Archive for January, 2016

-

Stryker Earned $1.56 per Share for Q3

Eddy Elfenbein, January 26th, 2016 at 4:13 pmStryker‘s (SYK) earnings are out. For Q4, the company earned $1.56 per share. As I said in Friday’s newsletter, this isn’t such a big surprise since they already told us earnings would be between $1.53 and $1.56 per share.

Quarterly sales grew 3.7% to $2.7 billion. That’s 7.0% in constant currency.

“With 2015 organic sales growth of 6.1%, bolstered by a strong fourth quarter increase of 6.4%, our top line results came in above our initial guidance,” said Kevin A. Lobo, Chairman and Chief Executive Officer. “This performance reflects the strength of our diversified revenue model, a commitment to innovation and the competitive advantage of our sales and marketing organizations. Our full year adjusted diluted EPS also exceeded our initial expectation, underscoring our commitment to delivering sales growth at the high end of med tech and leveraged earnings gains. With these results and the current momentum across our businesses, we feel well positioned heading into 2016.”

For all of 2015, Stryker made $5.12 per share. Just for the record, let’s remember Stryker’s guidance for this year. In January, the initial guidance was $4.90 to $5.10 per share. Then in April it went to $4.95 to $5.10 per share.

In July, Stryker brought it up to between $5.06 and $5.12 per share. In October, they raised the low end by one penny per share. A few weeks ago, they raised the low end by another two pennies.

Stryker made $4.73 per share last year.

Sales for the year rose by 2.8% to $9.9 billion. Again, that’s 7.0% in constant currency.

Now for guidance.

We expect 2016 constant currency sales growth in the range of 5.0% to 6.0% and adjusted net earnings per diluted share to be in the range of $1.17-$1.22 and $5.50-$5.70 for the first quarter and full year. If foreign currency exchange rates hold near current levels, we expect net sales in the first quarter and full year of 2016 to be negatively impacted by approximately 1.1% and 1.0% and adjusted net earnings per diluted share to be negatively impacted by approximately $0.02-$0.03 and $0.12-$0.13 in the first quarter and full year.

This was another solid year for Stryker. Here’s the annual EPS trend for Stryker: $2.95, $3.33, $3.72, $4.07, $4.23, $4.73, $5.12. And now make that $5.50 to $5.70 for next year.

-

Bond Yields and Stock Yields

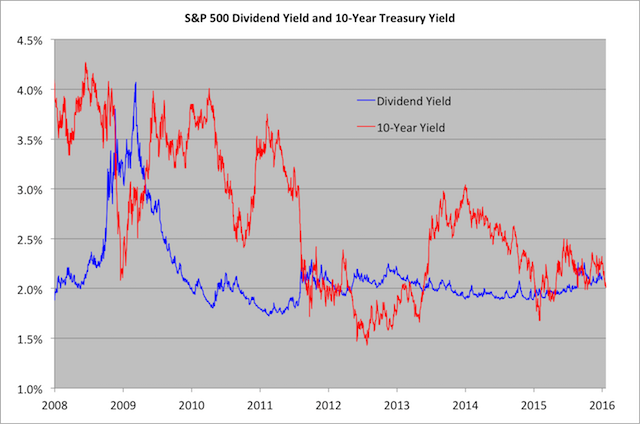

Eddy Elfenbein, January 26th, 2016 at 9:11 amSorry for the teeny type. Here’s a chart I made showing the yield of the S&P 500 (in blue) along with the yield on the 10-year Treasury (in red).

For decades, stocks yielded more than bonds. That changed in the mid-1950s when bonds paid better yields than stocks as Americans got used to capital gains.

That relationship lasted for over 50 years, but during the Financial Crisis stocks again out-yielded bonds. They’ve stayed pretty close to each other over the last four years.

Here’s some earlier (partial) data I was able to get from FRED.

