Archive for May, 2017

-

Morning News: May 23, 2017

Eddy Elfenbein, May 23rd, 2017 at 7:11 amOPEC on Verge of 9-Month Cuts Extension After Iraq Gives Backing

Merkel’s Weak-Euro Complaint Has Two Goals

Greek Deal on Debt Relief Founders as Talks Stretch to June

Supreme Court Limits Locations of Patent Lawsuits

The Case That Could Doom Elizabeth Warren’s Wall Street Watchdog

CEOs Of Target, ADM To Square Off On U.S. Border Tax At Hearing

Ford Taps Former Office Furniture Executive To Be New CEO

Here’s Why Tesla’s Elon Musk Just Called Himself an ‘Idiot’ on Twitter

Puma Biotech Shares Are Roaring On An FDA Review. Here’s What Could Still Go Wrong

The Future of Whole Foods Isn’t About Groceries

Apple and Nokia Settle Patent Dispute And Sign New Deal

Even Harley-Davidson Can’t Resist the Tug of Overseas Factories

Cullen Roche: Why I Am An Optimist

Roger Nusbaum: Political Volatility Catches Up To Markets (Kind Of)

Be sure to follow me on Twitter.

-

The Quants Are Taking Over

Eddy Elfenbein, May 22nd, 2017 at 3:43 pmThe WSJ runs a story today on the emergence of quant funds:

Up and down Wall Street, algorithmic-driven trading and the quants who use sophisticated statistical models to find attractive trades are taking over the investment world.

On many trading floors, quants are gaining respect, clout and money as investment firms scramble to hire mathematicians and scientists. Traditional trading strategies, such as sifting through balance sheets and talking to companies’ customers, are falling down the pecking order.

“A decade ago, the brightest graduates all wanted to be traders at Wall Street investment banks, but now they’re climbing over each other to get into quant funds,” says Anthony Lawler, who helps run quantitative investing at GAM Holding AG . The Swiss money manager last year bought British quant firm Cantab Capital Partners for at least $217 million to help it expand into computer-powered funds.

Guggenheim Partners LLC built what it calls a “supercomputing cluster” for $1 million at the Lawrence Berkeley National Laboratory in California to help crunch numbers for Guggenheim’s quant investment funds, says Marcos Lopez de Prado, a Guggenheim senior managing director. Electricity for the computers costs another $1 million a year.

Algorithmic trading has been around for a long time but was tiny. An article in The Wall Street Journal in 1974 featured quant pioneer Ed Thorp. In 1988, the Journal profiled a little-known Chicago options-trading firm that had a secret computer system. Journal reporter Scott Patterson wrote a best-selling book in 2010 about the rise of quants.

Prognosticators imagined a time when data-driven traders who live by algorithms rather than instincts would become the kings of Wall Street.

That day has arrived. In just one sign of their power, quantitative hedge funds are now responsible for 27% of all U.S. stock trades by investors, up from 14% in 2013, according to the Tabb Group, a research and consulting firm in New York.

Quants have almost caught up to individual investors, which outnumber quants and collectively have 29% of all stock-trading volume.

At the end of the first quarter, quant-focused hedge funds held $932 billion of investments, or more than 30% of all hedge-fund assets, estimates HFR Inc. In 2009, quant funds held $408 billion, or 25% of all hedge-fund assets.

Quants got $4.6 billion of net new investments in the first quarter, while the overall hedge-fund business saw withdrawals of $5.5 billion.

The computers are outperforming humans at picking investments. In the past five years, quant-focused hedge funds gained about 5.1% a year on average. The average hedge fund rose 4.3% a year in the same period.

This is a good article and I recommend you give it a read. My only quibble, and it’s a small one, is that it seems late by about ten years. These trends have been building for a long time.

-

New High Today for Stryker

Eddy Elfenbein, May 22nd, 2017 at 2:21 pmI noticed that Stryker (SYK) is at a new all-time high today. I added the stock to the Buy List in 2008. It promptly crashed with the bear market and underperformed for more than four years. We held on and have done quite well. Good investing takes patience.

-

Incentives Matter

Eddy Elfenbein, May 22nd, 2017 at 12:01 pmJosh Brown noticed that Steven Russolillo is winding down the WSJ‘s stock-picking column. Why? Simply put, hunting for cheap stocks has become a dying art.

