CWS Market Review – February 8, 2019

“The public, as a whole, buys at the wrong time and sells at the wrong time.”

– Charles Dow

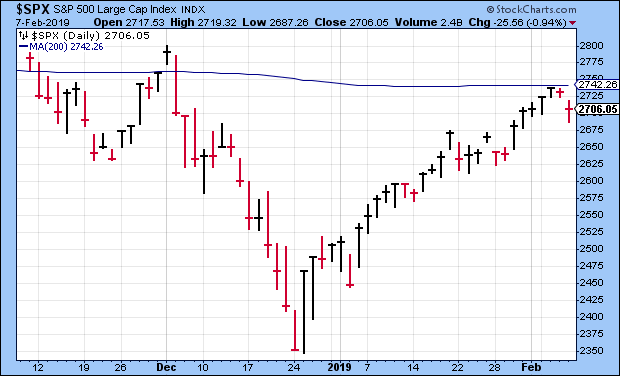

I often talk about the market’s 200-day moving average and this week is a good example of why. The S&P 500 has been recovering at a steady clip, but on Tuesday of this week, it ran into a brick wall better known at the 200-DMA (the blue line in the chart below). We then had losing days on Wednesday and Thursday.

Prior to those two losses, the stock market had had only six losing days this year. The down-up market of the last few months has drawn out a nice little “V” sign on everyone’s stock chart. In the last few issues, I’ve cautioned you to expect the market to go back and “retest” its December low. Fortunately, the market has flatly ignored my warnings. That may not last.

But the big news this week has been earnings. Lots and lots of earnings. We had nine Buy List earnings reports this week. I’ll run through them all (here’s our complete Earnings Calendar). I’m happy to say that we got nice dividend hikes from Intercontinental Exchange and Church & Dwight. Plus, Cerner said they’re initiating a dividend. Before I get to all the earnings reports, I want to mention last week’s strong jobs report.

The U.S. Economy Created 304,000 New Jobs Last Month

Last Friday, not long after I sent you last week’s CWS Market Review, the government reported that the U.S. economy created an impressive 304,000 net new jobs last month. That’s a solid number, although revisions trimmed the gains from previous months.

As investors, it’s not important for us to get too deep in the weeds on these reports. The important thing is that the economy is doing well. Also, workers are finally getting an increase in wages. That’s very good to see. Remember, those higher wages eventually translate into higher sales at businesses.

There are two points in the jobs report that I want to highlight. The first is that even though the unemployment rate ticked up by 0.1% to 4.0%, more folks are going back into the workforce. The government only counts you as unemployed if you’re looking for a job. During the recession, lots of folks simply stopped looking. In February, the labor force participation rate got up to 63.2%. That’s a five-year high. The job-to-population rate reached a ten-year high.

The other point about the jobs report is how subdued the bond market’s reaction has been. On Thursday, the 10-year Treasury closed at 2.65%. That doesn’t strike me as reason for fear that the economy is overheating. In fact, this year, former Fed chair Janet Yellen recently said that it’s possible that the Fed’s next move could be a rate cut. I wouldn’t say that’s likely, but it’s not unreasonable. I think the message is becoming clear—the Fed won’t do much on interest rates in 2019. That’s good news for investors. Now let’s take a look at our earnings reports.

Five Buy List Earnings Reports on Tuesday

Tuesday was another busy day for us. Five of our Buy List stocks reported results.

Let’s start with Becton, Dickinson (BDX). Three weeks ago, the company told us they made $2.70 per share for fiscal Q1. Sure enough, the official earnings report came out and confirmed exactly that. On a currency-neutral basis, that’s an increase of 14.9%.

Becton’s CEO said the results were better than expected across all three business segments and that the CR Bard acquisition is going well. For 2019, Becton expects revenues to grow by 5% to 6%, and they see EPS ranging between $12.05 and $12.15. The shares pulled back some this week. Becton, Dickinson remains a buy up to $260 per share.

Church & Dwight (CHD) reported Q4 earnings of 57 cents per share which was a penny below estimates. For the year, CHD earned $2.27 per share. For the year, organic sales rose 4.3% which beat the company’s forecast of 4.0%. For Q4, organic sales rose by 4.3% which beat their outlook of 3%.

The CEO noted that they’re hitting 2019 “with momentum,” and that they have price increases on the way. Church & Dwight also boosted its quarterly dividend from 21.75 cents per share to 22.75 cents per share. That’s a 4.6% increase and the 23rd annual dividend increase in a row.

