Archive for July, 2016

-

Morning News: July 27, 2016

Eddy Elfenbein, July 27th, 2016 at 7:10 amPM Abe’s Plan For $265 Billion Stimulus Puts Pressure on BOJ to Ease

U.K. Economy Grew Faster Than Forecast Before Brexit Vote

Deutsche Bank, Facing Criticism, Surveys Limited Options

Analog Devices Acquires Linear Technology for $14.8 Billion

The Chinese Company Behind the Vizio Deal

At McDonald’s, All-Day Breakfast Cools

Coca-Cola Quarterly Revenue Drops 5.1%

Twitter Shares Plummet After Company Misses Revenue Estimates

Apple’s iPhone Sales Drop Again, but Services Are a Bright Spot

Airbus Suffers $1.5 Billion Hit Against Delays to Two Key Models

JetBlue’s New Airbus Could Upend Travel to Europe

Caterpillar Cuts Guidance, Announces More Job Cuts

Valero Energy Did Its Part for Earnings, but Refining Margins Didn’t Cooperate

Goldman Sachs Is Sued Over Ties to Malaysia’s Prime Minister

Cullen Roche: NGDP Futures Targeting – Still Doesn’t Work….

Be sure to follow me on Twitter.

-

CR Bard Earns $2.54 per Share

Eddy Elfenbein, July 26th, 2016 at 4:22 pmAnother good earnings report from CR Bard (BCR). For Q2, the company earned $2.54 per share. They had given us a range of $2.43 to $2.47 per share. Quarterly sales rose 8% to $931.5 million. Not including forex, sales were up 9%.

Timothy M. Ring, chairman and chief executive officer, commented, “We continue to see strong results as we prioritize product leadership across the globe. Our commitment to innovation and product differentiation, along with a focus on delivering economic benefits to the healthcare system, have driven global demand for our products, and our targeted investments in emerging markets continue to expand our presence internationally. We believe this investment approach positions us well to continue to provide attractive returns to our shareholders.”

Now for guidance. Bard sees full-year earnings coming in between $10.10 and $10.20 per share. That’s an increase from the previous guidance of $10.05 to $10.18 per share.

Update: On the earnings call, Bard gave of range of $2.51 to $2.55 for Q3.

-

Morning News: July 26, 2016

Eddy Elfenbein, July 26th, 2016 at 7:15 amBOJ Leaning Toward Standing Pat on Policy, Yen Moves May Complicate Call

Fed Doves Won’t Be Able to Rule the Roost Forever

AB InBev Raises Offer for SABMiller

Verizon Q2 Misses on Declining Sales of $30.5 Billion, Beats with EPS of $0.94

Nintendo Faces More Pressure After Biggest Drop in 26 Years

Amazon Partners With U.K. to Test Deliveries by Aerial Drone

DuPont Profit Beats as Costs Decline

Vivendi Backs Out of Deal to Buy Berlusconi’s Pay-TV Unit

Outerwall to Be Taken Over by Apollo in $1.6 Billion Deal

Hyundai Motor Warns on Sales as Profit Slips

Uber Targeted as Daimler’s Mytaxi Merges With U.K.’s Hailo

Express Scripts Narrows Annual Guidance

Citigroup, HSBC Jettison Customers as Era of Global Empires Ends

Josh Brown: Non-Traded REIT Sales Plunge 75% in Three Years

Roger Nusbaum: Surprised That There Were No Suprises

Be sure to follow me on Twitter.

-

Express Scripts Earns $1.57 per Share

Eddy Elfenbein, July 25th, 2016 at 6:36 pmAfter the closing bell, Express Scripts (ESRX) earned $1.57 per share which matched Wall Street’s consensus. The company had previously given a range for Q2 of $1.55 to $1.59 per share.

Express also raised the low end of its full-year guidance by two cents per share. The old range was $6.31 to $6.43 per share. The new range is $6.33 to $6.43 per share.

For Q3, Express sees earnings between $1.72 and $1,76 per share. The Street had been expecting $1.72 per share.

Founded in 1986, Express Scripts went public in 1992. Its two largest customers are Anthem Inc., with which it is in the middle of a contract dispute, and the Defense Department. Collectively, Anthem, the second-largest U.S. health insurer, and the Defense Department accounted for nearly 30% of revenue last year, according to regulatory filings.

Over all, Express Scripts reported a profit of $720.7 million, or $1.13 a share, compared with $600.1 million, or 88 cents a share, a year earlier. Excluding certain items, profit rose to $1.57 a share, from $1.44 a year earlier, in line with the company’s guidance.

