CWS Market Review – January 18, 2019

”It’s amazing how difficult it is for a man to understand something if he’s paid a small fortune not to understand it.” – John C. Bogle

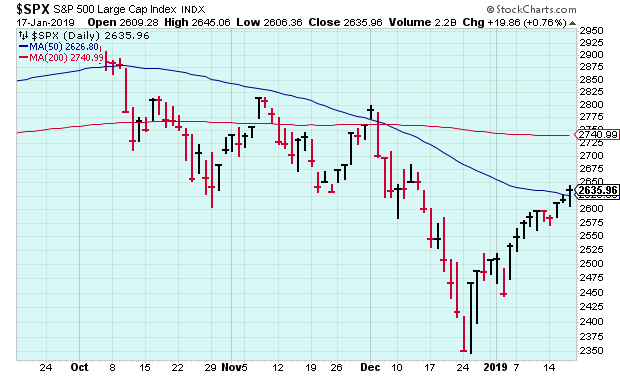

Behold the Boxing Day Bounce! Since December 26, the S&P 500 has gained more than 12.3% off its December low. That’s an impressive bounce for such a short period of time. The index has gained back more than 60% of what it lost during the September to December swoon.

So it looks like the bulls are back in charge. The S&P 500 has now closed higher in 12 of the last 16 sessions. On Thursday, the index closed above 2,635 for the first time in a month. The index also finished the day above its 50-day moving average which is something it hasn’t done since early December.

Is the coast clear? Don’t bet on it. While the bounce is nice to have, bear market rallies are known to be fleeting. I’m sorry, but that’s just how they are. The good news is that earnings season is here, and our stocks are poised to do well. In fact, our two banking stocks already beat the Street this week. Signature Bank (SBNY) soared after its results, and the bank is already an 18% winner this year. It’s still mid-January!

We also had some big news this week. Two of our stocks released preliminary earnings results. Sherwin-Williams (SHW) warned that earnings will come in below expectations, while Becton, Dickinson (BDX) said they’ll beat earnings.

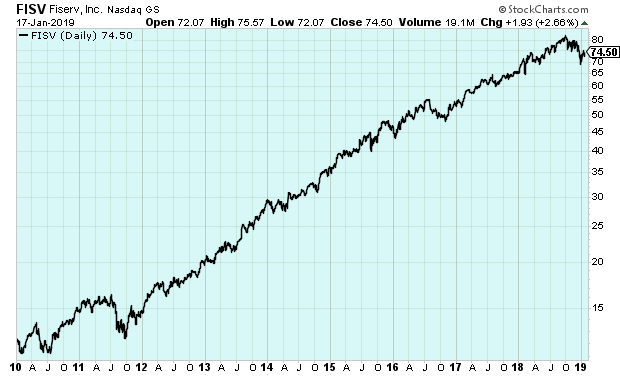

But the biggest news of the week came from Fiserv (FISV). The company said it’s buying First Data in a massive $22 billion deal. They’re paying a 29% premium for the stock! This is a game-changer in the financial-technology sector. I’ll break down what it all means for us. First, though, let’s look at this week’s Buy List earnings news.

Both Eagle and Signature Beat the Street

This is an important time for investors. Over the next few weeks, 20 of our 25 Buy List stocks will report their earnings results. Below, I’ve made a table of each stock, its reporting date, Wall Street’s estimate and the result. Bear in mind that these dates and numbers can change.

