Archive for April, 2010

-

Eddy’s Rule on European Monetary Integration

Eddy Elfenbein, April 29th, 2010 at 10:30 amNew rule: Everyone with nice beaches, please leave the eurozone.

(This rule may come in handy if Florida and California are kicked out of the dollar.) -

This Won’t End Well

Eddy Elfenbein, April 28th, 2010 at 6:21 pm

This is a HUGE mistake:Hewlett-Packard Agrees to Buy Palm

Hewlett-Packard has agreed to acquire Palm for $1.4 billion in cash, uniting two companies that have failed to make much recent headway in the smartphone business.

H.P. announced its all-cash purchase of Palm just after the financial markets closed on Tuesday, saying it would pay $5.70 a share. Shares of Palm were down during regular trading on Wednesday, closing at $4.63, and rose in early after-hours trading by 27 percent to $5.90. The $1.4 billion price includes the Series B and Series C shares, most of which are owned by Elevation Partners.

During the last year, shares of Palm have traded as high as $18 a share and as low as $3.65.

Palm listed $400 million in debt at the end of its third quarter, which H.P. would retire using some of the $592 million in cash that Palm has on hand.Let’s look at some of Palm‘s (PALM) recent quarterly results:

Q1 2008: +0.09

Q2 2008: -0.07

Q3 2008: -0.16

Q4 2008: -0.22

Q1 2009: -0.12

Q2 2009: -0.73

Q3 2009: -0.86

Q4 2009: -0.40

Q1 2010: -0.10

Q2 2010: -0.37

Q3 2010: -0.61

That’s not a good tend.

For those of you keeping score at home, Palm was spunoff from 3Com on March 2, 2000.Living up to feverishly high expectations, 3Com’s (COMS) Palm (PALM) division exploded onto the market today, tripling at the open and moving to a high of $165 — up 334% from its offering price of $38 a share. It slid back to around $95.06 by the closing bell, but still stood 150% higher.

The deal — which also included the private placement of shares to AOL (AOL), Motorola (MOT) and Nokia (NOK) — was co-managed by Goldman Sachs and Morgan Stanley Dean Witter. Palm offered 23 million shares, or a 4% stake in the company.At one point, Palm was worth more than 3Com, the company that owned almost all of its shares. Chalk one up for EMH!

By the way, that $165 bolded above is really $1,650 in today’s shares since the company had a 1-for-20 reverse split followed by a 2-for-1 split. HP is agreeing to buy Palm for $5.70.

-

AFLAC Holds Greek and Portuguese Bonds

Eddy Elfenbein, April 28th, 2010 at 3:05 pmOn AFLAC’s earnings call, the company revealed that it holds $1.75 billion in Greek and Portuguese bonds.

Aflac Inc., the world’s largest seller of supplemental health insurance, said it holds almost $2 billion of bonds tied to banks in Greece and Portugal, nations that have been cut by ratings firm on mounting debt.

Aflac has about $1 billion in Greek bank bonds and $750 million issued by Portuguese lenders, Chief Investment Officer Jerry Jeffery said in a conference call today. The insurer also holds about $285 million in Greek sovereign bonds, Jeffery said. Greece is waiting on word of a 45 billion-euro ($59 billion) rescue package from the European Union and the International Monetary Fund after the nation’s credit rating was cut to junk by Standard & Poor’s yesterday. The ratings firm lowered its rating on Greece by three levels to BB+ from BBB+ and warned that investors could recover as little as 30 percent of their initial outlay if it restructures its debt.

Aflac is “looking very carefully” at limits on sovereign debt, Jeffery said. “I still don’t think it’s predictable what’s going to happen with Greece, but there is enormous pressure being applied by the EU and IMF as we speak. It will be very instructive as to how we proceed.” -

Today’s FOMC Statement

Eddy Elfenbein, April 28th, 2010 at 2:41 pmHere’s today’s policy statement:

Information received since the Federal Open Market Committee met in March suggests that economic activity has continued to strengthen and that the labor market is beginning to improve. Growth in household spending has picked up recently but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software has risen significantly; however, investment in nonresidential structures is declining and employers remain reluctant to add to payrolls. Housing starts have edged up but remain at a depressed level. While bank lending continues to contract, financial market conditions remain supportive of economic growth. Although the pace of economic recovery is likely to be moderate for a time, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability.

With substantial resource slack continuing to restrain cost pressures and longer-term inflation expectations stable, inflation is likely to be subdued for some time.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period. The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to promote economic recovery and price stability.

In light of improved functioning of financial markets, the Federal Reserve has closed all but one of the special liquidity facilities that it created to support markets during the crisis. The only remaining such program, the Term Asset-Backed Securities Loan Facility, is scheduled to close on June 30 for loans backed by new-issue commercial mortgage-backed securities; it closed on March 31 for loans backed by all other types of collateral.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Donald L. Kohn; Sandra Pianalto; Eric S. Rosengren; Daniel K. Tarullo; and Kevin M. Warsh. Voting against the policy action was Thomas M. Hoenig, who believed that continuing to express the expectation of exceptionally low levels of the federal funds rate for an extended period was no longer warranted because it could lead to a build-up of future imbalances and increase risks to longer run macroeconomic and financial stability, while limiting the Committee’s flexibility to begin raising rates modestly. -

150 Years of Corporate Bond Defaults

Eddy Elfenbein, April 28th, 2010 at 2:28 pmHere’s a bit of a geeky post. This recent academic paper looks at default rates for corporate bonds over the last 150 years. There are plenty of studies of corporate bond defaults, but none that I know of that go back this far.