The most recent quarter’s results were based on 6.7% fewer shares outstanding.

Revenue edged down 0.9% to $25.22 billion, compared with analysts’ projected $25.42 billion.

Adjusted claims fell 2% to 315.3 million, within the company’s range of 312 million to 322 million.

Gross profit margin improved to 8.6% from 8.4% a year earlier.

-

Earnings Season So Far

Eddy Elfenbein, July 25th, 2016 at 3:27 pmI wanted to share some stats from Anna-Louise Jackson’s piece at Bloomberg.

So far, 130 stocks in the S&P 500 have reported Q2 earnings. We’re tracking for a 1% decline in earnings. Expectations were for -4.5%.

Of S&P 500 companies that have changed guidance, nearly 90% have raised guidance. That’s the best rate in six years.

But here’s the interesting part — BofA says that 49 companies have provided earnings guidance this month compared with the historical average of 190.

Perhaps the elevated guidance rate is really would-be lower-guiders staying quiet.

More than 70% of mid-caps have raised guidance while about 60% of small-caps have.

-

My Munich Tweet Goes Viral

Eddy Elfenbein, July 25th, 2016 at 12:56 pmI wanted to update you about some interesting events from last Friday. After I sent the newsletter, I was driving back home from Canada. I received a series of text messages from my brother who was vacationing in Munich at the time of the terrorist attack.

Fortunately, he’s fine and was never in any danger. He wasn’t near the mall where the shooting took place. However, he was in the section of town where the authorities believed, erroneously, the killers had fled to.

Everything was on lockdown and people were ordered to stay inside. All the municipal transportation was closed. My brother was basically stranded until he came across, Mosab, a young Syrian man working in Germany. Mosab tried to get my brother help, but when that fell through, he volunteered to drive him home. My brother mentioned that Mosab’s phone was full of messages from his family in Aleppo worrying about his safety. Ironic.

I took my brother’s Facebook post and made this tweet:

My brother is in Munich. He was helped to safety by a young Syrian immigrant. The young man's family called from Aleppo to see if he was OK.

— Eddy Elfenbein (@EddyElfenbein) July 22, 2016

I didn’t think much of it, and I was completely surprised to see that the tweet had been retweeted hundreds of times. Looking back on it, I now see it why people appreciate the human interest side—a Syrian immigrant assisting people in the wake of an awful terrorist attack.

My tweet was even quoted in the Washington Post:

A U.S. investment adviser and blogger, Eddy Elfenbein, tweeted Friday that his brother was in Munich. “He was helped to safety by a young Syrian immigrant. The young man’s family called from Aleppo to see if he was OK,” Elfenbein wrote.

The tweet has now been RT’d over 1,500 times. Some people have claimed that I was pushing a political point. I can assure you I wasn’t. We all know that social media can be a raucous place. I just relayed the story as I heard it.

But wherever you are, Mosab, thank you for your generous spirit.

-

Wabtec Earns $1.05 per Share

Eddy Elfenbein, July 25th, 2016 at 8:43 amThis morning, Wabtec (WAB) reported Q2 earnings of $1.05 per share. That was three cents below Wall Street’s consensus.

Raymond T. Betler, Wabtec’s president and chief executive officer, said: “Our Transit business is performing well, with revenue growth, improved profitability and a strong backlog. Our Freight business, however, continues to be affected by overall rail industry conditions and the sluggish global economy. In this environment we are focused on controlling what we can by aggressively reducing costs, generating cash and investing in our growth opportunities, including acquisitions. As demonstrated by our first half operating margin of 18.4 percent and cash from operations at 14 percent of revenues, we are managing the business well in these market conditions.”

Quarterly revenues came in at $723.6 million which was below estimates of $806.48 million.

The company said they expect full-year earnings to be between $4 and $4.20 per share.

-

Morning News: July 25, 2016

Eddy Elfenbein, July 25th, 2016 at 7:18 amGerman Business Sentiment Declines Slightly in July

Japan Sees Trade Surplus in June as Imports Drop 19%

Yellen Still Waiting for Overwhelming Evidence to Warrant Hike

Verizon Agrees to Buy Yahoo’s Web Assets for $4.83 Billion

LVMH Sells Donna Karan to G-III for $650 Million

Google Races to Catch Up in Cloud Computing

Will Netflix Miss Big Opportunities In Foreign Markets?

