Archive for October, 2014

-

S&P 500 = 2,018.05

Eddy Elfenbein, October 31st, 2014 at 4:21 pmThe S&P 500 closed the week and month at 2,018.05. That’s the highest close ever. The S&P 500 is up 9.18% for the year. The total return index, which includes dividends, is up 10.99% for the year.

Six of our Buy List stocks hit new highs today: CR Bard ($BCR), Fiserv ($FISV), Medtronic ($MDT), Moog ($MOG-A), Ross Stores ($ROST) and Stryker ($SYK).

-

The Stock Market Soars Above 2,000

Eddy Elfenbein, October 31st, 2014 at 11:54 amToday is a very good day for stocks. The big news was that Japan announced massive new stimulus measures.

The S&P 500 has been as high as 2,017.45 this morning which is less than two points away from its all-time intra-day high. The index is on track to close above its all-time high close of 2,011.36 set on September 18.

Thanks to its good earnings report, Moog ($MOG-A) is leading the Buy List today. The shares have been as high as $79.24 which is a gain of 6.2%. I also see that Ross Stores ($ROST) hit $82 per share which is a fresh high for them.

-

Moog Earns $1.12 per Share

Eddy Elfenbein, October 31st, 2014 at 9:16 amMoog ($MOG-A) just reported earnings of 93 cents per share for its fiscal fourth quarter (the September quarter). That includes a 19-cent charge, so the adjusted figure is $1.12 per share which beat estimates of $1.08 per share.

“Fiscal ’14 was a very respectable year for our company, given the challenging market conditions we faced,” said John Scannell, Chairman and CEO. “Earnings were up and cash flow was very strong. Our financial position allowed us to buy back 4 million shares of stock. In a year with little top-line growth, our employees put in a tremendous effort to deliver on our commitments to both our customers and our investors and I thank them for their hard work and dedication. As we look forward, we are projecting a stronger fiscal ’15 with earnings per share of $4.25, up 21% from fiscal ’14 on sales growth of about 1%.”

-

CWS Market Review – October 31, 2014

Eddy Elfenbein, October 31st, 2014 at 7:08 am“Sometimes the hardest thing to do is to do nothing.” – David Tepper

I’m happy to report that my favorite investment strategy, doing absolutely nothing, has been very successful of late. The S&P 500 has rallied on nine of the last 11 trading days. On Thursday, the index closed at 1,994.65, which is a dramatic turnaround from the intra-day low of 1,820.66 which we hit just two weeks ago.

The stock market has regained nearly everything it lost during the mini-panic of early October. On Thursday afternoon, the S&P 500 came within 0.6 points of touching 2,000 for the first time in more than a month. Several of our Buy List stocks, like CR Bard, Stryker and Medtronic, recently broke out to new 52-week highs. The sudden reversal clearly upset a lot of market bears. I’m often surprised by how many people are disappointed that the world didn’t end.

The big economic news this week was that the Federal Reserve announced that Quantitative Easing will finally come to an end. This has been a hugely misunderstood policy. I’ll tell you what this means for the market and our portfolios. We also had some very good Buy List earnings this week. AFLAC not only beat earnings, but it raised its dividend as well. Fiserv beat earnings, raised guidance and broke out to a new 52-week high. Later on, I’ll preview our remaining Buy List earnings reports. But first, let’s look at what Janet Yellen and her friends at the Fed had to say this week.

QE Finally Comes to an End

The Federal Reserve met earlier this week, and as expected, the central bank announced the end of Quantitative Easing. This was hardly a surprise since the Fed has been gradually tapering its asset purchases for nearly a year.

Let’s take a step back and review what QE was all about. Since the economy was in such poor shape, the Fed responded to the financial crisis by lowering interest rates. The problem was that rates were already near 0%, and they couldn’t go any lower, yet the economy needed more help. Several models indicated that interest rates need to be negative by a few percentage points.

