Archive for July, 2019

-

Cognizant Earned 94 Cents per Share

Eddy Elfenbein, July 31st, 2019 at 4:21 pmQuarterly revenue rose to $4.14 billion, up 3.4% (4.7% in constant currency1) from the year-ago quarter.

Quarterly Adjusted Diluted EPS was $0.94, compared to $1.05 in the year-ago quarter.

“We are taking the necessary steps to position Cognizant for improved commercial and financial performance,” said Brian Humphries, Chief Executive Officer. “While there is lots of work ahead, I am encouraged by what I have seen to date and am optimistic on our future.”

The Company is providing the following guidance:

Third quarter 2019 year-over-year revenue growth in the range of 3.8-4.8% in constant currency.

Full year 2019 year-over-year revenue growth in the range of 3.9-4.9% in constant currency.

Full year 2019 Adjusted Operating Margin expected to be approximately 17.0%.

Full year 2019 Adjusted Diluted EPS expected to be in the range of $3.92-$3.98.

“Second quarter results were in-line with our guidance and position us to achieve our full-year outlook,” said Karen McLoughlin, Chief Financial Officer. “We are implementing actions in the second half of the year that we expect will lower our existing cost structure and allow for greater investment in growth, talent, and digital solutions. Using our strong balance sheet we returned over $1.1 billion to shareholders in the second quarter.”

The shares are up about 4% after hours.

-

The Fed Cuts 25

Eddy Elfenbein, July 31st, 2019 at 2:00 pmThe Fed cut by 25 basis points. The new range for Fed funds is 2.00% to 2.25%. The vote was 8 to 2.

Information received since the Federal Open Market Committee met in June indicates that the labor market remains strong and that economic activity has been rising at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Although growth of household spending has picked up from earlier in the year, growth of business fixed investment has been soft. On a 12-month basis, overall inflation and inflation for items other than food and energy are running below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In light of the implications of global developments for the economic outlook as well as muted inflation pressures, the Committee decided to lower the target range for the federal funds rate to 2 to 2-1/4 percent. This action supports the Committee’s view that sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective are the most likely outcomes, but uncertainties about this outlook remain. As the Committee contemplates the future path of the target range for the federal funds rate, it will continue to monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion, with a strong labor market and inflation near its symmetric 2 percent objective.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

The Committee will conclude the reduction of its aggregate securities holdings in the System Open Market Account in August, two months earlier than previously indicated.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; James Bullard; Richard H. Clarida; Charles L. Evans; and Randal K. Quarles. Voting against the action were Esther L. George and Eric S. Rosengren, who preferred at this meeting to maintain the target range for the federal funds rate at 2-1/4 to 2-1/2 percent.

-

Church & Dwight Earned 57 Cents per Share

Eddy Elfenbein, July 31st, 2019 at 11:14 amThis morning, Church & Dwight (CHD) reported Q2 earnings of 57 cents per share. That’s up 16.3% over last year. Wall Street had been expecting 52 cents per share.

Gross margins rose to 44.6% and organic sales rose by 4.9% (9.1% internationally).

Matthew Farrell, Chief Executive Officer, commented, “Q2 organic sales growth of 4.9% was exceptionally strong and exceeded our 3.5% outlook. Q2 was the fifth consecutive quarter of greater than 4% organic growth and the fourth consecutive quarter of positive price and product mix (+4.8%). Our categories continue to grow, our market shares are healthy, and we’ve introduced new products in many of our categories. Thirteen of our 15 domestic categories grew during the quarter and more than half have grown for at least 7 consecutive quarters. In the domestic business, 9 out of 12 power brands met or exceeded category growth in the second quarter. The international business continues to perform strongly with reported sales growth of 6.0% and organic growth of 9.1%.”

The company now sees full-year earnings of $2.47 per share, and 60 cents per share for Q3. The previous EPS guidance was for $2.43 to $2.47.

Mr. Farrell stated, “We have delivered a strong first half. As a result, we now expect full year 2019 sales growth to be approximately 6% (previously 5 – 6%) and organic sales growth to be approximately 4% (previously 3.5%). We now expect full year gross margin to expand 80 basis points (previously 50 basis points) reflecting a lower inflationary outlook and the impact of acquisitions. We continue to expect marketing dollars to increase year over year and now expect marketing as a percentage of sales to be flat versus prior year (previously down 20 basis points). We continue to expect adjusted operating profit expansion to be in-line with our evergreen model of +50 basis points. We expect to achieve $2.47 per share or 9% adjusted EPS growth (previously 7-9%). To the extent we over-deliver on organic sales growth or gross margin expansion, we expect to spend back on long-term brand building activities, research and development, and new product investments. Our strong full year performance is expected to exceed our evergreen model.”