-

Morning News: January 26, 2016

Eddy Elfenbein, January 26th, 2016 at 7:01 amChina Stocks Plunge to 13-Month Low Amid Capital Outflow Concern

African Economies, and Hopes for New Era, Are Shaken By China

OPEC’s El-Badri Calls on Global Oil Producers to Help Curb Glut

Russian Entente Nears as Allies Hint at End of Ukraine Sanctions

Iran’s Sanctions Lift, and the West Goes to Talk Business

The Five Scenarios Now Facing the Federal Reserve

Court Hands Administration, Environmentalists A Win In Electricity Supply Ruling

Hyundai Posts Lowest Profit in Five Years on China Slowdown

Twitter’s Overhaul of Top Ranks: Analysts React

So Far, Amazon and Netflix Are Sundance’s Top Buyers

J&J Sales Fall on Strong Dollar

U.S. Cruise Lines Look For Growth in China’s Waters

These Dudes Built An Igloo During The Blizzard And Listed It On Airbnb

Howard Lindzon: THE BANKS ARE CRASHING….Everyone to the FAZmobile

Joshua Brown: On Everyone’s Mind

Be sure to follow me on Twitter.

-

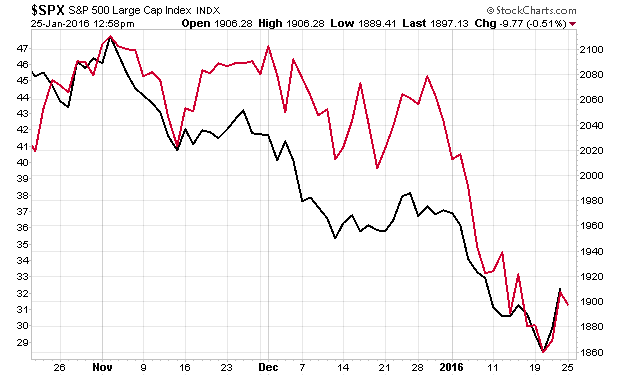

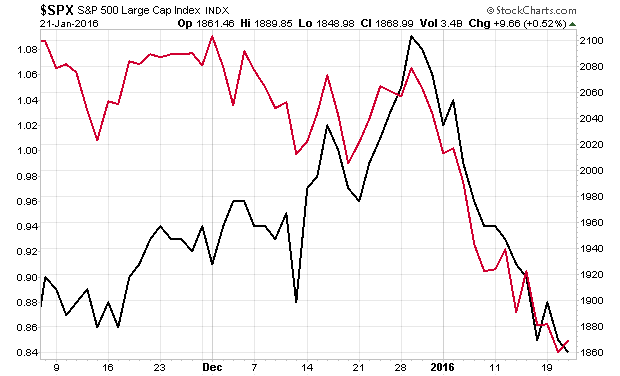

Stocks and Oil Are Correlated

Eddy Elfenbein, January 25th, 2016 at 12:56 pmThe WSJ notes that stocks and oil are 97% correlated this year. That’s the highest in 26 years.

The unusually strong link between the two markets partly reflects a common theme driving both: fears that a slowing Chinese economy could tip the global economy into recession. But as traders and investors in each market look at the other for clues as to how bad things are, they have exacerbated the overall bearish mood.

The recent pattern marks a shift in the dynamics of oil’s 19-month collapse. Traders who long worried that the oil market was suffering from oversupply are now growing increasingly concerned that demand may be weakening as well.

“There is a vicious-cycle mentality among investors,” said François Savary, Chief Investment Officer at Prime Partners, a Swiss investment firm managing $2.6 billion of assets. “It is become self-sustaining.”

In the chart above, red is the S&P 500 and black is oil.

It seems that we’ve turned a corner where lower oil went from being a net a benefit for the economy (lower gas prices, more consumer spending) to being a net negative for the economy (defaults, etc).

-

My Lousy Timing with McDonald’s

Eddy Elfenbein, January 25th, 2016 at 12:41 pmIt’s always good to look at my mistakes. In 2014, I added McDonald’s (MCD) to our Buy List. I can’t say I’m a big fan of their food, but I thought the stock was cheap and the company was poised for a turnaround.

My thesis was correct but my timing was off. The stock went nowhere during 2014 and I decided to boot it from the 2015 Buy List. Then in August 2015, the stock started to move. MCD went from a low of $87.50 in August to high today of $121.90.

