Archive for March, 2012

-

The Turnaround at Ford

Eddy Elfenbein, March 31st, 2012 at 7:04 pmThis is from a NYT review of “American Icon: Alan Mulally and the Fight to Save Ford Motor Company.”

In 2008, the Ford Motor Company seemed caught in a death spiral.

The company was hemorrhaging cash — more than $83 million a day — as the bottom fell out of the car market. In late autumn, Ford’s stock price bottomed out at $1.01.

Move forward three years. For 2011, Ford turned a net profit of $20 billion on sales of $128 billion. It distributed profit-sharing payments of about $6,200 to each of 41,600 eligible employees. On Friday, its stock closed at $12.48.

(…)

First, Mr. Mulally knew that Ford could not hope to improve its market performance without simultaneously changing its culture. Some of the book’s most interesting passages deal with his efforts — often one person at a time — to improve accountability and to foster commitment among executives.

Mr. Mulally’s chief instrument here was data-driven management, in which each executive was responsible for consistently knowing and reporting how his — very few women appear in this story — department was performing. Concentrating on consistent metrics, he argued early on, would focus managerial attention on the big picture while increasing transparency.

He eliminated all corporate-level meetings except for two he introduced: the weekly, mandatory business plan review, when the senior team reported its progress on specific goals, and the special-attention review, when executives took up issues needing in-depth consideration. Over time, both meetings — which occurred daily in crucial periods — would become the highway on which Ford’s leaders drove change.

-

Technical Issues

Eddy Elfenbein, March 30th, 2012 at 1:22 pmI apologize for the delay in getting this week’s CWS Market Review emailed out to everyone. We’re having some technical issues that we’re trying to address. Fortunately, we were able to post the text below.

-

CWS Market Review – March 30, 2012

Eddy Elfenbein, March 30th, 2012 at 7:48 amLook at market fluctuations as your friend rather than your enemy; profit from folly rather than participate in it.

— Warren Buffett

Since February 22nd, the S&P 500 has rallied 3.36% while our Buy List is up even more, 4.31%. The lesson is that investors are gradually gravitating to the kinds of high-quality stocks that we favor.

In this week’s issue of CWS Market Review, I want to take a closer look at some of the challenges ahead for Wall Street. I also want to discuss the shellacking that Joey Banks ($JOSB) took on Wednesday. (Ugh!) Finally, I’ll highlight some of the exceptional bargains on our Buy List. As well as we’ve done both in overall terms and against the broader market, I think the Buy List will do even better this spring and summer.

Expect the Market to Enter a Holding Pattern

Now let’s take a closer look at what’s been happening on Wall Street. On Monday, the S&P 500 closed at its highest point since May 2008. But like last week, Wall Street quickly gave back our gains. Actually, the stock market seems to be following the same pattern as last week—up on Monday, down on Tuesday, Wednesday and Thursday.

I think it’s very likely that the market will be in a holding pattern until we clear two important events. The first will be next week’s jobs report. The second will be the first-quarter earnings season which will start during the second week of April. The last earnings season wasn’t too hot, so investors may have grown skeptical.

The stock market has rallied almost consistently since the beginning of October, and much of the recent strength is due to the jobs market. As I’ve explained before, the stock market has become highly focused on the jobs outlook. The reason is that corporate profit margins have been stretched about as far as they can go. Historically, the stock market hasn’t done quite as well after profit margins have peaked. Since inflation is still low, many companies don’t have the market power to raise their prices. As a result, businesses need to get more customers.

The latest jobs news has been pretty good. On Thursday, the Labor Department said that jobless claims fell by 5,000 to 359,000. That’s the lowest reading since April 2008. Wall Street had been expecting a little bit better number, so that may have prompted the sell-off on Thursday. The weekly jobless claims report tends to have a lot of “noise” so economists prefer to look at the general trend which has been very favorable.

But Wall Street is waiting for the big daddy of jobs reports: the Labor Department’s March jobs report. The two big numbers to watch for are non-farm payrolls and the overall unemployment rate. You can be sure that this report will also be closely scrutinized by Governor Romney and President Obama. The March jobs report is due out next Friday, April 6th; and to make matters more dramatic, the stock market will be closed that day for Good Friday. This means we won’t know the market’s reaction until the following Monday.

I was very optimistic for the February jobs report (you might say too optimistic although the future revisions may prove me right). But I’m a bit less sanguine for the March report. My concern is that traders are already factoring in a strong jobs report into current stock prices, and I’d prefer to see the facts before we take action.

Earlier this week, the Grand Poobah of the Fed, Ben Bernanke, said that he was a bit mystified that the economy is creating jobs despite our subdued economic growth. The Bearded One suggested that one possibility is that companies “have become sufficiently confident to move their workforces into closer alignment with the expected demand for their products.” I think that, combined with the catch-up effect, may be correct. This is probably related to our theme that investors have been willing to shoulder more risk. Bottom line: There’s optimism out there, and it will help our portfolios later this spring and summer.