Josh sees this as part of a long-term decline for active investing, and he highlights AllianceBernstein’s new incentive-based pay structure for active managers.

Later on, Josh talks about my venture into exchange-traded funds:

I gave some money to my old friend Eddy Elfenbein when his Crossing Wall Street ETF launched last fall. He did well and I will probably give him some more.

He’s got the first actively-managed ETF with a variable management fee built into it (his product was launched through Noah Hamman’s AdvisorShares fund family). He’s doing between 20 and 30 of his favorite stocks, which will either be very good or very bad in different market environments. But overall, he’s not snuggling up to the Russell 3000 or the S&P 500. I have no way of knowing whether or not what he’s trying to do will work, I only know that it won’t look exactly like an index fund I can buy for approximately zero dollars.

Here’s Voss and Howard again on concentration:

Studies show that buy-side analysts are quite good at security selection: Take, for example, the high levels of accretive alpha of their highest conviction/largest positions, as measured by ex-ante relative portfolio weights. Moving down the relative weights, performance worsens, with holdings beyond the top 20 generating negative alpha. In other words, most portfolios are overdiversified and research shows that hurts performance.

What’s interesting is that, because Eddy doesn’t focus on the benchmark in terms of how he talks about his approach, I have never even once looked at CWS’s performance against it, only absolutely. There’s a benefit to this sort of reframing that I should probably think more deeply about.

There should be more attempts at innovation like what we’re seeing from Eddy and AB. Something will eventually click.

-

Mark Fields is Out at Ford

Eddy Elfenbein, May 22nd, 2017 at 9:48 amMark Fields has been fired as CEO of Ford. That’s a tough break for him and I feel bad. The company is making a decent profit but the stock has gone nowhere.

Last year, I finally decided to ditch Ford from our Buy List after holding on for too long.

During Mr. Fields’s three-year tenure — a period when Ford’s shares dropped 40 percent — he came under fire from investors and Ford’s board for failing to expand the company’s core auto business and for lagging in developing the high-tech cars of the future.

The change came less than two weeks after Mr. Fields was sharply criticized during the company’s annual shareholders meeting for Ford’s deteriorating financial results.

(…)

As recently as last week, Mr. Fields, 56, had been trying to strengthen Ford’s bottom line by cutting 1,400 salaried jobs. But, unable to reverse the stock decline, he ran out of time to carry out his strategy to slash costs and expand Ford’s lineup of trucks and sport utility vehicles, while also investing in autonomous and electrified vehicles.

Despite spending heavily on self-driving research, Ford was struggling to keep pace with larger automakers such as General Motors and tech giants like Google, both of which have been testing self-driving vehicles. Ford is promising to have a fully autonomous vehicle on the road by 2021.

I think this is a good example of a CEO getting blamed for things that weren’t entirely his fault. The new CEO is Jim Hackett. He was in charge of Ford’s efforts in autonomous vehicles.

The shares are back up over $11. At last week’s low, Ford was yielding 5.6%.

-

Morning News: May 22, 2017

Eddy Elfenbein, May 22nd, 2017 at 6:35 amFarming the World: China’s Epic Race to Avoid a Food Crisis

Saudi Arabia’s $20 Billion Wager With Blackstone is Record-Sized Bet on U.S. Infrastructure

Saudi Arabia and Russia Are at Odds on Almost Everything, Except Oil

Swiss Voters Back Plan to Phase Out Nuclear Power

Ford Fires CEO Mark Fields; Former Steelcase Chief Jim Hackett To Take Over

Cathay Pacific Is Cutting 600 Jobs in Its Largest Restructuring in Decades

Huntsman, Clariant Agree to Merge

LafargeHolcim Poaches Sika’s Jan Jenisch For Chief Executive

Move Over Tesla, Europe’s Building Its Own Battery Gigafactories

At Warner Bros., Former Disney Exec Leads New Charge on Merchandise

SoftBank’s Son Chases Boyhood Dreams With $100 Billion Fund

`The Internet Is Broken’: @ev Is Trying to Salvage It

Jeff Miller: Will The Fed Change Course?

Howard Lindzon: How Many Bankers Did it Take to Grow Ethereum?

Michael Batnick: These Are The Goods

Be sure to follow me on Twitter.