This morning, the fast food joint reported good earnings.

McDonald’s Corp.’s fourth-quarter profit and revenue soundly beat analysts’ expectations, as the company’s move to all-day breakfast helped drive the best quarterly results in the U.S. in nearly four years.

Signs that a turnaround under Chief Executive Steve Easterbrook was beginning to take hold emerged in the third quarter, when McDonald’s U.S. division posted its first quarterly increase in same-store sales in two years. That momentum continued into the fourth quarter with the launch of breakfast all day in early October—the company’s biggest strategic change since it rolled out McCafe beverages nationwide in 2009.

Investors expected all-day breakfast to boost sales, but not this much. Sales at U.S. restaurants open at least 13 months jumped 5.7% in the fourth quarter—far above the 2.7% growth analysts were expecting and the best same-store sales results in the U.S. in 15 quarters. Globally, same-store sales rose 5%, while analysts were expecting growth of 3.2%.

As Keynes supposed said, “markets can remain irrational a lot longer than you and I can remain solvent.” The guys in The Big Short had to wait and wait for their big bet to pay off as well. But it took time.

-

Mid-Day Market Update

Eddy Elfenbein, January 25th, 2016 at 12:15 pmHere on the East Coast, we’re still digging out from the blizzard. Fortunately, the sun is helping us out today.

The stock market has calmed down today. At noon, the S&P 500 is down about 0.6%, but that’s more subdued than the previous few days. Once again, energy stocks are leading the down swing. Financials are doing poorly as well. On our Buy List, Signature Bank is down about 4%. I suspect that some of that is due to their recent second offering. Still, the important point on SBNY is that their earnings were quite strong.

So far, healthcare is the only group in the green. CR Bard is our top performer today. It’s up about 1.4%.

-

Morning News: January 25, 2016

Eddy Elfenbein, January 25th, 2016 at 6:50 amThe Case for the World Economy’s Defense Is Made as Stocks Swoon

It’s All About Oil as Falling Crude Leads Exporters, Ruble Lower

Oil Drops as Saudis to Maintain Spending, China Diesel Use Falls

China Capital Outflows Rise to Estimated $1 Trillion in 2015

Yellen Losing Dollar Bet as its Rise Slows Growth and Inflation

Europe’s Top Digital Privacy Watchdog Zeros In on U.S. Tech Giants

Wal-Mart: It Came, It Conquered, Now It’s Packing Up and Leaving

As Jack Dorsey Tries to Reshape Twitter, Revolving Door Takes Another Spin

Looking For Signs That Apple’s Runaway Growth is Waning

Did Google Escape Too Lightly With Its U.K. Tax Deal?

Why Small Businesses Are Getting LinkedIn Wrong

Second-Year Super Bowl Advertisers Face Their Own Pressures to Succeed

Cullen Roche: Revisiting Max Pain

Jeff Miller: A Dovish Tilt From The Fed?

Be sure to follow me on Twitter.

-

CWS Market Review – January 22, 2016

Eddy Elfenbein, January 22nd, 2016 at 7:08 am“It’s waiting that helps you as an investor, and a lot of

people just can’t stand to wait.” – Charlie MungerI know the feeling, Charlie. And it’s been especially painful this week. Compared with Wall Street, The Revenant bear went easy on Leo! The financial bears went marauding down Wall Street this week, wrecking everything in their path.

At one point on Wednesday, the S&P 500 was down more than 3.6%. The index had erased all of its gains of the past two years. The S&P 500 was more than 13% below last month’s low.

But that was only the morning. Once the S&P 500 hit 1,812—what I’m calling the “Tchaikovsky low”—the big cannons came out. The market turned around and promptly rallied 3.5% Wednesday afternoon. That’s usually the kind of action you see spread over a week, not your lunch break.

Fear not. In this week’s CWS Market Review, I’ll break down what’s got everyone so frazzled. The good news is that earnings season is here, and we’ve already had good results for our Buy List. I’ll highlight our two bank stocks that just beat Wall Street’s consensus.

