Archive for October, 2008

-

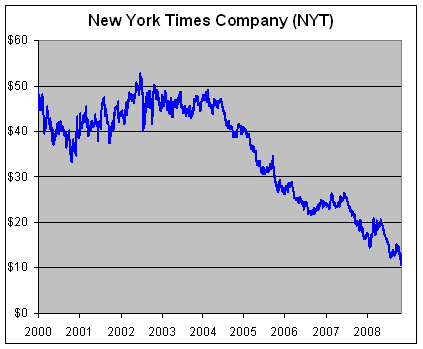

The Decline and Fall of Old Media

Eddy Elfenbein, October 23rd, 2008 at 11:10 amThe New York Times Company (NYT) closed yesterday at a 13-year low. The company reported a loss for the third quarter and it considering cuttings its dividend. The current dividend indicates a yield of 8.4%.

-

Does this Make Any Sense?

Eddy Elfenbein, October 23rd, 2008 at 11:02 amIn July, Apple said to expect $1 a share in the next earnings report. Since Wall Street had been expecting EPS of $1.23, the stock dropped $4 to $162.

Now here we are three months later and Apple reported earnings of $1.26. So the shares rallied $5…to $96! -

Dennis Kneale Shocked then Composed

Eddy Elfenbein, October 23rd, 2008 at 10:52 am -

Nicholas Financial’s Financials

Eddy Elfenbein, October 23rd, 2008 at 10:46 amA reader weighs in:

I am not averse to buying microcaps and have in fact made some good money doing so. I bought stocks that had a good business model and became big companies. This is why I think I can help with regards to NICK.

First, the finance receivables is very large compared to any other part of the left side of the balance sheet. Basically, you are buying the receivables, as a shareholder. You are buying them leveraged a bit (as you mentioned 2:1). You’re not really buying the operations of the company because again, earnings and cash flows are tiny compared to the asset side of the balance sheet; there will also be no earnings if receivables shrink and the company can no longer collect interest.

With that being said, I’d like to point out that last quarter there was a charge off of close to $20M, applied to the receivables. This was 9% of the receivables, or roughly 20% of the equity. Meaning your shares, as they represent equity, should have declined by at least that amount — assuming there was no reason book value would increase in the near-term, which would be a long shot as “charge-offs” tend to be just that… off… for good. These are not to be confused with unrealized losses which occur due to mark-to-market fluctuations.

Delinquencies on payments also increased across all time periods, indicating that further charge offs are in the wings. If the economy recovers soon there’s not much to worry about. If consumers pull pack (in Florida in particular) then even just a 20% charge off will have a massive impact. Because the company is leveraged about 2:1, that’s a 40% decline in equity. That’s also a cumulative ~30% decline in the receivables portfolio, meaning that next year revenues will decline by about 30% as well, because they make money from interest payments. The costs of running the company and collecting those payments are relatively fixed, so you will get an earnings decline of more than 30%, under this scenario. The cost of debt isn’t likely to get cheaper either, increasing another cost in the short run.

Finally, in the last year there was a share offering which diluted your ownership stake by another 10-20% depending on the time periods you compare.

If you know the risks then that’s fine. I respect the bet, which will either have a huge upside or go to zero. But this really is a bet on the consumer and finance receivables. There is no sustainable operating company if borrowing rates increase and the consumer weakens further. I didn’t feel that your post stressed this point enough.

I hope my input is of value. I started looking through the financial thinking you’d spotted a gem. Under most economic scenarios there’s no operating company going forward. If we recover, then you are absolutely right, the stock will jump. But don’t expect this company to be around in six months if the economy gets much worse. -

Your Daily TED Update

Eddy Elfenbein, October 22nd, 2008 at 9:28 amWe’re down to 251. This is looking much better.

-

It Was Only a Matter of Time

Eddy Elfenbein, October 22nd, 2008 at 8:40 am -

Some Thoughts on Nicholas Financial

Eddy Elfenbein, October 21st, 2008 at 1:53 pmYesterday, Felix Salmon had some questions for value investors and he concluded by saying: “I might have some faith in the ability of value investors to find cheap stocks, but I have no faith at all in the ability of value investors to time the market.” As usual, I agree with him.