“For Q3, we expect year over year reported sales growth of approximately 6%, organic sales growth of approximately 3%, higher marketing expense, and higher SG&A associated with the FLAWLESS acquisition. We expect adjusted EPS to be $0.60 per share, a 3% increase over last year’s Q3 EPS excluding the earn-out adjustment from our acquisition of the FLAWLESS business.”

The shares are up about 1% today.

-

Busy Day

Eddy Elfenbein, July 31st, 2019 at 11:07 amThere’s a lot going on today. Several earnings reports are coming out. Of course, the big news is the Fed meeting at 2 pm. Expect to see a rate cut.

The big jobs report is this Friday. This morning, ADP said that 156,000 private payroll jobs were created last month. Economists had been expecting 150,000.

-

Morning News: July 31, 2019

Eddy Elfenbein, July 31st, 2019 at 7:13 amBrexit and Boris Johnson Send the British Pound on a Slide

Some Very Hungry Cows May Rescue India From a Giant Sugar Glut

With Fed Sure to Cut Rates, Powell on Hook to Flag Next Steps

For Big Banks, It’s an Endless Fight With Hackers

Apple’s Services, Wearables Shore Up Results as iPhone Drops Below Half of Sales

Getting Under the Hood of Amazon’s Auto Ambitions

GE Raises Outlook for Earnings and Cash Flow; Shares Gain

Brexit and Subsidy Row Cloud Strong Airbus Profits

Carlyle’s Founders Give Outsiders More Power

EssilorLuxottica Sets Sights on Retail Dominance with $8 Billion GrandVision Deal

Under Armour Is Warning Of More Trouble Ahead In North America

German Prosecutors Charge Ex-Audi Boss Stadler Over Emissions Cheating

Michael Batnick: The State of the Financial Services Industry

Jeff Miller: Stock Exchange: What’s On Your Pre-Trade Risk Checklist?

Be sure to follow me on Twitter.

-

Morning News: July 30, 2019

Eddy Elfenbein, July 30th, 2019 at 8:48 amChina Says Hong Kong Protest Violence ‘Is Creation of U.S.’

Trump Lashes Out at China as Trade Talks Resume; Stocks Fall

Your Next iPhone Might Be Made in Vietnam. Thank the Trade War.

Tipster’s Email Led to Arrest in Massive Capital One Data Breach

Huawei’s Sales Jump Despite Trump’s Blacklisting

Texas Shale Pioneers Struggle to Appease Investors

Fortnite Is Here to Stay. Just Ask Its Fans.

Amazon Wants to Rule the Grocery Aisles, and Not Just at Whole Foods

P&G Rises After Posting Best Sales Growth in at Least a Decade

Beyond Meat Acts Rationally, Upsets Investors

A Plan to Take on the `Sociopaths’ in the Boardroom

Ben Carlson: Investing Proceeds From the Sale of a Business

Jeff Carter: Financial Literacy

Roger Nusbaum: Undersaved, Overspent and Overfed

Be sure to follow me on Twitter.

-

It’s Official

Eddy Elfenbein, July 29th, 2019 at 10:54 amFiserv and First Data are now one. First Data shareholders received 0.303 shares of Fiserv for each share of First Data they owned. First Data no longer trades.

Fiserv, Inc., a leading global provider of financial services technology solutions, today announced that it has completed its acquisition of First Data Corporation. With the transaction complete, Fiserv is one of the world’s leading payments and financial technology providers with the ability to deliver unique value to financial institutions, corporate and merchant clients, and consumers.

“The completion of this transformative combination is a major milestone in the evolution of our companies,” said Jeffery Yabuki, Chairman and Chief Executive Officer, Fiserv. “We have continued to identify ways in which we can deliver differentiated value to clients, associates and shareholders, and are excited to work together on fulfilling the promise of the combination. We are confident that our people are the best in the industry and will push the boundaries of excellence and innovation for the benefit of all of our stakeholders.”

As a global leader in technology and payments that enables commerce, banking and the safe and secure movement of money, Fiserv has the breadth of capabilities and depth of expertise to deliver unmatched value to clients. As a result of the combination, clients will have access to a more comprehensive set of solutions and innovations, an extensive range of end-to-end capabilities and integrated delivery, which enable differentiated value for their customers.