ECB Says QE Shored Up Inflation Expectations and Its Credibility

Julius Baer Profit Advances as Wealthy Clients Trade More

Chipotle Has Bought Back 2 Million Shares in 2016. Should Investors Be Happy?

Ryanair Clings to Profit Goal as Fare Cuts Counter Brexit Risk

When Health Insurers Merge Consumers Often Lose

Howard Lindzon: Getting a Hedge Fund Chart Art and Technical Analyst in Your Corner

Jeff Miller: What Does the Election Mean for Stocks?

Be sure to follow me on Twitter.

-

Verizon to Buy Yahoo

Eddy Elfenbein, July 24th, 2016 at 7:03 pmVerizon said it’s going to buy Yahoo’s core business for $4.8 billion. Yahoo will still have its investment in Alibaba, plus its patents.

Founded in 1994, Yahoo was one of the last independently operated pioneers of the web. Many of those groundbreaking companies, like the maker of the web browser Netscape, never made it to the end of the first dot-com boom.

But Yahoo, despite constant management turmoil, kept growing. Started as a directory of websites, the company was soon doing much more, offering searches, email, shopping and news. Those services, which were free to consumers, were supported by advertising displayed on its various pages.

For a long time, the model worked. It seemed like every company in America — and across much of the world — wanted to reach people using the new medium, and ad revenue poured in to Yahoo.

In the end, the company was done in by Google and Facebook, two younger behemoths that figured out that survival was a continuous process of reinvention and staying ahead of the next big thing. Yahoo, which flirted with buying both companies in their infancy, watched its fortunes sink as users moved on to apps and social networks.

I’ve often been critical of Yahoo as a potential investment. I don’t know how I can say it more plainly — the company simply isn’t that profitable.

While Google was singularly focused on search, Yahoo recast itself as a content company under its second chief executive, Terry Semel, who succeeded Timothy Koogle in 2001.

By the mid-2000s, Yahoo was struggling. Web portals, as they were called, were fading in importance, and social networks like Facebook were emerging as powerful competitors for people’s attention. Google had become the world’s dominant internet company through its search engine and its lucrative search ads.

In 2007, Mr. Semel was pressured to resign and Mr. Yang took over as chief executive. The next year, Mr. Yang rebuffed a $44.6 billion acquisition offer from Microsoft, infuriating many Yahoo shareholders.

If you were to turn back the clock to 1998, Yahoo was in a perfect position to own the Web. They had all the talent and all the smarts. They blew it.

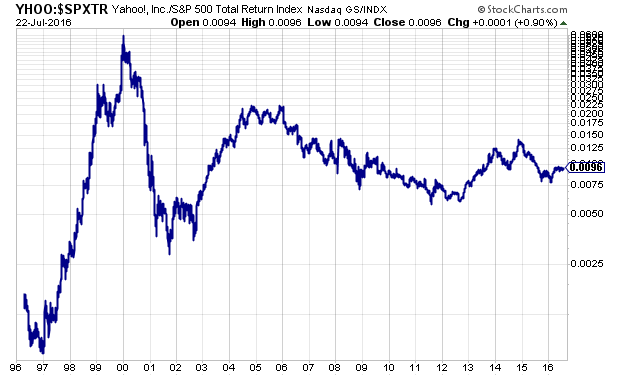

Here’s Yahoo divided by the S&P 500 Total Return Index. The stock has been in a long 16-year downtrend.

If Yahoo had merely kept pace with the S&P 500 Total Return Index, the stock would be at $244 today instead of $39.

-

CWS Market Review – July 22, 2016

Eddy Elfenbein, July 22nd, 2016 at 7:08 am“Every generation laughs at the old fashions, but follows religiously the new.”

– Henry David ThoreauFor the last several weeks, the market has been distracted by a flurry of distracting events, ranging from Turkey and Brexit to the Federal Reserve and oil prices, not to mention a soap opera-like election campaign. But now we’re at earnings season. This is what really counts.

So far, things are going well for our Buy List. We’ve had impressive earnings beats from stocks like Biogen (BIIB), Microsoft (MSFT) and Alliance Data Systems (ADS). Biogen creamed estimates, gave an optimistic forecast and jumped more than 7% (see below). Microsoft is cleaning up with its cloud business, and the stock just hit a new 52-week high. We’ve also had some disappointments from stocks like Signature Bank (SBNY).

In this week’s CWS Market Review, I’ll recap our earnings reports from this past week, plus I’ll highlight the ones coming our way next week. We have a lot of earnings reports to cover, so let’s get right to it.

