CWS Market Review – August 23, 2019

“Losing an illusion makes you wiser than finding a truth.” – Ludwig Borne

After the stock market reached an all-time high on July 26, the S&P 500 fell for six days in a row. Fears about the trade war and China and the yuan combined to knock 6% off the stock market in those six days.

This is the 25th correction of more than 5% in this bull market dating back to March 2009. All 24 of the previous drops failed to turn into bear markets. I strongly suspect this will eventually become #25, but at some point, the streak will end. The good news is that the market has calmed down over the last few days.

On our Buy List, we had impressive earnings reports from Hormel Foods and Ross Stores. I’ll cover that in a bit. The outlook from Ross was a bit light due to the tariffs with China. Later on, I’ll preview next Tuesday’s earnings report from Smucker. That will be our last earnings report for some time. But first, let’s take a closer look at the divided economy.

The Consumer Is Healthy but Factories Are Not

In last week’s CWS Market Review, I mentioned how there’s a growing divergence in the U.S. economy. The consumer sector is doing just fine. Consumer spending is rolling along. Retail sales are doing well. This week, in fact, shares of Target jumped 20% after the company’s earnings report.

The industrial sector, however, has hit the skids. The numbers on manufacturing have been pretty sluggish. We can also see this divide in the stock market. I’m often asked when the stock market will finally break. In one respect, it’s already broken down. If we measure from late January 2018, then the stock market hasn’t done that well, especially compared with alternatives such as bonds or gold.

Since January 26, 2018, the S&P 500 is up just 1.74%. That’s nothing. It’s as if we had a silent bear market and no one noticed. The market didn’t plunge 20%, but we’ve barely moved over a period when the stock market averages about 20%, give or take. It’s not exactly the same, but there are some similarities.

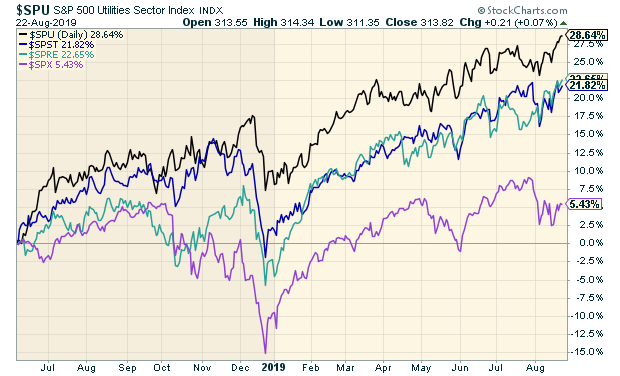

Not only that, but we can see the effect within the stock market. There’s the defensive side of the market. That includes Consumer Staples, Utilities and Real-Estate Investment Trusts (REITs). These stocks have done fairly well. All those sectors are near new 52-week highs. These stocks are sometimes called Low Volatility stocks because they’re far more stable than other shares. On our Buy List, this includes stocks like Church & Dwight (CHD) and Hershey (HSY). Chocolate and condoms aren’t going to be terribly impacted by a recession.

This chart shows how the three defensive sectors have outpaced the S&P 500 (in purple) for several months.

At the other end of the market, you have cyclical stocks. This includes sectors like Energy, Materials, Industrials and Financials. These stocks have not done well at all. In particular, the plunge in the Energy sector is remarkable. The S&P 500 Energy sector is still more than 40% below its high from five years ago. The scars from the recession are still visible. The S&P Bank Index is lower than where it was over 20 years ago.

Part of our success this year compared with the market is that the Buy List is skewed toward these defensive areas. That wasn’t a macro call on my part. Most any portfolio will lean in one direction or another even without trying. This year we’ve been fortunate enough to catch the tailwind helping defensive sectors.

I’m not fully convinced that the economy is in trouble, the inverted yield curve aside. Historically, an inverted yield curve can presage a recession by as much as two years. Also, with rates already so low, perhaps the indicator isn’t as reliable as it once was.

The important variable to watch is the housing market, and that’s moving along. This week’s report on existing-home sales was above expectations. Lower mortgage rates are playing a big role here. As long as the housing market remains healthy, it’s very hard for the economy to fall into a recession.

In fact, Edward Leamer, a well-known economist and econometrician, wrote a piece called “Housing IS the Business Cycle” arguing that housing is central to the overall economy. This isn’t due to its size but due to its cyclical nature.

Any Fed rate cuts for the rest of this year probably won’t have the stimulating impact that the recent decline in mortgage rates has had and will have later this year.

For now, investors should make sure their portfolios have plenty of defensive stocks and stocks with generous dividends. On the Buy List, Check Point Software (CHKP) looks quite good now. I also like Becton, Dickinson (BDX). If you’re more speculative, then Eagle Bancorp (EGBN) is worth a look. Now let’s check out this week’s earnings reports.

Earnings from Hormel Foods and Ross Stores

We had two Buy List earnings reports this week. On Thursday morning, Hormel Foods (HRL) reported fiscal Q3 earnings of 37 cents per share. That was one penny better than expectations.

