CWS Market Review – July 15, 2016

“Don’t confuse brains with a bull market.” – Humphrey B. Neill

After 14 months of not making any new highs, the S&P 500 finally burst through to record territory on Monday. In fact, the index continued to make new records on Tuesday, Wednesday and Thursday. So much for all those predictions of gloom and doom!

It’s hard to believe that three weeks ago, the financial world got rocked to its core by the stunning Brexit vote in Britain. The experts didn’t see that coming. Not only that, but they were also wrong on the effects of their own incorrect forecasts. Stocks and bonds are up and volatility is way down. In the last twelve days, the stock market has closed higher ten times!

I’m always reminded of the story Jack Bogle tells of being a young broker. An old-timer took him aside and told him, “nobody knows nothing!” I have to think that guy was onto something.

In this week’s CWS Market Review, I’ll take you through the latest drama on Wall Street. I’ll also preview a slew of Buy List earnings report for next week. Here’s a fun fact that shows you just how strange Wall Street can be. Thanks to something called Pokémon Go, Nintendo’s market cap rose by $9 billion in two days. That’s about half the market value of Deutsche Bank, which is a 146-year-old company. Trading in Nintendo was so heavy that it accounted for 17% of all the volume on the Tokyo Exchange.

Yep. Nobody knows nothing!

The S&P 500 Soars to an All-Time High

Last Friday, the U.S. government reported that the economy created 287,000 net new jobs last month. That crushed expectations by over 120,000 jobs. That was the biggest “jobs beat” in seven years!

The jobs report was especially good considering that it came after a lousy report for May. Truthfully, the long-term trend of roughly 220,000 jobs per month is still largely intact. The monthly volatility masks how persistent the underlying trend has been.

Last week’s jobs report will have minimal impact on the Fed. The central bank gets together in two weeks, and it’s very doubtful they’ll touch interest rates. In fact, it’s doubtful they’ll touch interest rates for the rest of the year. The futures market doesn’t expect a rate hike until next June, and even then, the odds are far from overwhelming. We have to get used to the fact that we’re living in a low-rate world.

I want to elaborate on an important point that I think confuses too many investors: the importance of the Federal Reserve. This may surprise a lot of folks, but the Fed isn’t nearly as powerful as is sometimes presented. I notice a lot of undue hostility towards the Fed. While I’m hardly one to jump to their defense, especially on policy grounds, I think much of the criticism goes towards areas outside the Fed’s control.

I think it’s better to see the Fed as another player on the field chasing after the ball. While they currently have interest rates very low, it’s difficult for me to believe that they have rates very far from equilibrium. If they did, we should see far greater distortions like inflation or a recession.

No matter what the Fed does, it will have some financial market consequences. That’s why I’m baffled by so much commentary that says the stock market is merely a Fed-induced bubble that’s about to burst. We’ve been hearing this for several years now, and nothing’s burst so far.

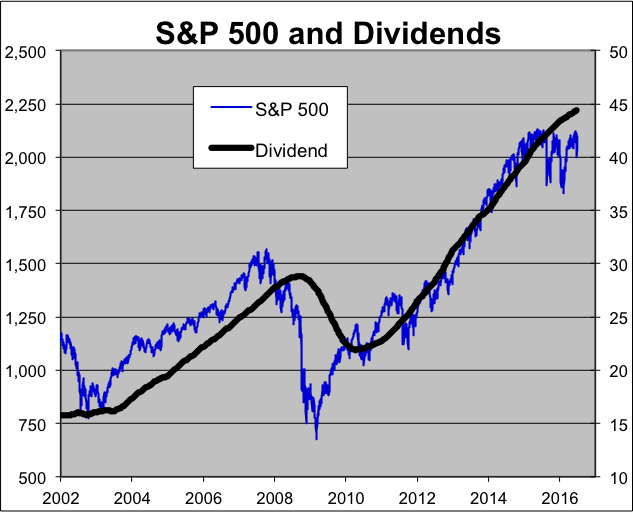

Going by most valuation measures, the stock market is about where you’d expect. Except for the worst parts of the Financial Crisis, the dividend yield for the S&P 500 hasn’t strayed very far from 2% for over a decade. Through Thursday, the S&P 500 is up 5.9% for the year, while dividends were up 5% for the first half. That’s hardly a bubble.

Simply put, the Fed isn’t forcing interest rates this low. Instead, they’re following interest rates this low. I think there have been some important changes in the structure of the world economy that makes low rates the new normal. For example, population growth has slowed down in much of the developed world, and that’s going to be an important part of nominal GDP growth. I think it’s interesting that Japan was the first country to deal with ultra-low and negative rates, and they’re experiencing a declining population.

The economist Scott Sumner has pointed out that the tech economy isn’t as capital-dependent as the old economy. Unlike, say, a steel plant, Google and Facebook don’t need enormous amounts of money to keep their operations running. As such, there’s less demand to rent capital, and that means lower rates. I’m not sure if that’s right but it highlights an important fact that the world has changed. This wasn’t all the Fed’s doing.

I’m guilty of getting caught up in overemphasizing the importance of the Fed. In reality, the stock market is responding to underlying strength in the economy and productivity. The stock market celebrated the strong June jobs report by rallying 1.5% to just below its all-time high. Interestingly, the market’s gain last Friday matched the 10-year Treasury’s annualized yield.

Second-quarter earnings season began on Monday, and we’ve had enough momentum to carry us to a few more new highs. Since the stock market’s low in March 2009, the S&P 500 is up 225%. While other people have waited for it all to crash, we’ve been riding the trend. Now let’s take a look at some earnings reports coming our way next week.

