CWS Market Review – January 25, 2019

“Fear is an emotion, not a stock indicator.” – Coreen T. Sol

The stock market has been oddly calm this week. This is especially interesting now that earnings season is underway. So far, the earnings results look pretty good. About 25% of the companies in the S&P 500 have reported Q4 earnings, and the “beat rate” is running close to 70%.

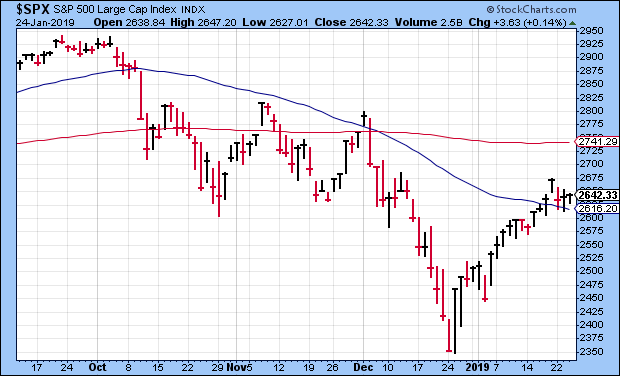

Last Friday, the S&P 500 briefly got over 2,675. From trough to peak, the S&P 500 gained 14% in a little over three weeks. That’s a nice little rally. In the last 14 trading sessions, the index has only had three losing days. Crucially, the index is still above its 50-day moving average (the blue line in the chart below), and the 200-DMA isn’t that far off (the red line).

Still, I’m cautious. The shutdown isn’t helping things, and the Federal Reserve gets together next week. My fear is that the central bank is clinging to an unnecessary need for higher interest rates. Hopefully, we’ll hear evidence that the FOMC is bowing to reality. With central bankers, one never knows.

We didn’t have any Buy List earnings reports this week, but we have a full slate next week. I’ll preview them all in this week’s issue. I also have an update on Fiserv, which just reached a new all-time high. Some of our Buy List stocks already look like big winners this year. (Anyone else notice that Signature Bank is up 21% YTD? Good: me too.) Before we get to that, let’s look at the best initial jobless-claims reports in half a century.

Don’t Expect a Rate Hike Next Week

There was important news on Thursday that didn’t get a lot of attention. The initial jobless-claims report came in below 200,000. Specifically, it was 199,000. What makes this noteworthy is that this hasn’t happened in nearly 50 years. The last time it was lower was in November 1969.

The jobless claims report kinda sorta lines up with the government’s jobs reports, but not exactly. This suggests that we’re going to get another good jobs report next Friday. Importantly, I think we’ll see more folks wander back to the workforce. During the recession, many people simply stopped looking for jobs. That’s how rough things were. I noticed that Walmart is looking to hire 900 truckers and pay them $90,000 a year. A lot of companies need more workers, but now they finally have to pay more to get them.

The Federal Reserve meets next week on Tuesday and Wednesday. Don’t expect any movement on interest rates. The Fed may be done for a while, but I’m not sure if they realize it yet. Their forecasts for this year were pretty bold. The median FOMC member sees the need for two more rate hikes this year, and a sizable faction thinks we need three.

Color me skeptical.

Let’s run down the evidence. The U.S. dollar has been holding up well. Inflation has been low. The CPI report for December showed a slight drop in consumer prices thanks to a decline in energy prices, but even the “core rate” is low. Currently, the futures market thinks there’s a 1-in-6 chance of a Fed rate hike by June. That sounds right. The futures market thinks there’s a 71% chance the Fed won’t make any changes to rates this year. A lot of people think the next move could be a rate cut.

But the best news has been on the jobs front. The U.S. labor market continues to expand, and people are returning to the jobs market. There’s also evidence that wages are finally improving. Economic theory tells us that this results in inflation. At some point, I suppose that’s right, but I prefer to look at the real world over theory. (This, among many reasons, is why I’m not on the Fed.) There simply isn’t a need for higher rates right now.

The housing market got knocked down in 2018, but it’s far from done for. Last month, existing-home sales fell 6.4%. We don’t yet have the new-homes sales data yet (thank you, shutdown), but the recent weakness is certainly due to higher mortgage rates. That’s another reason for the Fed to cool it. This may be why Sherwin-Williams recently warned that Q4 will be weak.

