Archive for January, 2021

-

Why Did Robinhood Places Restrictions on GameStop?

Eddy Elfenbein, January 29th, 2021 at 12:47 pmMany people are upset with Robinhood for refusing to allow customers to see shares of GameStop. There are a lot of conspiracy theories for why.

The real reason is much less interesting.

The question is whether such critics will dig into the industry’s inner workings, where pressure mounted on Robinhood and other firms to limit certain trades. That would put a rare spotlight on arcane parts of the market designed to prevent catastrophe, such as the Depository Trust & Clearing Corp.

One key consideration for brokers, particularly around high-flying and volatile stocks like GameStop, is the money they must put up with the DTCC while waiting a few days for stock transactions to settle. Those outlays, which behave like margin in a brokerage account, can create a cash crunch on volatile days, say when GameStop falls from $483 to $112 like it did at one point during Thursday’s session.

“It’s not really Robinhood doing nefarious stuff,” said Bloomberg Intelligence analyst Larry Tabb. “It’s the DTCC saying ‘This stuff is just too risky. We don’t trust that these guys have the cash to be able to withstand settling these things two days from now, because in two days, who knows what the price could be, it could be zero.

Sure enough, Robinhood raised $1 billion.

And now, the broker has removed its trading curbs.

-

Church & Dwight Raises Dividend and Beats Earnings

Eddy Elfenbein, January 29th, 2021 at 7:38 amThis morning, Church & Dwight (CHD) reported Q4 earnings of 53 cents per share. That beat the company’s own range of 50 to 52 cents per share.

For 2020, C&D made $2.83 per share. That’s an increase of 14.6% over 2019. The company had been expecting growth of 13%. Full-year net sales grew 12.3% to $4.9 billion. Cash from operating activities increased 14.6% to $990.3 million.

The best news is that Church & Dwight increased its quarterly dividend by 5.2% to 25.25 cents per share. This makes the annual payout $1.01 per share. This is the 25th consecutive year in which Church & Dwight has increased its dividend.

For 2021, C&D expects earnings of $3.00 to $3.06 per share. That’s growth of 6% to 8%. Wall Street had been expecting $3.05 per share.

For Q1, the company sees sales growth of 3.0% and organic sales growth of 2.0%. For EPS, Church & Dwight expects 80 cents per share. The Street had been expecting 86 cents per share.

-

CWS Market Review – January 29, 2021

Eddy Elfenbein, January 29th, 2021 at 7:08 am“I can calculate the motion of heavenly bodies, but not the madness of people.”

– Isaac NewtonThis was the week that an internet message board nearly took over Wall Street. Well, I’m exaggerating—but not by much.

The world of finance has been captivated by the incredible rally in shares of GameStop. Six months ago, this rather unimpressive company was going for about $4 per share. Then the denizens of Wall Street Bets, a Reddit subgroup, took control.

On Wednesday, Game Stop got as high as $483 per share. Less than 90 minutes later, it was going for $112. I’ve never seen anything quite like this. Even the White House said it was “monitoring” the situation. It’s hard to convey the zoo-like atmosphere of this story. Put it this way: one of the more prominent Wall Street Betters goes by the name Roaring Kitty. After that, the story gets a little weird.

Here’s a chart you don’t see every day:

In this week’s issue, I’ll explain it all for you.

Meanwhile, earnings season is underway. So far, five of our Buy List stocks have reported, and all five have beaten earnings. Some of our stocks, like Abbott Labs and Cerner, have jumped to new highs.

In this week’s issue, I’ll discuss the five earnings reports. I’ll also preview six more earnings reports coming next week. If that’s not enough, we also had a Fed meeting this week. But first, let’s look at what the heck happened to GameStop.

Wall Street Bets Takes Over Wall Street

The action in GameStop and some other stocks was so dramatic this week that it’s hard to give it a proper description. I’ll try to explain what happened.

The Reddit message board Wall Street Bets found a winning formula. If you combine a few variables, you can shake an orderly market to its foundations. This requires a stock with a small float, light trading volume, and most importantly, a very heavy short position. Then if you assemble an army willing to buy the share relentlessly, you can shatter the market.

The plan is that the buy orders eventually cause the shorts to cover their positions by buying more shares. That sets off a self-reinforcing cycle. The short-covering causes the price to rise, which in turn, causes more shorts to cover, and the stock keeps rising.

That’s a classic short squeeze, but this time the move was exacerbated by activity from options. Investors who wanted to hedge their call options by buying the underlying stock also added buying pressure. The fancy word for this is a “gamma squeeze.”