Decent Earnings for WFC, Very Good Earnings for MSFT

Last Friday, Wells Fargo (WFC) kicked off earnings season for our Buy List by reporting Q2 earnings of $1.01 per share. That exactly matched Wall Street’s forecast. In last week’s issue, I said that Wall Street’s consensus “sounds about right.”

Obviously, an environment where interest rates stay low for longer is a tough one for any bank. Still, Wells is getting by quite nicely despite the challenges. Wells is a bit different from its mega-bank competitors because it’s more focused on consumers instead of Wall Street. That means it’s more susceptible to shifts in interest rates. The bank’s total loans are up 7.7% from a year ago. WFC’s net interest margin came in at 2.86%. That’s been in a downtrend for several quarters.

Shares of WFC dropped immediately after the earnings report but have regained much of that lost ground since then. There’s not much more to say about Wells, except that it’s a good bank operating in a difficult time for banks. I’m keeping my Buy Below at $52 per share.

On Tuesday, Microsoft (MSFT) gave us a very good earnings report. For its fiscal Q4, the software giant earned 69 cents per share. That was 11 cents better than estimates. I really like the way this company has turned itself around. I think traders completely overreacted to the slight earnings miss three months ago. I should add that according to Microsoft’s CFO, roughly six cents of the earnings surprise was due to a lower-than-expected tax rate.

Once again, we’re seeing that Microsoft’s cloud business is doing quite well. After several missteps, Microsoft is determined not to be left behind in this business space. Although the profit margins aren’t as generous, there are greater opportunities for growth. In a point of contract, Microsoft’s phone revenue is down 71% from a year ago. Thank you, Steve Ballmer.

Overall, I’ve been impressed by the way Satya Nadella has turned the ship around. The job isn’t done yet, but Microsoft is clearly moving in the right direction. The shares jumped more than 5% on Wednesday’s trading and touched a new 52-week high. The stock is even within striking distance of its all-time high ($59.97), set on the second-to-last day of the previous millennium. This week, I’m raising my Buy Below on Microsoft to $59 per share.

Medallion Loans Weigh on SBNY

Our first big earnings disappointment came on Wednesday when Signature Bank (SBNY) reported Q2 earnings of $1.90 per share. That was seven cents below estimates.

For one, Signature is dealing with the tough environment facing all banks. The other issue for them is their taxi medallion business. Thanks to Uber and others, the price for a taxi medallion has basically been cut in half. Signature’s been in the business of financing loans to buy these medallions. During Q1, the bank wrote off $4.4 million in bad medallion loans.

I’ll sum it up as succinctly as possible: Signature is doing fine. The basics of their business continue to do well. The medallion issue is a problem. But what’s particularly difficult is that we can’t say whether this issue has passed us just yet. We don’t know what we don’t know. Last quarter, Signature added $24 million in loan-loss reserves. Last quarter, the medallion loans made up 2% of all their loans. That’s down from 3% in Q1.

Shares of SBNY dropped sharply at Wednesday’s open. At one point, SBNY was below $120 per share, but the stock recovered throughout the day. By the closing bell, it had lost 4.5%. I’m not giving up on SBNY. I believe in their management and continue to see a bright future for them. This week, I’m lowering my Buy Below to $133 per share.

Very Impressive Earnings from ADS and Biogen

We had three more Buy List earnings reports on Thursday morning. First off, Alliance Data Systems (ADS) reported earnings of $3.68 per share. That beat Wall Street’s consensus by nine cents per share.

For Q3, ADS said they see earnings coming in at $4.42 per share. That’s below Wall Street’s consensus of $4.58. But the good news is that ADS sees full-year earnings coming in at $16.85 per share. Wall Street had been expecting $16.78 per share.

The activist fund, ValueAct Capital, recently announced that it has a sizable stake in ADS, and they’ve floated the idea of breaking the company up. I think it’s very possible that the component parts of an un-allied Alliance Data Systems could trade more than the current company.

This has been a tough year for ADS, so it was nice to see the stock pop 6.4% on Thursday. I’m going to cautiously bump up my Buy Below price for Alliance Data Systems to $237 per share.

Biogen (BIIB) became the star of the earnings season! The biotech company reported Q2 earnings of $5.21 per share. That beat estimates by 54 cents per share. The stock jumped 7.6% on Thursday. Biogen’s quarterly revenue rose 12% to $2.89 billion.