The Fed then decided that the best way to simulate negative rates would be by buying bonds. Lots and lots of bonds. The Fed had tried bond-buying twice before but had exited both efforts. Then in September 2012, Ben Bernanke embarked on round three, but this one was different. The Fed said it would buy tons of bonds, and it wouldn’t stop until things got better. No timeline. That was a strong message the market needed to hear. The Fed’s plan was that each month, it would buy $45 billion worth of Treasuries and $40 billion worth of mortgage-backed securities.

The goal of QE was to lower interest rates and thereby help the housing market. Economists are divided on the efficacy of all this bond-buying. Of course, economists are divided on nearly everything. Personally, I’m a pragmatist. I don’t know if QE helped, did nothing or even caused more pain, but I can’t help noticing that the stock market liked QE a lot. Any pro-QE announcement (or rumor) could send shares soaring, while any hint that it would end would cause a rash of sell orders. That’s all the evidence I need.

In addition to helping the stock market, I think QE also gave a boost to riskier assets at the expense of more secure ones. Or at least, those that are perceived as being more secure. Gold, for example, has not done well over the third round of QE. The yellow metal rallied to over $1,920 per ounce three years ago, and it’s been a painful ride ever since. On Thursday, gold closed below $1,200 per ounce.

We’re in an unusual situation for the market and the economy. For the last few years, the market has done well while the economy has experienced a very tepid recovery. Now it looks as if the economy is poised to do better, but the market probably won’t be able to repeat such stellar gains.

On Thursday, the government announced that the economy grew by 3.5% in the third quarter. That’s a good number, but some of the details were pretty mediocre. Personal consumption only grew by 1.8%. Frankly, that’s kinda blah. Here’s what’s happening: At first, the economic recovery was held back by the dead weight of the housing market. Then it was held back by austerity by state and local governments. Fortunately, we’re now past both those hurdles, so I expect to see better economic growth in the months ahead.

In fact, the economic growth rate of the last two quarters was the best for back-to-back quarters in more than a decade. It doesn’t end there. On Tuesday, we learned that Consumer Confidence jumped to a seven-year high. The initial jobless claims reports are still quite good. The only bump this week was a lousy report on Durable Goods.

I’m even going to say something that might be blasphemous on Wall Street, and that’s that the monthly jobs reports aren’t so important anymore. (GASP!) Of course, they’re important in the sense that people are getting more jobs, and we can see that companies are expanding. But don’t expect to see any dramatic inflexion points soon. The jobs-growth trend has been established, and that’s what the Fed wants to see.

The next question for the market and the Fed is, “When will the central bank finally raise interest rates?” That’s a tough one. So far, every forecast (mine included) has been far too premature. Initially, Janet Yellen said that the first rate hike would be about six months after the conclusion of QE. That was a rookie mistake, and she’s disavowed those comments ever since.

The futures market currently sees the first rate hike coming in August 2015. I’m a doubter, but I can’t say I have a strong conviction either way. The problem is that the Strong Dollar Trade, which I’ve discussed in recent issues, has held back inflation and economic growth. That gives the Fed a little more breathing room. As a result, that could put off a rate increase for a few more months. I wouldn’t be surprised if the first rate hike doesn’t come until 2016.

What does this all mean? The overall climate remains the same. As long as rates are low, stocks are the place to be. It’s just that simple. This earnings season has been a good one for the market. The latest numbers show that nearly 72% of the stocks in the S&P 500 have topped earnings expectations, while 53.7% have beaten on sales. I should add that these are reduced expectations compared with a few weeks ago. The earnings growth rate is currently tracking at 6.5%. That’s not great, but it sure beats anything you’d see in the bond market.

Until interest rates become competitive with stocks, stocks are the best place to be. I encourage investors to keep focusing on high-quality stocks like you see on our Buy List. Now let’s turn to our recent earnings reports.

Ford Motor Is Still a Buy

First, though, let me mention Ford Motor ($F) which reported Q3 earnings shortly after I sent you last week’s CWS Market Review. The automaker reported earnings of 24 cents per share which topped estimates by five cents per share.