Even though CHD missed by just one penny per share, traders were not pleased. CHD fell 7.6% on Tuesday. I thought that was overblown. Sure enough, CHD gained back about half of that on Wednesday. It’s our biggest loser on the year so far (-4.8%). Church & Dwight is still a buy up to $70 per share.

Cerner (CERN) hit Wall Street’s consensus on the nose. The healthcare-IT firm reported Q4 earnings of 63 cents per share, up from 58 cents per share in Q4 of 2017. Revenue rose 4% to $1.366 billion. For the year, Cerner made $2.45 per share, and revenue rose 4% to $5.366 billion.

Now the good news. Cerner also said it will initiate a quarterly dividend of 15 cents per share starting in the third quarter. Based on Thursday’s close, the dividend works out to about 1%.

For Q1, Cerner expects earnings between 60 and 62 cents per share on revenue of $1.365 billion to $1.415 billion. For all of 2019, the company is looking for earnings between $2.57 and $2.67 per share on revenue of $5.65 billion to $5.85 billion.

Cerner gapped up over 5% on Wednesday but later gave back some of those gains. I like this stock a lot, but don’t chase it. Cerner is a buy up to $58 per share.

After the closing bell on Tuesday, Torchmark (TMK) reported Q4 earnings of $1.56 per share. That also hit expectations on the nose. For the year, Torchmark made $6.13 per share. That’s a nice increase from $4.82 per share for 2017.

I’ll be honest—Torchmark’s business is dull as dirt, but that suits me just fine. The numbers look good. They really don’t surprise anyone much. For 2019, Torchmark sees earnings of $6.50 to $6.70 per share. Wall Street had been expecting $6.61 per share. This means the stock is going for 12.2 to 12.5 times this year’s earnings. That’s not a bad deal. Torchmark is a boring buy up to $91 per share.

One of our new stocks this year, Disney (DIS) was frustrating for us this week. The company had a blow-out quarter, but the market basically yawned. While it can be aggravating, that’s how investing is sometimes.

Last week, I told you to expect an earnings beat, and I was right. Let’s look at the numbers. For their fiscal Q1, the Mouse House made $1.84 per share. That creamed estimates by 29 cents per share. Revenue fell to $15.30 billion, but that beat expectations of $15.14 billion.

The big story is that Disney is making a big push into streaming. Of course, Disney is into a lot of things. The parks are doing well. The movie business was down from last year, but that’s only because of some tough comparisons with some blockbusters in 2017. On top of that, the Twenty-First Century Fox deal is in the works. That deal should close in June.

I really like what I’m seeing with Disney, and I think it’s going for a good price here. The stock is lower today than it was in May 2015. Be patient with this one. Disney is a buy up to $118 per share.

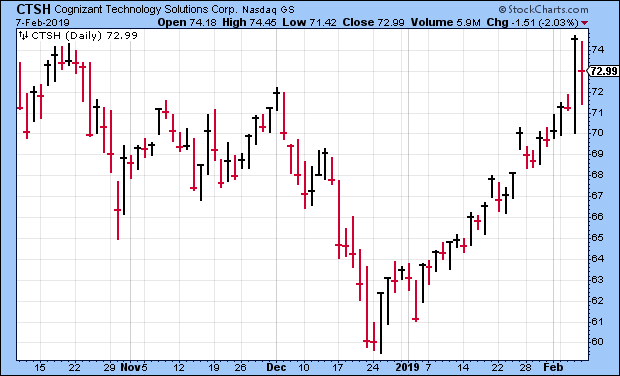

Impressive Earnings from Cognizant Technology Solutions

We had one Buy List earnings report on Wednesday. Cognizant Technology Solutions (CTSH) reported Q4 earnings of $1.13 per share. That was a good number. It’s up from $1.03 per share for Q4 2017, and it beat the company’s own forecast. Three months ago, the IT-outsourcer told us to expect earnings of at least $1.05 per share. Wall Street had been expecting $1.06 per share. In constant currency, quarterly revenue rose 8.8%.

For the year, Cognizant made $4.57 per share. Just a reminder that CTSH originally said they expected to make at least $4.53 this year. Then in May, they lowered that to $4.47, and Wall Street freaked out. We ignored it. Three months ago, they raised their full-year forecast to $4.50 per share. As it turns out, Cognizant beat that by seven cents per share, yet the stock is still well below where it was during the initial slide in May. For the year, Cognizant’s operating margin was 20.7%. They’ve said that their long-term target is for 21%.

