Archive for December, 2013

-

The 2014 Buy List

Eddy Elfenbein, December 31st, 2013 at 8:05 pmHere are the 20 stocks for the 2014 Buy List. It’s locked and sealed and I can’t make any changes for 12 months.

For tracking purposes, I assume the Buy List is a $1 million portfolio that’s equally divided among 20 stocks. Below are all 20 positions with the amount of shares for each and the closing price for 2013. Whenever I discuss how the Buy List is doing, the list below is what I’m referring to.

Company Ticker Price Shares Balance AFLAC AFL $66.80 748.5030 $50,000.00 Bed Bath & Beyond BBBY $80.30 622.6650 $50,000.00 CA Technologies CA $33.65 1485.8841 $50,000.00 Cognizant Technology Solutions CTSH $100.98 495.1476 $50,000.00 CR Bard BCR $133.94 373.3015 $50,000.00 DirecTV DTV $69.06 724.0081 $50,000.00 eBay EBAY $54.87 911.2448 $50,000.00 Express Scripts ESRX $70.24 711.8451 $50,000.00 Fiserv FISV $59.05 846.7401 $50,000.00 Ford Motor F $15.43 3240.4407 $50,000.00 IBM IBM $187.57 266.5671 $50,000.00 McDonald’s MCD $97.03 515.3045 $50,000.00 Medtronic MDT $57.39 871.2319 $50,000.00 Microsoft MSFT $37.41 1336.5410 $50,000.00 Moog MOG-A $67.94 735.9435 $50,000.00 Oracle ORCL $38.26 1306.8479 $50,000.00 Qualcomm QCOM $74.25 673.4007 $50,000.00 Ross Stores ROST $74.93 667.2895 $50,000.00 Stryker SYK $75.14 665.4245 $50,000.00 Wells Fargo WFC $45.40 1101.3216 $50,000.00 There are five new stocks and five stocks that I’m removing. The five new stocks are eBay ($EBAY), Express Scripts ($ESRX), IBM ($IBM), McDonald’s ($MCD) and Qualcomm ($QCOM).

The five stocks I’m removing are FactSet Research Systems ($FDS), Harris ($HRS), JPMorgan Chase ($JPM), Nicholas Financial ($NICK) and WEX Inc. ($WEX).

The average market cap is $80 billion. That ranges from a high of $312 billion for Microsoft ($MSFT) to $3 billion for Moog ($MOG-A).

Thirteen of the twenty stocks pay dividends. The average yield is 1.35%.

Only four stocks have remained on the Buy List for all eight years: AFLAC ($AFL), Bed Bath & Beyond ($BBBY), Fiserv ($FISV) and Medtronic ($MDT).

The 2013 Buy List

Eddy Elfenbein, December 31st, 2013 at 6:04 pmThe 2013 trading year has come to a close, and it was a great year for Wall Street and our Buy List.

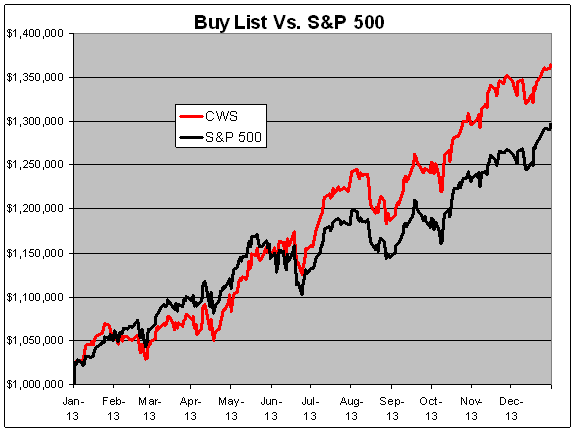

For the year, our Buy List gained 36.42%. Including dividends, we gained 38.48%. This was the seventh year in a row in which we beat the S&P 500.

The S&P 500 gained 29.60%. Including dividends, the index gained 32.39%. The dividend yield of our Buy List was 1.51%. For the S&P 500, it was 2.15%. The Buy List’s “beta” was 1.0067.

All 20 stocks on the Buy List rose this year. The #1 performer was Moog ($MOG-A) which gained 65.59%. The worst was Oracle ($ORCL) which gained 14.83%.

Over the eight-year history of our Buy List, our total compounded gain, including dividends, is 124.71%. For the S&P 500, the total return is 75.62%.