Since rates have backed off, I expect a pickup in housing this year. It seems that a decade on from the economy going kablooey, folks are still nervous about a housing bust. Please. We’re not even close to one. We just need the Fed to cooperate.

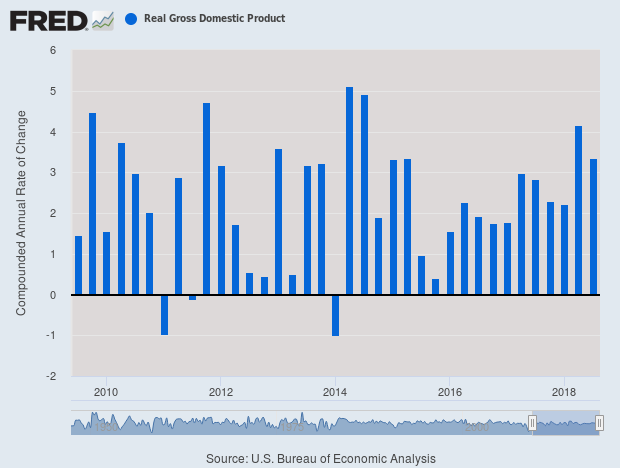

Next week, we’re going to get the initial report on Q4 GDP growth. This will be an interesting one because the last two reports were pretty good: +4.2% and +3.4%. The economy has had a very hard time stringing together three quarters in a row of decent growth (see chart above). This time, we may finally do it.

As I mentioned earlier, earnings season is young, but the early results look promising. The consensus is for earnings growth of 13.5%. We should top that. With this earnings season, I’m also paying attention to guidance for 2019. Companies aren’t required to give investors guidance, but the better companies do, particularly those on our Buy List. Having said that, let’s look at the Buy List earnings reports for next week.

Next Week’s Earnings

Here’s a look at our Earnings Calendar:

| Company | Ticker | Date | Estimate | Result |

| Eagle Bancorp | EGBN | 16-Jan | $1.13 | $1.17 |

| Signature Bank | SBNY | 17-Jan | $2.80 | $2.94 |

| Stryker | SYK | 29-Jan | $2.15 | |

| Danaher | DHR | 29-Jan | $1.27 | |

| Check Point Software | CHKP | 30-Jan | $1.63 | |

| Sherwin-Williams | SHW | 31-Jan | $3.68 | |

| AFLAC | AFL | 31-Jan | $0.94 | |

| Hershey | HSY | 31-Jan | $1.27 | |

| Raytheon | RTN | 31-Jan | $2.88 | |

| Cerner | CERN | 5-Feb | $0.63 | |

| Church & Dwight | CHD | 5-Feb | $0.58 | |

| Disney | DIS | 5-Feb | $1.56 | |

| Becton, Dickinson | BDX | 5-Feb | $2.61 | |

| Torchmark | TMK | 5-Feb | $1.56 | |

| Cognizant Technology Solutions | CTSH | 6-Feb | $1.07 | |

| Broadridge Financial | BR | 7-Feb | $0.71 | |

| Fiserv | FISV | 7-Feb | $0.87 | |

| Intercontinental Exchange | ICE | 7-Feb | $0.92 | |

| Moody’s | MOC | 15-Feb | $1.68 | |

| Continental Building Products | CBPX | 21-Feb | $0.59 |

As you can see, we have seven earnings reports scheduled for next week.

On Tuesday, Danaher and Stryker are set to report. Previously, Danaher (DHR) told us to expect Q4 earnings between $1.25 and $1.28 per share. My math tells me they’ll probably beat that by a little.

For all of 2018, Danaher expects earnings between $4.49 and $4.52 per share. For context, at this time last year, Danaher gave initial 2018 guidance of $4.25 to $4.35 per share. That should tell you how well things have been going for them. I love seeing our stocks raise guidance.

With the earnings report, Danaher will probably give initial 2019 guidance. I’m expecting something around $4.75 to $4.80. Don’t be surprised if they low-ball us. That’s how the game is played. Remember that Danaher is also planning to spin off its dental business sometime this year. We may get an update on Tuesday.

