Archive for January, 2019

-

Join Our Conference Call on Thursday

Eddy Elfenbein, January 31st, 2019 at 11:50 amJoin me this Thursday at 4 pm ET for a conference call to discuss earnings season.

To join the call, register here: https://etf.as/EddyCall. After you register, you’ll be able to hear the call either online or by phone.

This is the busiest time for earnings, and I want to make sure you know what’s happening. Seven of our Buy List stocks are scheduled to report this week, plus another nine are due to report next week.

I’ll go over each of them and tell you what to expect.

I also wanted to remind you that you can easily buy the whole Buy List in one move by buying shares of the AdvisorShares Focused Equity ETF (CWS). The ETF has rebounded nicely from the market’s December low. In fact, we just had to print another 25,000 shares to keep up with demand. Thanks to everyone who has come on board!

Remember that the ETF is tax-efficient. Also, if you wanted to buy one share each of all 25 Buy List stocks, it would cost more than $2,800. But one share of CWS, which holds all 25, currently goes for about $30. For more info on the ETF, check out our website: advisorshares.com/fund/cws.

I’ll talk to you on Thursday.

– Eddy

Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by visiting the Fund’s website at www.AdvisorShares.com. Please read the prospectus carefully before you invest. Foreside Fund Services, LLC, distributor.

There is no guarantee that the Fund will achieve its investment objective. An investment in the Fund is subject to risk, including the possible loss of principal amount invested. The prices of equity securities rise and fall daily. These price movements may result from factors affecting individual issuers, industries or the stock market as a whole. Shares of the Fund may trade above or below their net asset value (“NAV”). The trading price of the Fund’s shares may deviate significantly from their NAV during periods of market volatility. There can be no assurance that an active trading market for the Fund’s shares will develop or be maintained. In addition, equity markets tend to move in cycles which may cause stock prices to fall over short or extended periods of time. Other Fund risks include market risk, liquidity risk, large cap, mid cap, and small cap risk. Please see prospectus for details regarding risk.

Shares are bought and sold at market price not net asset value (NAV) and are not individually redeemed from the Fund. Market price returns are based on the midpoint of the bid/ask spread at 4:00 pm Eastern Time (when NAV is normally determined) and do not represent the return you would receive if you traded at other times.

-

Hershey Earns $1.26 per Share

Eddy Elfenbein, January 31st, 2019 at 9:20 amFrom Reuters:

Hershey Co forecast full-year profit largely above Wall Street expectations, as the maker of Kisses chocolate and Reese peanut buttercups benefits from a clutch of snacking brand acquisitions.

Hershey has been building up a portfolio of snack brands through acquisitions as consumers opt for healthy food over sugary candies and processed food.

The company bought cheese puff maker Pirate Brands for $420 million in September 2018, adding to its portfolio of snacks brands that includes SkinnyPop popcorn maker Amplify Snack Brands, beef jerky maker Krave and barkTHINS.

The Pennsylvania-based company forecast full-year adjusted profit to be in the range of $5.63 per share to $5.74 per share, the mid-point of which at $5.69 is above analysts’ estimate of $5.65 per share, according to IBES data from Refinitiv.

The candy maker also forecast full-year sales growth to be in the range of 1 percent to 3 percent in line with expectations.

However, Hershey reported quarterly sales and profit that narrowly missed estimates in the fourth quarter ending Dec. 31.

Net income attributable to the company surged to $336.8 million, or $1.60 per share, in the fourth quarter ended Dec. 31, from $181.1 million, or 85 cents per share, a year earlier.

Excluding items, Hershey earned $1.26 per share, missing analysts’ estimate by one cent.

Sales rose 2.5 percent to $1.99 billion, but narrowly missed the average analyst estimate of $2 billion, according to Refinitiv data.