-

Ingredion in Barron’s

Eddy Elfenbein, May 20th, 2017 at 5:33 pmThis weekend’s Barron’s discusses the attractiveness of defensive stocks in tough markets. Derek Anguilm of the Westcore Mid-Cap Value Dividend Fund mentions one of his favorites:

One favorite is Ingredion (INGR), which makes sweeteners and nutrition ingredients, like ones that make crackers crisper, and pharmaceutical products like intravenous solutions. The stock has pulled back amid concerns about changes in foreign trade. Anguilm sees demand rising from a growing middle class in emerging markets and aging populations in the developed world.

Ingredion “generates strong and consistent cash flows, has a healthy balance sheet, and has a history of returning cash to shareholders,” he says. Ingredion yields 1.7% but has grown its dividend by 170% over the past five years. Its payout ratio is 26% of earnings, “which we believe will allow for attractive dividend growth in the years ahead,” says Anguilm, who recently added to the fund’s position.

-

CWS Market Review – May 19, 2017

Eddy Elfenbein, May 19th, 2017 at 7:08 am“Pride of opinion has been responsible for the downfall of more men on Wall Street than any other factor.” – Charles Dow

Wall Street’s deep sleep came to an end this week. The S&P 500 had a run of 16 straight days in which it never traded outside a band that was a little more than 1% wide. Then on Wednesday, the index suddenly dropped 1.8% for its biggest plunge all year.

Of course, that drop was from an all-time high close, so we can hardly say that there’s been a lot of pain on Wall Street. The major indexes are still having a very good year, and it’s only May. The move was such a shock since everything had, until then, been so complacent.

But here’s the key, Wednesday’s drop wasn’t spread out evenly. Many of the stocks that characterized the Trump Rally, like the big banks, fell the most. At the other end, defensive stocks fell the least. Some, like Hormel Foods, even rose a tad.

What does this all mean? There’s been a lot of talk that this is Wall Street’s verdict on President Trump. I don’t buy that at all. What’s really going on is that Wall Street is suddenly getting cold feet about another Fed rate hike. I’ve been warning that a rate increase next month would be a mistake. Some folks, apparently, are coming around to my side. I’ll have more on that in a bit.

On the earnings front, we got a very good report from Ross Stores, plus higher full-year guidance. I love it when that happens. Ross seems to be one of the players that’s standing up to the great Retail Apocalypse. I’ll also preview two Buy List earnings reports headed our way next week, from HEICO and Hormel. But first, let’s take a closer look at Wall Street’s worst day since September.

Wednesday’s Selloff Was about the Fed, Not Trump

In recent issues, I’ve said that it would be a mistake for the Federal Reserve to raise interest rates next month. The economy, sadly, just isn’t strong enough. Since I’m not a member of the Federal Open Market Committee, my views on the matter don’t count for much. But this week, the world may have shifted in my direction.

According to the latest futures prices, the market is placing 73.8% odds on a rate increase in June. That’s high, but it was even higher not too long ago. That’s why Wednesday’s selloff caught my attention. The worst performers were big banks and financial institutions. The best performers were high-dividend stocks like REITs and utilities, with some consumer cyclicals.

Whenever you see banks and dividend stocks move in opposite directions like that, you know that the market is arguing about the direction of short-term interest rates. Banks want short rates to go up. Dividend-payers want them to go down. When it’s a big drop like this, it’s almost as if the market is begging the Fed for some relief. I don’t know if they’re listening.

What makes this more interesting is that the economic news has been getting a little better recently. Still not enough to justify a rate hike, in my opinion, but we must consider all the evidence. For example, on Monday, the industrial production report was quite good. Economists had been expecting industrial production to show a 0.4% rise for April. Instead, it was up a full 1%. That’s the biggest increase in three years. Importantly, it’s for the month of April, which is in Q2.

A few weeks ago, we learned that the U.S. economy grew by a meager 0.7% for Q1. That’s pretty bad. Next week, we’ll get an update. But now we’re starting to get a few clues for what the Q2 numbers will be like. The Atlanta Fed has its GDPNow forecasting tool, which says that Q2 GDP is currently tracking at 4.1%. I have to be honest: that shocked me. I hope they’re right, but we still need to see more data.

