CWS Market Review – November 30, 2021

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

Omicron Rattles Wall Street

I find it interesting that on Wall Street, a market drop of more than 10% is called a “correction.” But if you take a long-term perspective, then, properly speaking, every market drop has truly been the error while the rally has been the correction.

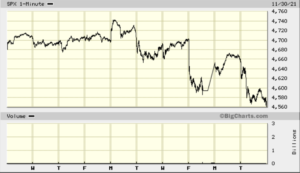

It’s odd to think that way, but it’s true. The S&P 500 last hit an all-time high less than two weeks ago. Thanks to fears of the Omicron strain, the stock market got shaken up on Friday. It was the worst day for the S&P 500 in nine months, and for the Dow, it was the worst day in more than a year.

It was also a calm market. Before last Friday, the S&P 500 had gone 29 days in a row without closing up or down by more than 1%. In fact, that understates how relaxed the market had been. Of those 29 days, 22 had market daily moves that were less than 0.5%. Now we’ve had three 1% days in a row.

Here’s the minute-by-minute chart for the last two weeks:

As a general rule, volatility tends to feed on itself in the markets. In other words, high volatility often produces higher volatility, while low volatility produces even lower volatility. Consider that this year, the stock market has fallen more than 1% 17 times. In eight of those times, it rebounded by more than 1% the next day.

Today, the S&P 500 lost 1.90% and the index closed at its lowest level in over a month. All 11 sectors were down. For November, the index lost 0.83%. This was the second monthly loss in the last three months. Prior to that, the S&P 500 had rattled off seven straight monthly gains.

The stock market’s drop on Friday was very reminiscent of the kinds of days we saw in March 2020. The worst-performing stocks were travel and leisure companies while many of the top performers were defensive stocks. For example, Clorox had a very good day.

The trouble with the Omicron strain is that we don’t have a lot of information yet. Whenever this happens, Wall Street is more than happy to fill in the gap with fear. On Monday, the market made back some of those gains as we heard that Omicron may not be that bad, but on Tuesday, Wall Street reverted to fear.

My guess is that we’re going to witness Wall Street wrestle with the “lockdown trade.” That means that on most days, cruise stocks will be either the best- or worst-performing stocks, and there won’t be much left over in the middle. Today was a good day for the cruise stocks. Apple and Tesla also did well. In other words, investors are willing to take on more risk. Only seven stocks in the entire S&P 500 closed higher today.

By the way, our Buy List as whole skews towards being a classic defensive portfolio. That’s not a macro prediction on my part. It’s simply how our stock-picking worked out. In plain English, when folks get scared, they flee toward our stocks.

A good example is Hershey (HSY), a Buy List favorite. Shares of Hershey fell about 1.69% on Friday. That’s bad, but it was better than the overall market’s drop of 2.27%. Today, the S&P 500 fell 1.9% while shares of Hershey only fell 0.93%. Whatever Omicron may do or not do, I doubt it will impact chocolate sales.

By the way, investors shouldn’t overlook “downside Alpha.” That’s a fancy word for not falling as much as everyone else. I’ve found that most of the long-term outperformance comes during rough markets. Everyone can look brilliant in a rally but emerging from a harsh bear market mostly unscathed is an impressive feat.

Powell Said It’s Time to Retire “Transitory”

Besides Omicron, probably the main reason for today’s selloff was hawkish comments from Federal Reserve Chairman Jay Powell. At a Senate hearing, Powell said that it may be appropriate to speed up the tapering of bond purchases and that inflation will “linger well into next year.”

No, duh.

Jay, look around. Just recently, General Mills said that it will increase prices next year. That means you’ll be paying more for Cheerios or Lucky Charms. Even Dollar Tree is raising prices to $1.25.

Here’s a look at gasoline prices over the last 18 months:

Until now, the Fed has often described inflation as being “transitory.” Today, Powell conceded that it’s “probably a good time to retire” that word. Still, he’s pinning most of the blame on supply/demand imbalances.

The Fed’s original plan was to pare back bond purchases until they reached zero by June. After that, the Fed would start to hike interest rates.

Now that timeline is uncertain. According to the futures market, traders are placing a 45% chance of the Fed hiking by early May. That’s up 10% from yesterday. Traders narrowly see a second hike coming by September.

The bond market is reacting as well. I like to look at the spread between the 10- and 2-year Treasury yields. The spread got down to just 91 basis points today. That’s the narrowest since January. In March, the spread was 159 basis points.

For being such a simple metric, the 2/10 Spread has an eerily good track record. Whenever it turns negative, you know bad times aren’t far behind. The last time the 2/10 turned negative was in August 2019, only a few months before Covid rocked the world.

Jack Quits Twitter

On Monday, Jack Dorsey announced that he’s stepping down as Twitter’s CEO. The stock responded by vaulting 11% higher. That’s got to sting when news of your departure causes investors to celebrate. At its peak, Jack’s leaving added $4 billion to Twitter’s market value. Ouch!

Parag Agrawal will take over as CEO. He’ll be the youngest CEO in the S&P 500. At 91, Warren Buffett is the oldest. Agrawal is a little younger than Mark Zuckerberg. The Bloomberg story contained this curious sentence, “Citing security concerns, Twitter wouldn’t disclose Agrawal’s date of birth, but confirmed he was born later in 1984 than Zuckerberg’s May 14 birthday.”

Despite Wall Street celebrating Jack Dorsey’s departure, shares of Twitter closed lower yesterday and they were down 4% today. This brings up a good point that often isn’t discussed, namely that Twitter isn’t that profitable as a business enterprise.

You’ll have to excuse me for relying on antiquated notions, such as return-on-equity, a balance sheet, or “profits,” but Twitter really doesn’t look that good.

Jack Dorsey is also the CEO of Square. I’ve found that shareholders are willing to overlook a lot, as long as the stock is going up. Just look at Elon Musk. Yes, he says silly things, but the stock has done well over the years. That’s not the case with Twitter, so that added additional pressure on Dorsey to choose one of his companies to lead.

Twitter went public seven years ago and the shares are now below where they were after the first day of trading. The IPO was priced at $26 per share. On the first day of trading, it zoomed over $50 and eventually closed at $44.90. Today, Twitter closed 96 cents below that. In seven years, Twitter has basically gone nowhere.

At the end of this year, Twitter will have brought in about $5 billion in revenue. Their gross profit will be around $3 billion while the operating profit will probably be about $300 million, give or take. That’s probably around 35 to 40 cents per share, and we still haven’t gotten down to taxes and other non-operating expenses.

Are investors willing to pay at least 100 times earnings for a company that seems to have little direction? Clearly, Agrawal has his work cut out for him.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. Don’t forget to sign up for our premium newsletter.

Posted by Eddy Elfenbein on November 30th, 2021 at 7:46 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His