-

Sherwin-Williams Earns $3.54 per Share

Eddy Elfenbein, January 31st, 2019 at 9:15 amConsolidated net sales for the year increased 17.0% to a record $17.53 billion

Net sales from stores in U.S. and Canada open more than twelve calendar months increased 5.1% in the year

Full year diluted net income per share decreased 35.9% to $11.67 per share from GAAP 2017 $18.20 per share, revised to reflect a voluntary inventory accounting change

Full year net operating cash increased $151.2 million to a record $2.04 billion

The Company anticipates diluted earnings per share for 2019 in the range of $16.77 to $17.77 per share, including acquisition-related costs and other non-operating items of $3.63 per shareCommenting on the financial results, John G. Morikis, Chairman, President and Chief Executive Officer, said “Sherwin-Williams delivered record results in 2018 despite a fourth quarter that was below our expectations. Consolidated sales for the year grew at a mid-single digit rate excluding the five months of Valspar incremental sales, and adjusted diluted earnings per share grew by approximately 23 percent. In all business segments, we continued to focus on innovative products and services to help our customers improve their productivity and profitability. We also implemented price increases during the year to combat persistent raw material inflation. In addition, our team made significant progress on our acquisition integration efforts, with the resulting benefits exceeding our target for the year. We also generated record cash from operations in 2018, enabling us to invest in growth initiatives, increase our dividend, purchase shares of stock and significantly reduce debt.

“We enter 2019 well-positioned and focused on what we can control. While the current macroeconomic outlook is less than clear, we see significant opportunities for profitable growth throughout the business. In The Americas Group, we will continue to invest in our store model and best-in-class products while executing on share of wallet and new account activation initiatives. In the Consumer Brands Group, we are excited by the exclusive national partnership and shared commitment to growth we have with our largest retail partner, as well as by our strong relationships with other leading retailers. Finally, in the Performance Coatings Group, we are focused on leveraging the combined capabilities of our integrated organization across the various end markets and geographies we serve.

“In the first quarter of 2019, we anticipate our net sales will increase two to six percent compared to the first quarter of 2018. The first quarter 2019 will include the expenses related to the defined benefit plan annuity purchase of approximately $.43 per share. For the full year 2019, we expect core net sales to increase four to seven percent compared to full year 2018. With annual sales at that level, we anticipate diluted net income per share for 2019 will be in the range of $16.77 to $17.77 per share compared to $11.67 per share earned in 2018. Full year 2019 earnings per share includes acquisition-related costs and other non-operating expenses of approximately $3.20 and $.43 per share, respectively. We expect our 2019 effective tax rate to be in the low twenty percent range.”

-

Raytheon Earns $2.93 per Share

Eddy Elfenbein, January 31st, 2019 at 9:10 am– Strong bookings of $8.4 billion in the quarter and $32.2 billion for the year; book-to-bill ratio of 1.15 in the quarter and 1.19 for the year

– Fourth quarter net sales of $7.4 billion, up 8.5 percent; full-year net sales of $27.1 billion, up 6.7 percent for the year

– Fourth quarter EPS from continuing operations of $2.93, up 117 percent; full-year EPS from continuing operations of $10.15, up 46 percent for the year

– Strong operating cash flow from continuing operations of $2.4 billion in the quarter and a record $3.4 billion for the year

Raytheon Company (RTN) today announced net sales for the fourth quarter 2018 of $7.4 billion, up 8.5 percent compared to $6.8 billion in the fourth quarter 2017. Fourth quarter 2018 EPS from continuing operations was $2.93 compared to $1.35 in the fourth quarter 2017. The increase in the fourth quarter 2018 EPS from continuing operations was primarily driven by operational improvements and lower taxes primarily associated with tax reform.

Net sales in 2018 were $27.1 billion, up 6.7 percent compared to $25.3 billion in 2017. Full-year 2018 EPS from continuing operations was $10.15 compared to $6.94 for the full-year 2017.

“Raytheon had a very successful year in 2018. We accelerated our sales growth yet again and achieved a new company record for operating cash flow,” said Thomas A. Kennedy, Raytheon Chairman and CEO. “We ended the year with record bookings and backlog which positions us well for 2019 and beyond.”