Seven Buy List Earnings Reports Due Next Week

Wells Fargo (WFC) is due to report earnings later today. The consensus is for $1.01 per share. That sounds about right. The bank recently passed the Fed’s latest stress test with flying colors.

We have seven more Buy List earnings reports coming next week; five of them are due on Thursday. Here’s our Earnings Calendar for the second quarter:

| Company | Ticker | Date | Estimate |

| Wells Fargo | WFC | 15-Jul | 1.01 |

| Microsoft | MSFT | 19-Jul | 0.58 |

| Signature Bank | SBNY | 19-Jul | 1.97 |

| Alliance Data | ADS | 21-Jul | 3.61 |

| Biogen | BIIB | 21-Jul | 4.69 |

| Snap-on | SNA | 21-Jul | 2.23 |

| Stryker | SYK | 21-Jul | 1.37 |

| Wabtec | WAB | 21-Jul | 1.08 |

| Express Scripts | ESRX | 25-Jul | 1.57 |

| CR Bard | BCR | 26-Jul | 2.47 |

| AFLAC | AFL | 28-Jul | 1.67 |

| Ford Motor | F | 28-Jul | 0.6 |

| Stericycle | SRCL | 28-Jul | 1.18 |

| Cerner | CERN | 2-Aug | 0.57 |

| Fiserv | FISV | 2-Aug | 1.07 |

| Cognizant Tech | CTSH | 5-Aug | 0.82 |

On Tuesday, July 19, Microsoft (MSFT) is scheduled to report its fiscal fourth quarter earnings. The software giant had a surprise earnings miss three months ago. But that was a rare misstep for a company that’s been on the right track under a new CEO.

Last month, Microsoft announced a major acquisition of LinkedIn. That’s the biggest deal in their history. Critics are right to point out that many of Microsoft’s recent acquisitions haven’t gone well, but I would chalk that up to Steve Ballmer, not Satya Nadella, who seems to prefer a more cautious approach.

Signature Bank (SBNY) is also due to report earnings on Tuesday. I like this bank a lot but its shares have become unusually volatile recently. SBNY dropped from $147 in April to less than $115 in June. The bank has reported record earnings for 26 quarters in a row. I have little doubt they’ll make it #27 on Tuesday. The consensus on Wall Street is for earnings of $1.97 per share. That’s up 20 cents from last year’s Q2.

I’ll be particularly interested to see where SBNY’s net interest margin is. I’m expecting something around 3.25%. I also want to see if they have any updates on their medallion loans which have taken a bite off their bottom line. Fortunately, the damage doesn’t appear to be too severe.

Thursday is going to be a very busy day for us. Alliance Data Systems, Biogen and Snap-on are due to report before the opening bell. Stryker and Wabtec are due to report after the closing bell.

In January, shares of Alliance Data Systems (ADS) got crushed after a lousy earnings report. The stock fell again in April after another earnings report. The loyalty rewards company actually topped expectations in April, but the outlook for Q2 was below the Street. ADS said they see Q2 earnings of $3.58 per share which was 20 cents below Wall Street’s consensus. Interestingly, they kept their full-year estimate at $16.75 per share. The stock got a boost this week when ValueAct Capital, an activist fund, announced that it had taken a 6.8% position in ADS.

While the biotech sector has had a rough time lately, I was pleased to see Biogen (BIIB) report very good earnings three months ago. The shares started to rally, but that got abruptly halted after the company said that one of its experimental drugs performed poorly during mid-stage tests.

In just three weeks, BIIB went from $290 per share to $223. Look for another good earnings report. The consensus on Wall Street is for earnings of $4.69 per share.

I have to admit that Snap-on (SNA) is a fairly dull company (hydraulic lifts!!), which is one of the reasons why I like it. In April, the company beat expectations by nine cents per share. The stock was punished very harshly at the start of the year. At one point in February, SNA was a 22% loser on the year (and the year had barely started). Fortunately, the shares have since rebounded. Wall Street is targeting Q2 earnings of $2.23 per share. I think that’s very doable. I’m expecting full-year earnings of $9 per share.

Stryker (SYK) has had a very impressive run in 2016. It’s our #1 stock this year with a gain of 31.6%. In April, the orthopedic company reported earnings of $1.24 per share which was four cents better than expectations.

For Q2, Stryker said they see earnings coming in between $1.33 and $1.38 per share. They should have little trouble hitting that range. For the entire year, Stryker sees earnings ranging between $5.65 and $5.80 per share. I’ll be curious to see how much the strong dollar has impacted SYK’s earnings.

Wabtec (WAB) has thrown us for a head-fake recently. In April, the company had a very good earnings report, and the stock popped to a new high. Since then, however, the stock has been a kind of a dud. On Thursday, shares of WAB settled at $71.47, which is over 17% below its April high.

I’m expecting another good earnings report. Wall Street expects $1.08 per share. The company also recently raised its modest dividend by 25%. The good news for us is that Wabtec has reaffirmed its full-year earnings of $4.30 to $4.50 per share.

That’s all for now. Next week will be dominated by earnings reports. Most of the media will be focused on the Republican National Convention in Cleveland. The convention runs from Monday to Thursday, and the economic reports will be fairly light. Building permits and housing starts will come out on Tuesday. The report on sales of existing homes will come out on Thursday. Also on Thursday will be initial jobless claims. The recent jobless claims reports have been just above 43-year lows. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on July 15th, 2016 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His