CWS Market Review – December 14, 2018

“Investment success does not require glamour stocks or bull markets.” – John Neff

Before I get to today’s issue, I want to announce that I will unveil the 2019 Buy List in an email to you on Christmas Day. As usual, there will be five new stocks and five deletions. The Buy List will remain at 25 stocks.

The new Buy List will go into effect on January 2, the first day of trading in the new year. All 25 stocks will start the year equally weighted, and I won’t make any changes for the next 12 months. I’ll have another email for you on January 1 which will summarize the 2018 Buy List and have the details for the 2019 Buy List. Stay tuned!

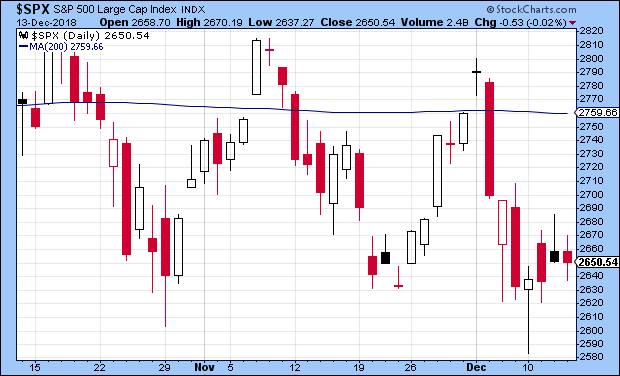

Now let’s review some of the market’s action this week—and what a week it was. At one point on Monday, the Dow was down over 500 points; by the closing bell, the index finished in the green. Then on Tuesday, the Dow was up over 360 points before it closed in the red. Perhaps, the Dow is getting into the Christmas spirit with its red-green motif. Stranger things have happened.

Or more likely, the market is frazzled and undecided as we move into the closing days of 2018. On Thursday, the Russell 2000, which is a popular measure of small-cap stocks, closed at a 15-month low; it’s now close to being in a bear market. This is part of the larger trend of riskier and more economically sensitive stocks falling out of favor. Recently, the S&P 500 sector indexes for Financials, Industrials and Energy all reached fresh 52-week lows.

In this week’s issue, we’ll break down what’s going on. I’ll also preview next week’s big Federal Reserve meeting. It looks like the Fed is going to raise interest rates again. I’ll also preview next week’s earnings report from FactSet. This will be our last Buy List earnings report this year. But first, let’s see what the Fed has in store for us next week and into 2019.

There’s a Good Chance the Fed Will Raise Rates Next Week

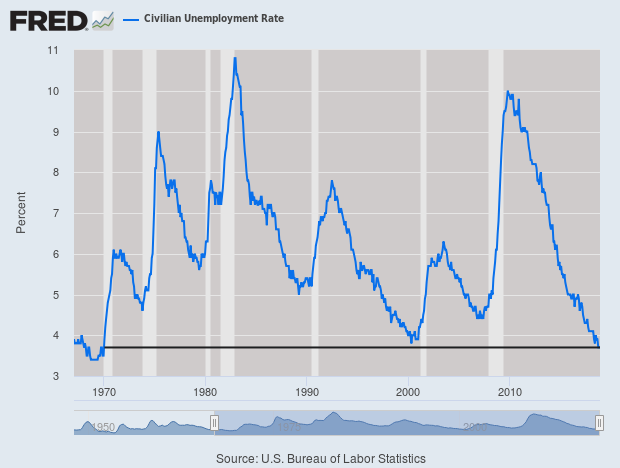

Last Friday, the government reported that the U.S. economy created 155,000 net new jobs last month. For November, the unemployment rate was 3.7%. I like to look at all the decimals, and I found out that last month we had the lowest unemployment rate since December 1969 (see below). In fact, if we exclude the wars in Korea and Vietnam, then we had the lowest peacetime unemployment rate in 70 years.

That wasn’t the only good news. We also had some encouraging news on wages. Over the last 12 months, wages are up 3.1%. Sure, that’s not too far ahead of inflation, but it’s the best growth rate we’ve seen in some time.

Then on Wednesday, the government released the latest CPI report. For November, inflation rose by just 0.019%. That’s the smallest increase since March. Obviously, falling energy prices played a big role. Last month, gasoline prices fell 4.2%. Over the last year, CPI is up 2.532%.

November is a good example of why we also want to look at “core” inflation which excludes food and energy. Last month, core inflation rose by 0.209%, and in the last year, it’s up 2.242%. In other words, the improving labor market is not leading to higher inflation. At least, not yet.

That leads us to next week’s Federal Reserve meeting. In my opinion, the Fed has been overly concerned with the threat of higher inflation. So far, I just don’t see evidence that inflation is upon us. I should explain that central banks are, by their nature, very fearful of inflation. Given the history of central banking, that’s understandable.

The Federal Reserve meets again next week, and it looks like they’ll raise interest rates again. This would be the fourth rate hike this year and the ninth of this cycle. I should caution that unlike previous rate hikes, Wall Street is not 100% convinced a rate hike is coming. According to the most recent futures prices, traders place the odds of a rate increase next week at 80%. So it’s widely expected but not in the bag.

Also with this meeting, the Fed will update its economic projections for the coming few years. Going by the most recent projections, the Fed sees itself raising interest rates three times next year. I don’t think that’s going to happen.