The company generated strong operating cash flow for both the fourth quarter and full-year. Operating cash flow from continuing operations for the fourth quarter 2018 was $2.4 billion. Operating cash flow from continuing operations for the full-year 2018 was a record $3.4 billion, after making the $1.25 billion pretax discretionary pension contribution in the third quarter 2018. Operating cash flow from continuing operations for the fourth quarter 2017 and full-year 2017 was $1.6 billion and $2.7 billion, respectively, after making the $1.0 billion pretax discretionary pension contribution in the fourth quarter 2017. Operating cash flow from continuing operations for the fourth quarter and full-year 2018 was better than the company’s prior guidance primarily due to improved working capital.

For 2019, RTN expects EPS of $11.40 to $11.60, on sales of $28.6 to $29.1 billion.

-

Morning News: January 31, 2019

Eddy Elfenbein, January 31st, 2019 at 7:12 amAs Chances of No-Deal Brexit Rise, British Companies Scramble to Prepare

Trump’s Venezuela Sanctions Put Russian Billions at Risk

PetroChina to Drop PDVSA as Partner in Refinery Project

U.S., China Take the Lead in Race for Artificial Intelligence: U.N.

Friendly Fed Fires World Stocks to Best January on Record

The Hot Topic in Markets Right Now: ‘Quantitative Tightening’

Deutsche Bank Sees Merger by Mid-Year If All Else Fails

Foxconn Reconsidering Plans for a Wisconsin Factory Heralded by Trump

Tesla’s Incredible Shrinking Growth Machine

Releasing Earnings, Microsoft Stays In Stride With Cloud Powering the Way

CEO Made $357 Million From Small Businesses, $3.50 at a Time

Inside the Takedown That Put Carlos Ghosn in Jail

Howard Lindzon: Niche Niche Niche is The New Location Location Location

Jeff Miller: Knowing When to Walk Away

Michael Batnick: The Single Greatest Error, I Guess I’m Bearish Now, Adverse Variance

Be sure to follow me on Twitter.

-

Today’s Fed Policy Statement

Eddy Elfenbein, January 30th, 2019 at 2:55 pmInformation received since the Federal Open Market Committee met in December indicates that the labor market has continued to strengthen and that economic activity has been rising at a solid rate. Job gains have been strong, on average, in recent months, and the unemployment rate has remained low. Household spending has continued to grow strongly, while growth of business fixed investment has moderated from its rapid pace earlier last year. On a 12-month basis, both overall inflation and inflation for items other than food and energy remain near 2 percent. Although market-based measures of inflation compensation have moved lower in recent months, survey-based measures of longer-term inflation expectations are little changed.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 2-1/4 to 2-1/2 percent. The Committee continues to view sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective as the most likely outcomes. In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

Voting for the FOMC monetary policy action were: Jerome H. Powell, Chairman; John C. Williams, Vice Chairman; Michelle W. Bowman; Lael Brainard; James Bullard; Richard H. Clarida; Charles L. Evans; Esther L. George; Randal K. Quarles; and Eric S. Rosengren.

-

Stryker Soars on Earnings News

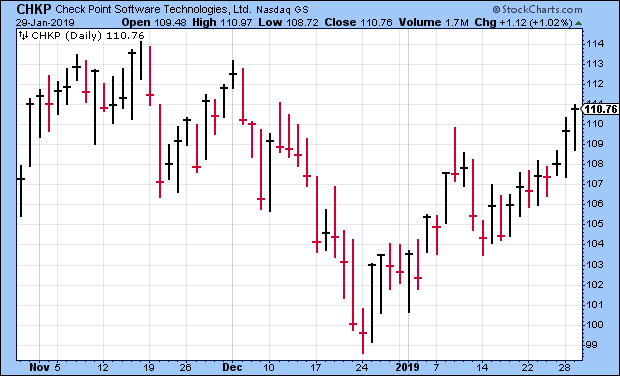

Eddy Elfenbein, January 30th, 2019 at 1:02 pmShares of Stryker (SYK) are doing very well today. At one point, SYK was up over 12% from yesterday’s close. Check Point (CHKP) is down a little bit after its earnings report.