The characteristics I’ve described acted like dry kindling. Reddit brought the match. GameStop wasn’t the only stock this happened to. The WSB crowd found a rather disparate group of stocks to play with, such as AMC, Koss and Bed Bath & Beyond (a former Buy List stock). Even Tootsie Roll fell under WSB’s command.

The frenzy extended to the remains of Blockbuster. The company went belly up 10 years ago. That didn’t stop the nearly-worthless shares from rallying more than 700%.

Once the short-covering got media attention, the rally only grew stronger. It was then helped by a tweet from Elon Musk. It seemed that the market had lost control.

One of the many curious aspects of this story is that the WSB crowd believes it is somehow bringing down a slew of corrupt hedge-fund managers and that it’s exposing the Wall Street establishment. They see this as the little guy getting his revenge on a manipulated game.

I find this odd. Certainly a few hedge funds got squeezed hard. In fact, shares of Fiserv were weak the other day. Not for anything the company did, but due to fears that a hedge fund that owns a big chunk of Fiserv would go under—and so have to dump it in a hurry. (This hasn’t come to pass.)

But this is hardly damaging Wall Street. Perhaps 1% of hedge funds are involved. If anything, the heavy volume is good for Wall Street. While some folks on Reddit are making money, the corporate execs at these stocks have made much more. This was hardly class warfare.

On Thursday, Robinhood said it was placing restrictions on trading in GameStop and other heavily-shorted companies. Other brokers did the same. This appears to have come from the clearing houses. I don’t have all the information. No matter. This, too, was used as evidence that Wall Street is plotting against you. It even brought Senator Ted Cruz and Congresswoman Alexandria Ocasio-Cortez into rare agreement. The news of the restrictions helped kill the rally. At least, for a bit.

Everyone, it seemed, wanted to bring out their pet theory to explain what happened. One professor blamed it on a lack of sex (for men, of course). A former SEC commissioner made a clunky comparison with the Capitol Hill Riot. That’s the kind of week it’s been.

The point I want to convey to you is how irrational financial markets can be. I’ll let you in on a secret: finance suffers from physics envy. Finance desperately wants to see itself as a respectable hard science. We have lots of numbers and equations, and even Greek letters to toss around. But that’s a mirage. Why? Because markets are made up of people, and they’re only as rational as people are. That means that markets can go completely haywire, and no equation can explain it.

Ultimately, what is a stock worth? The only answer is, what another guy will pay for it. It’s that simple. If someone wants to pay you $480 for GameStop, well then, that’s the price.

So, what determines what another person is willing to pay you? Beats the heck out of me! That’s all due to a person’s judgement, hopes, fears and vanity. It’s a deep well of mystery.

How did GameStop happen? It just did. It can’t be quantified. There are no easy heroes or villains. The reasons are lost in the shadows of human folly. How can a stock go from $480 to $112 in 84 minutes? I’ve got no clue, but it happened. To borrow from Kipling: “If you can keep your head when all about you are losing theirs…yours is the Earth, and everything that’s in it.”

We’re going to continue to keep our heads about us. Now let’s look at this week’s earnings reports.

Five Buy List Earnings Reports

We had five Buy List stocks report earnings this week. Additionally, Church & Dwight (CHD) is due out on Friday. Here’s an updated look at our Earnings Calendar:

Stock Ticker Date Estimate Result Silgan SLGN 26-Jan $0.53 $0.60 Abbott Labs ABT 27-Jan $1.35 $1.45 Stryker SYK 27-Jan $2.55 $2.81 Danaher DHR 28-Jan $1.87 $2.08 Sherwin-Williams SHW 28-Jan $4.85 $5.09 Church & Dwight CHD 29-Jan $0.52 Thermo Fisher TMO 1-Feb $6.56 Broadridge Financial Sol BR 2-Feb $0.70 AFLAC AFL 3-Feb $1.05 Check Point Software CHKP 3-Feb $2.11 Hershey HSY 4-Feb $1.43 Intercontinental Exchange ICE 4-Feb $1.08 Fiserv FISV 9-Feb $1.29 Cerner CERN 10-Feb $0.78 Disney DIS 11-Feb -$0.44 Moody’s MCO 12-Feb $1.94 Zoetis ZTS 16-Feb $0.86 Stepan SCL 18-Feb $1.08 Trex TREX 22-Feb $0.36 Ansys ANSS 24-Feb $2.54 Middleby MIDD TBA $1.40 Miller Industries MLR TBA n/a After the closing bell on Tuesday, Silgan Holdings (SLGN), our container stock, reported fiscal-Q4 net income of 60 cents per share. That’s an impressive number. Wall Street had been expecting 53 cents per share.