Despite the earnings beat, Wall Street was not pleased with Ford. The company has been plagued by costly recalls and the impact of the strong greenback. For the first time since 2010, Ford had negative quarterly cash flow. The stock dropped 4.3% last Friday. Ford’s stock already got beat up a month ago when they said they wouldn’t meet their profit goals for this year.

I feel bad for Ford because a lot of this isn’t their fault. The automaker has been squeezed by the strong dollar, higher operating costs and weaker economies overseas. I also think investors are nervous that former CEO Alan Mulally is no longer running things.

Still, the big issue facing Ford is the new F-150 with an aluminum body. This is a ballsy move by Ford; the truck is their biggest moneymaker. To get ready for the new production, Ford had to convert some factories and that costs money. Right now, the success of the F-150 is a giant question mark that’s weighing on the shares. For its part, Ford has made it clear that they’re going ahead with their plans. In fact, they just started with mass production of the truck.

I’m sticking with Ford. The shares currently yield over 3.5%. I admire companies that are trying to change things up.

Strong Earnings from AFLAC, Fiserv and Express Scripts

On Tuesday, AFLAC ($AFL) reported Q3 operating earnings of $1.51 per share. That was eight cents more than estimates. That was even better than the guidance they gave us three months ago, $1.38 to $1.47 per share. Operationally, AFLAC is doing well. The problem has been the weak yen. Fortunately, forex only cost them four cents per share last quarter.

For Q4, AFLAC expects operating earnings to range between $1.28 and $1.37 per share. That assumes the yen stays between 105 and 110 to the dollar. It’s currently at 109.29. That brings the full-year earnings estimate to $6.14 to $6.23 per share. For 2015, AFLAC aims to increase their operating earnings by 2% to 7% on a currency-neutral basis.

But the best news was that AFLAC’s board decided to raise the quarterly dividend from 37 to 39 cents per share (I had been expecting a one-cent increase). This is the 32nd year in a row that AFLAC has increased its dividend. On Thursday, the shares closed over $60 for the first time in more than seven weeks. AFLAC remains a solid buy up to $63 per share.

Fiserv ($FISV) reported Q3 earnings of 86 cents per share, which was two cents better than expectations. The company also raised expectations. Fiserv now expects 2014 earnings per share between $3.34 and $3.38. The old range was $3.31 to $3.37. For 2013, Fiserv earned $2.99 per share. The new guidance implies Q4 earnings between 86 and 90 cents per share. The Street had been expecting 89 cents per share.

The stock came close to breaking $70 on Wednesday. Fiserv has been on our Buy List all nine years. In the last three years, the stock is up 133%. This week, I’m raising my Buy Below on Fiserv to $72 per share.

Express Scripts ($ESRX) posted earnings of $1.29 per share, which matched expectations. The pharmacy-benefits manager also narrowed their full-year range to $4.86 to $4.90 per share. The previous range was $4.84 to $4.92 per share. The new full-year guidance means that the guidance for Q4 is $1.36 to $1.40 per share. The Street had been expecting $1.38 per share. Basically, the company delivered what was expected, and I’m fine with that. Express Scripts is a buy up to $77 per share.

Moog ($MOG-A) is due to report earnings later this morning. I’ll have details on the blog. The consensus on Wall Street is for earnings of $1.08 per share. The stock reached an all-time high on Wednesday.

Earnings Next Week from Qualcomm, Cognizant and DirecTV

Earnings season is almost over, but we have a few more to go. Next Wednesday, November 5, Cognizant Technology Solutions and Qualcomm are due to report.

Cognizant ($CTSH) was our big dud last earnings season. The stock dropped more than 12% after its earnings report. As is often the case, the earnings were quite good: 66 cents per share versus estimates of 62 cents. No, what troubled traders was the guidance. In fact, it wasn’t even the earnings guidance, but rather the sales. Cognizant said they see Q3 earnings of at least 63 cents per share, and sales between $2.55 billion and $2.58 billion. Wall Street had been expecting sales of $2.66 billion. Basically, CTSH lowered their full-year sales growth from 16.5% to 14%. That’s still very strong growth. Cognizant isn’t one to worry about.

