Posts Tagged ‘WMT’

-

Harry Reid Spooked the Market

Eddy Elfenbein, November 28th, 2012 at 6:40 amThe stock market got spooked late yesterday when Senate Majority Leader Harry Reid said that little progress had been made on budget talks. Still, most political people in Washington say they’re optimistic that a deal will be reached before we reach the dreaded fiscal cliff. My take is that there’s simply too much to lose in not reaching a deal. Somehow something will happen at some point. You heard it here first.

The bad news from our markets spilled over into Europe as stocks dropped modestly over there. Interestingly, Italian bonds have been soaring lately. In fact, soccer players have been profiting. The two-year yield in Italy is at its lowest point in more than two years. The 10-year yield is down to 4.674%. Four months ago, it was yielding 6.6%. Clearly, the crisis that consumed investors this past summer has faded away.

Costco ($COST) became the latest company to announce a big special dividend. The company is going to pay out $7 per share. That’s a yield of 7.25% based on yesterday’s close. All the cash-rich stocks are looking to dish out money to shareholders before the end of the year when tax rates are expected to rise. So far, 103 companies have announced special dividends. Other companies, like Walmart ($WMT), have moved up their dividend dates.

Later today, the Commerce Department will release its report on new home sales.

-

Some Retail Stocks Are Heating Up

Eddy Elfenbein, June 11th, 2012 at 2:50 pmEven though the stock market hasn’t been doing well lately, a number of retail stocks have bucked the trend. Target ($TGT), for example, just hit a new 52-week high today, and it’s not far from an all-time high. I expect Tar-Zhay to announce its 45th-straight dividend increase any day now. Last month, the company said it’s aiming to have its dividend at $3 per share by 2017. That’s pretty optimistic, but I like to see folks who have big plans.

Walmart ($WMT) has also been doing well. On Friday, the Behemoth of Bentonville broke $68 per share for the first time since January 2000.

Ross Stores ($ROST) hit a new all-time high today. The stock has practically been in a nonstop bull market for 18 years. In January 1994, shares of ROST were going for 74 cents. Now they’re at $64. That’s an annualized gain of over 27% a year, and it doesn’t include the dividend.

On our Buy List, Bed Bath & Beyond ($BBBY) has pulled back from its all-time high of $74.67 (reached on May 29th). The company had an outstanding earnings report in early April. They beat Wall Street’s consensus by 15 cents per share. What’s interesting, though, is that the stock market took a while to react. After a small bump up after the earnings report, it was almost all gone three weeks later. Then the stock started to rally.

BBBY will report earnings again on June 20th. The company sees fiscal Q1 earnings ranging between 79 cents and 83 cents per share.

-

Walmart Nears 10-Year High

Eddy Elfenbein, May 22nd, 2012 at 9:11 amApparently there are other stocks on the market besides Facebook ($FB). One such company is called Walmart ($WMT), and unlike FB, it has been doing well lately. Facebook began with a checking account of $15,000 which is roughly the amount of revenue WMT generates every single second of every hour of every day. That adds up to $475 billion a year.

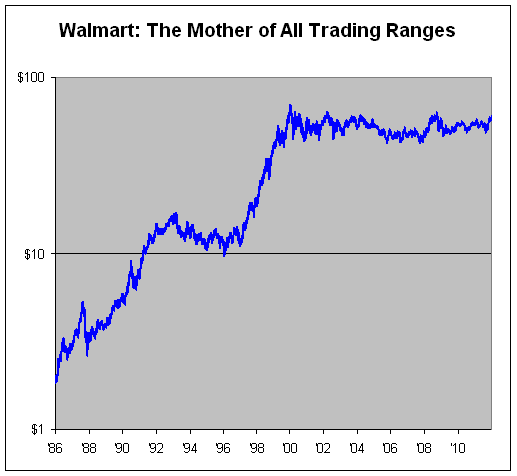

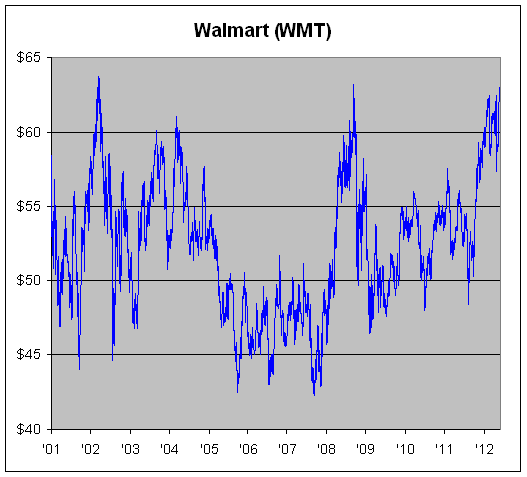

What’s fascinating about WMT is that it’s been stuck in the Mother of All Trading Ranges for several years. For over a decade, WMT has rarely strayed far outside its $45 to $60 band.

But thanks to its good earnings report the other day, the stock looks ready to break loose. On Monday, Walmart closed at $63.04 which is just 13 cents shy of its highest close in the last ten years.

Wall Street expects earnings next year of $5.33 per share with a five-year growth rate of 8.3%. That makes the stock almost perfectly priced.

-

Walmart: The Mother of All Trading Ranges

Eddy Elfenbein, December 27th, 2011 at 3:28 pmOn Friday, Walmart ($WMT) closed at $59.99 and the stock doesn’t look like it will close above $60 today. That’s not too surprising. The stock of the giant retailer has been stuck in a trading range for nearly 12 years.

Think about this: Not once in over 3,000 trading days has WMT closed above $64 or below $42. The last time it did was on January 19, 2000 when it closed at $64.06.

Here’s a look at WMT’s closing prices by range:

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His