CWS Market Review – June 1, 2018

“Don’t confuse brains with a bull market.” – Humphrey B. Neill

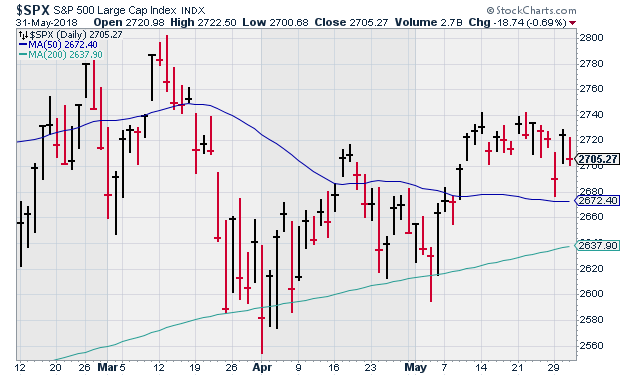

It’s good to be back after taking a break for Memorial Day. It’s almost like the stock market went on vacation as well. Over the last 15 trading sessions, the S&P 500 has closed between 2,705 and 2,733 a total of 14 times. That’s a range of about 1%. It seems the market can’t get momentum in either direction.

That doesn’t mean that nothing’s been happening. Wall Street has been worried about (in no particular order) trade, the mess in Italy, the bigger mess in Spain, the Fed, earnings and North Korea. I may have left a few things out.

In this week’s issue, I’ll explain why I’m a little cautious going into summer. Fortunately, our Buy List continues to do well. We recently had good earnings reports from Hormel Foods and Ross Stores. Traders, however, punished the stocks in the short term. (Fine by me. Just makes ‘em cheaper!).

But the best news came from Wabtec. The stock jumped after announcing a big merger with GE’s rail division. Wabtec is now a 20% winner for us this year. This deal is a huge opportunity for them. Later on, I’ll preview next week’s earnings report from JM Smucker. But first, let’s look at the stock market’s recent turn towards safety.

Wall Street Turns Defensive

Later today, the government will release the jobs report for May. Of course, this is just a guess as to what really happened. I don’t see how the government can claim to be even close to counting the number of jobs created in a month just 8.5 hours after the month ended. In Hawaii, the month ended just 2.5 hours before the jobs report came out.

Still, the jobs report is a big deal. There’s a good chance the unemployment rate fell to a 50-year low. Yet despite better news on the jobs front, the market’s perception of the economy has changed over the past few weeks. In short, investors are less optimistic about the economy. It’s nothing to worry about, but I wanted to make sure you’re aware of what’s happening.

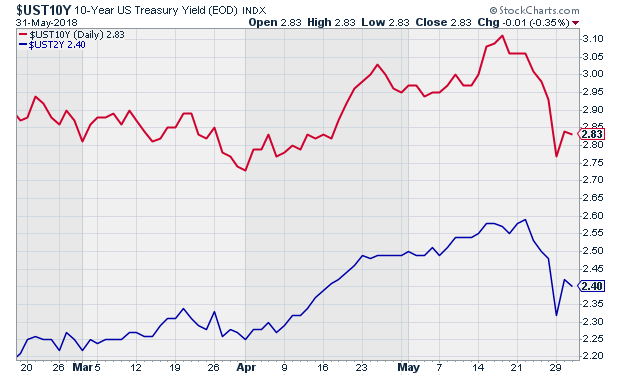

Not too long ago, the futures market saw a 50-50 chance of the Fed’s raising rates four times this year. (We’ve already had one, and another is coming in two weeks.) Now, however, the chance of a fourth hike is fading fast. The Fed pretty much admitted this at its last meeting. The central bank said it has no problem with inflation running hot for a bit. I think this is the right call. Central bankers tend to overreact in the face of a little bit of inflation.

Alongside this, the markets have become more defensive recently. Just two weeks ago, the yield on the 10-year Treasury got to 3.11%. On Thursday, it closed at 2.83%. That shows you how much people have shifted towards safer assets. The spread between the 2- and 10-year Treasuries has narrowed as well.

This move has been mirrored in the stock market as sectors like REITs and Utilities have perked up. For the most part, these defensive sectors haven’t done that well this year. Instead, the big winners have been in Tech and Energy. That generally signals greater optimism for the economy, and, as an extension, a greater willingness to shoulder risk, so what we’re seeing is some of that trend unwind.

Let me be clear that this doesn’t signal impending doom. Not at all. It simply means that investors are acting with greater caution, and that’s good for our type of investing. The fading need for higher rates has also dented many financial stocks. The banks tend to outperform when rates go up (or more accurately, when they’re perceived to be going up). This has given us some compelling buying opportunities.