Personally, I don’t try to time the market, and the times that I have tried, I’ve been awful. Perhaps I’m a contrary indicator. Of course, even when I try to go against my instincts, I’m still lousy. I guess it’s just me.

That’s why I stick to stock-picking. As followers of my Buy List know, I’m a buy-and-hold type of guy. The Buy List has 20 stocks that I choose at the beginning of the year. Each year, I’ve only replaced five stocks, so that implies a four-year holding period.

One stock that’s been on my mind lately is Nicholas Financial (NICK). This is what I would call a deep value stock. It’s a very low-priced micro-cap and in all honesty, it probably won’t do much of anything for a bit of time. Still, I like it and I own it.

The reason I find NICK so interesting is that it’s almost a perfect lab experiment for looking at some theories of investing. First, it’s a value stock. Second, it’s a micro-cap stock. Historically, both groups have outperformed the market as a whole. This of course doesn’t mean NICK will outperform, but it’s got those two characteristics on its side.

I should add that NICK isn’t just a micro-cap. It’s really micro. The company has a market value of just $33 million. Some Yankees make more than that. I was buying it last week, and trying my best not to throw the price out of whack, but it’s hard to avoid. Some days, no shares trade.

Also, NICK isn’t just a value stock, it’s a deep value stock. The shares are going for less than four times trailing earnings. The company’s book value runs $7.91 a share. Yesterday’s close was $3.21. That, my friends, is a value stock.

Why is it so cheap? Well, NICK is in the worst possible industry right now. The company makes loans for used cars. Cars sales are plunging and the credit market is frozen. NICK isn’t officially called a subprime lender, but it sort of is. The stock has dropped from $14 to $3. But there’s a lot to like about NICK, and I’m comfortable owning it. Let me explain why.

One thing that makes NICK interesting is that they actually hold their loans to term. Shocking, I know. They don’t sell their loans immediately. Most of the loans they buy from dealers at a discount. NICK also originates some loans, which tend be of decent quality, but that’s a small part of their portfolio.

Here’s very generalized description of their financials from last year. (Please check the SEC docs for the exact numbers. I’m just using this to explain what NICK does.)

NICK has a loan portfolio of about $180 million. That carries an interest rate of 26%. Their debt is about $100 million and they paid about 6.5% on that (it’s tied to LIBOR). So we’re talking about a company leveraged 2-to-1 with $50 million coming in the door and $6 million going out. That sounds good to me. That’s a yield of around 23%. Costs for running the business take out another 10%. The real killer is provisions for credit losses. That ran about 4% last year. This year I think it will be around 7%. NICK’s accounting tends to be fairly conservative. In fact, they could be over-providing, but I’m not complaining.

Earnings last quarter were 15 cents a share down from 27 cents a share a year ago. Earnings will be lousy for the next earnings report (due sometime in early November), but they will be positive. I think they’ll probably be about five cents a share, give or take. So they are making money, which is impressive in this environment.

The big driver for NICK is the provision for loan losses. The rest of their business is fairly stable. The major driver of loan defaults in unemployment. There’s a strong relationship between the jobless rate and NICK’s defaults. I think unemployment will top out around 8% sometime in 2009, maybe early 2010. The company isn’t in any danger of going under, although there will be losses for a bit. Once things start to improve, NICK ought to prosper.

If you’re tempted to buy NICK, I will warn you. You probably won’t make anything for over a year. Once the market wakes up and isn’t afraid of less liquid stocks, NICK should rally. -

Lincare and WR Berkley

Eddy Elfenbein, October 21st, 2008 at 12:26 pmTwo notes from the Buy List to pass on. First, Lincare (LNCR) reported third-quarter earnings of 76 cents a share, which beat estimates by four cents a share. The company earned 66 cents a share for last year’s third quarter, so that’s pretty decent growth. Earnings were squeezed by a 6% cut in Medicare prices.