Don’t Give Up on Joey Banks

Now let’s talk about this week’s problem child, Jos. A. Bank Clothiers ($JOSB). The company reported Q4 earnings of $1.78 per share which hit Wall Street’s consensus on the button. On top of that, they wrapped up a very successful year. Sales rose 14.2% to nearly $1 billion. The key metric for the industry is comparable store sales, and that rose by 7.6% last year. Net income increased by 13.6% to $97.5 million and earnings-per-share rose from $3.08 to $3.49. Not many companies have numbers like that.

The problem, however, is what they had to say about the current quarter:

The first quarter of 2012 has started out more slowly than we had planned with declines in both comparable store sales and Direct Marketing sales for the first 8 weeks of the quarter. The declines are primarily due to weaker than expected traffic and also due to the warmer winter weather which is resulting in significantly lower sales of outerwear and cold weather merchandise. We are making marketing changes to address the sales trend. We believe that these changes will be effective and appealing to our customers; however we remain cautious about the outcome of the first quarter of 2012.

The stock dropped 8.55% on Wednesday. I’m disappointed, but I’ll remind you that this has happened before. JOSB often gets knocked around after earnings — good or bad — and eventually recovers. Last June, the stock dropped 13.3% after the company missed earnings by two cents per share. Yet by October, the stock had nearly made up all the lost ground. (The next two earnings reports beat by six cents and by two cents.)

I was pleased to see the stock recover a bit on Thursday. I want investors to play this one safely. I’m lowering my buy price on Jos. A. Bank from $54 to $52.

Our next Buy List earnings report will be from Bed Bath & Beyond ($BBBY) on Wednesday, April 4th. This will be for the all-important holiday quarter. The company has told us to expect earnings to range between $1.28 and $1.33 per share. That’s very doable.

As I explained last week, BBBY’s recent rally has made me slightly queasy on the price. Don’t chase it. Let’s see what the earnings report and guidance are like. For now, Bed Bath & Beyond is a very good buy up to $66 per share.

Outstanding Bargains on Our Buy List

I want to highlight some bargains on the Buy List. A few of our financial stocks have drifted lower recently. AFLAC ($AFL) is below $46 and Nicholas Financial ($NICK) is under $13.50. Both are very good buys. Reynolds American ($RAI) hasn’t done much of anything this year. At $41 per share, the stock yields more than 5.4%. I’m confident we’ll see another dividend increase near the end of the year.

CR Bard ($BCR) is one of our quieter stocks, but it’s climbed steadily all year. We already have a 15.72% YTD gain. Bard has increased its dividend every year since 1972 and it will happen again in a few months. I’m raising my buy price from $96 to $102.

Let me add a quick word on Oracle ($ORCL). If you recall, the stock initially bounced on better-than-expected earnings. Then the stock market had second thoughts and Oracle pulled back below $29 per share. The stock stabilized this week above $29 and I still believe it’s an excellent buy up to $32 per share.

One more thing: Oracle and Google ($GOOG) are about to go to court in a fight over patent issues surrounding Android. The trial will get a lot of attention, but don’t be too worried. Relative to the size of these companies, the dollar amount involved is small potatoes.

That’s all for now. Remember that the market will be closed on Friday, April 6th for Good Friday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: March 30, 2012

Eddy Elfenbein, March 30th, 2012 at 7:09 amEurope Moves to Bolster Firewall to Protect Spain, Italy

Europe Agrees to $1 Trillion Bailout Fund for Euro

Eurozone Inflation Slows Less Than Expected

Greek Leader Puts a Halt To Jockeying Ahead of Vote

Spain Gives Assurances on Austerity Budget

Santander Proves Greenest as No. 2 Bank of America Becomes Solar

Case Based in China Puts a Face on Persistent Hacking

PetroChina Plans ‘Large Scale’ Acquisitions to Expand Output

Large Hedge Funds Fared Well in 2011

Oaktree Capital Files to Raise as Much as $595 Million in IPO

Three Major Banks Prepare for Possible Credit Downgrades

RIM Earnings, Sales Fall Short as BlackBerry Demand Wanes

AIG Targets China Drivers in $50 Billion Insurance Market

Phil Pearlman: Doug Kass and the Housing Recovery

Joshua Brown: Intermarket Correlations – Ten Years Ago and Today

Be sure to follow me on Twitter.

-

Bernanke’s Third Lecture

Eddy Elfenbein, March 29th, 2012 at 12:55 pmHere’s the third installment of Ben Bernanke’s lecture series at GW.