Next week is going to be a busy week for us. Six of our Buy List stocks are due to report earnings, including four next Thursday. Plus, the Federal Reserve meets again next week. (Don’t expect them to do anything.) We’ll also get our first look at Q4 GDP. But first, let’s look at the damage the angry bear has done.

The Fed’s Plans Have Come Undone

One of the most basic truths of investing is that financial markets move in two gears—either slow and boring, or everyone freaking out. We’re now in the latter gear.

We hit a similar patch last summer. You may recall that I sounded an “all-clear” signal once the VIX fell below 20. That proved to be accurate.

This time around, I’m afraid I can’t be so optimistic. The reason is that the market has been getting battered for more consequential reasons. The decline in energy prices has turned from a slump into a decline and now into an all-out crash.

The price for February WTI (that’s how the cool kids refer to the futures contract for West Texas Intermediate) fell as low as $26.41 on Wednesday. The oil crash has been astounding, and it’s wreaking havoc on world economies. Consider this fact: Russia’s budget would be balanced if oil were at $82 per barrel. We’re not even close to that. In response, currency traders gave the ruble a super-atomic wedgie. Russia isn’t the only one in trouble. This week’s CPI report showed that the price for motor fuel plunged 38% last month. Later on, I’ll talk about energy defaults at Wells Fargo.

The market turmoil has led folks to believe that Janet Yellen’s rate increase last month was a big mistake. I want to be precise in how I state this. I don’t think the Fed’s rate increase was an obvious mistake, and I don’t see how a small rate increase could cause such mayhem.

But investing forces pragmatism upon us. We have to deal with the market we have, not the one we wish for. The simple fact is that the futures market has completely walked away from the idea of the Fed raising rates a few more times this year. Odds for a March rate hike dropped from even money at the start of the year to 19% today. A good proxy to watch for Fed policy is the yield on the two-year Treasury. Ever since the Fed raised rates last month, the two-year yield (below in black) has synced up with the S&P 500 (in red). That’s a major tell. Stocks are dropping in perfect harmony with the Fed’s plans coming undone.

Like I said, I don’t see the Fed’s move as obvious policy error, but the market clearly thinks otherwise. Falling energy prices and a surging dollar will help keep the lid on inflation. In a sense, oil and currency traders are doing the Fed’s job for them. Several currencies like the pound, ruble and rupee are at multi-year lows against the greenback. There’s even talk of the Fed’s next move being a rate cut.

The reassessment of Fed policy has ruptured the stock market. The market has traded red for at least part of the session every day this year. In 14 days, the S&P 500 shed 10.5%. At the end of the day on Wednesday, more than 400 of the stocks in the S&P 500 were below their 200-day moving average. On the NYSE, 1,492 stocks hit a new 52-week low. Except for the hysteria in late 2008, that’s a 20-year low. Nineteen out of 20 stocks in the S&P 500 are trading below their 20-day moving average.

The intra-day swings have been remarkable. Look at Southwestern Energy (SWN). On Wednesday, the shares went from being down 10% in the morning to being up 14% in the afternoon. This isn’t some penny stock—it’s a multi-billion-dollar outfit that’s getting treated like a hand in blackjack.

The rising dollar doesn’t just impact commodities. It also hits the bottom line at many companies. IBM (IBM) said that the strong dollar cost them $7 billion last year, and they project that forex will cost them another $1.3 billion this year.

This highlights an important fact about the market. There’s been a growing divide between cyclical stocks and everybody else. By cyclical, I mean sectors like Energy, Materials and Industrials. If your job involves sliding off a dino into your car, then you probably work for a cyclical.

Check out the chart below of different S&P 500 sectors. The bottom three performers are Energy, Materials and Industrials. They’ve been getting creamed, especially Energy, while the top four lines (Tech, Healthcare, Staples and Discretionaries) are down but not by much.

The downturn has particularly affected small-cap indexes which skew toward domestic manufacturing companies. In the last seven weeks, the Russell 2000 is down more than 17%.

