CWS Market Review – March 2, 2018

“Your margin is my opportunity.” – Jeff Bezos

The S&P 500 went 94 straight days without a 1% day either up or down. Now it’s happened 15 times in the last 24 sessions including the last five in a row (first two, up; last three, not up).

I cautioned investors that the ruckus hasn’t yet passed. Three weeks ago, the S&P 500 bounced off its 200-day moving average, and it will likely “test” that support level again. Financial markets don’t walk away from a mess like we had so easily. Fear of the market gods is clean, enduring forever.

Let’s remember that the broad economic climate is quite good. This week’s initial jobless claims report showed figures at their lowest level since the 1960s. Thursday’s ISM Manufacturing report was the best one in 13 years, and consumer confidence is now at a 17-year high.

So what’s bugging Wall Street? This week, investors got a bit spooked by fears of a trade war. President Trump proposed steep tariffs on steel and aluminum. I thought it was interesting that on Thursday, stocks of big steel consumers like Ford and GM fell hard. Our own Snap-on (SNA) was down 3.3%.

Frankly, I’m skeptical that these plans will be implemented. Within the business community, the opposition to steep tariffs is nearly overwhelming. Also, a lot of the big steel exporters are good friends of the United States. Perhaps President Trump is sending a message to China. As usual, I’ll steer clear of the politics, but I’ll comment on the policy’s impact. Wall Street will not like a trade war.

I wanted to do something a bit different this issue. I recently asked readers for some feedback on the newsletter, and I got very constructive suggestions. A number of readers wanted to hear more in-depth reasons for why I like a particular stock.

Since there wasn’t a whole lot of news this week (Jay Powell made some hawkish comments on interest rates on Capitol Hill), instead I thought I would focus on one our favorite Buy List stocks: Ross Stores (ROST). This is a good time to highlight Ross because the deep discounter will report fiscal Q4 earnings after the close on Tuesday.

Why I Like Ross Stores

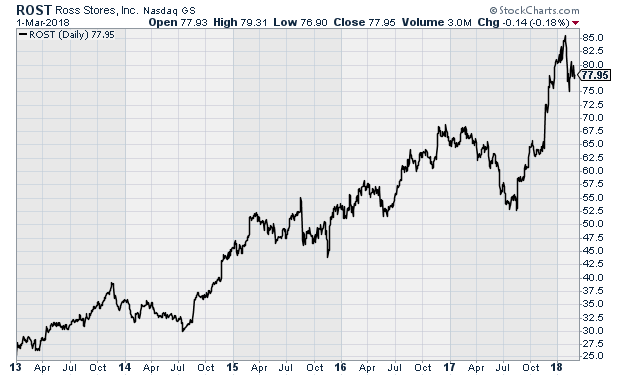

I like Ross Stores a lot. This is the sixth year the company has been on our Buy List. We added the stock at the beginning of 2013 when it was going for $27 per share (that’s adjusting for one 2-for-1 split in 2015). Now it’s at $78 per share. The stock is up 188% for us in a little over five years. It’s had a few nasty dips along the way, but I’m glad we’ve stuck with it.

Our return has been even better when we include dividends. When we added Ross, the quarterly dividend was 8.5 cents per share. Now it’s 16 cents per share, and they’ll probably raise it again on Tuesday.

The upcoming earnings report will be for ROST’s fiscal fourth quarter. I have to explain that many retailers, Ross included, like to use a January fiscal year so they don’t have to break up the holiday shopping season between quarters. Also like other retailers, Ross prefers to use a 13-week reporting period rather than a three-month one. Thanks to Pope Gregory XIII, this means that every so often Ross will have a 14-week quarter. As luck would have it, this past Q4 was a 14-weeker.

The important thing to understand about Ross’s business is that they’re a retailer. That means it’s a low-margin business. In fact, it’s even more so for Ross because they compete as a deep-discount alternative to other stores. There are several ways a business can implement its competitive advantage. Some companies offer something that no else does. In Ross’s case, they’re competitive on price. What Ross tries to do is squeeze every penny out of its costs and pass the savings to its customer base.

When we look at any business for an investment opportunity, we have to ask, “What makes you different? What’s so special about you?” What impresses me about Ross is how they’re able to maintain relatively high profit margins compared with similar businesses.

Let’s look at some financials. I promise not to get too mathy. Last fiscal year, Ross Stores had total sales of $12.7 billion. Major expenses fall into two categories: the cost of the stuff they sell and the cost of running the business. What’s left is the operating profit. For Ross, last year saw an operating profit of $1.9 billion with an operating profit margin of 14%. For a retailer in Ross’s business, that’s quite good. Think of it this way. For every $1 of sales, 71 cents went to the cost of the clothes, and 15 cents went to running the store. They’re left with 14 cents.

There are two items left. The company had interest expenses on their borrowing of $16.5 million. That’s tiny—about 0.13% of sales. Finally, there’s Uncle Sam. Last year, Ross paid about 37% of its pre-tax income to the government. This gives us a net income of $1.1 billion and a net margin of 8.7% which works out to $2.83 per share.

(As a side note, the recent tax reform helps domestic retailers more than other businesses. Large tech companies can use all sorts of fancy methods to shovel their cash around the world. With retailing, that option is very limited. )

Here’s an important reason why I like Ross. Their net profit margin is actually higher than most apparel retailers including The Gap, Nordstrom and Urban Outfitters. Ross’s margins are also higher than TJX’s, their closest rival. Strong relative margins tell us two key things. One is that there’s a good chance of superior management. Secondly, it means the company has pricing power. Even with Ross’s low prices, they can go lower if they need to. (Note this week’s epigraph, courtesy of Mr. Bezos.)

