-fences strategy that often winds up causing a fund to get schlonged. Note the Pascal quote in this week’s epigraph.

I also want to clarify an important point. For track-record purposes, I rebalance the Buy List each year, but there’s no need for you to rebalance your portfolio each year. That’s only necessary when a position may grow to an unusually large weighting in your holdings. Then it might be a good idea to cut back on it and reallocate the funds to other positions. But that kind of rebalancing is only needed every three years or so, assuming you start with a well-diversified portfolio.

The New Additions for 2016

Now let’s look at 2016. The five new stocks for 2016 are Alliance Data Systems, Biogen, Cerner, HEICO and Stericycle.

First, let me explain how I go about selecting our stocks. A big mistake many investors make in stock selection is that they use a top-down approach. By this I mean that they’ll say to themselves, “What’s going to be really big in the future? I know! Biotech! Or green energy! Or China. Or a Chinese green energy firm that does biotech!”

That’s the wrong approach. The right way is to find a few companies that are really, really good at what they do. What they do is secondary. I realize that sounds counterintuitive, but remember that in a free-enterprise economy, just about any task can be profitable. Check out the impressive long-term chart of Smuckers (SJM). I find it reassuring that very few hedge funds have come close to the performance of the jelly people.

If in the early 1980s you had been prescient about the personal-computer revolution, you probably would have invested in Wang, DEC and IBM. That’s the weak part of a top-down approach. Even if you’re right on the top part, that doesn’t mean you’re going to be right on the down part.

You may have noticed that again, we don’t have any energy stocks. That’s not me making a prediction on the energy market. I simply couldn’t find anyone I liked at the moment. I also realize that this hinders some of the Buy List’s diversification. You may also notice that there are a lot of healthcare stocks on the Buy List. Again, that’s not a sector call on my part. It just so happens that a lot of my favorite stocks are in healthcare at the moment. Still, I don’t believe the new Buy List is unduly weighted towards healthcare.

I also know that many investors really don’t like stocks with high nominal prices. I’m sorry, but this is a fear you’ll have to get over. There are lots of great stocks that go for over $200 per share. You can always buy fewer shares.

Now let’s look at our five new stocks.

Alliance Data Systems (ADS). These are the guys behind the rewards programs for many different companies. It’s one of the businesses you would never think is as profitable as it is. ADS has grown its EPS very steadily for the last several years: $5.16, $5.86, $7.63, $8.71, $10.01 and $12.56. The company expects $15 for 2015 and $17 for next year. I think they can top both of those. Again, don’t let the high share price scare you.

After I got done making fun of biotech, here I am adding Biogen (BIIB). But I like it. Like a lot of biotech stocks, Biogen has gotten slammed this year. In March, it crossed $480 per share. Now it’s around $300. There are about 400 publicly traded biotech stocks. Only about 10% are profitable in any meaningful sense. Biogen is one, and it’s a good one. The recent numbers have been quite good. The company also took a painful but necessary step in cutting its workforce. Biogen also has one of the highest profit margins you’ll see, about 34%. Only the mafia and the government get higher than that.

Cerner (CERN) is a healthcare IT company. What Fiserv is to finance, Cerner is to healthcare. This is another stock that’s been chopped down this year. CERN was over $75 in April and now it’s near $60. Last month, the company gave a weak outlook for 2016. They see earnings ranging between $2.30 and $2.40 per share. Wall Street had been expecting $2.53 per share. Still, that’s a nice increase over the $2.07 they should earn for 2015 and the $1.65 they made last year. Cerner is a solid company.

HEICO (HEI) is exactly the kind of company I love to find. HEICO is a defense and aerospace contractor. They’re not well known. They’re kind of boring. And they’re very profitable. In fact, the stock was just upgraded by Bank of America Merrill Lynch. Please note that I’m recommending HEI, the common shares. There are A shares which have slightly different voting rights. Of the five new stocks, HEICO is the only one that pays a dividend, but it’s pretty small (0.30%).

