CWS Market Review – June 15, 2018

“There are no patents in finance. Everything has a decay curve, in terms of its margins.” – Stephen Schwarzman

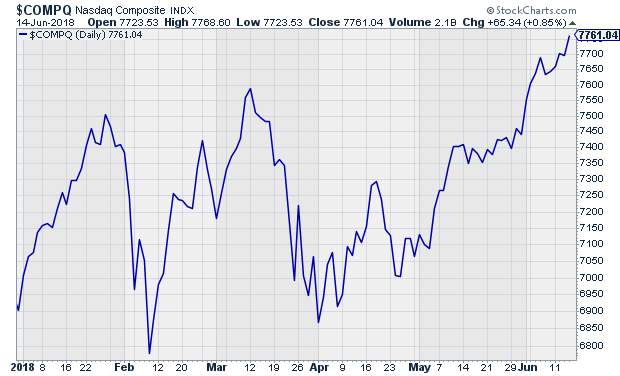

Well, it happened. The Federal Reserve decided to raise interest rates this week, and the stock market didn’t seem to mind much at all. In fact, on Thursday, the Nasdaq closed at an all-time high (see below), and the broader S&P 500 is close to a three-month high.

The big headline from the Fed meeting is that Mr. Powell & Co. now plan on raising rates two more times this year. Their earlier projection had been for one more increase. This is a good example of the headlines being narrowly true yet missing the larger picture. The fact is that the Fed’s long-term path for interest rates hasn’t changed one iota. I’ll explain what it all means in a bit.

The big news for our Buy List was that on Monday, it was reported that Stryker was going to buy Boston Scientific. Then, 48 hours later, Stryker wasn’t going to buy Boston Scientific. So, was this Wall Street’s version of Runaway Bride? Or maybe Runaway Groom? I’ll bring you all the details. But first, let’s look at what the Fed has in store for us.

The Federal Reserve Hiked Rates

The Federal Reserve met again this week, and for the seventh time this cycle, the central bank decided to raise overnight interest rates. The new target range for Fed funds is 1.75% to 2.00%. This move was widely expected. The Fed had been quietly signaling to financial markets that a rate hike was coming. The futures market in Fed funds was nearly unanimous that rates were about to rise.

Even though this week’s move was expected, there were a few interesting items I wanted to highlight for you. First off, Chairman Jay Powell said that he’ll hold press conferences at all FOMC meetings starting next year. That’s good to hear. The current schedule has him holding press conferences at every other meeting. This is another sign of more transparency from the Fed.

I also like how Powell speaks in plain English. I like to tease Fed officials for lapsing into “Fedspeak,” which is my pet name for their official-sounding econo-babble. Alan Greenspan once said, “I guess I should warn you, if I turn out to be particularly clear, you’ve probably misunderstood what I’ve said.” Not with Powell. I think it’s noteworthy that he’s a lawyer by background and not an economist. Powell speaks clearly and to the point. We need more of this.

For example, the Fed cut way back on the length of its policy statement. I’ve been calling for this for years. There’s no need for a policy statement to run on for several hundred words. Just tell what you did, why you did it and move on.

This week’s policy statement said that the jobs market is strong, consumer spending looks good and inflation is holding near 2%. The previous statement said that economic activity is rising at a “moderate” rate. Now it’s rising at a “solid” rate. (Yes, there are people whose job it is to freak out about these minor changes.) Let me boil it down for you—the key takeaway is that things are slowly getting better, and the Fed is going to continue raising rates.

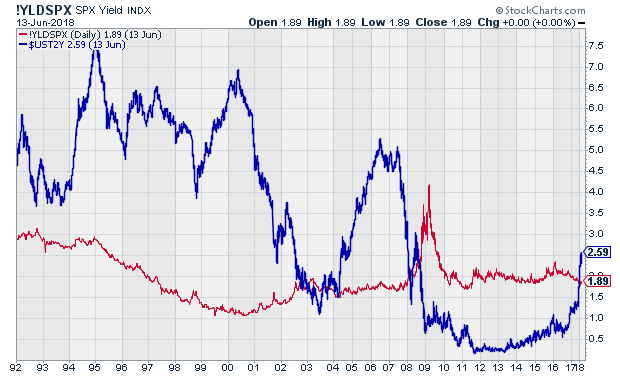

That’s fine for us. The Fed is still some distance away from harming the market or the economy, but the danger zone is no longer purely theoretical. The recession was a long time ago. While the recovery has been uneasy, it’s been stable. With this meeting, the Fed updated its economic forecasts. This is what I was most interested in. Here’s a look at the dividend yield of the S&P 500 (red) along with the two-year Treasury yield (blue). The two-year is often pretty close to the Fed funds rate. Notice how the blue line went from nearly 0% and it just jumped above the red.

