CWS Market Review – April 3, 2020

“This is going to be a very painful two weeks.” – President Trump

Before I begin today’s newsletter, I want to let you know that I’m hosting a conference call at 2 p.m. ET today. John Schindler, a national security expert, will be joining me. We plan to cover a wide range of topics from the market and economy to defense and foreign affairs. It’s free. Please join us. You can register for the event at this link.

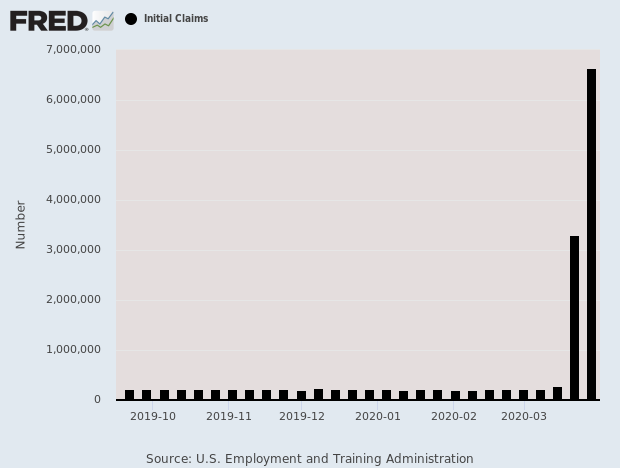

Now, on to the markets. On Thursday, the Department of Labor reported that initial jobless claims surged to 6.648 million. This is an astounding figure. It’s double what experts had been expecting. It’s also double last week’s figure, which topped the previous all-time high by more than fourfold. That’s 10 million jobs lost in two weeks.

I’m sending this to you ahead of Friday morning’s jobs report, so you may know the results by the time you’re reading this. I won’t venture a prediction except to say that the official number of job losses will be staggering.

The U.S. Economy Has Come to a Standstill

The numbers are clear. The U.S. economy hasn’t merely slowed down—it’s come to a halt. If anything, the jobless-claims figure probably understates how damaged the economy is. I can’t think of a similar period in American history. Here’s one stat via the TSA: on Wednesday, 136,000 people went through a TSA checkpoint. On the same day one year ago, the figure was 2.15 million. That’s a drop of more than 93%.

The government has responded, but the need is overwhelming. The Federal Reserve has brought back several measures from the financial crisis designed to keep the financial system operating. Last Friday, President Trump signed the $2.2 trillion economic-stimulus package. As a side note, I noticed how often the media reported the package as a “$2 trillion” bill, neglecting the “0.2.” I certainly understand the need for brevity in a headline. Still, it’s somewhat arresting to learn that $200 billion is now merely a detail.

Goldman Sachs, the investment firm, recently said it expects Q2 GDP to fall by 34%, and the unemployment rate will rise to 15% by the middle of this year. That’s actually a downward adjustment to Goldman’s initial forecast for Q2 GDP to fall by 24%. I have no idea if this forecast is correct because there are no numbers to go by. Remember, the jobless claims are double what the experts thought.

The Worst Could Be Behind Us

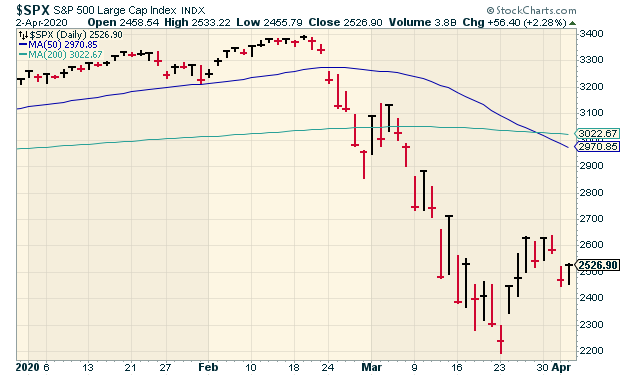

I say this with some hesitation, but it appears that the worst of the market’s mayhem has passed. Not that the storm has passed entirely, but the worst of it may be over. Of course, that could change quickly, but we should note that the market’s extreme volatility has calmed down.