Stericycle (SRCL) is a medical-waste-management company whose stock got clobbered last earnings season. SRCL plunged from around $150 to $120 per share, which is about where it is today. The company missed earnings by 10 cents per share. I’m not sure why a profit miss is valued with a P/E Ratio of 300, but in this case, it was. Some of the earnings miss was due to the dollar, and some was due to a business slowdown. Stericycle said that should pass. I like that this business has high fixed costs. Also, almost all of their revenue comes from long-term contracts. Stericycle is poised for a good year.

The Six Deletions

We’re deleting six stocks this year. I often asked about why a stock may go off the list. The most common reason is that the company somehow changes into something different from the firm we added.

This year, for example, Ball Corp. is different from the company we added. They’re in the process of merging with Rexam. I wish them well, but the fact is, that’s a major merger, and it’s not the same old Ball that we knew.

Another good example is eBay. The stock was flat for us last year, but I was eager to keep it for 2015. I knew the PayPal spinoff would lift the shares. I thought the combined entities would return 20% for us in 2015. It turns out I was a little too optimistic. The combined investment has made about 15% for us, which is still quite good. I’m not a big fan of eBay as a stand-alone company. I suspect that PayPal will be bought out by somebody within the next three years, perhaps sooner.

Qualcomm and Oracle were easier decisions. The companies have performed very poorly this year. Just about everything that could go wrong with Qualcomm did. In many ways, I felt my decision to add QCOM was justified. It was financially strong with high cash flow and solid dividends. But that’s not enough. The company is under attack from all sides. They need to break themselves up but management is against the idea.

I feel more optimistic for Oracle. The company indicated that things should get better from here, but I’m tired of waiting for the promised turnaround. These things take time. With a company like Ford, I’m much more willing to wait.

Moog was a hard decision. I like the company a lot, but this was a very challenging year for them. They lowered guidance three times this year. That really stung. For its part, Moog is optimistic for 2016. I hope things improve over there since this is a sound company.

Buy List Updates

After the closing bell on Tuesday, Bed Bath & Beyond (BBBY) issued a press release that said that fiscal Q3, which ended in November, will come in below its previous guidance. The official earnings report doesn’t come out until January 7, but they wanted to give us a heads up.

Bed Bath now expects Q3 revenues to rise to $3.0 billion. That’s an increase of just 0.3%. They had previously expected sales to rise between 1.8% and 4.0%. They also expect same-store sales to fall by 0.4%. The previous guidance was for an increase between 1% and 3%.

Now for earnings. BBBY sees Q3 earnings ranging between $1.07 and $1.10 per share. The previous range was $1.14 to $1.21 per share. Note that a miss on the top line is inevitably a larger percentage miss on the bottom line.

This isn’t good news. The stock dropped 4.6% on Wednesday and reached a new 52-week low. However, I’m more concerned about a slowdown during their crucial fiscal Q4 (December, January, February). This news suggests that Q4 won’t be good, but we can’t confirm by how much. Bed Bath & Beyond gave us a small hint when they said they expect same-store sales to rise by 1% from the beginning of December through Christmas.

Bed Bath & Beyond reached the final round in my debate regarding stocks to vote off the island. Ultimately, I thought the price was low enough to keep them around for another year. While this week’s news is unpleasant, it doesn’t alter my outlook. I’m lowering my Buy Below on BBBY to $53 per share.

This week, Express Scripts (ESRX) said it sees earnings next year ranging between $6.08 and $6.29 per share. Wall Street had been expecting $6.04 per share. That’s a nice increase.

“Our focused model of alignment has positioned us uniquely in the healthcare-services landscape to improve health outcomes and lower costs for our clients and patients,” said George Paz, CEO and chairman of Express Scripts. “No one matches our focus on serving clients and patients, and we remain confident in our continued growth and returning exceptional results to our shareholders.”

“The fundamentals of our business allow us to deliver solid financial results while making investments to continue our growth as a leading independent PBM and healthcare provider,” said Tim Wentworth, President. “We have an aligned book of business and a deep set of innovative solutions to help clients and patients. As we create value for our patients and clients, we create value for our shareholders.”