I’ll restate the rules of the Buy List. I choose a portfolio of 20 stocks at the beginning of the year. After that, the Buy List is locked for the year and I can’t make any changes until the following year. For tracking purposes, I assume that the Buy List is a $1 million portfolio equally divided among the 20 stocks. You can check the performance of the Buy List anytime at our Buy List page.

My goal is to show investors that by choosing stocks wisely and by sticking with high-quality stocks, they can beat the market—and that’s exactly what we’ve done.

Here’s how each stock performed:

Stock Shares 12/31/2012 Beginning 12/31/2013 Ending Profit/Loss AFL 941.2651 $53.12 $50,000.00 $66.80 $62,876.51 25.75% BBBY 894.2944 $55.91 $50,000.00 $80.30 $71,811.84 43.62% CA 2,274.7953 $21.98 $50,000.00 $33.65 $76,546.86 53.09% CTSH 676.7731 $73.88 $50,000.00 $100.98 $68,340.55 36.68% BCR 511.5613 $97.74 $50,000.00 $133.94 $68,518.52 37.04% DTV 996.8102 $50.16 $50,000.00 $69.06 $68,839.71 37.68% FDS 567.7947 $88.06 $50,000.00 $108.58 $61,651.15 23.30% FISV 1,265.3422 $39.515 $50,000.00 $59.05 $74,718.46 49.44% F 3,861.0039 $12.95 $50,000.00 $15.43 $59,575.29 19.15% HRS 1,021.2418 $48.96 $50,000.00 $69.81 $71,292.89 42.59% JPM 1,137.1390 $43.97 $50,000.00 $58.48 $66,499.89 33.00% MDT 1,218.9176 $41.02 $50,000.00 $57.39 $69,953.68 39.91% MSFT 1,871.9581 $26.71 $50,000.00 $37.41 $70,029.95 40.06% MOG-A 1,218.6205 $41.03 $50,000.00 $67.94 $82,793.08 65.59% NICK 4,032.2581 $12.40 $50,000.00 $15.74 $63,467.74 26.94% ORCL 1,500.6002 $33.32 $50,000.00 $38.26 $57,412.96 14.83% ROST 924.3853 $54.09 $50,000.00 $74.93 $69,264.19 38.53% SYK 912.0759 $54.82 $50,000.00 $75.14 $68,533.38 37.07% WFC 1,462.8438 $34.18 $50,000.00 $45.40 $66,413.11 32.83% WEX 663.3939 $75.37 $50,000.00 $99.03 $65,695.90 31.39% Total $1,000,000.00 $1,364,235.66 36.42% Note that Fiserv split 2-for-1 on December 17.

Here’s how the Buy List performed throughout the year:

Home Prices Rise the Most in Seven Years

Eddy Elfenbein, December 31st, 2013 at 11:33 amHome prices in 20 U.S. cities rose in October from a year ago by the most in more than seven years, signaling the real-estate rebound will keep bolstering household wealth in 2014.

The S&P/Case-Shiller index of property prices in 20 cities climbed 13.6 percent from October 2012, the biggest 12-month gain since February 2006, after a 13.3 percent increase in the year ended in September, a report from the group showed today in New York. The median projection of 22 economists surveyed by Bloomberg called for a 13.5 percent advance.

A dwindling inventory of foreclosed properties has helped restrict the supply of homes for sale, pushing up prices even as higher mortgage rate cool demand. The real-estate market will probably get its next boost from gains in employment that are lifting consumer confidence in the economic expansion.

“Prices are mostly being supported by a slower rate of foreclosures, smaller share of distressed housing transactions and low levels of inventories,” Ryan Wang, an economist at HSBC Securities USA Inc. in New York, said before the report. “We’ll see a smaller increase in 2014, but low inventory levels should help prices recover a bit more.”

The folks inside the Fed are certainly paying attention. What’s remarkable is that home values are rising as the average mortgage rate has jumped from 3.35% to 4.48% in the past year.

The Final Day of 2013

Eddy Elfenbein, December 31st, 2013 at 9:30 amToday is the final trading day of 2013. This has been a fantastic year for the stock market. Yesterday, the Dow made its 51st record close of the year. The market looks to open higher today as well.

Outside of it being the end of the year, there isn’t much economic news or news on our stocks this week. Yesterday, Bed Bath & Beyond (BBBY) finally cracked $80 per share. I’m glad to see that Harris (HRS) will be leaving our Buy List on a high. The shares are up 70% from its April low.