For the full year, Silgan made $3.06 per share. That’s up 42% over last year. It’s also well above Silgan’s earlier estimate of $2.92 to $2.97 per share (which itself was an increase over the prior estimate).

Cash flow from operations rose 19% to $602.5 million. Silgan had free cash flow of $383.5 million. Q4 net sales rose 17.0% to $1.23 billion.

Silgan has a bold forecast for this year. The company sees earnings ranging between $3.30 and $3.45 per share. Going by the midpoint, that’s a 10.3% increase over last year. I’m pleased with Silgan’s performance. SLGN is a buy up to $40 per share.

On Wednesday morning, Abbott Labs (ABT) reported Q4 earnings of $1.45 per share. That beat Wall Street’s forecast by 10 cents per share.

For the year, Abbott earned $3.65 per share. That’s pretty impressive. Last January, Abbott give an earnings range for 2020 of $3.55 to $3.65 per share, so they hit the top end.

The company sees earnings for 2021 of at least $5 per share. That’s earnings growth of 35%. Wall Street had only been expecting $4.37 per share.

For the quarter, Abbott had sales of $10.7 billion. That includes $2.4 billion of COVID-19 diagnostic testing-related sales. Organic sales grew by 28.4%. In Q4, Abbott delivered more than 300 million COVID-19 diagnostic tests. The shares gained more than 5% on Thursday after Raymond James raised the price target on the stock to $126 per share.

I’m lifting our Buy Below price on Abbott Labs to $130 per share. It’s already our #1 performing stock this year.

After the closing on Wednesday, Stryker (SYK) reported fiscal Q4 earnings of $2.81 per share. That beat estimates of $2.55 per share. Compared with last year’s Q4, that’s an increase of 12.9%.

For the quarter, net sales increased by 3.2% to $4.3 billion, although organic sales were down 1.1%.

For the year, Stryker’s EPS fell 10% to $7.43. Stryker still maintains some impressive performance numbers. For example, last year’s operating margin was 24.4%.

For 2021, Stryker sees earnings ranging between $8.80 and $9.20 per share. Wall Street had been expecting $9.13 per share. Unfortunately, given the economic climate, Stryker can’t give quarterly guidance. Stryker remains a buy up to $240 per share.

We had two more earnings reports on Thursday. Let’s start with Danaher (DHR). The company reported Q4 earnings of $2.08 per share. That beat Wall Street’s forecast of $1.87 per share. For the full year, Danaher made $6.31 per share on revenues of $22.3 billion.

Danaher didn’t provide earnings guidance, but it had some general numbers for revenues. For Q1, Danaher sees revenue growth “in the mid to high-teens range.” For all of 2021, the company expects revenue growth “in the low-double digit range.” That’s pretty good.

Rainer M. Blair, President and CEO, said, “For the full year 2020, we achieved nearly 10% core revenue growth, including Cytiva, strong margin expansion, and more than $5 billion of free cash flow.” Danaher is a buy up to $250 per share.

Sherwin-Williams (SHW), the paint folks, reported Q4 earnings of $5.09 per share. Wall Street had been expecting $4.85 per share. For the year, Sherwin made $24.58 per share.

Commenting on the financial results, John G. Morikis, Chairman and Chief Executive Officer, said, “We finished the year strong in the fourth quarter, driven by 9% U.S. and Canada same-store sales growth, continued North American DIY growth and growth in all industrial end markets. My deepest thanks go to our 61,000 employees, who delivered outstanding results in what was an extremely challenging and unpredictable year. For the full year, we delivered record sales, EBITDA and EPS, and we generated over $3.4 billion in net operating cash, which enabled us to return over $2.9 billion to shareholders via dividends and share repurchases. Each of our segments delivered improved segment profit and margin in 2020.

For Q1, Sherwin expects that “sales will increase high single digits.” For the whole year, the company expects “sales to increase mid-to-high single digits.” Sherwin sees full-year earnings ranging between $26.40 to $27.20 per share. The stock remains a buy up to $720 per share.

Six Buy List Earnings Reports Next Week

We have six more earnings reports next week. Let’s start with Thermo Fisher (TMO), which is due to report on Monday. This is one of our new stocks this year.