Qualcomm ($QCOM) is in an unusual spot. Three months ago, the company crushed earnings. They beat by 22 cents per share. The problem was news out of China. The company is involved in a nasty anti-trust suit with the Chinese government, and they’re simply not going to win. Why is the PRC doing this? Because they can.

The company wisely wants to put this dispute behind them, but it’s going to be costly. As a result, Qualcomm had rather weak guidance for the September quarter (their fiscal Q4). Qualcomm said it expects earnings between $1.20 and $1.35 per share. That’s less than I had been expecting. Time is on Qualcomm’s side, and the shares have perked up recently. Look for an earnings beat here.

DirecTV ($DTV) is due to report on Thursday, November 6. The satellite-TV company has been doing just fine lately. The problem hasn’t been with them but with their merger partner, AT&T ($T). Shares of T recently fell below the lower bound of $34.90. That, in turns, lowers the merger price for DTV. Fortunately, shares of AT&T have rebounded and may soon go back into the safe range, which would once again value DTV at $95 per share. For the time being, these two stocks are joined at the hip.

That’s all for now. The big news next week will be the mid-term elections. Control of the Senate may change hands. On Monday, the ISM report comes out. On Thursday, we’ll get a look at the productivity report for Q3. Then on Friday is the big jobs report for September. This is still the biggest economic report, but as I said before, its importance has greatly diminished. We also have many more earnings reports. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: October 31, 2014

Eddy Elfenbein, October 31st, 2014 at 6:55 amYen Declines to Six-Year Low on BOJ Monetary Easing; Ruble Drops

RBS Takes $640 Million Forex Charge and Warns of More to Come

BNP Paribas Surprises With Q3 Profit Boost, Shares Rise

Third-Quarter G.D.P. Rose 3.5%, Lifting Hopes for U.S. Economy

Fed’s Williams Sees Inflation Target Flaws at Zero Rates

Weak Wages Stir Voter Ire at Obama Amid Gridlock

Sony’s Quarterly Loss Balloons on Mobile Woes

Tencent Teams Up With IBM to Offer Business Software Over the Cloud

LinkedIn New Businesses Lift Third-Quarter Sales Above Estimates

Starbucks Delivery Is Coming; Sales Rise 10%

Investigation Causes Citigroup to Cut Profit

AB InBev Profit Capped by Weak U.S., Brazil Recession

GoPro Spikes As New Hero 4 Drives Sales Through The Roof

Joshua Brown: Chart o’the Day: Massive, Misinformed Pessimism

Cullen Roche: QE: Until We Meet Again…

Be sure to follow me on Twitter.

-

Q3 GDP +3.5%

Eddy Elfenbein, October 30th, 2014 at 8:45 amThe government just reported that the economy grew, in real terms, by 3.5% last quarter. That’s a decent number. Four of the last five quarters have shown good growth, although there’s obviously room for improvement. Nominal GDP rose by 4.87% last quarter.

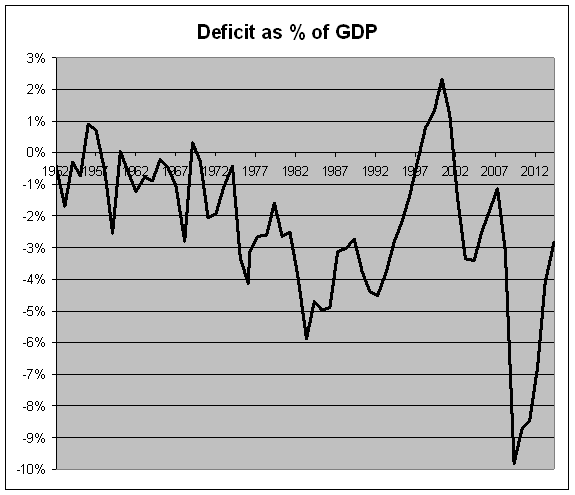

With the end of the third quarter, it’s also the end of the government’s fiscal year. That means that we have one more data point for the government’s taxing, spending and deficit.

