CWS Market Review – August 17, 2018

“Look at market fluctuations as your friend rather than your enemy. Profit from folly rather than participate in it.” – Warren Buffett

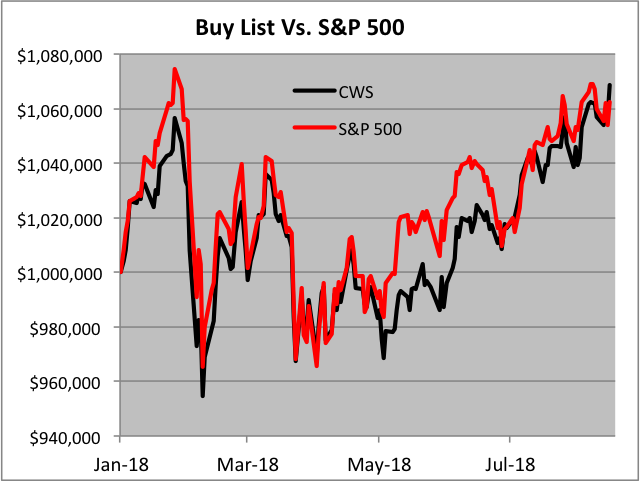

On Thursday, our Buy List closed at another high. We’re now up 6.87% for 2018. We also closed at a new relative-performance high. We’re running 62 basis points (or 0.62%) ahead of the S&P 500. (Note that these numbers don’t include dividends which I haven’t had time to calculate.)

This is a nice change of pace from the spring when our Buy List had a rough time. Since May 14, our Buy List is up 7.84% compared with 4.04% for the S&P 500. Fortunately, our “be a little patient” strategy is paying off. Best of all, we still haven’t made a single trade all year, nor will we!

In this week’s CWS Market Review, I’ll discuss the emerging sector rotation on Wall Street. Conservative stocks are suddenly hot. I’ll also preview three Buy List earnings reports coming our way next week. But first, let’s take a quick summary of our Buy List’s performance so far.

Buy List Summary

As I mentioned before, our Buy List is up 6.87% so far this year, but that’s coming after a soggy start. By the middle of May, our Buy List was trailing the S&P 500 by more than 3%. We’ve had a pretty nice recovery since then.

I’ll be honest—I didn’t see the turnaround coming. I’m not so good at predicting the future, but what’s important is that we were prepared to take advantage of change when it finally came. This why we focus on high-quality stocks. We also don’t run and hide at the first sign of trouble.

I’ll also note that our three best performers this year are Continental Building Products (CBPX), Wabtec (WAB) and RPM International (RPM). Sexy, right? I know, these aren’t exactly household names. It’s a nice lesson for investors to consider that our wallboard stock is doing roughly six times better than the rest of the market.

Of course, it’s not all good news. On the downside, our worst stock is Ingredion (INGR), and it’s much worse then everybody else. INGR is down nearly twice as much as our second-worst stock. I’m not making excuses for it, but I want to show you why diversification is so important. It’s not uncommon that your median performer (the middle guy) winds up being a better performer than the average of your entire portfolio. That’s happening to us this year. On Wall Street, the downs tend to be down a lot more than the ups are up. This is a crucial lesson for investors.

All told, Ingredion has knocked about 1.41% off the total performance of the Buy List this year, and that includes a 5% jump on Thursday. Too many investors hurt themselves by failing to diversify. You’ll notice that our Buy List covers many different sectors and industries. That’s not an accident.

The High-Beta Crackup

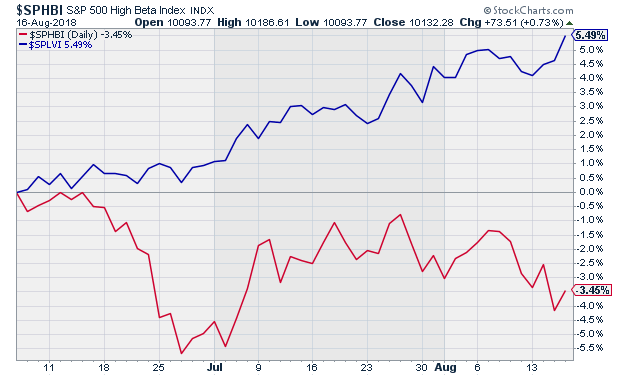

The Buy List has been helped recently by a shift in the stock market’s risk profile. Starting in February 2016, the stock market rallied and High Beta stocks did the best while conservative stocks were left far behind. (Forgive me for the financial mumbo-jumbo. By “High Beta,” I mean riskier stocks, and by “Low Vol,” I mean more conservative stocks.)

The most prominent aspect of this rally was the FAANG stocks. The high-profile FAANGs powered the High Beta stocks higher. In terms of relative performance, the High Beta sector peaked in June. They still went higher, but not by as much as the rest of the market. This was the moment for conservative stocks to shine as the Low Vol sector gradually outpaced the broader market.

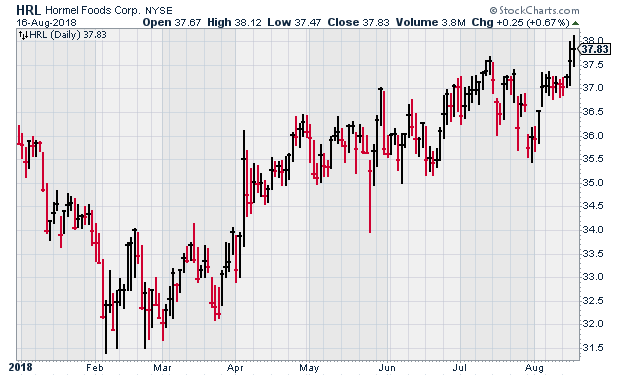

I’ve touched on this subject a few times in recent issues of CWS Market Review, but the trend has gotten much bolder. Twice recently—first on Friday, then again on Wednesday—High Beta stocks did very badly. What started as a trickle has turned into some serious pain. The risky stocks are hurting, and conservative stocks are doing just fine. In fact, a bedrock sector in the Low Vol world is consumer staples. Some Buy List favorites here are Hormel (HRL) and Smucker (SJM), the Spam and Jam twins, plus Church & Dwight (CHD). After a long slumber, these consumer staples are getting the attention of investors.