In October, TMO reported Q3 earnings of $5.63 per share. That creamed Wall Street’s consensus of $4.31 per share. In fact, that helped convince me to add TMO to this year’s Buy List. The company also announced a share-repurchase program of $2.5 billion.

Thermo didn’t provide any earnings guidance, but Wall Street expects $6.56 per share. The stock is currently a little bit above our Buy Below price of $490 per share. I may raise it next week, but I want to see the earnings report first.

Broadridge Financial Solutions (BR) will report on Tuesday. The company had a very strong earnings report in October. For its fiscal Q1, Broadridge earned 98 cents per share. Wall Street had been expecting 63 cents per share.

The best news is that Broadridge increased its earnings guidance for this fiscal year (ending in June). The company now expects earnings growth of 6% to 10%. The previous range was 4% to 10%. Last year, BR made $5.03 per share, so the new guidance works out to a full-year range of $5.33 to $5.53 per share.

For Tuesday, Wall Street’s consensus is for 70 cents per share.

AFLAC (AFL) had a pretty lousy year in 2020, but I’m sticking with the duck. The supplemental-insurance company is scheduled to report on Wednesday. Three months ago, AFLAC gave us a stellar earnings report. AFLAC’s operating earnings rose 19.8% to $1.39 per share. Wall Street had been expecting $1.13 per share.

The duck stock is managing itself well during a challenging time. AFLAC is usually pretty good at giving earnings guidance. For obvious reasons, they can’t now. Wall Street expects Q1 earnings of $1.05 per share. AFLAC should beat that.

Check Point Software (CHKP) expects earnings to range between $2.00 and $2.18 per share and revenues to be between $525 million and $575 million. Gil Shwed, the CEO, said that given the higher level of uncertainty, the company needed to have a guidance range that’s wider than normal. The cyber-security firm said it’s seen an increase of coronavirus vaccine-related hacks. Back-to-school domains have also been a major theme for the bad guys. Wall Street expects earnings of $2.11 per share.

Hershey (HSY) will report on Thursday. The chocolatier expects full-year earnings of $6.18 to $6.24 per share. That’s up 7% to 8% over last year. For the first three quarters of this year, Hershey has made $4.80 per share. That implies Q4 earnings of $1.38 to $1.44 per share. Look for an earnings beat.

Intercontinental Exchange (ICE) will also report on Thursday. Business has been very good lately. The exchange operator recently bought Ellie Mae, and the unit already added to the bottom line during Q3.

For Q3, ICE earned $1.03 which beat estimates by four cents per share. Financial-data revenue rose 6% to $589 million. That’s above their forecast of $575 million to $580 million. ICE’s operating margin runs at 57%, which is amazing.

For guidance, the company covers lots of metrics except EPS. The key I like to watch is their forecast for data revenue. For Q4, ICE sees that as ranging between $590 million and $595 million. The consensus for Thursday is for earnings of $1.08 per share.

That’s all for now. We’re already one trading month into the new year. There will be some key economic reports next week. On Monday, we’ll get the latest ISM Manufacturing report. On Wednesday, ADP will release its report on private payrolls. The initial-jobless-claims report is due out on Thursday. Then on Friday, the government will release its January jobs report. For December, the unemployment rate stood at 6.7%. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Morning News: January 29, 2021

Eddy Elfenbein, January 29th, 2021 at 7:02 amU.S. Oil Industry Seeks Unusual Alliance with Farm Belt to Fight Biden Electric Vehicle Agenda

G.M. Will Sell Only Zero-Emission Vehicles by 2035

How Wall Street Gains from ‘Populist’ Trading Movement

The GameStop Reckoning Was a Long Time Coming

Robinhood, in Need of Cash, Raises $1 Billion From Its Investors

Bitcoin Jumps Above $38,000 as Musk Adds It to Twitter Profile

Dogecoin Soars 370% as Reddit Group Works to Send the Cryptocurrency ‘To The Moon’

Facebook Stock Falls as Zuckerberg Calls Out Apple

SolarWinds Attackers Hit Strategic Targets: Cyber and Tech Firms

New Billionaire Mints Fortune From Humble Lockers

Cullen Roche: Three Things I Think I Think – GAMESTONK!

Michael Batnick: Is this Legal?

Ben Carlson: How Does the GameStop Saga End?

Jeff Carter: Retail Abandons GameStop ($GME)

Joshua Brown: Who the F*** Is Handling Comms For Robinhood LOL

Be sure to follow me on Twitter.

