CWS Market Review – April 14, 2017

“A good decision is based on knowledge and not on numbers.” – Plato

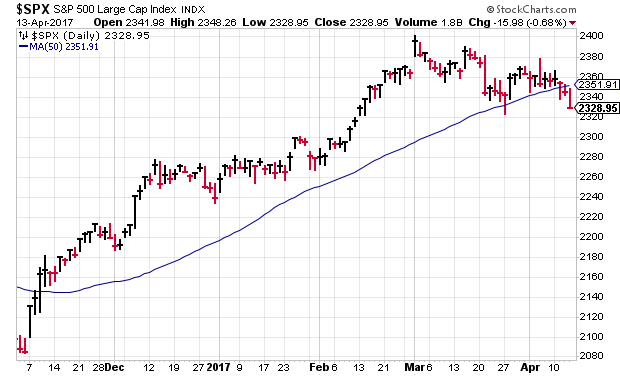

On Wednesday, the S&P 500 closed below its 50-day moving average for the first time since Election Day. We had a pretty good run. This was the third-longest streak of trading above the 50-DMA in the last 20 years.

What does it mean? Falling below your 50-DMA is a nice shortcut way of saying that the stock market is losing momentum. That’s not exactly a newsflash because we’ve seen this coming for a few weeks, but breaking below a 50-DMA is often a key technical indicator.

The bears were clearly paying attention because on Thursday, the S&P 500 dropped to a two-month low. We’re in this weird pattern of fading momentum combined with extremely low volatility. Consider that the market just snapped a 10-day streak of closing up or down by less than 0.35%. That’s a market with barely a pulse! We haven’t done that since 1968. Overall, the market is still just 2.8% below its all-time high set at the beginning of March.

We may see some action soon. Next week, we’ll get our first five Buy List earnings reports. Another nine come the week after that. In this week’s CWS Market Review, I’ll preview next week’s reports. I’ll also bring you up-to-speed on the latest on our Buy List stocks. But first, let’s get ready for next week’s earnings parade.

Earnings Season Is About to Start

In last week’s issue, I mentioned how this earnings season may be one of the best in the last few years. For one, the U.S. dollar won’t be such a negative presence on income statements. Also, the energy sector will show some signs of life. Additionally, we’ll probably see decent revenue growth from companies. Lastly, earnings estimates haven’t fallen as much as they have in previous quarters.

Bank stocks did poorly on Thursday in the wake of results from JPMorgan Chase and Wells Fargo. The big banks are usually the first major companies to report. Next week, 68 stocks in the S&P 500 are due to report earnings. As of now, Wall Street expects earnings growth for the quarter of 10.4% which would be the best since 2011.

Over the next few weeks, 20 of our 25 Buy List names will report earnings. Here’s an earnings calendar I made. I’ve included each stock’s ticker symbol, reporting date and Wall Street’s consensus estimate.

| Company | Ticker | Date | Estimate |

| Signature Bank | SBNY | 19-Apr | $2.10 |

| Alliance Data Systems | ADS | 20-Apr | $3.89 |

| Danaher | DHR | 20-Apr | $0.84 |

| Sherwin-Williams | SHW | 20-Apr | $2.05 |

| Snap-On | SNA | 20-Apr | $2.36 |

| Express Scripts | ESRX | 24-Apr | $1.32 |

| Stryker | SYK | 25-Apr | $1.42 |

| Wabtec | WAB | 25-Apr | $0.82 |

| Axalta Coating Systems | AXTA | 26-Apr | $0.25 |

| CR Bard | BCR | 26-Apr | $2.65 |

| Fiserv | FISV | 26-Apr | $1.19 |

| AFLAC | AFL | 27-Apr | $1.62 |

| Cerner | CERN | 27-Apr | $0.57 |

| Microsoft | MSFT | 27-Apr | $0.70 |

| Intercontinental Exchange | ICE | 3-May | $0.73 |

| Cognizant Technology | CTSH | 5-May | $0.83 |

| Moody’s | MCO | 5-May | $1.17 |

| Cinemark | CNK | TBA | $0.52 |

| Continental Building Products | CBPX | TBA | $0.26 |

| Ingredion | INGR | TBA | $1.76 |

Please note that these dates and numbers are subject to change. I did the best I could but some companies are, shall we say, less than forthcoming with their financial info.

