CWS Market Review – November 16, 2018

“In a roaring bull market, knowledge is superfluous and experience is a handicap.”

– Benjamin Graham

Last week, I urged caution on the stock market’s rebound. Sure enough, the S&P 500 lost ground five days in a row. The index rebounded on Thursday, but that was after it dropped to its lowest intra-day point this month. The S&P 500 is still below its 200-day moving average, and that’s often a sign that the bears still are in charge.

Don’t worry. I’ll explain what this all means for us and our portfolios. Interestingly, the big news recently hasn’t been coming from the stock market. Instead, the oil traders have been making headlines.

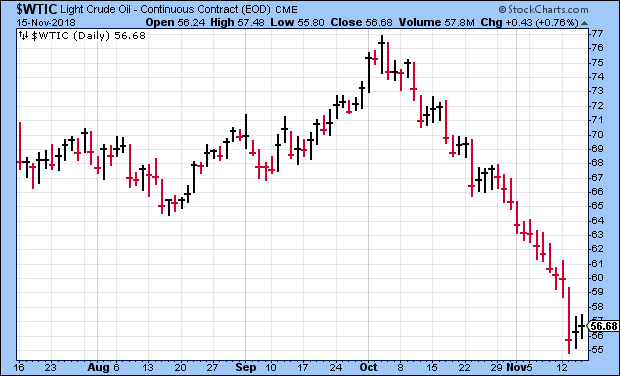

The price of crude fell for eleven days in a row. Then on day 12, it had its worst plunge in three years! At one point, West Texas Crude was going for less than $55 per barrel. That’s down from nearly $77 per barrel in early October. The falloff is due to fears of oversupply. Production in the U.S. has been hitting new highs, and the Trump administration granted waivers that are keeping Iran’s oil on the market. (The Saudis are not exactly pleased about that!)

In this week’s CWS Market Review, I’ll break down what it means. I’ll also highlight the performance of our Buy List which has perked up lately. Later on, I’ll preview three Buy List earnings reports coming our way. But first, let’s look at this week’s economic news.

What’s Behind the Plunge in Oil?

On Wednesday, the government reported that consumer inflation had its largest increase in nine months. In last week’s issue, I told you that I suspected that the CPI would run on the high side and might cause the market some drama. For October, consumer prices rose by 0.3%, and over the past year, the CPI is up 2.5%. I also like to look at the “core rate,” which excludes food and energy. Last month, core inflation was 0.2%, and in the past year, it’s been running at 2.2%. That’s quite tame.

The numbers for November will likely be quite different. As I touched on before, oil prices have been tumbling. The Oil Services ETF (OIH) is at a 15-year low. The latest numbers show that domestic crude production rose for the eighth week in a row. OPEC would love to cut production, but it’s not so easy to get everyone on board for that.

Other commodities are down as well. Gold isn’t doing much, and silver recently dropped to a three-year low. This phase might not pass so quickly. With the Fed raising rates, the dollar is now at a 16-month high. The British pound just got hammered due to the chaotic nature of the Brexit drama. Heck, even Bitcoin has been in the dumps.

I don’t believe these recent events will be enough to cause the Fed to pause on rate hikes. There’s a very good chance—though not a rock solid one—that we’ll get another rate hike next month, but after that…well, things get dicey. There’s a decent chance the Fed may take a six-month break to give the economy some breathing room.

The drop in commodities may signal that the world economy isn’t as strong as previously thought. The concern is more about Europe and Asia rather than the United States. As far as America goes, this week’s retail sales report was pretty good, and that could mean we’re in for a strong Q4.

I’m happy to say that our Buy List has been acting better lately. Since November 1, the Buy List is up 2.14% while the S&P 500 is down -0.37%. For the year, we have a slight lead over the S&P 500: +2.65 compared to +2.12% (those figures don’t include dividends; the final numbers will).