The good news for us is that our Buy List doesn’t have many cyclicals. It’s obviously very early, but our Buy List has already opened up a lead against the S&P 500 (we’re down, but not by as much). While I can’t sound an all-clear signal for you, I urge you to focus on high-quality stocks like those on our Buy List. Some names that stand out at the moment are Biogen (BIIB), Ford Motor (F) and Snap-on (SNA). Now let’s look at some recent earnings reports from our Buy List.

Earnings Beats from Wells Fargo and Signature Bank

Wells Fargo (WFC) kicked off earnings season for us last Friday. The big bank reported Q4 earnings of $1.03 per share which topped Wall Street’s consensus by a penny per share. This is a very well-run bank, but don’t expect massive gains here. It’s a slow and steady winner. (Remember, Warren Buffett owns a big stake.)

Frankly, this has been a tough time for a lot of banks. The results from Wells may not sound so impressive, but considering the environment, they’re quite good. Compared with Q4 of 2014, Wells’s profit increased by just one penny per share, but the bank increased its assets by 6%. Management’s plan has been to acquire assets ahead of the Fed’s interest rate increase.

Looking at Wells’s numbers, the weak spot isn’t hard to find: energy loans. Wells got stung here just like everybody else. No matter where you look in the financial world, you see the impact of falling oil. Last quarter, the bank lost $118 million on defaults to energy companies. That sounds bad, but it’s just 2% of Wells’s overall portfolio. Still, the numbers here are going to be a drag on the bottom line for at least a few more quarters.

Right now, their retail and wholesale banking business is basically flat, but wealth management is doing well. Wells’s mortgage business is also on the rebound, but it’s a lot smaller than it was a few years ago.

The stock’s been a weak performer of late (-11.68% YTD) but I still like WFC a lot. The environment won’t always be so tough on banks. Going by Thursday’s close, WFC yields more than 3.1%. This week, I’m lowering my Buy Below on Wells Fargo to $52 per share. There’s nothing wrong with it. I simply want our Buy Belows to reflect the current market.

In last week’s CWS Market Review, I wrote on Signature Bank’s (SBNY) upcoming earnings report: “Wall Street expects $1.93 per share. Guess what? They’ll beat that.” Guess what? I was right. For Q4, Signature earned $2.01 per share.

I’m surprised more people don’t know about SBNY. The numbers continue to be amazing. Net income was up over 26% last quarter. For all of 2015, the bank earned $7.27 per share. That’s a nice increase over the $5.95 per share they made in 2014. Net interest margin, which is the key metric for any bank, was 3.30% for Q4. That’s quite good.

“2015 was another record year in which Signature Bank demonstrated its ability to deliver exemplary results. Once again, we set records across all of our key metrics, including deposits, loans and earnings, reporting our eighth consecutive year of record earnings. And, for the first time, the Bank earned more than $100 million in one quarter,” explained Joseph J. DePaolo, President and Chief Executive Officer.

Signature was also named to Forbes magazine’s list of the “Best Banks in America” for the sixth year in a row. Like Wells, SBNY’s stock has been taking a beating lately. In fact, it has done even worse then Wells. In late November, the shares were over $163, but they got as low as $131.21 last week. Fortunately, the good earnings report helped a little. The bank also plans to raise money by floating 2.2 million shares. I like SBNY a lot. I’m lowering my Buy Below on Signature Bank to $150 per share. Again, like Wells, I want to be more in line with the current price.

Six Earnings Reports Next Week

Get ready for a busy week next week. Six of our Buy List stocks are due to report earnings. You can see our complete Earnings Calendar. Bear in mind that some dates may change. We’ll update the calendar as best as we can.

On Tuesday, Stryker (SYK) is due to report its Q4 earnings, but this won’t be much of a surprise because the company already told us to expect good results. Last week, the medical device-maker raised its full-year guidance to a range of $5.09 to $5.12 per share.

Since they already made $3.56 per share for the first three quarters of 2015, that means that Q4 should range between $1.53 and $1.56 per share. (That’s compared with $1.44 from Q4 2014.) Stryker remains a very good stock. Remember that they raised their dividend by 10% last month.