The results of the study are pretty interesting. The researchers found that there have been several episodes of high levels of defaults. These episodes are tightly bunched together and they’re separated by many years of very low default rates. The Great Depression wasn’t nearly as bad as some of the 19th century panics. In fact, default periods are only weakly associated with bad economies.

The researches also found that bond spreads are about twice the default rate. Plus, spreads don’t have much forecasting ability although stock market returns and stock volatilities do. They found that over the very long haul, corporate bonds fault about 1.5% of the time. -

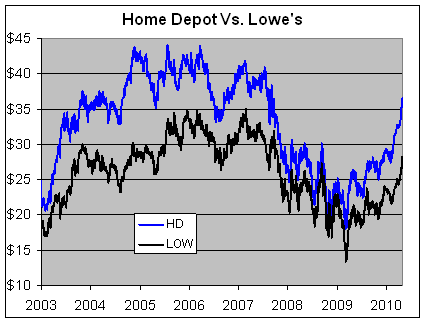

Lowe’s or Home Depot

Eddy Elfenbein, April 28th, 2010 at 1:56 pmAn emailer asks me: “Lowe’s (LOW) or Home Depot (HD)?”

Ooohh, this is a toughy. Both are excellent companies and both have done extremely well over the past 13 months. This means that both have probably made the vast majority of their “easy gains” this cycle.

I would say that Lowe’s and Home Depot are very nearly tied. Both stocks go for almost exactly 19 times this year’s estimate. I’ll give a slight edge to Home Depot since their recent earnings reports have exceeded expectations by a nice margin.

-

SEI Investment’s Q1 Earnings

Eddy Elfenbein, April 28th, 2010 at 10:57 amWe have just one Buy List earnings report. SEI Investments (SEIC) reported Q1 earnings of 31 cents per share. Although this was four cents better than estimates, traders seem displeased. The shares are currently down about 5%.

I’m not sure why the stock is down. Perhaps this is just a near-term sell-off. Today’s report clearly shows that SEIC’s business is bouncing back. The company earned $1.36 per share on 2007. That dropped to $1.22 in 2008 and 94 cents last year. The business is now running well ahead of last year’s result (they made just 18 cents per share in last year’s first quarter). I shouldn’t be too worried about SEIC pulling back. The stock had been making new highs consistently.

I think SEIC has a good shot of making $1.30 a share this year which means it’s still reasonably priced (but not a screaming bargain).

Strangely, AFLAC (AFL) opened nicely this morning but is now in the red. The company reported earnings yesterday.

Tomorrow we’ll have earnings reports from Fiserv (FISV) and Becton Dickinson (BDX). -

Kling on the Senate Hearings

Eddy Elfenbein, April 28th, 2010 at 9:41 amArnold Kling sums it nicely:

Too bad somebody at Goldman could not have called out a Senator. It must have been tempting to say, “Look. You can’t make a market by bending over backwards giving buyers every reason not to buy and sellers every reason not to sell. Sophisticated investors understand how we operate. Just like everybody who goes to play blackjack understands that some of the cards are dealt face down. You can complain that you think all the cards should be face up, but that would totally change the game. Do you hold to such high standards in your election campaigns? Do you think your disclosure of the consequences of your votes is honest? Do you disclose how lobbyists told you to vote? Do you go out of the way in your campaigns to give people all the possible reasons not to vote for you? You want to tell me about my responsibility to my clients? How would you like to hear my opinion about your responsibility to your constituents?”

-

AFLAC’s Earnings

Eddy Elfenbein, April 27th, 2010 at 4:17 pmAfter the bell, AFLAC (AFL) reported first-quarter operating earnings of $1.41 per share. With insurance companies, it’s more important to focus on operating earnings since net earnings can be heavily influenced by investments. The Street was looking for $1.32.

This is what AFL had to say about guidance:With one quarter of the year complete, we continue to believe we are positioned for another year of solid financial performance. Although challenges posed by weak economic conditions clearly persist, particularly in the United States, we still believe our goal for increasing operating earnings per diluted share is reasonable and attainable. As such, our goal remains an increase of 9% to 12% this year in operating earnings per diluted share, excluding the impact of the yen. If the yen averages 90 to 95 to the dollar for the full year, we would expect reported earnings to be in the range of $5.24 to $5.56 per diluted share. Using that same exchange rate assumption, we would expect second quarter operating earnings to be $1.33 to $1.38 per diluted share.

The stock is at $52.41 and they see full-year EPS coming in between $5.24 and $5.56. That’s a forward P/E Ratio of 9.4 to 10. AFLAC is a very good buy.

-

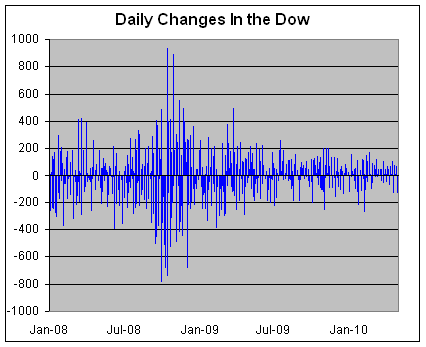

Putting Today In Perspective

Eddy Elfenbein, April 27th, 2010 at 3:30 pmThe Dow is off about 150 right now. I see that people are concerned.

My how we forget what real volatility looks like!

Here’s a look at the daily changes in the Dow since the beginning of 2008:

Update: The Dow closed down 213 points.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His