Now let’s look at guidance. For 2019, Cognizant sees earnings of at least $4.40 per share. Wall Street had been expecting $4.45 per share. The stock gained close to 5% on Wednesday.

The other big news from Cognizant is that Brian Humphries will be taking over as CEO on April 1 from Francisco D’Souza who has been CEO since 2007. D’Souza has done a great job, and he’ll remain a member of the board. We have a 15% gain in Cognizant so far this year. Buy up to $74 per share.

Earnings from Intercontinental Exchange, Broadridge and Fiserv

Finally, we had three earnings reports on Thursday. Before the bell, Intercontinental Exchange (ICE) said they made 94 cents per share for their Q4. That’s two cents more than expectations. Revenues rose 14% to $1.3 billion. ICE’s operating margin was an impressive 58%. For the year, ICE made $3.59 per share. That’s up 21% over 2017. This was ICE’s 13th consecutive year of record revenues.

The exchange operator also raised its dividend by 15%. The quarterly dividend is increasing from 24 cents to 27.5 cents per share. The dividend is payable on March 29 to stockholders of record as of March 15.

ICE provides guidance for several metrics except EPS. Wall Street had been expecting 2019 earnings of $3.90 per share, and that appears slightly overly optimistic. The stock lost a little over 2% on Thursday. ICE is a buy up to $78 per share.

Broadridge Financial Solutions (BR) bombed its earnings report. For its fiscal second quarter, BR earned 56 cents per share which is 15 cents below estimates. Total revenues fell 6% to $953 million.

Management tried to put a happy spin on the results:

“Broadridge had a strong second quarter and is well positioned for the full year 2019 and beyond,” said Tim Gokey, Broadridge’s President and CEO. “We generated strong increases in recurring revenue, record closed sales, and earnings in line with our expectations, all of which further strengthen our ability to deliver future growth. As anticipated, event-driven revenues declined significantly, returning to more normalized levels from a near-record quarter a year ago.

“We enter our seasonally strong second half with positive momentum and on track to achieve our full-year guidance, including 5-7% recurring fee growth and 9-13% Adjusted EPS growth. Broadridge also remains well positioned to deliver on our three-year growth objectives,” Mr. Gokey added.

Their fiscal 2019 guidance is unchanged. BR sees revenue growth of 3% to 5%, operating margin at 16.5% and EPS growth of 9% to 13%.

For Q3, the company sees revenue between $1.195 billion and $1.245 billion and earnings of $1.40 to $1.56 per share. Wall Street had been expecting $1.53 per share. The stock lost 6.4% on Thursday. I’m keeping the buy below on Broadridge at $102 per share.

Lastly, Fiserv (FISV) reported Q4 earnings of 84 cents per share. That was at the low end of their guidance, and it was two cents below Wall Street’s estimate. For the year, Fiserv made $3.10 per share. This was their 33rd year in a row of double-digit earnings growth.

Despite the earnings miss, Fiserv had Q4 earnings growth of 24% and operating margin came in at 33.4%. Fortune named Fiserv to their list of most admired companies for the sixth year in a row.

For 2019, Fiserv expects earnings to range between $3.39 and $3.52 per share. They’ll need to get above $3.41 to extend their double-digit streak. Fiserv also said they expect the First Data deal to close in the second half of 2019. Fiserv is a buy up to $84 per share.

Moody’s Earnings Preview

After a very busy week, we only have one Buy List report next week. Moody’s (MCO) is due to report next Friday, February 15. This will be an interesting report because the Q3 report was a rare bum note from Moody’s. It missed by eight cents per share. The company said that non-financial corporate debt issuance slowed down last quarter.

Even though it was an earnings miss, Moody’s Q3 earnings were still up 11% from a year ago. The company lowered its full-year range to $7.50 to $7.65 per share. That implies a Q4 range of $1.74 to $1.89 per share. Wall Street expects $1.67 per share.

That’s all for now. We have still more earnings reports next week. On Wednesday, we’ll get a look at the CPI report for January. I’m expecting more tame inflation news. Then on Friday, we’ll get the next report on industrial production. The shutdown has messed with some of the government’s economic reports. It looks like we’ll get our first look at the Q4 GDP on February 28. That’s a month later than usual. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on February 8th, 2019 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His