The next big event for Wall Street will be next week’s jobs report. After that, the fourth-quarter earnings season will begin. Until then, there will be a lot of year-end positioning.

Morning News: December 31, 2013

Eddy Elfenbein, December 31st, 2013 at 6:30 amChina Debt Swelling Adds Urgency to Xi’s Fiscal Repair Job

Latvia to Join Euro Zone: What You Should Know

American-Style Start-Ups Take Root in India

At 20 Years, NAFTA Didn’t Close Mexico Wage Gap

Gold With Silver Heading for Worst Year Since ’81 on Asset Sales

Congress Letting 55 Tax Breaks Expire at Year’s End

Wells Fargo to Pay $591 Million to Fannie Mae

Deutsche Telekom’s New CEO Faces Twin Tests

Crocs Rally Has Legs, Supported by Blackstone’s $200 Million

Updating Facebook’s Profile: It’s Getting Older

Apollo’s Failed Deal for Cooper Sows Doubt on Future Indian M&A

JPMorgan’s Mistake Was Not Hiring Chinese Princelings Fast Enough

UPS Holiday Season Fiasco: A Failure of Strategic Planning

Jeff Carter: Networks Are Not New

Roger Nusbaum: The Best Financial (and Life) Advice I Ever Got

Be sure to follow me on Twitter.

Morning News: December 30, 2013

Eddy Elfenbein, December 30th, 2013 at 7:07 amEurozone Set for Volatile 2014 as It Tackles Banks

France’s Constitutional Council Okays “Millionaire Tax” Despite Rich’s Refusal

Tokyo’s Nikkei Index Soars 57% in 2013, Best in Four Decades

Mixed Messages on Mountain of Debt Confuse China’s Markets

Won at 5-year High Vs. Yen to See Strong 2013 Amid Weak Asia Forex

Hong Kong, China to Sign Cross-Border Funds Deal

Why Economic Growth Alone Won’t Fire Up Oil in 2014

Bitcoin Gang Gets 67 New E-Currencies; Value Grows to $13 Billion

Regulators Reviewing Volcker Rule Provision

SEC Pushes U.S. Insurers for Details on ‘Captives’

Vestas 400% Gain Can’t Suppress Buy Ratings at 3-Year High

On Defensive, JPMorgan Hired China’s Elite

Joshua Brown: My ‘Wolf of Wall Street’ Review

Jeff Miller: Weighing the Week Ahead: How Should Investors Judge the Prospects for 2014?

Be sure to follow me on Twitter.

Johnny Cash: Don’t Think Twice It’s Alright

Eddy Elfenbein, December 27th, 2013 at 9:14 pmCWS Market Review – December 27, 2013

Eddy Elfenbein, December 27th, 2013 at 9:01 amIn last week’s CWS Market Review, I unveiled the 20 stocks for next year’s Buy List. This week, I want to discuss the changes we’re making in greater detail.

The five new stocks are eBay ($EBAY), Express Scripts ($ESRX), IBM ($IBM), McDonald’s ($MCD) and Qualcomm ($QCOM). Remember that the new Buy List goes into effect at the start of trading on Thursday, January 2. For tracking purposes, the Buy Prices will be the closing prices on Tuesday, December 31. I’ll have complete details on the blog.

I want to remind investors that good stocks often appear as dented merchandise. The question we should ask is, how severe and lasting is the damage? With each of the new buys, my analysis tells me the issues are manageable and the prices are well worth it.

Whenever I release my Buy List changes, I often get people asking me if I’ve completely lost my mind. Last year, for example, many readers questioned my selection of Microsoft ($MSFT). They told me all the mistakes the company had made, but what’s interesting is that very few people mentioned the price. Sure, any company can have problems. But as investors, we’re always looking at the impact those problems have on share price. Fortunately for us, MSFT has been a 40% winner this year.

Now let’s look at our five new buys.

Our Five New Buys for 2014

In less than 20 years, eBay ($EBAY) has grown to become the largest marketplace in the world. It’s a truly phenomenal business. The online auction house will generate revenue of $16 billion this year. I’m not a pure value investor and I think there are times where it’s worthwhile to pay a premium for growth; eBay is a good example ($CTSH is another). Wall Street expects eBay to earn $3.14 per share next year, which means the stock is going for about 17 times earnings. That’s above the market, but it’s not a gigantic premium. I like the current valuation. eBay’s revenues will rise about 15% this year, and the Street sees another 14% increase next year. Bottom line: You’re getting a strong brand for a good price.