Stryker (SYK) took a big hit in December, and the shares have been rallying back. For Q4, the company expects $2.13 to $2.18 per share. For all of 2018, Stryker sees earnings between $7.25 and $7.30 per share. I think the Street will be watching their Q1 guidance carefully. The consensus is for $1.84, which is probably too high, but don’t sweat this one. Stryker is a solid company.

Check Point Software (CHKP) is due to report on Wednesday. This is another stock that ended 2018 on a rough note. So far, 2019 is looking a lot better. In October, CHKP told us it expects Q4 earnings of $1.56 to $1.67 per share on revenue of $500 million to $528 million. That’s a pretty big range, but, according to my numbers, that’s reasonable. I don’t know enough to predict an earnings miss or beat. Again, guidance will be key. Consensus on the Street for Q1 is for $1.38 per share.

Next Thursday will be a busy day for us. Four Buy List stocks are due to report.

AFLAC (AFL) has been a strong performer lately. In October, the duck stock said it sees itself coming in at the “high end” of its previous full-year guidance. (Warning, math ahead.) That guidance was $3.90 to $4.06 per share, and it assumed an exchange rate of ¥112.16 to the dollar. If by “high end” AFLAC means $3.98 to $4.06 per share, then that means they see Q4 coming in between 87 cents and 95 cents per share. Lately, the yen has been running around ¥109 to the dollar. I may raise my Buy Below on AFLAC, but I want to see the Q4 numbers first.

Hershey (HSY) is one of our new stocks this year. The shares got knocked down on Thursday with some other consumer-staples stocks. Three months ago, the stock took a hit when it met Wall Street’s estimate for Q3. The lower share price helped convince me to add it to this year’s Buy List. Hershey expects full-year earnings of $5.33 to $5.43 per share. That works out to $1.22 to $1.32 per share for Q4.

Raytheon (RTN) is another new stock this year. We already have an 8.5% gain this year, but it’s early. Three months ago, the aerospace firm easily beat expectations and raised guidance. Despite the good earnings news, the stock has been going for a decent valuation. I think we got RTN at the right time. In October, Raytheon raised its full-year guidance range from $9.77 – $9.97 per share to $10.10 – $10.11 per share. When the range is one-penny wide, I think that’s a clue that the company knows what to expect. I hope to see 2019 guidance between $11.50 and $12 per share.

Sherwin-Williams (SHW) already warned us that the Q4 report won’t be a good one. The paint people had been expecting a sales increase in the mid-single digits. Instead, it will be 2%. The company said they had weak North American sales in October and November. Sales improved in December but not enough to make up the difference.

Before, Sherwin told us to expect Q4 earnings between $4.07 and $4.22 per share. Now it says earnings will be $3.55 per share. On a full-year basis, the company expects earnings of $18.53 per share (which excludes merger-related costs). The previous estimate was $19.05 to $19.20 per share.

I’m not pleased with this news, but I’m prepared to give Sherwin the benefit of the doubt. This is a well-run outfit, and their results speak for themselves. I appreciate the company getting out ahead of the news. This could be a very good year for Sherwin.

Fiserv Is a Buy up to $84 per Share

There’s an old saying about the movie business: “nobody knows nothing.” Well, that applies to investing as well. Last week, I told you about Fiserv’s (FISV) deal with First Data. After the deal was announced, shares of Fiserv plunged 8.8%. Since then, they’ve rallied back impressively.

On Thursday, Fiserv hit a new all-time high. In six days, from low to high, Fiserv gained more than 20%! This is why we trade our positions so infrequently. Nobody knows nothing. This week, I’m lifting my Buy Below to $84 per share. Earnings are due out on February 7.

That’s all for now. There will be a lot more earnings news next week. The Fed meeting is on Tuesday and Wednesday. Don’t expect any change on interest rates. The policy statement will come out on Wednesday afternoon. Also on Wednesday, the Q4 GDP report comes out. Wall Street expects growth of 2.9%. If that’s not enough news, the January jobs report will come out on Friday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. Several readers have asked if I could host another conference call, especially about earnings season. That’s a great idea. I’m planning one now. I’ll have more details soon.

Posted by Eddy Elfenbein on January 25th, 2019 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His