Bear in mind that six months ago, our Buy List was trailing the market by more than 3% YTD. This hasn’t been a good climate for stock-pickers, but we’ve held up well. Fourteen of our 25 stocks are beating the market this year. The problem is that the laggards have been pretty bad. Carriage Services (CSV) is down 36% this year which dinged the whole portfolio by 1.6%.

Overall, I’m pleased with our performance. Remember that next month we make our annual changes. According to the rules of the Buy List, we can’t touch our stocks for the entire year. Only at the end of the year are we allowed to break the seal. We’ll add five new stocks, and delete five current stocks. Stay tuned for more details. Now let’s look at three of our stocks that are due to report earnings soon.

Three Upcoming Buy List Earnings Reports

There are three stocks on our Buy List with quarters ending in October. That means they’re due to report earnings soon. Ross Stores and Hormel Foods will report on November 20, while JM Smucker will report on November 28. Let’s run down what to expect.

Ross Stores (ROST) is set to report its fiscal Q3 earnings on Tuesday, November 20. Business has been going well for the deep-discounter, and the share price reflects that. Just last week, ROST hit another new 52-week high, although the shares have pulled back a bit in the last few days due to some weakness in the retail sector.

In the last earnings report, Ross gave guidance for both Q3 and Q4. For Q3, Ross expects same-store sales growth of 1% to 2% and earnings between 84 and 88 cents per share. That sounds about right. For Q4, which is the all-important holiday-shopping quarter, Ross again expects same-store sales growth of 1 to 2%. For earnings, Ross is looking for $1.02 to $1.07 per share. That translates to full-year earnings of $4.01 to $4.10 per share.

The company has bold plans for the future. They’re aiming to buy back more than $1 billion of stock. Ross also plans to open 3,000 stores which is up from the previous goal of 2,500. Fifteen months ago, I said that Ross looks to be “a good value here.” The stock is up 54.80% since then. Let me caution you that the stock has taken near-term hits after the last few earnings reports even though results have been good. The stock eventually shook off all the hits.

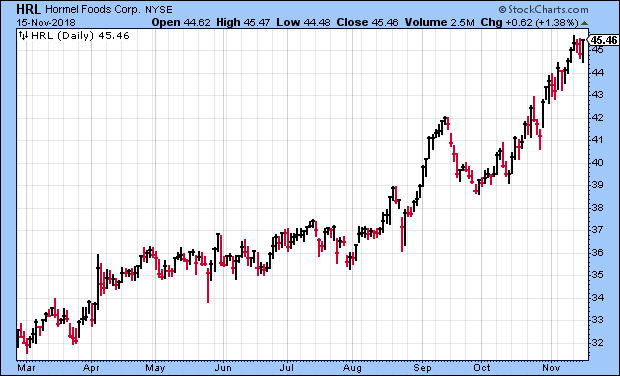

In August, Hormel Foods (HRL) had an OK earnings report, but not a great one. The Spam people said they made 39 cents per share for their fiscal Q3. That matched Wall Street’s expectations. Net sales were up 7% while organic sales were flat. The company said it’s feeling the squeeze from tariffs on U.S. agricultural products. Lean hog prices have been slammed this year, and as a result, Hormel has had to cut prices.

In August, Hormel trimmed its full-year sales range to $9.4 – $9.6 billion but stood by its EPS forecast of $1.81 to $1.95 per share. Since they’ve already made $1.38 per share for the first three quarters of their fiscal year, that implies Q4 earnings of 43 to 57 cents per share. Wall Street expects 49 cents per share.

The stock has been holding up very well this autumn. Since September 27, shares of HRL are up 16.9%. The stock made a new high earlier this week. I also predict that Hormel will increase its dividend. I make this claim based on a detailed analysis of the company’s financial statements. Also, they’ve raised their dividend every year for the last 52 years. Expect #53 soon. The current quarterly dividend is 18.75 cents per share. My guess is that they’ll raise it to 20 cents per share.