In many ways, this earnings report was a big sigh of relief. Hormel’s numbers weren’t outstanding, but they were good enough. I think some investors had pretty low expectations, so Hormel proved that things are mostly okay.

In May, the Spam folks lowered their full-year guidance due to African swine fever and other issues. I think that rattled investors. Fortunately, there was no lower guidance this time. Instead, Hormel stood by its full-year forecast for earnings of $1.71 to $1.85 per share.

Since Hormel has already earned $1.33 through the first three quarters, the guidance implies a range for fiscal Q4 of 38 to 52 cents per share. Wall Street had been expecting 45 cents per share. Hormel also sees full-year sales of $9.5 billion to $10 billion.

For Q3, Hormel’s operating margin was 11.2% which is up from 10.9% a year ago. That’s a good sign. Shares of HRL rallied 4.8% on Thursday, and we now have a slight gain on the year. I’m cautiously raising my Buy Below on Hormel Foods to $46 per share.

After the bell on Thursday, Ross Stores (ROST) reported fiscal Q2 earnings of $1.14 per share. That was above their guidance range of $1.05 to $1.11 per share. Quarterly sales were up 6% to $4.0 billion. The all-important comparable-store-sales figure was up 3%. Ross had projected growth of 1% to 2%.

Barbara Rentler, ROST’s CEO, said, “We delivered respectable gains in both sales and earnings for the second quarter. While our Ladies business continued to trail the chain, trends in this important area showed some improvement during the period. Operating margin of 13.7% was better than expected, mainly due to favorable timing of expenses that are expected to reverse in the second half.”

Now for guidance. Ross sees comparable-store sales growth of 1% to 2% for Q3 and Q4. However, because of the trade war with China, Ross is adjusting its second-half guidance. Ross now expects Q3 earnings of 92 to 96 cents per share. Wall Street had been expecting $1 per share. For Q4, which is their biggest, Ross sees earnings of $1.20 to $1.25 per share. Wall Street had been expecting $1.24 per share.

That adds up to full-year guidance of $4.41 to $4.50 per share which is narrower than the previous guidance of $4.38 to $4.52 per share. Despite the tariff issues, Ross continues to do very well. Remember that they like to low-ball their guidance. I’m raising my Buy Below on Ross Stores to $113 per share.

Earnings Preview for Smuckers

We’ll get the last of our August earnings reports next Tuesday when Smuckers (SJM) reports. The jelly stock started off very strongly for us this year but hasn’t done much this summer.

That’s a shame because in June, the company released a strong earnings report. For Q4, Smucker earned $2.08 per share. That was 13 cents better than Wall Street had been expecting.

Smucker also provided guidance for the current fiscal year. The company expects sales growth of 1% to 2% and earnings ranging between $8.45 and $8.65 per share. That’s a bold forecast. Wall Street had been expecting $8.33 per share.

The company has worked to integrate the recent purchase of Ainsworth. The core brands are performing well. The pet-food business is also holding up. For Tuesday, Wall Street expects $1.74 per share.

Buy List Updates

There are a few Buy List updates I have for you. Shares of AFLAC (AFL) got dinged on Wednesday after the Japan Times said that Japan Post “improperly sold around 104,000 insurance policies issued by U.S. partner Aflac Inc.”

AFLAC had partnered with Japan Post to sell AFLAC’s policies, but Japan Post double-charged some customers or left others uninsured. Japan Post said it will stop selling third-party insurance products but it will make an exception for AFLAC’s cancer products.

AFLAC issued a press release to address the issue. I don’t expect this will be a major issue. Shares of AFLAC lost more than 5.5% on Wednesday. Don’t let this concern you. AFLAC is a very strong company.

Shares of Disney (DIS) dropped about $3 per share just before the closing bell on Monday. A whistleblower had told the SEC that Disney has been inflating its revenue for years. A long-time analyst with the company said they had overstated the amount of revenue the parks were taking in.

I can’t judge the merits of the accusation. Disney said they had reviewed the matter and found no wrongdoing. Following Monday’s quick drop, shares of Disney seem to have moved on. Disney remains a solid buy.

Before I go, I want to adjust a few of our Buy Below prices. Fiserv (FISV) continues to look very strong since its last earnings report. The company beat expectations, reiterated guidance and completed the big deal with First Data. This week, I’m lifting our Buy Below on Fiserv by $10 to $113 per share. Hershey (HSY) has also performed well since its earnings report. I’m lifting my Buy Below on HSY to $162 per share.

That’s all for now. There will be no newsletter next week. I’m on the road ahead of Labor Day. Next week is the final trading week of August. On Monday, we’ll get the latest report on durable goods. The data here have been pretty weak lately. Then on Tuesday, the report on consumer confidence will be released. On Thursday, the government will update its report on Q2 GDP growth. The initial report said that the U.S. economy grew in real terms by 2.1% last quarter. That’s right in line with the average for the last 10 years. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on August 23rd, 2019 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His