To give you an example, the S&P 500 recently had an eight-day run of closing up or down by more than 4%. In the last eleven days, it “only” happened four times. Starting from the closing low on March 23, the S&P 500 has rebounded by 12.94%. Of course, that’s off a very depressed low. I’m pleased to add that our Buy List has done even better. Since March 23, our Buy List has gained 15.91%. I do expect the market to “retest” its low. Don’t be lured in by a bear-market rally.

To a certain extent, our portfolio strategy planned for this beforehand. Not the exact events, or even the bear market itself, but our safety-first approach led us to own more stable stocks. That’s a big help when investors get scared, and it’s why we’ve outperformed in a nasty down market. Hormel Foods (HRL) for example, is one of the handful of stocks in the S&P 500 that’s up for the year.

To generalize from previous market crashes, there’s often a very brief period of very intense selling. Outside that period, the market is generally crummy but not frantic. That’s where we may be right now. What comes next? That all depends on our battle against the coronavirus. The sooner we see concrete gains in terms of tests, ventilators and bending the curve, the sooner we can get back to, not normal, but at least something much closer to normal. Last week, the yield on the one- and three-month Treasury bills were briefly negative. In other words, investors had to pay money to lend the government money.

The Q1 earnings season will start soon. This will certainly be an interesting one since half of the first quarter was pre-COVID-19, while the true economic news only came during the latter half of the first quarter (the second eighth, if you prefer). Many companies have simply withdrawn their guidance.

The consensus on Wall Street is that Q1 earnings will fall by 5.1%. But what’s interesting is that that figure is the average. The forecasts are all over the place. Normally, the dispersion is modest. Not now. So far, there have been 84 earnings warnings from companies in the S&P 500. For Q2, Wall Street expects an earnings drop of more than 10%. I think that’s very optimistic.

Since we’re in a very different period for investing, I think our analysis has to change as well. For example, a company’s price/earnings ratio of dividend yield may not be so important as it relies on trailing data. In this environment, I want to place greater stress on things like a solid balance sheet. The tells me if a company has the wherewithal to ride out the storm.

Recently, shares of Ross Stores (ROST) were upgraded, and analysts noted that Ross has plenty of cash to withstand the lockdown. I also think many of Ross’s customers will benefit from the stimulus checks.

I also would place greater stress on the reputation of individual companies. AFLAC (AFL) is a good example. As a supplemental insurer, the stock has been hit hard during the selloff. However, we’ve seen how well the duck stock manages itself during disasters. In particular, I think of how well they managed during the 2011 earthquake and tsunami in Japan.

Ansys (ANSS) just released a letter to shareholders. In it, the company highlighted its strong balance sheet and the high degree of its revenue that’s recurring. Right now, these characteristics are far more important than the next earnings report.

I want to reiterate a few key points. There’s no reason to panic and sell, especially now that we’re 25% off the high. There’s also no need to try and time the market perfectly. The goal is to be a good investor, not a perfect one.

Don’t chase after fads. For example, a lot of companies are working on a COVID-19 vaccine. I wish them well, but betting on the winner is a guessing game. It’s not a guessing game that Ross Stores will still be popular.

Continue to focus on high-quality stocks. I like all the stocks on our Buy List, but Hershey (HSY), Ansys (ANSS) and Church & Dwight (CHD) look particularly good here.

I also wanted to discuss the oil market. On Thursday, the price of oil jumped more than 24% on news of a possible détente in the price war between Russia and Saudi Arabia. This was oil’s largest daily jump on record. Earlier this week, oil fell below $20 per barrel to hit an 18-year low.