The company also announced a $5 billion share buyback, which it hopes to finish up within three years. Biogen also said that its CEO, George Scangos, will be stepping down. Scangos has done a fine job for shareholders, but I think it’s time for new leadership.

I was also pleased to see Biogen offer optimistic guidance for the rest of this year. The company sees revenue coming in between $11.2 and $11.4 billion. They see earnings-per-share ranging between $19.70 and $20. Wall Street had been expecting $18.96 per share.

Biogen has had a difficult year, so I’m glad to see it bounce back. I’ve been pretty conservative with my Buy Below price. This week, I’m going to raise our Buy Below on Biogen to $290 per share.

Snap-on (SNA) reported decent numbers, but traders weren’t impressed. No matter. I think the company is doing just fine. For Q2, Snap-on earned $2.36 per share which beat estimates by 13 cents per share.

One weak spot is that the company’s revenues fell below expectations. For Q2, SNA’s topline was $872.3 million. Wall Street had been expecting $876.9. The stock dropped 3.4% in Thursday’s trading. I’m not sure what caused the selloff, but it’s sometimes hard to divine the market’s wisdom, especially in the short term. Snap-on remains a good buy up to $166 per share.

After the closing bell on Thursday, Stryker (SYK) reported Q2 earnings of $1.39 per share which was two cents better than estimates. That’s up from $1.20 per share of last year’s Q2. The stock has been a huge winner for us this year.

For Q3, the medical-device company said it expects earnings to range between $1.33 and $1.38 per share. That’s a bit of a disappointment, as the Street had been expecting $1.41 per share. For all of 2016, Stryker now expects earnings to range between $5.70 and $5.80 per share. The previous range had been $5.65 to $5.80 per share.

The stock traded lower in the after-hours market, but that’s no guarantee of where the stock will open on Friday. I never understand why the market reacts negatively to a lower-than-expected quarterly outlook when it’s twinned with an improved full-year outlook, yet it happens all the time.

Nevertheless, Stryker is doing quite well. I’m afraid the U.S. dollar will be a headwind for the next few quarters. I’m keeping our Buy Below on Stryker at $122 per share.

Six More Earnings Reports Next Week

We have six more Buy List earnings reports for next week. Express Scripts and Wabtec report on Monday, July 25. CR Bard is due to report on Tuesday, July 26. Then on Thursday, July 28, AFLAC, Stericycle and Ford Motor are due to report. (In last week’s issue, I incorrectly said that Wabtec was due to report this week. WAB is reporting on Monday.)

In April, Express Scripts (ESRX) said it expects Q2 earnings to be between $1.55 to $1.59 per share. The pharmacy-benefits manager also increased its full-year range to $6.31 to $6.43 per share. The shares have been trending upward for several weeks.

Wabtec (WAB) had a very good earnings report in April, and the stock popped to a new high. Since then, however, it has been kind of a dud. On Thursday, shares of WAB settled at $70.40, which is over 18% below its April high.

I’m expecting another good earnings report. Wall Street expects $1.08 per share. The company also recently raised its modest dividend by 25%. The good news for us is that Wabtec has reaffirmed its full-year earnings of $4.30 to $4.50 per share.

CR Bard (BCR) was the big star of last earnings season. They beat and raised guidance. For Q2, Bard sees earnings coming in between $2.43 and $2.47 per share. For the entire year, they expect earnings to range between $10.05 and $10.18 per share. Be careful not to chase this one.

AFLAC (AFL) has been doing well for us lately. I’ll be curious to see how much the surging yen helps AFLAC’s bottom line. I think the company can earn as much as $6.60 per share this year in operating earnings. Even without the currency effect, the duck stock is a solid company.

I don’t understand why Ford Motor (F) is so cheap, but the market doesn’t always make perfect sense. The automaker now yields over 4.3%. The earnings report for Q1 was outstanding. For Q2, Wall Street expects earnings of 60 cents per share.

Stericycle (SRCL) had a disappointing earnings report three months ago. The company gave us full-year guidance of $4.90 to $5.06 per share. For Q2, Wall Street is expecting $1.18 per share.

That’s all for now. Stay tuned for a lot more earnings reports next week. We also have a Fed meeting on Tuesday and Wednesday. The policy statement is due out on Wednesday afternoon. I’m not expecting any rate change, but the odds of at least one rate hike before the end of the year are growing. They’re still not high, but they are growing. We’ll also get our first look at the Q2 GDP report next Friday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His