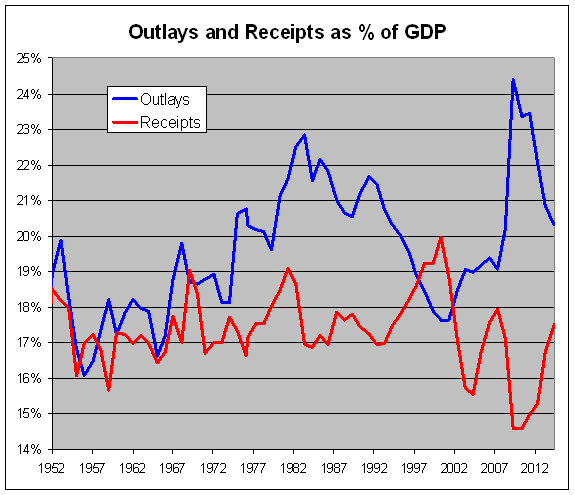

For 2014, outlays were 20.32% of GDP. Receipts were 17.52%. Here’s a look at the historical data.

The deficit was 2.82%.

The recent deficits were ugly, but it’s improved a lot. Last year’s deficit was lower than every year except one between 1982 and 1994.

This is unusual, but the numbers for FY 2014 were almost the exact same as those for FY 1994. Receipts were 20.31% in 1994 and 20.32% in 2014. Outlays were 17.49% in 1994 and 17.52% in 2014. The deficit was the same, 2.82% in both years.

-

Morning News: October 30, 2014

Eddy Elfenbein, October 30th, 2014 at 7:07 amEuropean Investors Get Jittery Over Banking Stocks

German Jobless Total Falls in October

Fed Ends QE, Perks Up Labor Market Outlook

Fed’s Lonesome Dove Dissents as Brighter Outlook Appeases Hawks

Time Warner Cable Profit Drops as Subscriptions Wane

Shell Profit Increases as Refining Trumps Lower Oil Prices

Lufthansa Lowers 2015 Earnings Outlook

Volkswagen Q3 Profits Jump 56%

Bayer Q3 Adj Profit Gains Slightly on Strong Crop Chemicals

’Dragon’ Sequel Sends Dreamworks Revenue Soaring; Shares Rise

Visa Posts Lower 4Q Profit; Beats Street Views

Kraft Profit Drops on Higher Commodity Costs

Food’s Latest Scandal: What’s Wrong With Your Shrimp

Joshua Brown: 20 Key Takeaways from Stocktoberfest 2014

Jeff Carter: Prediction Markets

Be sure to follow me on Twitter.

-

The Best Time of the Year to Invest

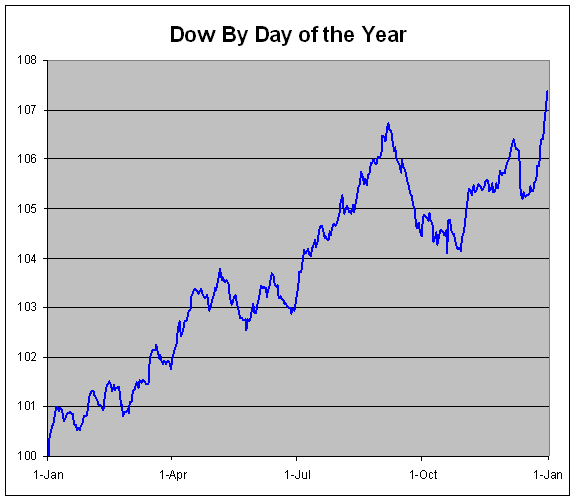

Eddy Elfenbein, October 29th, 2014 at 4:41 pmToday is October 29 which has historically marked the end of the worst period of the year for stocks. I took the Dow’s entire history and found that the index averages a gain of just 0.34% from May 6 to October 29 (“sell in May and go away”).