Outside of the price jump, what happened isn’t precisely clear. President Trump tweeted that he spoke with the Saudi crown prince who told him he had spoken with Russian President Putin. The Kremlin, however, denied this. Still, there could be an emerging consensus on the need to cut production in an effort to boost oil prices.

Our domestic shale industry is being squeezed hard. Already this week, Whiting Petroleum (WLL), one of the big dogs in shale, filed for bankruptcy. A year ago, WLL was around $30 per share. Today it’s at 30 cents. Others will follow.

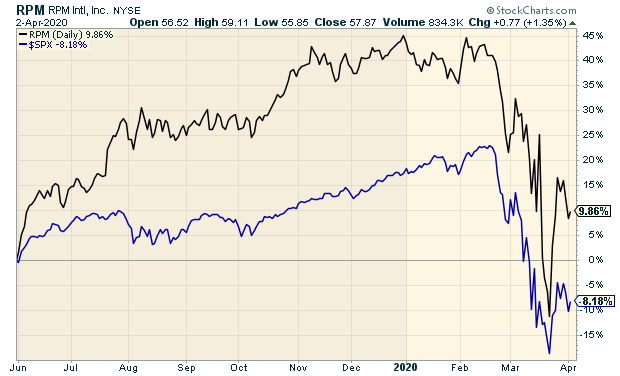

Earnings Preview for RPM International

RPM International (RPM) is due to report its fiscal Q3 earnings before the market opens on Wednesday, April 8. This is for the quarter that ended on February 29 which means that it will be largely unimpacted by COVID-19. The company owns Rust-Oleum and makes lots of workshop products.

Three months ago, RPM reported Q2 earnings of 76 cents per share. That was pretty good. The consensus on Wall Street had been for 73 cents per share. Net sales rose 2.8% to $1.40 billion. RPM had record cash flow, and EBIT margin improved by 180 basis points.

For fiscal 2020 (ending in May), RPM initially gave us earnings guidance of $3.30 to $3.42 per share. That was reiterating the same guidance they gave us in July. Wall Street expects full-year earnings of $3.34 per share.

For Q3, RPM said it expected EPS “in the high-teens to low-20-cent range.” However, two weeks ago, RPM said it expects to see earnings “at the higher end” of its previous range. To be safe, let’s say that’s 20 cents per share.

I’ll be curious to see what RPM has to say about the current quarter. Remember, this is a conservative company. RPM has raised its dividend every year since 1973.

Buy List Updates

Danaher (DHR) has closed on its deal to buy General Electric’s (GE) biopharma business. The deal was announced a little over a year ago. Danaher paid $21.4 billion, all cash. Interestingly, GE’s CEO is Larry Culp, who used to be CEO of Danaher (and a person who helped make a lot of money for us.)

An analyst at RBC said that Danaher is a “break glass in case of emergency” type of investment. Danaher remains a buy up to $150 per share.

Thanks to the selloff, several of our Buy Below prices are out of whack. Instead of lowering them all at once, I’m going to adjust a few for the next few weeks, depending on market conditions. The adjustments don’t mean I think any less of the companies. I simply want the Buy Below prices to better reflect current market conditions.

Cerner (CERN) talked about the possibility of having 27,000 employees work from home. I’m dropping my Buy Below price on Cerner to $70 per share.

Trex (TREX) provided an update on its business plans. I’m lowering Trex’s Buy Below to $85 per share.

Disney’s (DIS) Chairman Bob Iger said he will forgo his salary this year. The company said it’s going to furlough non-union employees starting on April 19. I’m lowering Disney’s Buy Below to $107 per share.

That’s all for now. Looking ahead to next week, on Wednesday, we’ll get the minutes from the last Fed meeting. Then on Thursday, another jobless-claims report is due out. The market will be closed next Friday for Good Friday. This is the only day of the year when the market is closed and most businesses are open. Despite the holiday, the CPI for March will be out on Friday morning. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. Don’t forget to register for today’s conference call.

Posted by Eddy Elfenbein on April 3rd, 2020 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His