“As a newly combined company, we will leverage our technology expertise and integrate our solutions to serve client needs in ways no one else can match,” said Frank Bisignano, President and Chief Operating Officer, Fiserv. “We are focused on innovating to enable our clients to better serve their customers and end users so they can succeed in a rapidly changing world.”

As previously announced, First Data shareholders will receive 0.303 of a Fiserv share for each share of First Data common stock they own prior to market open as of July 29, 2019. The all-stock transaction is intended to be tax-free to First Data shareholders. The combined company will carry the Fiserv brand and will continue to trade on The Nasdaq Global Select Market under the ticker symbol FISV. As of July 29, 2019, First Data common stock is no longer listed for trading on the New York Stock Exchange.

-

Morning News: July 29, 2019

Eddy Elfenbein, July 29th, 2019 at 7:05 amFrom Belarus to Bahrain, the Small States Going Big on Cryptocurrency

Don’t Bet on the Trade War Ending Quickly

Fed Poised to Cut Rates for First Time Since Financial Crisis, Ending an Era

A Recession Is Coming (Eventually). Here’s Where You’ll See It First.

The Elite Club That Rules the Diamond World Is Starting to Crack

Pfizer’s Dealmaker CEO Sharpens Cancer Focus With Mylan Plan

JPMorgan, UBS Among Banks Facing $1 Billion FX-Rigging Suit

Why Whole Foods Hasn’t Satisfied Amazon’s Grocery Appetite

Did Facebook CEO Mark Zuckerberg Intend To Deceive?

Exact Sciences to Buy Genomic Health for $2.8 Billion

Ex-Corporate Lawyer’s Idea: Rein In ‘Sociopaths’ in the Boardroom

37-Year-Old Former School Teacher Is India’s Newest Billionaire

Jeff Miller: Weighing the Week Ahead: Four Risky Hurdles

Cullen Roche: Three Things I Think I Think – Negative Rates and Stuff

Howard Lindzon: The Beginning Of The Melt-Up or The Height Of Insanity?, Privacy & Information Is Food

Be sure to follow me on Twitter.

-

Q2 GDP Growth = 2.1%

Eddy Elfenbein, July 26th, 2019 at 8:39 amThe GDP report is out. The government said that GDP grew by 2.1% during the second three months of the year. That was 0.1% better than expectations.

This report is a big relief. I know a lot of folks who were scared that the economy was about to run off a cliff. For now, the economy is doing fine.

I will point out that the rate of growth has been very low for an expansion.

Businesses investment declined in the second quarter for the first time since early 2016, according to the report. Nonresidential fixed investment-which reflects spending on software, research and development, equipment and structures-fell at a 0.6% rate, compared with a 4.4% rise in the first quarter.

Shoppers picked up the slack however. Consumer spending, which accounts for more than two-thirds of the economy, rose at an inflation-adjusted, annualized rate of 4.3% in the second quarter, accelerating from the first quarter when it rose 1.1% and marking the strongest pace of growth since late 2017. Americans boosted spending on big-ticket items like cars as well as everyday goods like food and clothing. Government expenditures also boosted growth, rising at a 5.0% annual rate in the second quarter.

I don’t think this report will alter the Fed’s plans. It looks like the Fed will cut interest rates next week by 0.25%.

-

CWS Market Review – July 26, 2019

Eddy Elfenbein, July 26th, 2019 at 7:08 am“The market is fond of making mountains out of molehills and exaggerating ordinary vicissitudes into major setbacks.” – Benjamin Graham

Earnings and more earnings. That’s what this week has been all about. This week, we had ten Buy List earnings reports to digest. Fortunately, most were pretty good and that helped make up for last week’s debacle from Eagle Bank.

Raytheon blew past estimates and raised guidance. So did Stryker. Sherwin-Williams beat by 20 cents per share. Torchmark beat estimates and announced a name change! On August 8, Torchmark will become Global Life and the new ticker will be GL.

We also have a bunch of earnings to preview next week. If that’s not enough, there’s a big Federal Reserve meeting next week. There’s a lot to get to so let’s jump into this week’s issue of CWS Market Review.