Express Scripts ($ESRX) is a pharmacy benefit management company. It’s a very large outfit with more than 30,000 employees and a market value of $56 billion. Last year, Express Scripts bought Medco Health Solutions which had been spun-off by Merck ten years ago. Large deals like that are usually hard to digest and ESRX has been a market laggard recently. The stock got dinged a few weeks ago when it missed earnings by a penny per share. The shares have rebounded lately, but it’s still a very solid buy. Truthfully, I’ve wanted to add ESRX to the Buy List for many years, but I’ve always thought it was too expensive. The price action over the last two years tells me I was right. Now’s our chance. This is a strong company and it could be a breakout winner next year.

Few companies have taken as much abuse as IBM ($IBM) has recently. The stock gradually drifted lower over the last year. What else can be said about Big Blue? It’s one of the largest multinational tech companies in the world. IBM is involved in just about every facet of business technology. Without exaggeration, IBM makes some of the largest and smallest technologies on the planet. Their earnings have been pretty good. IBM said their goal is to earn $20 per share by 2015. They’re aiming to return $70 billion to shareholders by then ($50 billion in buybacks, $20 billion in dividends). I know that investors are skittish of stocks with high nominal share prices. Try not to let that scare you away from IBM. Even if you only pick up a few shares, IBM is a outstanding company.

McDonald’s ($MCD) is probably the unlikeliest of the five new buys. It’s not the kind of stock I’m usually drawn to, but the valuation and generous dividend yield made me a believer. Again, it’s a strong brand name trading at a discounted value. Make no mistake: McDonald’s is working through some problems, but it’s nothing they can’t handle. Wall Street hates MCD right now which is one of the reasons why I like it. As of Thursday’s close, the stock yields 3.3%. They’ve increased the dividend every year since 1976.

Qualcomm ($QCOM) is good value play in the tech sector. The company has no debt and it generates tons of cash. The shares are currently going for less than 14 times next year’s earnings. I’ve also been very impressed with QCOM’s management.

The Five Stocks We’re Deleting

Now let’s run through the five stocks being deleted. Note that I am referring to these stocks as “deletions” not as sells – I don’t believe there’s a pressing need for investors to ditch any of these five positions.

FactSet Research Systems ($FDS) has been one of my favorite Buy List stocks. There aren’t many companies whose earnings trend is as smooth as FDS’s. Unfortunately, I think the price here is just too much. The stock is going for 23 times trailing earnings. I wouldn’t mind adding FDS again to a future Buy List. Actually, this time was the stock’s second visit to our Buy List.

Harris ($HRS) has been a wonderful investment for us. The communications equipment stock is up over 42% on the year for us, and it just hit a new all-time high. My concern is that the business environment for HRS will be much more challenging over the next few years (government spending in particular). I have little doubt that Harris can handle these challenges well, but for now, I’d prefer to focus on companies with better prospects.

JPMorgan Chase ($JPM) was a difficult call for me. We’ve done well with JPM and I still think the bank is a good value. However, the headline news and behavior of Jamie Dimon were just too much to bear. Ideally, I’d like to see JPM break itself up. I think that would be a huge benefit for investors, and I would certainly be interested in any of the Baby JP’s. I hope to see another big dividend increase in 2014.

Nicholas Financial ($NICK) was the easiest decision to make. As I’ve mentioned before, I’m not a fan of the “buy under” deal they made, but there doesn’t seem to be anything we can do. The buyer, Prospect Capital ($PSEC) seems to be a well-run closed-end fund with a rich dividend. The buyout is scheduled to take place in April at $16 per share. One benefit is that trading in PSEC is far more liquid than trading in NICK.

WEX Inc. ($WEX) was one of our more unusual stocks this year. The company provides payment processing info for vehicle fleets. WEX got off to a horrible start and was down 10% by early May. After that, the stock rallied dramatically off its low. The company posted good earnings, and the last report was particularly strong. This is a good company, but I think the price is a bit rich here.

Some of the other finalists for the 2014 Buy List were AbbVie ($ABBV), Target ($TGT), CVS Caremark ($CVS), Citigroup ($C), DaVita ($DVA), Transocean ($RIG) and Triumph Group ($TGI).

I’ll send out the next issue of CWS Market Review on Wednesday, January 1. The market is closed that day, but I’ll give you final results on the Buy List. I’ll also give you the Buy Below prices for our new Buys.