Express also reiterated its guidance for growth in 2015 of 13% to 14%. That’s what they said with the last earnings report when they also gave a full-year range of $5.51 to $5.55 per share. Unfortunately, Wall Street was not impressed by the higher guidance, but I am. Express Script remains a buy up to $92 per share.

A few other points to mention. Wabtec (WAB) was upgraded by Stifel. Ross Stores (ROST) was upgraded by Cowen. They said ROST’s merchandize is “un-Amazonable.” I like that word.

That’s all for now. The stock market will be closed next Friday for New Year’s Day. There’s really not much in the way of economic news. Expect most market commentary to focus on 2016. Remarkably, the S&P 500 has only had one down calendar year since 2003. We’re very close this year. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: December 25, 2015

Eddy Elfenbein, December 25th, 2015 at 7:14 amWorld’s Biggest Pension Fund to Add Board in Governance Overhaul

Lower Jobless Claims Don’t Point to Robust Labor Market

Oil Bankruptcies Reach Highest Quarterly Level Since Recession

Beijing Raises Smog Alert as Airport Cancels 227 Departures

China Plans a New Silk Road, but Trading Partners Are Wary

Without Energy’s Drag, Inflation in Japan Is Approaching Target

Ukraine Budget Vote Clears Way for Next Slice of IMF Cash

Security Experts and Officials Diverge in ISIS as Hacking Threat

Pep Boys Accepts Higher Takeover Bid From Bridgestone

A Silicon Valley for Drones, in North Dakota

Apple Asks Court to Make Samsung Pay $180 Million More in Patent Dispute

How Steph Curry, LeBron James and the NBA Stole Christmas

The 50 Best Investing Insights of 2015

Jeff Carter: Want to Get Rich? Here Is How To Do It In Tech

Be sure to follow me on Twitter.

-

Morning News: December 24, 2015

Eddy Elfenbein, December 24th, 2015 at 7:09 amJapanese Court Rules Two Nuclear Reactors Can Be Restarted

It’s Jammin’: Jamaica’s Tiny Stock Market Conquers World in 2015

Puerto Rico Utility Reaches Deal With Bond Insurers in Effort to Avoid Default

Oil Set for Biggest Weekly Gain in 2 Months as U.S. Supply Drops

Gain in U.S. Consumer Spending Accompanied By Rising Incomes

Investors Pull Out of Mutual Funds at the Fastest Rate in Two Years

Mitsubishi Delays Delivery of Japan’s First Commercial Jetliner

Lyft Gets Approval to Pick Up at LAX

BNP Paribas Sees $983 Million Earnings Hit From BNL Goodwill

Palantir, a Silicon Valley Start-Up, Raises Another $880 Million

Reindeer for Hire Work Long Hours in Months Before Christmas

Women Pay More for Everything From Birth to Death, Report Finds

Roger Nusbaum: There Is Nothing That Must Be Traded

Howard Lindzon: Peak Oil!!!…What is Good Research…and an Idea for 2016…

Be sure to follow me on Twitter.

-

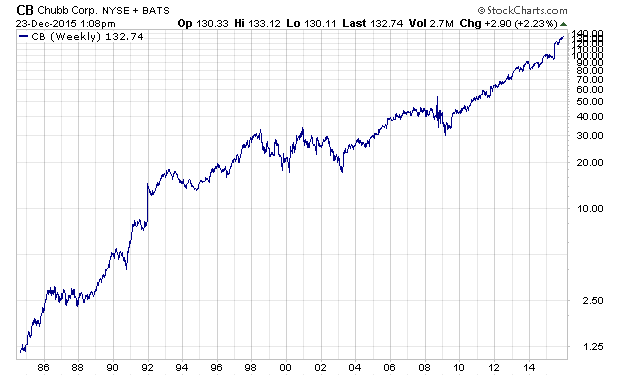

Boring Stocks: Chubb Edition

Eddy Elfenbein, December 23rd, 2015 at 1:03 pmOne of my themes with this blog is that boring stocks often make for great investments. I think many investors refuse to believe this can be true. It’s amazing how many dull stocks, ones that are rarely discussed on financial TV, do very well in the market.