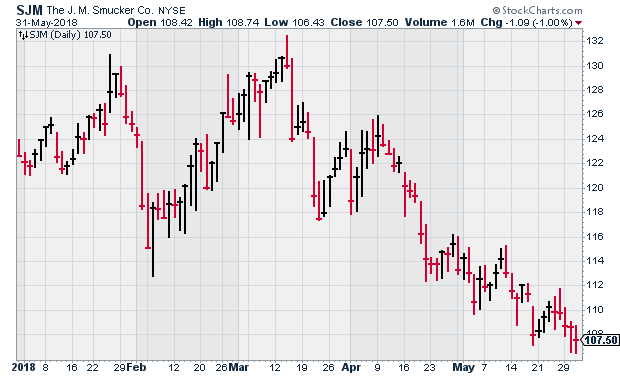

Some Buy List stocks that look particularly good at the moment include Signature Bank (SBNY), FactSet (FDS) and Church & Dwight (CHD). Later on, I’ll talk about Smucker (SJM). This could be our cheapest stock in the Buy List, but I want to see next week’s earnings report before I raise the flag on SJM. Now let’s take a look at two of our recent earnings reports.

Earnings from Hormel Foods and Ross Stores

We had two Buy List earnings reports last Thursday, May 24. Hormel Foods reported in the morning, and Ross Stores reported after the close.

Let’s start with Hormel (HRL). Wall Street had been expecting 45 cents per share from Hormel. I said in our last issue that that was probably a bit too high. I was right, but only by a penny. For this fiscal Q2, the Spam stock earned 44 cents per share.

I’m not too concerned about a one-penny miss. The business still looks pretty good. Bear in mind that Hormel’s profits were up 13% over last year’s Q2. I also said that I didn’t expect to see Hormel adjust its full-year earnings forecast. I was right again. They still expect to see full-year earnings between $1.81 and $1.95 per share. (Their fiscal year ends in October.) For net sales, Hormel expects $9.7 to $10.1 billion.

Let’s look at some comments from the company:

“Our team delivered record earnings per share of $0.44 which was in line with our expectation and keeps us on track to maintain our full year earnings guidance,” said Jim Snee, chairman of the board, president, and chief executive officer. “We were particularly pleased with the bottom-line performance from Refrigerated Foods as our experienced team grew our value-added profits while navigating through volatile markets. Our balanced business model helped mitigate higher freight costs and a difficult commodity environment.”

“We delivered record sales led by our Refrigerated Foods and International segments. Strong top-line growth from brands such as Hormel® Natural Choice® and Hormel® Bacon 1TM and international sales of products such as Skippy® peanut butter was complemented by the strategic acquisitions of Fontanini, Columbus Craft Meats, and Ceratti,” Snee said. “Our core center store portfolio of brands such as SPAM®, Dinty Moore®, and Herdez® also showed strong growth this quarter.”

Yes, I know. It’s typical corporate boilerplate. But still, it’s true.

By segment, their refrigerated foods group sales rose by 14%. Grocery products were down 1%. Jennie-O Turkey got clobbered. Sales fell 4%, but segment profits were down 34%. Apparently, there’s an oversupply of birds.

Tax reform was a big help for Hormel last quarter. The effective tax rate was 20% compared with 33.2% a year ago. For its outlook, the company said:

“We are reaffirming our sales and earnings outlook for fiscal 2018,” Snee said. “Our balanced business model allows us to manage through volatility and deliver consistent earnings growth. We continue to execute our value-added growth strategy in Refrigerated Foods and expect our retail and foodservice branded businesses to offset higher freight costs and lower pork commodity profits. Our expectation is for strong year-over-year earnings growth for International and for Grocery Products to return to its growth trajectory. While we are starting to see early signs of a recovery in the turkey industry, we expect Jennie-O Turkey Store to continue showing earnings declines for the remainder of this year.”

Overall, the earnings report was pretty much what I had been expecting. Unfortunately, the stock dropped about 5% on the morning of the earnings report. As you know, we don’t get too worried about short-term moves. Sure enough, HRL rallied after Thursday. I’m actually lifting my Buy Below price to $37 per share. They also announced a recall of some Spam, but that seems to be a small issue relative to Hormel’s overall business.

Ross Stores Earns $1.11 per Share for Fiscal Q1

After the close on May 24, Ross Stores (ROST) reported fiscal Q1 adjusted earnings of $1.11 per share. Earlier, the company had projected earnings of $1.03 to $1.07 per share. They made 82 cents per share for last year’s Q1.

There were a few accounting items to adjust for. Ross said they were helped in Q1 by 17 cents per share due to tax reform plus two cents per share thanks to “the favorable timing of packaway-related expenses that we expect to reverse in subsequent quarters.”

Q1 sales rose 9% to $3.6 billion, and comparable-stores sales were up 3%. Ross had been expecting 1% to 2%. I knew that forecast was too low. The company said it was hurt by poor weather during the quarter. I’m usually pretty skeptical of weather as an excuse. Ross’s operating margin fell to 15.1%. That’s still pretty good.