| Company | Ticker | Date | Estimate | Result |

| Eagle Bancorp | EGBN | 16-Jan | $1.13 | $1.17 |

| Signature Bank | SBNY | 17-Jan | $2.80 | $2.94 |

| Stryker | SYK | 29-Jan | $2.15 | |

| Danaher | DHR | 29-Jan | $1.27 | |

| Check Point Software | CHKP | 30-Jan | $1.63 | |

| Sherwin-Williams | SHW | 31-Jan | $3.68 | |

| AFLAC | AFL | 31-Jan | $0.94 | |

| Hershey | HSY | 31-Jan | $1.27 | |

| Raytheon | RTN | 31-Jan | $2.88 | |

| Cerner | CERN | 5-Feb | $0.63 | |

| Church & Dwight | CHD | 5-Feb | $0.58 | |

| Disney | DIS | 5-Feb | $1.56 | |

| Becton, Dickinson | BDX | 5-Feb | $2.61 | |

| Torchmark | TMK | 5-Feb | $1.56 | |

| Cognizant Technology Solutions | CTSH | 6-Feb | $1.07 | |

| Broadridge Financial | BR | 7-Feb | $0.71 | |

| Fiserv | FISV | 7-Feb | $0.87 | |

| Intercontinental Exchange | ICE | 7-Feb | $0.92 | |

| Moody’s | MOC | 15-Feb | $1.68 | |

| Continental Building Products | CBPX | 21-Feb | $0.59 |

On Wednesday, Eagle Bancorp (EGBN) kicked off earnings season for us. The bank reported Q4 earnings of $1.17 per share. That’s four cents above Wall Street’s forecast. For the year, Eagle made $4.42 per share. That’s up from $3.35 per share in 2018. The bank has increased its operating income every quarter for the last ten years.

Eagle’s CEO said, “Our strong financial performance has resulted from a combination of steady average balance sheet growth, revenue growth, and very favorable operating leverage. Additionally, we have maintained solid asset quality over an extended period through disciplined risk management practices. These factors have combined to achieve a return on average assets of 1.90% for the fourth quarter of 2018, a return on average common equity of 14.82%, and a return on average tangible common equity ratio of 16.43%, while sustaining very strong capital levels.”

Eagle had strong deposit growth last quarter. Unfortunately, that translated into a lower net-interest margin. When looking at banks, there’s a key metric to watch which is called the “efficiency ratio.” It’s their overhead as a percent of revenue. Basically, the efficiency ratio tells us how well-run the bank is. The lower the number, the better. As a general rule, anything below 50% is considered good. For all of 2018, Eagle’s was 37.3%.

At the beginning of the year, we got Eagle at a very good price. EGBN ended 2018 at $48.71. Some of you may have gotten it even cheaper. When I announced it was joining the Buy List, it had closed on Christmas Eve at $45.74 per share.

On Thursday, shares of Eagle plunged more than 10% during the day. Then they rallied to close lower by 2.8%. I’m not sure why the market was initially displeased. I liked the results. We have a gain of 7.3% this year. Eagle Bancorp remains a buy up to $54 per share.

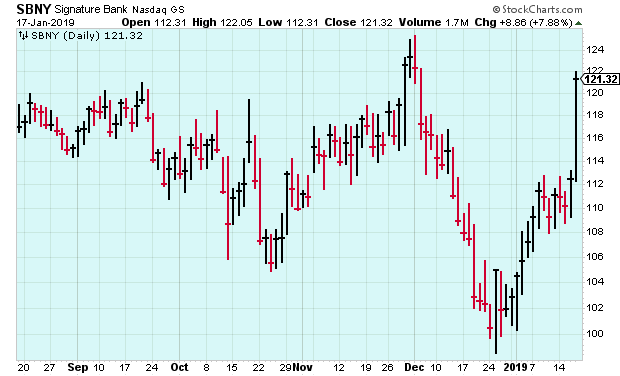

On Thursday morning, Signature Bank (SBNY) reported Q4 earnings of $2.94 per share. That beat Wall Street’s forecast of $2.80 per share. I like Signature a lot, but it’s been a very frustrating investment for us.

This is the fifth year that SBNY has been on our Buy List. The stock outpaced the market in 2015, but it lagged in 2016, 2017 and 2018. This is the tough part of investing. You tend to get angry at a stock that lags the market. However, you still need to view it dispassionately. If you liked it before, then you should like it even more at a lower price.

By the end of 2018, SBNY was going for a very cheap price, and I’m glad we stuck with it. The medallion mess seems to be behind them, finally. Deposit growth for last year was close to 9%. For Q4, SBNY’s net interest margin was 2.90% and its efficiency ratio was 34.94%. Those are pretty good numbers. Interestingly, the bank also launched Signet, a “new proprietary, blockchain-based digital-payments platform.”

The stock jumped 7.9% on Thursday. SBNY is now up 18% for us this year. This week, I’m raising my Buy Below on Signature Bank to $126 per share. I’ll note that this stock has given us a few false rallies before.

Preliminary Earnings Reports from Sherwin and BDX

Two of our Buy List stocks released preliminary earnings results this week. Every so often, a company will tell investors beforehand what to expect ahead of the official earnings report. This happens for one of two reasons. Either the company has good news, or it has bad news. We got each one this week.

Let’s start with the bad. On Tuesday, Sherwin-Williams (SHW) said their Q4 earnings won’t be so hot. The paint people had been expecting a sales increase in the mid-single digits. Instead, it will be 2%. The company said they had weak North American sales in October and November. Sales improved in December, but not enough to make up the difference.