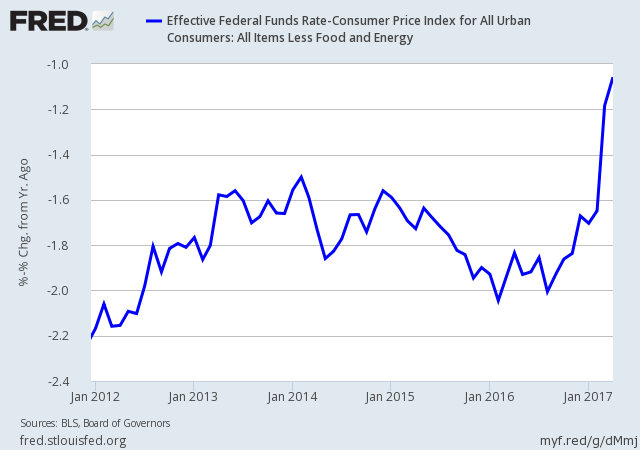

Last Friday, shortly after I sent out the newsletter, the government released the inflation report for April. If you recall, the report for March was light—very light. Core inflation had its steepest drop in 35 years. The numbers for April were higher, but still quite subdued. Headline inflation rose by 0.17% for April, and core inflation was up by 0.07%. Except for March, that’s the softest in four years. No matter how you look at it, inflation just isn’t out there.

What’s interesting is that if the Federal Reserve were doing nothing, then it would, in effect, be tightening. Stable rates plus falling prices means higher real rates, and that’s what puts the brakes on the economy. That’s what’s been happening (see above), and it needs to stop. Don’t believe the hype that the stock market is revolting against Trump. It’s upset with a short-sighted Fed policy. The sooner the Fed changes course, the better. Now, let’s check out the strong earnings report from Ross Stores.

Ross Stores Earned 82 Cents per Share

After the closing bell on Thursday, Ross Stores (ROST) reported fiscal first-quarter earnings of 82 cents per share. This is for the months of February, March and April, which is typically the slowest time of year for Ross.

Ross had been expecting Q1 earnings between 76 and 79 cents per share and comparable-store sales growth of 1% to 2%. In last week’s issue, I said, “This strikes me as conservative.” I was right, but I can’t take too much credit. We know that Ross likes to keep expectations low.

Barbara Rentler, Chief Executive Officer, commented, “We achieved respectable growth in both sales and earnings during the first quarter despite the uncertainty and volatility in the external environment. Operating margin of 15.2% exceeded our expectations due to above-plan sales and merchandise margin.”

I’m especially impressed by that operating margin number. Retail is all about keeping control of costs, especially for a deep discounter like Ross. The retail sector has been getting creamed lately, but Ross is one of the few that have been holding up relatively well. As I’ve long believed, Ross is a rare retailer that’s Amazon-resistant.

Now let’s look at guidance. For Q2, which ends on July 29, Ross sees EPS ranging between 73 and 76 cents per share. That’s compared with 71 cents per share for last year’s Q2. Ross sees comparable-store sales growth of 1% to 2%.

Now for the good news. Ross is raising its full-year earnings forecast. The company now projects 2017 earnings between $3.07 and $3.17 per share. That’s an increase from the previous range of $3.02 to $3.15 per share. Ross made $2.83 per share last year; however this year will include an extra business week. Ross estimates that adds eight cents per share.

Ross recently increased its quarterly dividend from 13.5 to 16 cents per share. That’s an increase of 18.5%. Over the last seven years, the company has raised its dividend by 300%. Ross is on track to buy back $875 million in stock this year. Ross Stores remains a buy up to $70 per share.

Earnings from HEICO and Hormel

We have two more Buy List earnings reports coming next week, from HEICO and Hormel Foods. Both companies ended their fiscal second quarters in April.

HEICO (HEI) is one of my favorite little companies. They make replacement parts for the aircraft industry. It was our top-performing stock last year, and it’s doing pretty well this year. The company is due to report its earnings on Tuesday, May 23.

In February, HEICO had Q1 earnings of 59 cents per share. That was five cents more than estimates. I was very pleased to see that cash flow rose 24%. The company provides guidance for several metrics, except earnings-per-share, so we need to make a few guesses. But the good news in February was that they raised their 2017 guidance.

Previously, HEICO expected full-year sales growth of 5% to 7% and net income growth of 7% to 10%. Now they see sales growth of 6% to 8% and net income growth of 9% to 11%. Assuming share count doesn’t meaningfully change, that’s probably about $2.02 to $2.05 per share. HEICO also recently split its stock 5-for-4.