The Second-Best GDP Report in the Last 30 Quarters

On Thursday, the S&P 500 rose for the fourth day in a row. The index closed at yet another all-time high. Through Thursday, the Buy List is up 36.07% on the year compared with 29.16% for the S&P 500 (not including dividends).

There wasn’t much news this past week, but I wanted to mention last Friday’s GDP report. The government revised higher GDP growth for the third quarter up to 4.1%. That’s the second-best GDP number in the last 30 quarters (see chart below). Of course, it’s just a start, but if the economy can average around 4% for the next, say, three years, then we can finally make a serious dent in our sagging labor market.

The GDP report also confirms many of the other indicators we’ve seen, such as the stronger ISM reports, outperforming cyclical stocks and the spread between 2-year and 10-year Treasuries. The ISM report for November was the best report in over two years. Next Thursday, we’ll get the ISM report for December, and I’ll be very curious to see if the strong trend continues.

Fourth-quarter earnings season is set to begin in just two weeks. According to numbers from S&P, earnings for Q3 hit an all-time record. Much of the increase in EPS was driven by share buybacks which reduces the number of outstanding shares. For Q4, Wall Street expects earnings of $28.35 (that’s an index-adjusted number). At the start of the year, analysts were expecting Q4 earnings of $29.63. AS far as reductions go, that’s more modest than what we saw for earlier quarters this year. If profits come in line, that will come out to full-year earnings for 2013 of $107.40. That means the S&P 500 is currently going just a bit over 17 times earnings.

Despite the quiet week for trading, I wanted to comment on a few stocks. Does anyone else remember eighteen months ago when Bed Bath & Beyond ($BBBY) crashed 17% in one day? I do. That certainly cleared out a lot of traders. On Thursday, the stock broke out to a new all-time high and came within a few pennies of touching $80 per share. Good stocks bend, but they don’t break.

BBBY’s next earnings report, which will be for their fiscal Q3, is due to come out on January 8. The company has given us a range of $1.11 to $1.16 per share. For the full year, they expect earnings to range between $4.88 and $5.01 per share. I think they’re probably being a tad conservative. I expect BBBY to top $5 per share without much difficulty. This is an excellent company. BBBY is a buy up to $83 per share.

How about the rebound in Oracle ($ORCL)? It’s about time! ORCL had a tough year in 2013, but I think it will beat the market soundly in 2014. Oracle remains a buy up to $39 per share.

Before I go, I want to raise a few Buy Below prices. Fiserv ($FISV) has been on a roll after its split. I’m bumping up my Buy Below to $61 per share. Moog ($MOG-A) is closing in on being a 70% winner on the year. I’m raising our Buy Below by $3 to $71 per share. Lastly, I’m going to raise DirecTV’s ($DTV) Buy Below to $72 per share.

That’s all for now. The trading year ends next Tuesday. On Wednesday, the stock market will be closed for New Year’s Day. On Wednesday evening, I’ll send out our year-end issue which will run down how well our Buy List did. I’ll also include the Buy Belows for the new stocks. The important ISM report comes out on Thursday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Morning News: December 27, 2013

Eddy Elfenbein, December 27th, 2013 at 7:13 amFastest Japan Inflation Since ’08 Stokes Wage Pressure

China Moves to Cool Bitcoin Trade but Heat Lingers

Foreigners Unload Turkey Bonds as Probe Tarnishes Erdogan Growth

France’s ‘Culture Tax’ Could Hit YouTube and Facebook

10-Year Treasury Yield Touches 3%

Fewer Than Forecast File for Unemployment Benefits

U.S. Holiday Sales Rise 3.5% on Discounts SpendingPulse Says

GM to Recall Around 1.5 Million Vehicles in China

Textron Combats Jet Slump With $1.4 Billion Buyout of Beechcraft

Microsoft’s Nokia Deal Said to Face China Limits on Patent Fees

Audi Plans $30.3 Billion in Investments to Challenge BMW

Amazon Sets Record Sales In Holiday Season 2013; Here Is A Glimpse Into What Customers Bought Most

Realistic Financial Resolutions for 2014

Cullen Roche: CBOE SKEW Index Spikes to Bearish Levels

Be sure to follow me on Twitter.

The 10,000-Point Rally

Eddy Elfenbein, December 26th, 2013 at 3:39 pmThe Dow got as high as 16,482.37 today. The low for the Dow on March 6, 2009 was 6,470.00. That means the index has gained 10,012.37 points.

- Tweets by @EddyElfenbein

-

-

Archives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His