Just look at the evidence. The dollar is doing well, the pound recently dropped to a 20-month low, and commodity prices are down. Inflation is well behaved and the housing market is jittery. I’m not sure if the Fed realizes it now, but their plans for 2019 are too much. At some point, the Fed will be forced to admit that we don’t need higher interest rates. The 10-year Treasury slipped to 2.85% earlier this week. That’s down 39 basis points since early November. I noticed that in the Seattle housing market, sales are down 20% from a year ago, while inventory is up 135%. (Of course, this is just one metro area.)

Here’s what’s happening. The stock market is getting nervous about economic growth for next year. That’s caused the spike in volatility that we’ve seen recently. The market is worried that higher rates are already damaging the economy, On Monday of this week, the S&P 500 got as low as 2,583.23. That’s the lowest intra-day mark since April 4.

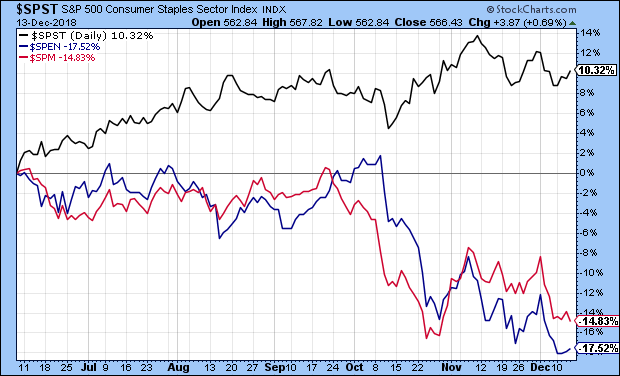

Not only are we seeing that concern play out in the broad stock market, and at the long end of the bond market, but we’re seeing it in particular areas of the stock market. It’s exactly those high-risk and economically cyclical areas that are getting rolled. As I mentioned earlier, we saw new 52-week lows this week for the Energy, Financial and Industrial sectors. The areas doing the best (or falling the least) are those defensive areas like Utilities and Consumer Staples.

Here’s a good chart showing S&P 500 Consumer Staples (black) along with Materials (red) and Energy (blue). Notice how the divergence has steadily grown wider.

It shouldn’t be much of a surprise that Church & Dwight (CHD) is our top-performing stock this year, with a gain of nearly 38%. Hormel Foods (HRL) is our second-best, with a gain of 25%. In other words, baking soda and Spam are the big winners this year. OK, they’re a lot more than that, but the key point is that these are businesses not impacted much by a recession.

Compare that with Wabtec (WAB), a stock I like. Shares of WAB are down 35% from their high, and the stock has closed lower for the last eight days in a row. This is an important lesson for investors. Wabtec hasn’t done anything wrong in the last four months except be a freight services company when that’s not what the market likes. All stocks, good and bad, hit bad parts of the cycle. Lately defensive names are in, and cyclical names are out. That trend may last until the Federal Reserve decides to face reality and chill out on interest rates. Now let’s take a look at our final Buy List earnings report for this year.

Earnings Preview for FactSet

FactSet (FDS) is due to report its fiscal Q1 earnings on Tuesday, December 20 before the opening bell. The company helps Wall Street professionals crunch all the numbers they need to make investment decisions. It’s a very profitable business. We have an 18% gain in FDS so far this year.

Three months ago, FactSet reported earnings of $2.20 per share for its fiscal Q4. That was one penny below Wall Street’s consensus. That morning, traders punished the stock. At one point, FDS was down more than 6%. However, by the end of the day, the stock closed down 1.9%.

For all of last year, FactSet’s organic revenues rose 5.6% to $1.35 billion, while their key metric, Annual Subscription Value or ASV, rose 5.7% to $1.39 billion. Earnings increased 16.7% to $8.53 per share. Previously, the company said its guidance range was $8.37 to $8.62 per share, so things seemed to work according to plan.

Now let’s look at guidance for fiscal 2019 (ending next August). FactSet expects earnings to range between $9.45 and $9.65 per share. That’s not a bad increase over last year. Wall Street had been expecting $9.61 per share. FactSet sees organic ASV rising by $75 million to $90 million in 2019, and they see operating margins between 31.5% and 32.5%. That’s pretty good. For Q1, the consensus on Wall Street is for earnings of $2.29 per share.

Shares of FDS have pulled back over the last few days, but I’m not particularly concerned. The stock had a very strong rally during much of August. FactSet remains a buy up to $242 per share.

Buy List Updates

On Thursday, Japan Post announced that it will buy a $2.6 billion stake in AFLAC (AFL). It’s not a merger, and no part of AFLAC will become part of Japan Post. AFLAC currently derives about two-thirds of its business from Japan.

This has been a big year for Japanese companies investing in foreign stocks. On Thursday, shares of the duck stock gapped up $2.85, or 6.64%, to close at $45.75 per share (see above). AFLAC remains a good buy up to $47 per share.

This week, I want to lower my Buy Below prices on two of our Buy List stocks. I’m dropping the Buy Below for Alliance Data Systems (ADS) to $193 per share. I’m also lowering the Buy Below on Continental Building Products to (CBPX) $28 per share.

I also wanted to point out that shares of Torchmark (TMK) have been very weak lately. The stock closed Thursday at $78.02 per share. That’s the lowest close all year. I think the shares are a good value here.

That’s all for now. The big news next week will probably be the Federal Reserve meeting. The Fed meets on Tuesday and Wednesday. The policy statement will come out Wednesday afternoon at 2 p.m. ET, along with the new economic projections. Also on Tuesday, we’ll get the report on housing starts. On Friday, we’ll get the latest revision on Q3 GDP. The last report showed that the economy grew by 3.5% on Q3. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on December 14th, 2018 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His