Two other items to note.

The ADP payroll report came in at 213,000. That’s a good number but it’s not always a reliable indicator of the official government report which is due out on Friday.

Ross Stores (ROST) is set to become a dividend aristocrat. That’s a stock with 25 straight years of dividend growth. The other four that are soon to make it are Albemarle (ALB), Essex Property Trust (ESS), Expeditors International of Washington (EXPD) and Realty Income (O).

-

Check Point Software Earns $1.68 per Share

Eddy Elfenbein, January 30th, 2019 at 7:20 amCheck Point Software (CHKP) reported Q4 earnings of $1.68 per share. That’s an increase of 6% and it beat Wall Street’s estimate by five cents per share. Revenue rose 4% to $526 million. During Q4, CHKP bought 2.8 million shares for $305 million.

For the year, Check Point earned $5.71 per share. That’s an increase of 7% over 2017. Revenue fell 3% to $1.916 billion.

“We finished the year with record results. Our revenues were toward the top of our projections and non-GAAP EPS exceeded. Our Security Subscriptions Business continued to increase, driven by cloud, mobile and zero-day advanced threat prevention technologies. We expanded our cloud security offering with the delivery of CloudGuard SaaS solution, and the acquisition of Dome9 and ForceNock,” said Gil Shwed, Founder and CEO of Check Point Software Technologies. “We started 2019 with many new innovations including two new threat prevention optimized security appliances and the new Maestro product line that provides Cloud-type HyperScale technology to reach unprecedented levels of security.” Shwed concluded.

Over the course of the year, the company bought back 10.3 million shares for $1.104 billion.

-

Morning News: January 30, 2019

Eddy Elfenbein, January 30th, 2019 at 7:09 amU.S., China Face Deep Trade, IP Differences in High-Level Talks

Venezuela Has 20 Tons of Gold Ready to Ship. Address Unknown

Trump Says the Economy Is Unstoppable. Most Economists Say Otherwise.

Why Trump’s Tariffs Didn’t Help Create More Steel Jobs

Apple Relief Boosts Futures Ahead of Fed Decision

The Very High Costs of Climate Risk

A Tesla Stock Bear Turns Gloomier

Verizon’s Profit Stung by Oath Restructuring

GameStop Stock Is Plunging After The Company Fails To Find A Buyer

Ghosn Says Nissan Executives Used ‘Plot and Treason’ to Halt Renault Integration

Ben Carlson: Planning For The Predictable & The Unpredictable

Roger Nusbaum: Success Is Driven From Behaviors

Be sure to follow me on Twitter.

-

Stryker Made $2.18 per Share

Eddy Elfenbein, January 29th, 2019 at 4:28 pmStryker (SYK) just reported Q4 earnings of $2.18 per share. That’s an increase of 11.2% and it’s three cents better than expectations. Stryker had given us a range of $2.13 to $2.18 per share, so they’re hitting the top end of that. For the quarter, net sales rose 9.4% to $3.8 billion. Organic sales were up 8.6% and operating margin rose to 27.5%.

For the year, Stryker made $7.31 per share. That’s an increase of 12.6% of the $6.49 per they made last year.

“We had an excellent finish to 2018 with the best organic sales growth in a decade, and strong adjusted earnings performance,” said Kevin A. Lobo, Chairman and Chief Executive Officer. “Our multi-year momentum reflects the strength of our diversified model, progress on globalization and outstanding people and culture. We are well positioned to deliver for our customers, employees and shareholders in 2019 and beyond.”

For Q1, Stryker says it expects earnings to range between $1.80 and $1.85. Wall Street was at $1.84, which I thought might be too high. For the year, Stryker sees earnings between $8 and $8.20 per share. Wall Street was expecting $8.01.

The shares are up 5% in the after-hours market.

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His