Before, Sherwin told us to expect Q4 earnings between $4.07 and $4.22 per share. Now it says earnings will be $3.55 per share. On a full-year basis, the company expects earnings of $18.53 per share (which excludes merger-related costs). The previous estimate was $19.05 to $19.20 per share.

I’m not pleased with this news, but I’m prepared to give Sherwin the benefit of the doubt. This is a well-run outfit, and their results speak for themselves. Just like we saw with Eagle, Sherwin dropped sharply on the news, then slowly made back most of what it lost. At one point on Tuesday, SHW was down 6.7%, but the shares rallied on Wednesday and Thursday. By the closing bell on Thursday, SHW was only down 0.82% from Monday’s close, before the earnings warning.

I appreciate the company getting out ahead of the news. The earnings report is due out on January 31.

Now for the good news. On Thursday, Becton, Dickinson (BDX) said they made $2.70 per share for their fiscal Q1. That’s nine cents more than Wall Street’s forecast. It’s also a nice increase from $2.48 per share last year. Revenues for the quarter rose by 5.2%.

Becton credits the good news to “timing of certain tax items, as well as better-than-expected performance across all three segments.” The company also reiterated its full-year guidance. Their fiscal year ends in September. For 2019, they see revenue growth of 5% to 6%, and earnings coming in between $12.05 and $12.15 per share. That works out to earnings growth of 10% over last year.

Shares of BDX climbed 2.1% on Thursday. Becton’s official earnings report is due out on February 5. This is a solid company.

Megadeal: Fiserv Buys First Data for $22 Billion

I’m saving the biggest news for last. On Wednesday, Fiserv (FISV) said it’s buying First Data (FDC) for $22 billion. This is a massive deal in the fintech space. Fiserv is offering all stock, and it’s a 29% premium for FDC.

The deal breaks out like this. Shareholders of FDC will get 0.303 shares of Fiserv for every one share they own of FDC. Once the deal is done, Fiserv’s CEO, Jeffery Yabuki, will be the CEO and chairman of the combined company. Fiserv shareholders will own 57.5% of the company, and FDC shareholders will own the other 42.5%. The deal is expected to close in the second half of this year.

Not many consumers are aware of the lucrative world of payments. Every time you use your card, several folks take a bite. Fiserv handles the processing of credit-card transactions, while First Data handles the merchants’ side. These well-established firms feel threatened by upstarts. I’m surprised by the amount of money Fiserv is willing to pay, but they clearly think it’s a move they need to make.

Some history. The private equity firm, KKR, took First Data private in 2007 for $26 billion. That didn’t go well. First Data went public again in 2015. KKR still owns a big chunk of FDC, and they clearly want to get rid of it. FDC is their single-biggest holding. I’d hate to be dragging that around.

Frankly, I have some reservations about this deal. Fiserv is paying a lot. The companies say the merger will provide cost-savings. Hmmm…I’m skeptical. Merging firms always say that. That being said, I’m a big fan of Fiserv. This is a great company. I admire their stance that a move should be made now before a rival gets too big. For now, I’m cautiously pro-deal, but I hate the price, and I really hate that they’re using stock. At least it’s below FDC’s high from last year.

Since they were making so much news, Fiserv also decided to release preliminary earnings this week. The company expects to report Q4 earnings on February 7. They look to report earnings of 84 to 85 cents per share. That’s just below the Street’s consensus of 87 cents per share. For the entire year, they see earnings of $3.10 to $3.11 per share. For 2019, Fiserv expects to earn between $3.39 and $3.52 per share.

Just like Eagle and Sherwin-Williams, shares of Fiserv initially tanked on the news but then rallied back. I guess that was a theme this week. At its low on Wednesday, Fiserv was down 8.8%. By the closing bell on Thursday, Fiserv was only down 0.7% from the before the deal (which is now also good news for FDC shareholders).

Before I go, I’m dropping my Buy Below price on Cerner (CERN) to $58 per share. The stock’s been struggling, but it may be due for a breakout. Earnings are due out on February 5. I’m expecting a beat. Stay tuned.

That’s all for now. The stock market will be closed on Monday, January 21, in honor of Dr. Martin Luther King’s birthday. The civil-rights leader would have been 90 years old. Next week, we can expect more news, or a lack thereof, on the government shutdown. There will also be a lot more earnings news, except for our Buy List stocks. None of our stocks reports next week, but our earnings will start up again in the following week. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on January 18th, 2019 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His