JM Smucker (SJM) will report its fiscal Q2 earnings on November 28. In August, the jelly people reported fiscal Q1 earnings of $1.78 per share. That was two cents better than estimates. However, that total included a charge of seven cents due to “a purchase accounting adjustment attributable to acquired Ainsworth inventory.”

Let me explain what’s going on with Smucker and some other big food companies. Basically, this is a fine company. At the moment, however, they’re caught by falling prices. The cost for a lot of the things they make is dropping, and that means they have to pass on the lower prices to consumers. As a result, dollar sales are flat even though sales by volume are doing fine.

Smucker knows what the problem is, and they’re working to address it. That’s why they recently sold off Pillsbury for a cool $375 million and picked up Ainsworth. Of course, it will take a few quarters to see the results of this strategy.

In August, Smucker updated its financial guidance. Importantly, they didn’t alter their full-year EPS range which is still $8.40 to $8.65 per share. They did pare back their revenue estimate from $8.3 billion to $8.0 billion. Smucker also lowered their free-cash range from between $800 million and $850 million to between $770 million and $820 million. The guidance reflects “the anticipated impact from the pending divestiture of its U.S. baking business.”

This is from the Wall Street Journal:

Divesting the baking line, which makes Pillsbury cake mixes, and acquiring pet-snack maker Ainsworth were appropriate moves to adjust Smucker’s portfolio. Ainsworth sales were up 28% from a year earlier in the July quarter, and the company said it expects this growth to be sustained for the full year.

But what Smucker really needs, like fellow struggling food giant Campbell, is a convincing plan to turn around its core brands. With respect to Folgers, Chief Executive Mark Smucker said the company is working on “longer-term initiatives to reinvigorate coffee rituals for this iconic brand.” It was unclear what he meant.

I know what he meant. Smucker will continue to jettison older businesses while concentrating on niche areas. That’s the smart play. This is a company that generates a lot of cash and can easily put those dollars to use.

Let’s look at some numbers: SJM is now going for just 13.2 to 13.6 times this year’s guidance range, plus the dividend yields 3%. In September, Smucker raised its dividend by 9%. That is SJM’s 17th annual dividend hike in a row. Wall Street is expecting earnings of $2.33 per share.

Buy List Updates

On Wednesday, Shareholders of Wabtec (WAB) approved the combination with GE Transportation. At the meeting, 99% of the shares that were voted approved the deal. That’s nice to see. The stock got taken to the woodshed last month, but it seems to have found a base. The GE deal is expected to close in early 2019.

Last month, Sherwin-Williams (SHW) got caught up in the great housing panic of October 2018. In a few weeks, the stock lost one-quarter of its value. On October 25, Sherwin missed earnings and lowered the upper end of its guidance range. Interestingly, that marked the low point for shares of SHW. Since then, the stock has rebounded smartly. At one point, SHW closed higher for eight days in a row. I’m going to cautiously raise my Buy Below on Sherwin to $420 per share (no, that’s not an homage to Elon).

Intercontinental Exchange (ICE) had a good earnings report two weeks ago. The exchange operator beat earnings by five cents per share, and the board announced a $2 billion share buyback. Last quarter was ICE’s 22nd quarter in a row of year-over-year revenue growth. The stock hit a new high on Thursday. This week, I’m hiking my Buy Below on Intercontinental Exchange to $85 per share.

That’s all for now. There will be no newsletter next week. I’m taking my traditional Thanksgiving break. The U.S. stock market will be closed on Thursday for Thanksgiving, and it will close at 1 p.m. on Friday, November 23. There’s not much in the way of economic news scheduled for next week. The housing-starts report will come out on Tuesday, following by the durable-goods report on Wednesday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. I’ve recently started a premium Twitter feed where I discuss the markets and investing in greater detail (and without any trolls or stock promoters). This is a great resource for investors. Check it out!

Posted by Eddy Elfenbein on November 16th, 2018 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His