-

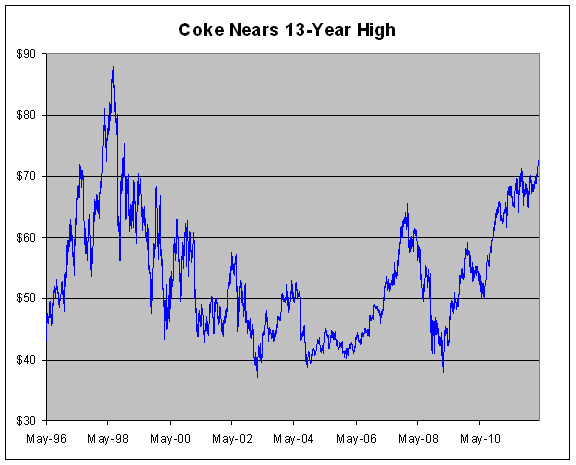

Coke Nears All-Time High

Eddy Elfenbein, March 29th, 2012 at 10:30 amAlthough the stock market is down this morning, shares of Coke ($KO) are at a 52-week high. In fact, the stock is at its highest point in more than 13 years. It’s interesting that the company hasn’t been able exceed its high from July 1998.

When you look at the chart, it’s interesting to see how much smoother the line has become over the years. It’s gone from highly jagged to pretty stable.

-

Is the U.S. Economy Still Accelerating?

Eddy Elfenbein, March 29th, 2012 at 9:56 amThat’s the big question: Is the rate of growth of the U.S. economy still increasing?

It may sound odd to many to say that the U.S. economy is not only growing but also it’s accelerating. But I assure you that’s what happened during much of 2011.

Bear in mind that the economy went from near-0% growth to very mediocre growth, but that still counts as acceleration. Check out the last four bars on this chart:

The government updated its Q4 GDP report this morning to show no change in its original number that the economy grew, in real terms, by 3.0% for the final three months of 2011.

But growth for this quarter may come in below that. The major bright spot is that jobless claims continue to decline. Today’s report showed that, once again, jobless claims fell to their lowest point since April 2008. The Labor Department said that claims fell by 5,000 to 359,000. Wall Street was expecting an better number of 350,000.

The fact that it was slightly below expectations may be the reason the market is down this morning. The S&P 500 is currently at 1,397 which is down about eight points from yesterday’s close.

-

Muppets Vs. Goldman Sachs

Eddy Elfenbein, March 28th, 2012 at 10:48 amFrom Funny or Die

HT Josh Brown

-

Joey Bank Drops After Earnings Report

Eddy Elfenbein, March 28th, 2012 at 10:12 amShares of Jos. A. Bank Clothiers ($JOSB) are down sharply today after the company reported fiscal Q4 earnings of $1.78 per share. The stock has been down as much as 10% today. Despite the sharp drop in the stock, the earnings were inline with Wall Street’s forecast.

In the earnings report, the CEO warned:

The first quarter of 2012 has started out more slowly than we had planned with declines in both comparable store sales and Direct Marketing sales for the first 8 weeks of the quarter. The declines are primarily due to weaker than expected traffic and also due to the warmer winter weather which is resulting in significantly lower sales of outerwear and cold weather merchandise. We are making marketing changes to address the sales trend. We believe that these changes will be effective and appealing to our customers; however we remain cautious about the outcome of the first quarter of 2012.

The company just wrapped up a very strong year. Sales rose 14.2% to nearly $1 billion. The key metric for the industry is comparable store sales, and that rose by 7.6% last year. That’s very good. Net income increased by 13.6% to 97.5 million, and earnings-per-share rose from $3.08 to $3.49.

I’d urge shareholders not to be too worried about today’s sell-off. The stock often gets knocked around after earnings — good or bad — and eventually recovers. Last June, shares of JOSB dropped 13.3% after the company missed earnings by two cents per share. Yet by October, the stock had nearly made up all the lost ground. (The next two earnings reports beat by six cents and by two cents.)

I’m going to lower my buy price from $54 to $52 per share.

-

Morning News: March 28, 2012

Eddy Elfenbein, March 28th, 2012 at 8:13 amECB: Private-Sector Loan Growth Slows In February

Italy Sells Bills at Lowest Since 2010 as Crisis Concerns Ease

News Corp. Piracy Claims Are Serious, Australia Says

Total Downplays Risks From North Sea Leak

Disasters Hit Lloyd’s of London

Brent Breaches $125 on Crude Stocks Rise, Possible Release

Gross Says Credit Expansion to Create Inflation, Slow Growth

Consumer Confidence in U.S. Holds Close to One-Year High

Court Considers Health Law Fate If Coverage Rule Voided

Knowing Cost, the Customer Sets the Price

Pentair, Tyco’s Flow Unit Plan $4.53 Billion Combination

Magic Johnson Group to Buy L.A. Dodgers for $2 Billion

Foxconn Counts on Apple’s Future Through Sharp Investment

Roger Nusbaum: Volatility is Not an Asset Class

Epicurean Dealmaker: Altar of a Minor God

Be sure to follow me on Twitter.

- Tweets by @EddyElfenbein

-

-

Archives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His