There’s also some trouble on the horizon.Revenue and earnings also were impacted by a change in ordering patterns for certain inhalation drugs by customers worried they were going to lose Medicare coverage for these drugs. Some patients placed large orders in June in an effort to get their drugs ahead of the Medicare change, which has since been delayed until Nov. 1.

Wall Street currently sees Lincare’s 2009 earnings falling by 27%.

The other news is that WR Berkley (WRB) said it expects to post a loss for the third quarter between 15 and 20 cents a share. Operating earnings, which is more important for insurance companies, will be between 70 and 75 cents a share. The company is taking an after-tax loss due to the hurricanes. The company also got screwed from owning preferred stock in Fannie and Freddie. WR Berkley is already up about 40% from its panic low on October 10. -

Fed Chairs for Obama

Eddy Elfenbein, October 21st, 2008 at 9:52 amThe Bearded One has stepped into the minefield and, apparently, endorsed Obama. Or at least, the Democrats’ stimulus idea. Perhaps Ben just wants four more years as Fed Chair. Is Princeton that bad?

While the Fed chief said any stimulus should be “well targeted,” even a general endorsement amounts to a political green light. Mr. Bernanke certainly knows that Mr. Obama and Democrats on Capitol Hill are talking about some $300 billion in new “stimulus” spending, while President Bush and Republicans are resisting. And by saying any help should “limit longer-term effects” on the federal deficit, he had to know he was reinforcing Democratic opposition to permanent tax cuts.

That probably wasn’t a smart move, and I seem to recall Bernanke saying he would try to avoid such actions. One of my complaints about Alan Greenspan was the way he injected himself into policy debates. Still, I don’t see any reason why the Fed Chair can’t give his opinion on fiscal matters.

On an interesting side note, Monica Langley points out in today’s WSJ that Obama is now BFF with 81-year-old Paul Volcker.On Tuesday, Mr. Volcker is scheduled to appear on the campaign trail with Sen. Obama for the first time. At a round-table discussion with voters in Lake Worth, Fla., he’ll “give his view on the state of the economy and the credit markets, and what needs to be done to fix them,” says one campaign adviser. Longtime Fed watchers are amused that Mr. Volcker, known for his muttered statements during Fed meetings in the 1980s, will be in a political role on the stump.

For Mr. Volcker, a connection with Sen. Obama could help burnish his record as Fed chairman. The cigar-chomping central banker from 1979 to 1987, he received blame for driving up interest rates and tipping the U.S. into the deepest recession since the Great Depression. But Mr. Volcker is just as well known for taming the runaway inflation of that era. His stock has risen in recent months as his gruff warnings about the risks of deregulating the financial sector have come to look prescient. His successor’s reputation, meanwhile, has come under a cloud. Alan Greenspan is under criticism that the low interest rates and deregulatory ideology of his tenure contributed to today’s crisis. -

Financial Crisis Hits Journalism

Eddy Elfenbein, October 20th, 2008 at 9:25 amCredit crisis hits America’s farmers

Financial Crisis Hits Moscow’s Wealthy and Fancy

Crisis hits Aussies’ holiday plans

Wall Street Crisis Hits Maine Housing Agency

Credit crisis hits Sands’ Macau resort plan

Crisis hits art world in auction flop

Economic Crisis Hits Northwestern, “We Ok, Though,” Bienen Reassures

Financial Crisis Hits Hungary Hard

Crisis hits Asia’s love affair with luxury

Financial crisis hits common man hard

Financial Crisis Hits Billionaires

Global credit crisis hits the poor, hard

Economic crisis hits home in Brookline

Stallion Fees Sink as Financial Crisis Hits Thoroughbred Market

Financial crisis hits pheasant and partridge shooting

Financial crisis hits your morning joe

Economic Crisis Hits NY’s Northern Suburbs Hard

Crisis hits Maine lobster industry

Credit crisis hits Harrisburg incinerator

Global financial crisis hits undertakers

Mortgage Crisis Hits Queens Especially Hard (FYI: They mean the borough)

Credit Crisis Hits Canada

Financial crisis hits many where it hurts the most

Elite Nightclubs Empty as Crisis Hits Oligarchs

Credit crisis hits feeder, stocker cattle

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His