Earnings from Danaher and Sherwin-Williams

Eddy Elfenbein, January 28th, 2021 at 11:20 amWe had two more earnings reports this morning. Let’s start with Danaher (DHR). The company reported Q4 earnings of $2.08 per share. That beat Wall Street’s forecast of $1.87 per share. For the full year, Danaher made $6.31 per share on revenues of $22.3 billion.

For Q1, Danaher sees revenue growth “in the mid to high-teens range.” For all of 2021, the company expects revenue growth “in the low-double digit range.”

Rainer M. Blair, President and CEO, said, “For the full year 2020, we achieved nearly 10% core revenue growth including Cytiva, strong margin expansion, and more than $5 billion of free cash flow.”

Also this morning, Sherwin-Williams (SHW) reported Q4 earnings of $5.09 per share. Wall Street had been expecting $4.85 per share. For the year, Sherwin made $24.58 per share.

Commenting on the financial results, John G. Morikis , Chairman and Chief Executive Officer, said, “We finished the year strong in the fourth quarter driven by 9% U.S. and Canada same store sales growth, continued North American DIY growth and growth in all industrial end markets. My deepest thanks goes to our 61,000 employees who delivered outstanding results in what was an extremely challenging and unpredictable year. For the full year, we delivered record sales, EBITDA and EPS, and we generated over $3.4 billion in net operating cash, which enabled us to return over $2.9 billion to shareholders via dividends and share repurchases. Each of our segments delivered improved segment profit and margin in 2020.

For Q1, Sherwin expects that “sales will increase high single digits.” For the whole year, the company expects “sales to increase mid-to-high single digits.”

Sherwin sees full-year earnings ranging between $26.40 and $27.20 per share.

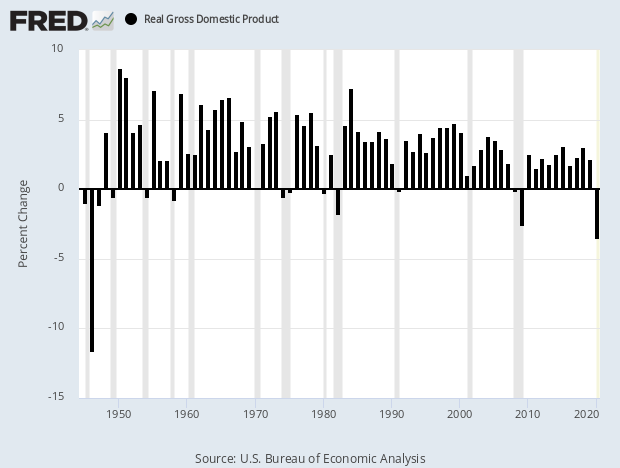

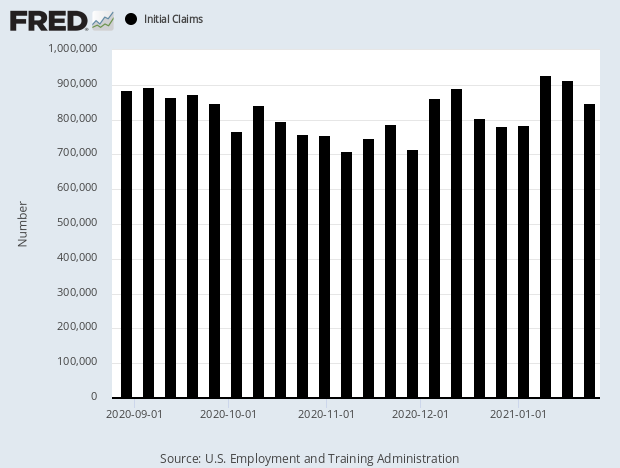

GDP and Initial Claims

Eddy Elfenbein, January 28th, 2021 at 11:04 amWe had two more economic reports this morning. First, the government said that fourth-quarter GDP grew in real terms by 4%. The estimate was for 4.3%.

For the year, the US economy shrank by 3.5%. That made it the worst year for economic growth in 74 years.

The initial claims report was for 847,000. That’s down from last week’s total of 914,000.

Still, the latest claims report showed that the total of Americans receiving unemployment benefits actually rose, jumping to 18.28 million, an increase of 2.29 million from the prior week. That increase is related to the latest fiscal package passed in December, which included extended benefits for displaced workers.

The bounce in consumer spending that had revived job and economic growth through the summer and fall has shown signs of fatigue, as household spending declined for the first time in seven months in November.

That slowdown, thought to be a function of colder weather and record-setting Covid cases, has led to a string of higher-than-expected jobless claims and stagnant unemployment figures.