Ten Buy List Earnings Reports This Week

Here’s our updated Earnings Calendar for Q2:

Company Ticker Date Estimate Result Eagle Bancorp EGBN 17-Jul $1.12 $1.08 Danaher DHR 18-Jul $1.16 $1.19 Signature Bank SBNY 18-Jul $2.71 $2.72 RPM International RPM 22-Jul $1.14 $1.24 Sherwin-Williams SHW 23-Jul $6.37 $6.57 Torchmark TMK 24-Jul $1.65 $1.67 Check Point Software CHKP 24-Jul $1.37 $1.38 Cerner CERN 24-Jul $0.64 $0.66 Stryker SYK 25-Jul $1.94 $1.98 AFLAC AFL 25-Jul $1.07 $1.13 Hershey HSY 25-Jul $1.17 $1.31 Raytheon RTN 25-Jul $2.64 $2.92 Fiserv FISV 25-Jul $0.81 $0.82 Moody’s MCO 31-Jul $2.01 Church & Dwight CHD 31-Jul $0.52 Cognizant Technology Solutions CTSH 31-Jul $0.92 Broadridge Financial BR 1-Aug $1.71 Continental Building Products CBPX 1-Aug $0.49 Intercontinental Exchange ICE 1-Aug $0.92 Disney DIS 6-Aug $1.76 Becton, Dickinson BDX 6-Aug $3.05 Let’s start with RPM International (RPM) which reported on Monday. This was for their fiscal fourth quarter which ended in May. For Q4, RPM made $1.24 per share. That was 10 cents more than estimates.

This was a very good quarter for RPM. Net sales rose by 2.8% to $1.6 billion. Unfortunately, they were dinged a bit by forex but you really can’t avoid that. The company sees 2020 earnings of $3.30 to $3.42 per share.

The stock gapped up to a new all-time high this week. Since the end of May, RPM is up 25% for us. I’m raising our Buy Below on RPM to $71 per share.

On Tuesday, Sherwin-Williams (SHW) said it made $6.57 per share for its Q2. That beat estimates by 20 cents per share.

For the quarter, consolidated net sales rose 2.2% to $4.88 billion. Net sales in stores open more than a year rose by 4.3%. Sherwin stood by its full-year EPS guidance of $20.40 to $21.40 per share. I’m so glad we held onto this one.

On Wednesday, the shares broke above $500 for the first time. I’m raising our Buy Below on Sherwin to $513 per share.

We had three Buy List earnings reports on Wednesday. Before the bell, Check Point Software (CHKP) said it made $1.38 per share. That beat estimates by one penny per share. Revenues rose 4% to $488 million which matched expectations.

“Second quarter results were driven by 13 percent growth in our security subscriptions revenues, which included our advanced threat prevention and our CloudGuard family of products,” said Gil Shwed, Founder and CEO of Check Point Software Technologies.

“We continued to expand our product offerings during the second quarter with the introduction of new technologies which included Malware DNA, a new artificial intelligence-based engine that accelerates zero-day threat prevention, and CloudGuard Log.ic, providing threat protection and context-rich security intelligence.”

Now for guidance. For Q3, Check Point sees EPS ranging between $1.36 and $1.44 on revenue of $480 to $500 million. For the entire year, CHKP projected earnings between $5.85 and $6.25 per share and revenue between $1.94 and $2.04 billion. I’m very pleased with this stock. Check Point remains a buy up to $120 per share.

After the close on Wednesday, Cerner (CERN) announced Q2 earnings of 66 cents per share. That beat the Street by two cents per share. The company said that bookings came in at $1.432 billion which was the high end of their range. Revenue rose 5% to $1.431 billion. That was in line with Cerner’s expectations.

“I am pleased with our financial results, which were in line with our expectations,” said Brent Shafer, Chairman and CEO, Cerner. “In addition to delivering solid quarterly operating results, we made good progress on the early stages of our transformation and positioning Cerner for long-term profitable growth. Cerner has played a key role in digitizing health care, and we believe our next era of growth will be driven by the tremendous opportunity related to helping our clients drive a higher order of benefits from this digitization.”

Now for guidance. For Q3, Cerner expects revenue between $1.405 billion and $1.455 billion and full-year revenue between $5.650 billion and $5.850 billion.

For Q3, Cerner expects earnings between 65 and 67 cents per share. That’s a tad light. Wall Street had been expecting 69 cents per share. Cerner sees full-year earnings between $2.64 and $2.72 per share. That’s the same as the previous guidance.

Overall, this is a good report. Earlier this year, Cerner reached an agreement with Starboard Value to start paying a dividend and increase its buyback authorization by $1.5 billion. Cerner remains a buy up to $76 per share.