For fiscal Q2, Ross expects earnings of 95 to 99 cents per share. They see same-store sales growth of 1% to 2%. That’s pretty low. The good news is that Ross raised its full-year guidance. The old range was $3.86 to $4.03 per share, and the new range is $3.92 to $4.05 per share.

Like Hormel, this report looked fine to me. Also like Hormel, Ross got hit after the report, and again, I’m not at all worried about Ross Stores. I’m raising my Buy Below to $82 per share.

Earnings Preview for Smucker

On Thursday, June 7, JM Smucker (SJM) will release its fiscal Q4 earnings report. This is for the months of February, March and April.

The company had a good quarter for Q3, and thanks to tax reform, it also raised full-year guidance. The company now sees adjusted EPS for this year ranging between $8.20 and $8.30 per share. That’s a big increase from the previous guidance of $7.75 to $7.90 per share. Smucker also gave a one-time bonus of $1,000 to nearly 5,000 employees. That’s good to see. We should never forget the people who are behind the great results.

The full-year guidance implies a Q4 range of $2.17 to $2.27 per share. Wall Street expects $2.20 per share. Either way, the stock is going for a pretty decent P/E ratio.

Smucker has been behaving horribly for us this year, but that’s why I like it right now. I apologize for the sinking price, but these are the times when patient investors do well. SJM is a good stock. I’ll be curious to see if they have anything to say about fiscal 2019. I’ll probably lower our Buy Below next week, but I want to see the earnings first.

Buy List Updates

There hasn’t been much news lately for our Buy List stocks, but I wanted to pass along two items.

The first is that Stacey Cunningham was named the first female president of the NYSE in its 226-year history. She had been the COO. The NYSE is owned by Intercontinental Exchange (ICE). I’ll add what should be good news to all young people. Ms. Cunningham started out as an intern in 1994.

But the biggest news story for us is that GE will merge their rail business with Wabtec (WAB). We knew this was coming; we just didn’t know when. The problem is that GE is in a very difficult position. Its business is not going well, so the company needs to sell off some businesses to raise cash. This places Wabtec is a good spot.

This is a very big deal. GE will sell its business to WAB for $11 billion, and GE will stay on as a part owner. GE will get $2.9 billion in cash and own about 40% of the company. WAB shareholders will own 49.9% of the business. Both companies believe the combined entity will cut costs by $250 million per year.

Shares of WAB got a nice bounce on this news, and it’s now our #1 performer this year. This week, I’m lifting my Buy Below on Wabtec to $102 per share.

That’s all for now. The May jobs report will be coming out later today. On Monday, we’ll get the factory-orders report for April. The ISM non-manufacturing report comes out on Tuesday. Then on Thursday, we’ll get the latest jobless-claims report. It continues to be near a multi-decade low. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Syndication Partners

I’ve teamed up with Investors Alley to feature some of their content. I think they have really good stuff. Check it out!

A Super Cheap Way to Protect Yourself from Risk Overseas

One of the questions I get a lot when I speak at events like the MoneyShow and TradersExpo is about the benefits of looking at large options trades. Large trades using options, typically called block trades, are often executed by big firms with a lot of capital and resources.

As such, block trades can be very valuable indicators of what the smart money is doing with their time and money. Block trades can potentially show you how funds are using covered calls, what stocks have breakout potential, or even what pension funds are using to protect themselves.

It’s true, block trades can be professional hedges or they can be speculative bets. Sometimes, it’s not all that obvious what you’re looking at. But, there are often clues. For instance, hedges tend to be long puts or long put spreads (buying a put vertical spread) in index ETFs.

That’s not to say that there aren’t large downside bets in index ETFs which are speculative. However, those downside bets tend to be a bit more creative than outright put or put spread purchases. Index puts can be expensive, so speculative options buyers will be looking to keep costs low. On the other hand, hedges are meant strictly for protection, and many firms or funds are willing to pay up for protection (or they have no choice).

Of course, if hedgers can find a way to protect themselves cheaply and effectively, they’ll definitely go that route. Take for example a big trade from last week in SPDR Euro Stoxx 50 ETF (NYSE: FEZ) options. Click here for more.

3 High-Yield Income Stocks for Conservative Investors

When it comes to income stocks, my investment strategy is aggressive. By aggressive I mean that I search out the highest yield stocks I can find where my research shows that the dividends should be secure.

I understand that with this type of high-yield stock, even the best stock research won’t let me avoid the occasional dividend cut. For balance, my overall strategy includes owning dividend stocks that are more conservative. These are shares of companies that will sustain and grow dividends through the worst market cycles.

You may be asking, what makes one high-yield stock safer than shares of other, comparable companies. While the business operations of each company are unique, there are certain attributes that will tell you whether the revenues and cash flow of a company could be at risk with a disruption in business conditions, such as the 2007-2008 financial crisis, or an economic recession.

Here are the financial items you should review and understand to determine the security of dividend payments.

Posted by Eddy Elfenbein on June 1st, 2018 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His