The media reported that the Fed’s forecast was more “hawkish,” meaning more willing to raise interest rates to fight off inflation. This is true, but I think a lot of investors were led astray by the headline. It’s true that the median forecast on the Fed now sees the need for two more rate hikes this year. However, when we look at the individual forecasts, only one vote changed. So while there is indeed a majority on the Fed that sees the need for two more hikes this year, it’s a majority by a single vote. Let’s remember that the Fed’s forecasts are typically overly hawkish early on, and they tend to correct to the dovish side as time goes by. That could easily happen again.

The median Fed member now sees two more increases this year, plus three more next year (again, by one vote). That would bring the range on Fed funds to 3.00% to 3.25%. This would be followed by one more rate increase in 2020.

Let me make clear that the idea of forecasting rate hikes so far in advance is utter folly. But the important point for us is that the 2020 forecast is the exact same forecast we saw at the previous Fed meeting. In other words, the Fed hasn’t changed its target for rate hikes; it merely altered the path slightly. Yet some traders mistook this for a bigger deal that it really is.

Here’s where we stand. Let’s say the Fed hikes again in September. That will bring real rates all the way up to 0%. The real short-term interest rate is one of the strongest variables in determining the direction of stock prices. The earliest we would have to worry about the Fed causing havoc is probably still a year away.

The housing market still looks good. The labor market is strong. The Atlanta Fed pegs Q2 GDP growth at 4.8%. That’s huge, but it’s just an estimate. The 2/10 Spread, a key finance metric, got down to 35 basis points on Thursday. That’s the narrowest in nearly eleven years, but it’s still positive. Tuesday’s inflation report showed that core prices rose 2.24% in the last year. That’s pretty good.

Overall, this is close to the sweet spot for the economy and the market. The biggest challenge for us is that the market has been rewarding lower-quality stocks. That’s why the Nasdaq has been so strong lately. The Nasdaq Composite is already up more than 12.4% this year.

Around here we favor high-quality stocks, and those haven’t been reaping the market’s big gains. Do not be tempted by the easy profits in lower-quality shares! Low quality typically has its day in the sun, but it ends badly. Our strategy, meanwhile, continues to do well. Continue to focus on a core group of high-quality stocks such as those you see on our Buy List. Now let’s turn this week’s almost big story.

Kalamazoo Scientific?

On Monday, the Wall Street Journal reported that Stryker (SYK) made an offer to buy Boston Scientific (BSX). Trading in shares of both stocks was halted before Boston Scientific confirmed the story. The WSJ didn’t disclose any details, but it would have been a major deal. I like both stocks a lot, especially Stryker. The Kalamazoo-based company has been a Buy List member since 2008.

A deal between the two makes some sense. Stryker is a leader in orthopedics, neuro and spine, while BSX is big in cardio. There’s also been a wave of mergers rolling over the industry. In fact, we were the beneficiaries of this wave last year when Becton, Dickinson snapped up CR Bard. We also rode the run-up in Express Scripts when they put themselves on the market.

Since Stryker was the would-be acquirer, its stock fell 5.1% on Monday, while BSX jumped 7.4%. Stryker fell another 4.3% on Tuesday (see below). Still, this deal seemed pretty shaky. I get the feeling they were pursuing a deal because they thought they had to, not because they wanted to.

Then on Wednesday, the whole thing fell apart. Stryker took the unusual step of releasing a regulatory filing. While acknowledging that they don’t typically comment on such matters, Stryker said, “Stryker is not in discussions with Boston Scientific Corporation regarding a potential acquisition.” Of course, that doesn’t mean they had not been in discussions.