Torchmark (TMK) is changing its name! On August 8, Torchmark will become Globe Life Inc. The new symbol will be GL. I’m generally not a fan of modern business names but this isn’t bad.

The company says that “the name change is part of a brand alignment strategy which will enhance the Company’s ability to build name recognition with potential customers and agent recruits through use of a single brand.”

For Q2, Torchmark reported earnings of $1.67 per share. That was two cents per share above the Street.

The details look pretty good. Net income as an ROE was 12.3%. Net operating income as an ROE excluding net unrealized gains on fixed maturities was 14.6%. For the year, Torchmark projects net operating income per share will be between $6.67 to $6.77. The current price is around 14 times that even though the stock just hit a new high. I’m lifting my Buy Below on Torchmark to $94 per share.

Thursday was a big day for us. We had five Buy List earnings reports.

Let’s start with Raytheon (RTN). Before the opening bell, the defense contractor reported very good results for their second quarter. For Q2, Raytheon earned $2.92 per share. That easily beat Wall Street’s consensus of $2.64 per share.

Raytheon also boosted its full-year guidance. The old guidance was for sales of $28.6 billion to $29.1 billion and earnings between $11.40 and $11.60 per share. The new guidance is for sales of $28.6 billion to $29.1 billion and earnings between $11.50 to $11.70 per share.

Raytheon will also be helped by the big defense spending bill recently passed by Congress. The shares jumped more than 4.5% on Thursday. I’m lifting my Buy Below on Raytheon to $195 per share. The company said the merger with United Technologies is expected to close in the first half of next year.

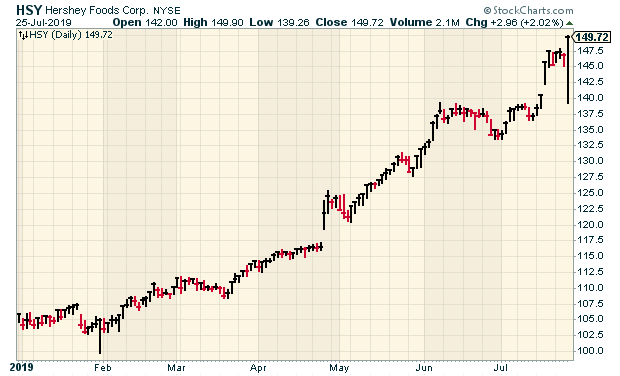

Hershey (HSY) had a very good quarter but guidance wasn’t that great. For Q2, the chocolate company earned $1.31 per share. That was an increase of 14.9% and it beat the Street by 14 cents per share. With that kind of earnings beat, you’d expect a big increase to guidance. Unfortunately, we didn’t get it.

On the plus side, I like that adjusted gross margin was 46.5% in Q2. That’s up from 44.5% in last year’s Q2. Organic constant currency net sales rose by 1.8%.

For this year, Hershey expects sales to rise by 2%. The previous guidance was 1% to 3%, so not much change here. Hershey also expects 2019 earnings of $5.68 to $5.74 per share. That’s an increase of five cents to the low end. This is after a 14-cent earnings beat.

On Thursday, Hershey opened sharply lower but the stock later regained its composure and rallied to a new high before the closing bell. I’m raising my Buy Below on Hershey to $155 per share.

AFLAC (AFL) said they made $1.14 per share for Q2, and forex knocked off a penny per share. The CEO said the duck stock aims to buy back $1.3 to $1.7 billion worth of stock this year.

AFLAC didn’t exactly raise guidance, but they said that earnings should come in at the higher end of their current range which is $4.10 to $4.30 per share. That’s based on an average exchange rate of 110.39 yen to the dollar. I’m raising my Buy Below to $57 per share.

Stryker (SYK) reported Q2 earnings of $1.98 per share which was four cents better than expectations. That’s up 12.5% from a year ago. Previously, the company had given us earnings guidance of $1.90 to $1.95 per share. For Q2, organic net sales rose by 8.5%, and operating margin expanded to 25.9%. That’s quite good.

I was also pleased to see Stryker raise its guidance for 2019. The company now expects full-year organic net sales to rise by 7.5% to 8.0%. The company expects earnings to range between $8.15 and $8.25 per share. The previous range was $8.05 to $8.20 per share.

This is a very strong stock. I’m lifting my Buy Below on Stryker to $223 per share.

Fiserv (FISV) reported Q2 earnings of 82 cents per share. That was a penny better than expectations.