But the $30 trillion question is, will this trend last? I don’t know, but the previous trend is quite old. Also, the shift towards conservative stocks seems to be more than a blip. I’m inclined to believe that this is a true turning point for the market, and more stable stocks will thrive. Investors’ love affair with trendy stocks like Tesla is on the rocks. All those hi-flying Chinese tech stocks are on the outs as well (see the FXI fund which has been the go-to fund here). I’ll add that historically, when the risk cycle changes, the new trend tends to last for a few years.

Three Buy List Earnings Reports Next Week

We have three Buy List earnings reports next week. These are for our three stocks with quarters that ended in July. I’ll be curious to hear the earnings report from JM Smucker (SJM). This will be for the first quarter of their fiscal year, and it’s due out on Tuesday, August 21.

Some background. In June, the stock got dinged after Smucker released a pretty bad earnings report for fiscal Q4. The company told us to expect earnings between $2.17 and $2.27 per share. Instead, they made $1.93 per share. Not surprisingly, traders punished the stock.

What happened? The CEO blamed the miss on “industrywide headwinds and certain discrete items.” Hmm. Smucker also had disappointing guidance for the current fiscal year. The company sees this year’s earnings (ending in April) coming in between $8.40 and $8.65 per share. Wall Street had been expecting $9.18 per share.

There were a few reasons for Smucker’s poor Q4. For one, Canada announced retaliatory tariffs on American jam which is a core SJM product. The company also faces higher costs which places it in the tough position of passing said costs on to consumers. This is a difficult environment in which to raise prices. Bear in mind that Smucker is a lot more than jelly. They also make Jif peanut butter and Folger’s coffee, and they have a pet-food division which is the company’s largest.

For Q4, sales of Smucker’s consumer foods fell by 1.8%. Pet food was flat while coffee was up 0.5%. For the quarter, net sales fell by 0.1%. The issue really comes down to pricing and how much latitude Smucker truly has. Frankly, everyone in the industry is facing the same issue. The Q4 results suggest that Smucker may have to give in and deal with lower margins. To be fair, Smucker has already started to adjust its business model to better compete in a challenging market. For example, a few weeks ago, Smucker sold off Pillsbury, their baking division, to a private-equity firm. That brought in a nice wad of cash.

Last year, Smucker made $7.96 per share. There’s a lot I like about Smucker. The company recently bumped up its dividend from 78 to 85 cents per share. That was their 17th consecutive annual dividend increase. For Tuesday, Well Street expects earnings of $1.79 per share.

On Thursday, August 23, Ross Stores (ROST) and Hormel Foods (HRL) are due to report. (These two seem to always report on the same day.)

Let’s start with Ross because I’m expecting good news from them. Three months ago, the deep discounter reported fiscal Q1 earnings of $1.11 per share. They had projected earnings between $1.04 and $1.07 per share.

The details were pretty solid. Q1 sales rose 9% to $3.6 billion, and comparable-stores sales were up 3%. Ross had been expecting 1% to 2%. (I knew that forecast was too low.) The company said it was hurt by poor weather during the quarter. I’m usually pretty skeptical of weather as an excuse. Ross’s operating margin fell to 15.1%. That’s still pretty good for a retailer.

For fiscal Q2, Ross expects earnings of 95 to 99 cents per share. They see same-store sales growth of 1% to 2%. Once again, that’s too low. In June, Ross raised its full-year guidance. The old range was $3.86 to $4.03 per share, and the new range is $3.92 to $4.05 per share.

I’m pretty confident Ross earned more than $1 per share last quarter. Probably more than $1.03. The real question is how strong same-store sales growth was. For now, I’m keeping a tight Buy Below price at $90, but I may raise it soon depending on their results.

Three months ago, Hormel Foods missed their fiscal Q2 earnings by a penny per share, but I’m not too concerned about a miss like that. Hormel’s business still looks pretty good. Profits were up 13% over last year’s Q2. Most importantly, the Spam folks reiterated their full-year earnings range of $1.81 to $1.95 per share. This November, I’m expecting another dividend increase which will be their 53rd in a row. On Thursday, shares of HRL closed at an 18-month high. For this report, Wall Street expects earnings of 39 cents per share.

Before I go, I wanted to pass along an update on Signature Bank (SBNY). The bank has been a lousy performer for us this year. Still, on Thursday, the bank announced that it had approved a share buyback of up to $500 million. That’s about 8% of the bank’s market cap. The deal still has to be approved by shareholders. I don’t think they’ll mind terribly since SBNY jumped 4.2% on Thursday. The bank is going for less than 13 times this year’s earnings.

That’s all for now. There are a few things to look out for next week. On Wednesday, we’ll get the report on existing-home sales. We’ll also get the minutes from the last Fed meeting. That could be interesting. Then on Thursday, we’ll get a look at new-home sales, plus another jobless claims report. Then on Friday, the durable-goods report comes out. Also on Friday, the Fed will kick off its annual shindig in Jackson Hole. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on August 17th, 2018 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

Archives

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His