The thing about the retailing business is that it’s more accurately termed the inventory-management business. Next time you’re in a Walmart, try to find an empty shelf. You’ll probably find Bigfoot first. That’s what efficient retailing is all about—keeping the merchandise flowing in and quickly flowing out. Ross does it as well as anybody.

Ross Stores Doesn’t Compete Directly with Amazon

Whenever we talk about retailing, the discussion always turns to Amazon. This is a key point about Ross Stores, and it’s something many critics don’t get: Ross doesn’t compete against Amazon. Ross is not at all like Borders or Barnes & Noble.

Let me explain the difference. Ross’s customers enjoy going to the physical stores. Many of their devoted fans go more than once a week. They enjoy the “treasure hunt” experience of shopping in the store, and you can’t easily recreate that online.

Another benefit of Ross’s business is what’s called “packaway.” This means the company can buy off-season stuff for cheap and lock it away for later. Other retailers can’t do that so easily. Let’s say the winter is unusually warm. That’s no big deal for Ross. They’ll just save their inventory for a later day. Other retailers are expected to always have current fashions. Ross can play by different rules because they’re playing a different game.

TJX is a good business, but I happen to like Ross more. They’re similar in many ways, but TJX has some stores outside the U.S. while Ross does not. TJX also sells some upscale items that you won’t find at Ross.

By the way, I should touch on an important point. Some investors are skittish about investing in a business that caters to lower-income consumers. Please, don’t let that bother you at all. Lower-income consumers are often one of the best, and most loyal, customer groups. Ross’s fans love the company, and there’s nothing wrong with giving the people what they want at a fair price. Sure, Tiffany draws some first-class shoppers, but around here, we care about stocks, and ROST has creamed TIF.

What to Expect on Tuesday

For the first three quarters of this fiscal year, Ross’s sales are up 7.6% while net income is up 11.6%. The higher net margin was helped by lower interest expenses. Thanks to fewer shares outstanding, Ross’s earnings-per-share is up by 14.6% so far this year. The company is gobbling up its own shares at an impressive rate.

In November, Ross said they expect Q4 earnings (remember this is for 14 weeks) of 88 to 92 cents per share. For the entire year, that works out to $3.24 to $3.28 per share. Ross estimates that the extra week works out to an extra eight cents per share. Here’s my take: The Q4 estimate is probably a little low, but not by much. I’ll say they made about 95 cents per share, give or take.

More importantly, on Tuesday, Ross will probably give a forecast for the coming fiscal year. I’ll caution you that Ross loves to lowball its initial estimates. That means they can raise it later on. Their first estimate for last year was $3.02 to $3.15 per share, which they later raised three times. Realistically, Ross should be able to earn around $4 per share this year. However, I expect them to go on the record with something like $3.75 to $3.85 per share. I’ll also be curious to hear about the impact of tax reform.

What about the quarterly dividend? It’s currently at 16 cents per share. I think they’ll raise it to 20 cents per share. That will give them an even 80 cents for the year which is around 20% of their profits.

Last August, when it was at $55 per share, I said Ross was “a good value.” Now it’s at $78 per share. It’s not the bargain it was, but it’s still worth owning. Ross is going for 19.5 times forward earnings which isn’t unreasonable especially considering tax reform, a higher dividend and the improved economy. Ross Stores is a buy up to $81 per share.

That’s all for now. There are some key economic reports coming next week. On Monday, we’ll get the ISM non-manufacturing report. Wednesday is the ADP payroll report. Then Friday is jobs day. The Labor Department will release the employment report for February. Wall Street estimates that 200,000 new jobs were created. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Syndication Partners

I’ve teamed up with Investors Alley to feature some of their content. I think they have really good stuff. Check it out!

How to Profit from the Death of Oil

In the latest annual energy outlook from BP PLC (NYSE: BP), it was the first time the company forecast oil demand would eventually peak and then steadily decline. BP put the date for peak oil demand in the late 2030s.

And the cause is one I’ve told you about quite often in my articles – the rise of electric vehicles. BP said there would be 300 million electric vehicles on the road by 2040, up from about 3 million today. BP says electric vehicles will account for only 15% of the roughly 3 billion cars on the road in 2040. But they will account for 30% of all passenger car transportation, as measured by distance traveled, because so many of them will be shared vehicles, à la Uber.

BP’s outlook also envisaged renewable power growing from just 4% of global energy consumption today to 14% in 2040.

Add all of that up and you can surmise that a lot of changes are ahead for the oil industry. Yet only some of the world’s major oil companies are preparing for what the future will hold.

How to Get Your Cut of Apple’s Money Coming Back to the US

Financial risks can seemingly come out of nowhere. Think about how many on Wall Street were caught off guard by the 2008-09 financial crisis or even the volatility of a few weeks ago. Yet the potential risk emanating from the packaging of bad mortgages was in plain sight, but ignored.

Today, there is another financial risk lurking in plain sight. It lies in the vast overseas holdings of technology giants like Apple, Alphabet, Microsoft and many others. I discussed this topic to my subscribers in the October issue of Growth Stock Advisor. But since there is so much misunderstanding about the roughly $1 trillion (or possibly as high as $2 trillion) in funds held overseas by U.S. multinationals, I wanted to clear it up for you.

I know there is much misunderstanding about this subject just from gleaning the comments section on several recent articles published by The Wall Street Journal. Apparently, Americans are under the impression that this $1 trillion is just sitting in bank accounts overseas and that both the overseas banks and host countries don’t want to lose control of this money. Nothing could be further from the truth. Let me explain…

Posted by Eddy Elfenbein on March 2nd, 2018 at 7:05 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

Archives

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His