I’m assuming BSX shot them down. I can’t say I’m disappointed. Big deals are hard to pull off, and bigger isn’t necessarily better in the business world. There are lots of examples of mega-mergers turning out to be duds. I’d rather see Stryker pursue a deal that they want to get instead of one that feels forced.

Stryker is a very good outfit. A few weeks ago, they beat earnings by eight cents per share. The CEO said, “We had an excellent start to 2018 with strong organic sales growth, operating margin and adjusted EPS in the first quarter.” The company also raised its full-year forecast. Their initial range was $7.07 to $7.17 per share. Now they see 2018 coming in between $7.18 and $7.25 per share.

Shares of Stryker rebounded a little after the deal fell through. If you have been looking to add Stryker to your portfolio, this is a good opportunity. For Q2, Stryker expects $1.70 to $1.75 per share. That’s pretty good. Look for another impressive report in late July.

Before I go, I want to raise a few of our Buy Below prices. I’m lifting Fiserv (FISV) to $81 per share. The stock hit a new 52-week high on Thursday. I’m raising Moody’s (MCO) to $190 per share. The credit-rating agency is a 19% winner for us this year. I’m also going to raise Intercontinental Exchange (ICE) to $79 per share. Lastly, I’m raising FactSet (FDS) to $223 per share. FDS will report earnings again on June 26.

That’s all for now. There’s not much on tap for next week in terms of market news, although we will get some key reports on housing. On Tuesday, the housing-starts report comes out. Then on Wednesday, we’ll see existing home sales. I’ll be curious to see if higher rates have had an impact on the housing market. So far, the evidence is pretty thin. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Syndication Partners

I’ve teamed up with Investors Alley to feature some of their content. I think they have really good stuff. Check it out!

3 Stocks Raising Dividends in July

There is a general misconception that rising interest rates are always bad for real estate investment trust (REIT) values. However, history shows that REITs have outperformed 75% of the time during the last 16 periods of rising interest rates. One reason is that quality REITs will grow their dividends, and if the dividend increases keep up or exceed the interest rate increases, you are better off owning the REIT shares.

Buying shares in the month before a dividend announcement is one strategy that can produce a quick start to a new for you REIT investment. Most REITs increase their dividend rate once a year, and then pay that new rate for the next four quarters. From the way share prices change, it is apparent the investing world is not aware of the timing of dividend boosts in the REIT world. I maintain a database of about 130 REITs and include which month each usually announces its dividend hikes.

Summer is one season with the fewest number of increase announcements. However, it can also be an opportunity because the market is not looking for higher dividend rate announcements. There are three REITs that should announce higher payouts in July. You can pick up shares now, and when a new higher dividend is announced you get the double bonus of a possible share price increase on the news and the guaranteed benefit of a higher yield than the current quoted rate. Here are three stocks to consider buying in June for a July dividend increase.

5 Low Risk Income Stocks Profiting from Stock Market Volatility

After a long period of low volatility, the measurement of stock price movement has moved much higher in 2018. Higher volatility is usually accompanied by big down days in the stock market. Over the last five months, the U.S. market has turned from a place of easy profits to one that has been tough on investor portfolio values. To make lemonade from lemons, consider those investments products that can pay you more based on increased volatility.

Measured volatility increases when the stock market goes down. The reason the metric was so low in 2017 is because down days were few and of limited magnitude. A recent article from Bloomberg highlighted the fact that in 2018 the average down day move of the S&P 500 this year has been 24% greater than the average up day gain. This is the largest gap since 1948. As I noted, down days result in increased volatility, so it’s understandable that even though the current S&P 500 is close to where it started the year, volatility has made stock investing more nerve racking.

The widely quoted volatility index or VIX is derived from the prices of options contracts trading against the S&P 500. Many investors do not know that VIX is just a measure of options prices. This means that when volatility or VIX is elevated, traders who sell options are making more money. While options trading can be complicated and risky, there are income focused investment products that use option selling to enhance cash flow and support dividend payments from a portfolio that without options would not carry as attractive a yield.

You can find these buy-write or covered call products in the form or ETFs or closed-end funds. When you invest in one of these funds, you should look for recent dividend increases due to higher volatility, or if you buy shares in funds that haven’t yet increased payouts, sell the shares if you don’t get a dividend boost in the next quarter or two.

Here are five funds to consider.

Posted by Eddy Elfenbein on June 15th, 2018 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His