Morning News: January 28, 2021

Eddy Elfenbein, January 28th, 2021 at 7:03 amU.S. Economy Likely Logged Its Weakest Performance in 74 Years in 2020

Fed Leaves Interest Rates Near Zero as Economic Recovery Slows

‘Dumb Money’ Is on GameStop, and It’s Beating Wall Street at Its Own Game

GameStop Resumes Rally After Reddit Forum Briefly Goes Private

The Hedge Fund Point72 Has Suffered a Nearly 15% Loss Amid the GameStop Frenzy on Wall Street

Big Tech Is Trying to Innovate Beyond the Black Rectangle Dead End

Apple Logs Record Quarterly Smartphone Shipments, Huawei in Freefall

Toyota Overtakes Volkswagen as World’s Biggest Automaker

Tesla Slumps 8% After First Results as a Blue Chip Disappoint

In the Race for Investment Dollars, Cars Are Pulling Ahead

Pandemic Piles On Already Reeling Boeing, Leading To Nearly $12 Billion Loss In 2020

Howard Lindzon: Curb Your Exuberance …A New Show By Larry David

Ben Carlson: What In the World is Going On in the Market Right Now?

Michael Batnick: Animal Spirits: It’s Very Different this Time

Joshua Brown: Hedge Fund “Idea Dinner” With 2 Million Guests & Connect the Dots, Man

Be sure to follow me on Twitter.

Stryker Earns $2.81 per Share

Eddy Elfenbein, January 27th, 2021 at 4:20 pmAfter the closing bell, Stryker (SYK) reported fiscal Q4 earnings of $2.81 per share. That’s a very good number. It beat estimates of $2.55 per share, and it’s a 12.9% increase over last year’s Q4.

For the quarter, net sales increased 3.2% to $4.3 billion although organic sales were down 1.1%.

For the year, Stryker’s EPS fell 10.0% to $7.43. Stryker still maintains some impressive performance numbers. For example, last year’s operating income margin was 24.4%.

For 2021, Stryker sees earnings ranging between $8.80 and $9.20 per share. Wall Street had been expecting $9.13 per share.

As we recover from the pandemic, we expect 2021 organic net sales growth to be in the range of 8% to 10% from 2019, as this is a more normal baseline given the variability throughout 2020, and expect adjusted net earnings per diluted share(2) to be in the range of $8.80 to $9.20. This includes the previously announced 10 cents of dilution driven by the acquisition of Wright Medical for the full year. Consistent with the pricing environment experienced in both 2019 and 2020, we expect continued unfavorable price reductions of approximately 1% in 2021. If foreign currency exchange rates hold near current levels, we expect EPS will be modestly favorable for the full year. This guidance assumes an ongoing recovery in our key geographies leading to more normalized elective procedure levels during the second quarter of 2021. We will not be providing quarterly guidance.

Today’s Fed Statement

Eddy Elfenbein, January 27th, 2021 at 2:01 pmHere’s the latest Fed statement. No rate change.

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

The COVID-19 pandemic is causing tremendous human and economic hardship across the United States and around the world. The pace of the recovery in economic activity and employment has moderated in recent months, with weakness concentrated in the sectors most adversely affected by the pandemic. Weaker demand and earlier declines in oil prices have been holding down consumer price inflation. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy will depend significantly on the course of the virus, including progress on vaccinations. The ongoing public health crisis continues to weigh on economic activity, employment, and inflation, and poses considerable risks to the economic outlook.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer‑term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. In addition, the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage‑backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals. These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Raphael W. Bostic; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Mary C. Daly; Charles L. Evans; Randal K. Quarles; and Christopher J. Waller.

Abbott Labs Earns $1.45 per Share for Q4

Eddy Elfenbein, January 27th, 2021 at 8:55 amThis morning, Abbott Labs (ABT) reported Q4 earnings of $1.45 per share. That beat Wall Street’s forecast by 10 cents per share.

For the year, Abbott earned $3.65 per share. That’s pretty impressive. Last January, Abbott give an earnings range for 2020 of $3.55 to $3.65 per share, so they hit the top end.

Additionally, the company sees earnings for 2021 of at least $5 per share. That’s earnings growth of 35%. Wall Street had only been expecting $4.37 per share.

For the quarter, Abbott had sales of $10.7 billion. That includes $2.4 billion of COVID-19 diagnostic testing-related sales. Organic sales grew by 28.4%. In Q4, Abbott delivered more than 300 million COVID-19 diagnostics tests.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His