The consensus on Wall Street (that’s only six analysts) is for Q2 earnings of 50 cents per share. This stock has an amazing long-term record. If you had invested $100,000 in HEICO in 1990, today it would be worth $18.7 million. For now, I’m keeping my Buy Below for HEICO at $72. I may raise it depending on the earnings report.

In February, Hormel Foods (HRL) missed earnings for the second time in a row. For Q1, the Spam stock earned 44 cents per share which was one penny below estimates. At the time, Hormel also lowered its full-year guidance to $1.65 to $1.71 per share, a decrease of three cents to both ends of the range.

The company cited “challenging market conditions in the turkey industry,” which, I have to admit, sounds kind of funny. Despite the earnings miss, the first quarter was Hormel’s 15th record quarter in a row. The fiscal Q2 earnings report is due out before the opening bell on Thursday, May 25. The consensus on Wall Street is for 40 cents per share.

Buy List Updates

On Monday, Moody’s (MCO) announced that they bought a Dutch company, Bureau van Dijk, for $3.1 billion. Moody’s will finance the deal with $1.3 billion in cash parked overseas plus a $2 billion debt offering. They expect the deal to close in the third quarter. Bureau van Dijk is a global business-intelligence and company-information provider. Shares of MCO rallied on the news.

I also want to make a few adjustments to some of our Buy Below prices. This week, I’m lowering my Buy Below on Cinemark (CNK) to $43 per share. I’m also dropping Alliance Data Systems (ADS) to $249 per share.

That’s all for now. Next week will be the last work week prior to the Memorial Day weekend, which is the traditional start of summer. On Tuesday, we’ll get the new-home sales report followed by the existing-home sales report on Wednesday. I’ll be particularly interested to see Friday’s update to the Q1 GDP report. The initial report showed real growth of just 0.7% which was the weakest report in three years. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: May 19, 2017

Eddy Elfenbein, May 19th, 2017 at 7:02 amFull Tanks and Tankers: a Stubborn Oil Glut Despite OPEC Cuts

Saudi-U.S. Ties Shift as Kingdom Turns to Trump for Investments

The Trump Administration’s Plans to Crack Down on Wall Street Are Being Called Into Question

Mnuchin May Face Fight With Watt Over Fannie-Freddie Dividends

In A Driverless Future, Uber and Lyft Will Sit in the Passenger Seat

Elon Musk Sends Seemingly Mixed Messages on Tesla’s Valuation

Walmart Will Never Beat Amazon

Cisco’s Soggy Outlook Tests Patience with the Transformation

Bain, KKR, Broadcom Among Suitors Lining Up For Toshiba’s Chips Business

4 Automakers Settle Takata Airbag Claims for $553 Million

The Giddy Messages Citi Traders Sent While Lehman Died

Anthony Scaramucci, Hedge Fund Showman, Finds Himself in Limbo

Victims Call Hackers’ Bluff as Ransomware Deadline Nears

Josh Brown: This Will Never End, But We’ll Get Used To It

Jeff Miller: Time To Buy The Dip in IBM?

Be sure to follow me on Twitter.

-

Morning News: May 18, 2017

Eddy Elfenbein, May 18th, 2017 at 7:13 amJapan’s Economy Is Growing, But Don’t Call It A Hot Streak

Oil Stuck in Trump Slump as Risk Aversion Damps U.S. Supply Drop

Here’s Why the Dow’s 373 Point “Plunge” Is Laughable

VIX Surge Is Unwelcome Lesson in Duplicity of Volatility Wagers

Deutsche Bank’s Cryan Sees Better Revenue Opportunities in 2017

U.S. Called Terror Risk Critical in Laptop Ban Meeting

E.U. Fines Facebook $122 Million Over WhatsApp Data Collection

Amazon’s Next Big Disruption May Be the Pharmacy Business

German Newcomer Lidl Threatens Walmart in Discount Grocery Wars

How Uber and Waymo Ended Up Rivals n the Race for Driverless Cars

GM Will Cut Operations in India, South Africa

Cisco Revenue Forecast Disappoints; Says to Cut 1,100 More Jobs

With Ransomware, It’s Pay and Embolden Perpetrators, or Lose Precious Data

Ben Carlson: Think Global to Avoid the Shrinking U.S. Stock Market

Cullen Roche: The All or Nothing Bias

Be sure to follow me on Twitter.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His