This time, I’m going to highlight Chubb (CB), the insurance company. My apologies to people who find insurance incredibly exciting. Here’s how Chubb describes itself.

Since 1882, members of the Chubb Group of Insurance Companies have provided property and casualty insurance products to customers around the globe. These products are offered through a worldwide network of independent agents and brokers. The Chubb Group of Insurance Companies is known for financial strength, underwriting and loss-control expertise, tailoring products for the needs of high-net-worth individuals and commercial customers in niche markets and select industry segments, and outstanding claim service.

Sexy, huh?

The stock us up more than 30% YTD. It’s at another 52-week high today. Since 1978, shares of CB are up 72-fold compared with 21-fold for the S&P 500. That doesn’t include dividends. Chubb has increased its dividend every year since 1966.

Update: I neglected to mention that Chubb is merging with ACE Limited. The deal should close in Q1 2016.

-

Bed Bath & Beyond Lowers Guidance

Eddy Elfenbein, December 23rd, 2015 at 12:22 pmAfter yesterday’s close, Bed Bath & Beyond (BBBY) issued a press release that said that fiscal Q3, which ended in November, will come in below their previous guidance. The official earnings report doesn’t come out until January 7, but they wanted to give us a heads-up.

Bed Bath & Beyond now expects Q3 revenues to rise to $3.0 billion. That’s an increase of just 0.3%. They had previously expected sales to rise between 1.8% and 4.0%. They also expect same-store sales to fall by 0.4%. The previous guidance was for an increase between 1% and 3%.

Now for earnings. BBBY sees Q3 earnings ranging between $1.07 and $1.10 per share. The previous range was $1.14 to $1.21 per share. Note that a miss on the top line is inevitably a larger percentage miss on the bottom line.

“Our performance in the third quarter reflects the recent trends we have been experiencing,” stated Steven H. Temares, Chief Executive Officer and Member of the Board of Directors of Bed Bath & Beyond Inc. “On the one hand we experienced softer in-store transaction counts, and on the other hand sales from our customer-facing digital channels demonstrated strong growth, in excess of 25%. These mixed results were also impacted by the overall softness reported in the macro-retail environment during the quarter. As the retail environment continues to evolve, we remain focused on positioning our Company for long-term success.”

This isn’t good news. The stock has been down as much as 6.5% today, and it touched a new 52-week low below $48 per share. However, I’m more concerned on a slow-down during their crucial fiscal Q4 (December, January, February). This news suggests that Q4 won’t be good but we can’t confirm how much.

Q4 accounts for close to 35% of their annual profit. Bed Bath & Beyond gave us a small hint when they said they expect same-store sales to rise by 1% from the beginning of December through Christmas.

I decided to keep Bed Bath & Beyond on next year’s Buy List, and this news doesn’t alter that.

-

Morning News: December 23, 2015

Eddy Elfenbein, December 23rd, 2015 at 7:03 amZimbabwe’s Curious Plan to Adopt China’s Currency

Meet 5 of China’s Disappearing Executives

OPEC Sees Demand for Its Crude Oil Falling for Rest of Decade

Calgary Woes Spread as Oil Patch Spending Cuts Deepen in 2016

Mitch McConnell and the Coal Industry’s Last Stand

Consumer, Business Spending Support U.S. Third-Quarter Growth

FAA Fines Boeing $12M for Fuel Tank, Other Violations

An Aging Society Changes the Story on Poverty for Retirees

ConAgra’s Sales Fall, Supporting Plan to Revive Food Brands

Storage Tech Company Nutanix Files For IPO

How Nike Escaped the Apparel Armageddon

Ban on Microbeads Proves Easy to Pass Through Pipeline

Turing Pharma Seeks CEO to Replace Shkreli, Plans Job Cuts

Cullen Roche: Control What You Can Control

Joshua Brown: On Pace For a Record-Breaking Year of ETF Inflows

Be sure to follow me on Twitter.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His