This was a good quarter for Fiserv and that’s important because the CEO had said that Q2 will be the “low watermark” for earnings growth. They also said that the First Data acquisition will close on July 29. Fiserv also reiterated its full-year EPS range of $3.39 to $3.52.

I’m raising my Buy Below on Fiserv to $103 per share.

Six Earnings Reports Next Week

We have six more earnings reports next week. Three are on Wednesday, July 31 (CHD, MCO, CTSH) and another three are on Thursday, August 1 (BR, CBPX, ICE).

In April, Church & Dwight (CHD) released a pretty good earnings report. The consumer-products company beat estimates by four cents per share. I was pleased to see gross margins increase by 20 basis points to 45.1%. Operating margins rose 120 basis points to 23.1%.

CHD reiterated its full-year EPS guidance of $2.43 to $2.47. That’s an increase of 7% to 9% over last year. For Q2, CHD expects earnings of 52 cents per share.

Moody’s (MCO) also had a very good Q1 earnings report. In April, the credit-ratings agency reported earnings of $2.07 per share. That beat estimates by 14 cents per share.

Revenue at Moody’s Analytics rose 16%. The company stood by its full-year forecast of $7.85 to $8.10 per share. Moody’s continues to be our top-performing stock this year with a YTD gain of 43.4%. Wall Street expects Q2 earnings of $2.01 per share.

I’m very curious to hear what Cognizant Technology Solutions (CTSH) has to say for its Q2 earnings report. Their Q1 report was terrible. Wall Street was expecting $1.04 per share. Instead, CTSH earned 91 cents per share. The stock plunged 18% in two days.

Cognizant also cut its full-year forecast. Previously, the company expected EPS this year to be at least $4.40. Now they see it ranging between $3.87 and $3.95.

Where was the weakness? Apparently, the banking sector hasn’t been spending as much. The company’s Financial Services division, which makes up about one-third of its revenue, posted a sales decline of 1.7%. Karen McLoughlin, the company’s CFO, said, “Our revised full-year outlook reflects the first-quarter underperformance and expectations of slower growth in Financial Services and Healthcare for the remainder of 2019.”

Cognizant has gradually made back about half of what it lost in two days of trading. Wall Street expects 92 cents per share.

Broadridge Financial Solutions (BR) had a good report in May (their fiscal Q3) but the company issued mixed guidance. The company lowered its full-year revenue growth forecast from 3% – 5% down to about 1%.

BR reiterated its full-year EPS growth of 9% to 13%. Last year, the company made $4.19 per share, so the current outlook works out to $4.57 to $4.73 per share. Through the first three quarters, Broadridge earned $2.94 per share. That’s implies Q4 earnings of $1.63 to $1.79 per share.

The CEO said, “After a solid third quarter, Broadridge is very well-positioned to deliver strong full-year results.” BR is now a 40% winner for us this year. I’ll probably raise the Buy Below price, but I want to see the earnings numbers first.

Continental Building Products (CBPX) has been an unusual stock this year. The earnings reports have been quite good, but the stock hasn’t done much.

Three months ago, the wallboard company said it made 42 cents per share for Q1. That was eight cents more than expectations. Net sales rose 4.5% to $122 million, and wallboard volume increased by 5.5% to 649 million square feet. Continental’s Q1 profits were up 16.7% from a year ago. Operating income was up 11.3%.

For Q2, Wall Street expects earnings of 49 cents per share. They should be able to beat that.

Intercontinental Exchange (ICE) did well during Q1. The exchange operator made 92 cents per share. That was two cents more than Wall Street had been expecting. Their adjusted operating margin was 58%. Operating cash flow was up 14% from last year.

Shares of ICE got off to a slow start this year, but the stock has picked up steam since the spring. ICE made a new 52-week high last week. For Q2, Wall Street expects 92 cents per share.

Before I go, Smucker (SJM) raised its quarterly dividend from 85 to 88 cents per share. The new dividend will be paid on September 3 to shareholders of record on August 16. Based on Thursday’s close, SJM now yields 3.11%.

That’s all for now. There will be lots more reports next week. There’s also the big Fed meeting on Tuesday and Wednesday. The policy statement will come out on Wednesday at 2 pm. I think we’ll see a cut of 25 basis points, but I’m not positive. Then on Friday, we’ll get the July jobs report. The June report showed an increase of 224,000 net new jobs and the unemployment rate ticked up 3.7%. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His