The Economist Looks at Momentum

The Economist highlights one of my favorite topics—momentum investing. Many studies have shown that once a stock gets going in one direction, the chances are very good that it will keep going. This is something that any practitioner can tell you is obviously true, yet it conflicts with how academics prefer to see the market:

What goes up must come down. It is natural to assume that the law of gravity should also apply in financial markets. After all, isn’t the oldest piece of investment advice to buy low and sell high? But in 2010 European investors would have prospered by following a different rule. Anyone who bought the best-performing stocks of the previous year would have enjoyed returns more than 12 percentage points higher than someone who bought 2009’s worst performers.

This was not unusual. Since the 1980s academic studies have repeatedly shown that, on average, shares that have performed well in the recent past continue to do so for some time. Longer-term studies have confirmed that this “momentum” effect has been observable for much of the past century. Nor is the phenomenon confined to the stockmarket. Commodity prices and currencies are remarkably persistent, rising or falling for long periods.

The momentum effect drives a juggernaut through one of the tenets of finance theory, the efficient-market hypothesis. In its strongest form this states that past price movements should give no useful information about the future. Investors should have no logical reason to have preferred the winners of 2009 to the losers; both should be fairly priced already.

Actually, it doesn’t necessarily drive a juggernaut through the efficient-market hypothesis. Believers in EMH can aver that it’s not the stock that’s following momentum but rather it’s positive news. This is precisely why EMH is hard to knock down–it can be very slippery.

Markets do throw up occasional anomalies—for instance, the outperformance of shares in January or their poor performance in the summer months—that may be too small or unreliable to exploit. But the momentum effect is huge. Elroy Dimson, Paul Marsh and Mike Staunton of the London Business School (LBS) looked at the largest 100 stocks in the British market since 1900. They calculated the return from buying the 20 best performers over the past 12 months and then holding them, rebalancing the portfolio every month.

This produced an annual average of 10.3 percentage points more than a strategy of buying the previous 12 months’ worst performers. An investment of £1 in 1900 would have grown into £2.3m by the end of 2009; the same sum invested in the losers would have turned into just £49 (see chart 1).

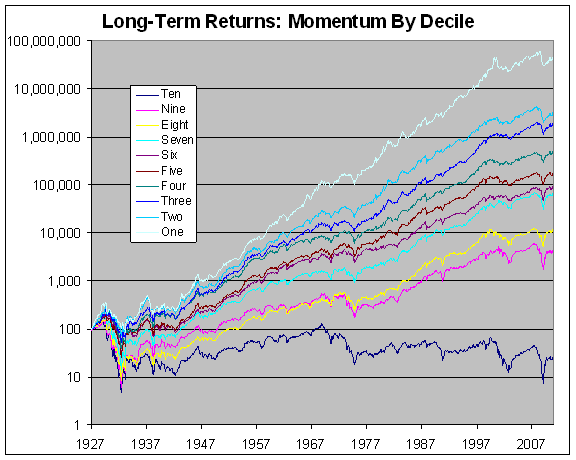

Messrs Dimson, Marsh and Staunton applied a similar approach to 19 markets across the world and found a significant momentum effect in 18 of them, dating back to 1926 in America and 1975 in larger European markets. A study by AQR Capital Management, a hedge fund, found that the American stocks with the best momentum outperformed those with the worst by more than ten percentage points a year between 1927 and 2010 (see chart 2). AQR has set up a series of funds that attempt to exploit the momentum anomaly.

With any strategy like this, we need to be reminded that even if it works, any positive effects are difficult to capture due to trading costs, turnover and taxes. However, even adjusted for this, momentum still holds up.

What I find interesting is that momentum seems to conflict with the other major hole in EMH — value investing. Studies have also shown that stocks with lower valuations outperform the market. So stocks ignored by the market do well and stocks madly embraced by the market do well. Or does it mean that the outperforming value stocks are the momentum stocks? I’ve never been able to reconcile these two phenomena.

More from The Economist:

Once a trend is established, a share may benefit from a bandwagon effect. Professional fund managers have to prepare regular reports for clients on the progress of their portfolios. They will naturally want to demonstrate their skills by owning shares that have been rising in price and selling those that have been falling. This “window-dressing” may add to momentum. Paul Woolley of the London School of Economics has suggested that momentum might result from an agency problem. Investors reward fund managers who have recently beaten the market; such fund managers will inevitably own the most popular shares. As they get more money from clients, such managers will put more money into their favoured stocks, giving momentum an extra boost.

It is hardly a surprise that the momentum effect has been exploited by some professionals for decades. Commodity trading advisers (CTAs), also known as managed futures funds, exist to exploit the phenomenon. They take advantage of trends across a wide range of asset classes, including equities and currencies as well as raw materials. Martin Lueck was one of the three founders of AHL, one of the more successful CTAs, and now works for another trend-follower, Aspect Capital. “Trends occur because there is a disequilibrium between supply and demand,” he says. “The asset is trying to get from equilibrium price A to equilibrium price B.”

Many of the trend-following models were developed in the late 1970s and early 1980s. They were exploited by investors such as John Henry, best known outside the financial world for owning a baseball team, the Boston Red Sox, and a football club, Liverpool (which is on a downward trend of its own). One of the simplest was to buy an asset when the 20-day moving average of its price rose above its 200-day average. In a recent study Joëlle Miffre and Georgios Rallis of the Cass Business School in London found 13 profitable momentum strategies in commodity markets with an average annual return of 9.4% between 1979 and 2004.

Here’s a look at long-term momentum returns by decile (10% slice). The data is from Ken French’s data library.

Notice that the market’s rally over the past two years has been strongly counter-momentum. Stocks that had been doing the worst gained over 265% in just seven months.

Posted by Eddy Elfenbein on January 20th, 2011 at 9:05 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His