Our Five Buy List Earnings Reports Next Week

We have five Buy List earnings reports next week. On Wednesday, April 19, Signature Bank (SBNY) is scheduled to report Q1 earnings. The stock jumped immediately after the election but has slowly lost ground over the last several weeks. Despite the pullback, the bank’s business has been basically sound. The consensus on Wall Street is for earnings of $2.10 per share. My numbers say Signature should be able to beat that.

Next Thursday will be an especially busy day for us. We have four earnings reports. Three months ago, Alliance Data Systems (ADS) beat earnings by a penny per share but the stock got knocked back due to poor top-line numbers. For the whole year, ADS expects earnings of $18.50 per share. For Q1, Wall Street’s consensus is for $3.89 per share. That seems doable. This week, Oppenheimer initiated coverage on ADS with an “underperform” rating. That helped ding the stock for a 3.8% loss on Tuesday. Don’t let that alarm you.

Danaher (DHR) gave us a good earnings report in January. For Q1, the company sees earnings ranging between 82 and 85 cents per share. For all of 2017, they forecast earnings of $3.85 to $3.95 per share. Wall Street is playing it safe. Their Q1 consensus is for 84 cents per share. I like Danaher a lot.

Sherwin-Williams (SHW) was the big star from last earnings season. The company earned $2.34 per share, which was 13 cents more than estimates. The stock jumped 7.6% the next day. For Q1, SHW sees earnings ranging between $2.03 and $2.13 per share and sales rising by mid-to-high single digits.

Sherwin has said that its merger with Valspar will take longer than expected. The company conceded that it will have to jettison some units in order to placate regulators. That’s often the case. This week, in fact, SHW announced they’re going to sell their wood coatings business for $420 million. And who’s the buyer? None other than our very own Axalta Coating Systems (AXTA). Our Buy List stocks are doing deals with each other! Wall Street is expecting Q1 earnings of $2.05 per share from Sherwin.

Snap-on (SNA) has been a fairly sluggish performer for us this year, but I still like this one a lot. The company had a good earnings report in January. They beat on both the top and bottom line. The results from the tool group, however, could have been better. For Q1, Wall Street expects earnings of $2.36 per share. Earlier this week, Oppenheimer initiated coverage on SNA with an outperform rating. (Is Oppenheimer secretly following us?)

Before I get to our Buy List updates, I wanted to add a brief word about Federal Reserve policy. The futures market currently thinks there’s a 57.3% chance the Fed will raise rates in June. If so, this will mark the first time I’ve broken sharply with what the Fed has done. In past instances, I may have leaned one way or another, but now I can say that I’m flatly opposed to another rate increase. It would be a big mistake.

Of course, just because it’s wrong is certainly not a reason why the Fed won’t do it. As I see it, the economy is far from its potential. Wage growth has been modest, and inflation is still well-behaved. On Thursday, we learned that wholesale prices actually fell last month.

We’re still two months away from the Fed’s June meeting, and I hope cooler heads prevail. I’ll have more on this in upcoming issues, but for now, I’m concerned that the Fed may make a big policy blunder.

Buy List Updates

On Tuesday, HEICO (HEI) will split 5-for-4. This means that shareholders will get 25% more shares, and the price will drop about 20%. Once the split takes effect, our Buy Below price will drop 20%, from $90 to $72 per share.

For track record purposes, I assume the Buy List starts the year as a $1 million portfolio that’s equally divided among the 25 stocks. For HEICO, that meant a position of 518.4705 shares at a starting price of $77.15 per share. After the split, that will become 648.0881 shares starting at $61.72 per share.

The retail sector has performed very poorly in recent months. A major Retail ETF (XRT) has badly lagged the overall market. This has also dragged Ross Stores (ROST) down below $64 per share. I think the shares look particularly attractive at the moment. Ross is one of the best retailers out there. The next earnings report will be due out around mid-May.

This week, Morgan Stanley downgraded JM Smucker (SJM). They also lowered their price target to $132 per share. The stock has pulled back about 10% in the last seven weeks. If SJM drops below $120, then it’s an exceptional value. This is one to key an eye on.

That’s all for now. The stock market is closed for Good Friday. Next week will mostly be about earnings but there will be some important economic reports. On Tuesday, the industrial production report for March is due out. On Wednesday, the Fed’s Beige Book comes out. This report is usually a good distillation of the economy. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on April 14th, 2017 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His