But from October 29 to May 6, the Dow has averaged a gain of 7.00%. This means that nearly 95% of the Dow’s average annual gain has come in slightly less than half the year. The rest of the other time, the market is basically flat.

I don’t think this data should be used to make any investment decisions. I simply think it’s interesting to see what the market has done historically.

-

RIP: QE

Eddy Elfenbein, October 29th, 2014 at 2:05 pmThe Fed announces the end of Quantitative Easing:

Information received since the Federal Open Market Committee met in September suggests that economic activity is expanding at a moderate pace. Labor market conditions improved somewhat further, with solid job gains and a lower unemployment rate. On balance, a range of labor market indicators suggests that underutilization of labor resources is gradually diminishing. Household spending is rising moderately and business fixed investment is advancing, while the recovery in the housing sector remains slow. Inflation has continued to run below the Committee’s longer-run objective. Market-based measures of inflation compensation have declined somewhat; survey-based measures of longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators and inflation moving toward levels the Committee judges consistent with its dual mandate. The Committee sees the risks to the outlook for economic activity and the labor market as nearly balanced. Although inflation in the near term will likely be held down by lower energy prices and other factors, the Committee judges that the likelihood of inflation running persistently below 2 percent has diminished somewhat since early this year.

The Committee judges that there has been a substantial improvement in the outlook for the labor market since the inception of its current asset purchase program. Moreover, the Committee continues to see sufficient underlying strength in the broader economy to support ongoing progress toward maximum employment in a context of price stability. Accordingly, the Committee decided to conclude its asset purchase program this month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee’s holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress–both realized and expected–toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. The Committee anticipates, based on its current assessment, that it likely will be appropriate to maintain the 0 to 1/4 percent target range for the federal funds rate for a considerable time following the end of its asset purchase program this month, especially if projected inflation continues to run below the Committee’s 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored. However, if incoming information indicates faster progress toward the Committee’s employment and inflation objectives than the Committee now expects, then increases in the target range for the federal funds rate are likely to occur sooner than currently anticipated. Conversely, if progress proves slower than expected, then increases in the target range are likely to occur later than currently anticipated.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Stanley Fischer; Richard W. Fisher; Loretta J. Mester; Charles I. Plosser; Jerome H. Powell; and Daniel K. Tarullo. Voting against the action was Narayana Kocherlakota, who believed that, in light of continued sluggishness in the inflation outlook and the recent slide in market-based measures of longer-term inflation expectations, the Committee should commit to keeping the current target range for the federal funds rate at least until the one-to-two-year ahead inflation outlook has returned to 2 percent and should continue the asset purchase program at its current level.

-

Three Buy List Earnings Reports

Eddy Elfenbein, October 29th, 2014 at 1:57 pmI’ve been traveling but I wanted to mention the three Buy List earnings reports that came after yesterday’s closing bell.

AFLAC ($AFL) had operating earnings of $1.51 per share. That was eight cents more than estimates. The currency exchange rate cost them four cents per share last quarter. As I’ve said, operationally, AFLAC is doing well.

AFLAC’s board raised the quarterly dividend from 37 to 39 cents per share. For Q4, AFL sees earnings ranging between $1.28 to $1.37 per share. That will give them full-year earnings between $6.14 to $6.23 per share. The stock broke $61 per share early today, but has pulled back.

Fiserv ($FISV) earned 86 cents per share which was two cents better than expectations. They now expect 2014 earnings per share between $3.34 and $3.38. That implies Q4 earnings between 86 and 90 cents per share. The Street had been expecting 89 cents per share. The shares got as high as $69.94 today.

Express Scripts ($ESRX) posted earnings of $1.29 per share which matched expectations. They also narrowed their full-year range to $4.86 to $4.90 per share. The previous view was $4.84 to $4.92 per share. The new full-year guidance means that the guidance for Q4 is $1.36 to $1.40 per share. The Street had been expecting $1.38 per share.

- Tweets by @EddyElfenbein

-

-

Archives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His