On Wednesday, Biogen (BIIB), one of our new guys, is due to report. This stock has been beaten up lately. This earnings report probably won’t be that great, but Wall Street isn’t expecting much. Our view on Biogen is that the future quarters will look much better. I’ll be curious to hear if they provide guidance for 2016. Biogen is going for about 14 times this year’s earnings estimate. There’s a lot of potential here.

Thursday is our big day as four of our stocks are due to report: Alliance Data Systems, CR Bard, Ford Motor and Microsoft.

When they reported Q3 earnings, Alliance Data Systems (ADS) said they expect earnings-per-share of $15 for 2015 and “at least” $17 for 2016. I think they should be able to hit both numbers.

CR Bard (BCR) is an outstanding company. They’ve bumped up their dividend every year since 1972. For Q4, Bard expects earnings to range between $2.38 and $2.42 per share. That means full-year earnings will come between $9.03 and $9.07 per share.

The recent drop in Ford Motor (F) has been stunning. Before the last earnings report, the stock had closed at $15.68 per share. This week, the stock was trading under $12 per share. Last week, the automaker announced a special 25-cent dividend. Ford also said earnings this year will be the same or better than 2015’s. For Q4, Wall Street expects earnings of 46 cents per share.

Microsoft (MSFT) has held up relatively well in the recent sell-off. The stock is still above $50 per share. The software giant has been in the midst of an impressive renaissance. Wall Street expects fiscal Q2 earnings of 71 cents per share. The last three earnings reports beat estimates by 7%, 13% and 19%. You can see why investors have taken notice.

That’s all for now. Get ready for a lot of earnings reports coming our way next week. Also, the Federal Reserve meets again next week, but don’t expect any moves in interest rates. The policy statement will come out on Wednesday afternoon. On Thursday, the durable goods report comes out. The report for November was flat. Then on Friday, we get our first look at the Q4 GDP report. I’m expecting something around 1.7%, give or take. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: January 22, 2016

Eddy Elfenbein, January 22nd, 2016 at 6:57 amPBOC Said to Tell Banks to Cancel Repos With Excessive Rates

Everyone’s Got a China Call As Markets Grapple With Who’s Right

Draghi’s Market Dialog Moves to Davos After ECB’s Groundhog Day

Euro Area Hit By Market Volatility as ECB Mulls March Action

U.S. Is Hiding Treasury Bond Data That’s Suddenly Become Crucial

This Time, Cheaper Oil Does Little for the U.S. Economy

Freeport-McMoRan Battles the Oil Slump

Schlumberger Reports Big 4Q Loss, Says Cut 10,000 More Jobs

Cable Acquisitions by Charter Communications Face Rising Opposition

United, Southwest Buy 73 Boeing Jets in Blow to Bombardier

Funds Roll In For Start-Up Harnessing Bitcoin Tech

Dimon’s Pay Jumps 35% to $27 Million

AmEx Shares Fall as 2016 Earnings Outlook Disappoints

Jeff Carter: Startups And Corporates

Roger Nusbaum: Bear Market Confirmed?

Be sure to follow me on Twitter.

-

Good Earnings from Signature Bank

Eddy Elfenbein, January 21st, 2016 at 1:45 pmBefore the bell, Signature Bank (SBNY) reported Q4 earnings of $2.01 per share. That was eight cents better than estimates. For the year, SBNY made $7.27 per share.

Deposits for the 2015 fourth quarter rose $162.6 million, or 0.6 percent, to $26.77 billion at December 31, 2015. Overall deposit growth in 2015 was 18.4 percent, or $4.15 billion, when compared with deposits at the end of 2014.

(…)

“2015 was another record year in which Signature Bank demonstrated its ability to deliver exemplary results. Once again, we set records across all of our key metrics, including deposits, loans and earnings, reporting our eighth consecutive year of record earnings. And, for the first time, the Bank earned more than $100 million in one quarter,” explained Joseph J. DePaolo, President and Chief Executive Officer.

SBNY has been unusually weak lately. The stock was over $163 last November and was recently as low as $131.21 on Friday. It’s back near $140 today.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His