CWS Market Review – March 20, 2020

This continues to be one of the most dramatic periods in Wall Street history. The coronavirus and subsequent “social isolation” policy have had major impacts on the U.S. economy.

This week’s CWS Market Review will be a bit different. Since we’re in such an unusual period, I’ll lay out for you my thoughts as to what’s happening, when it will end and what’s the best way to position ourselves for the future.

Let’s be clear, the U.S. economy is in a recession. We don’t have solid numbers yet, but I expect to see gigantic increases in unemployment and gigantic drops in GDP. In Washington, the government is working on a major stimulus program, but the details still need to be worked out. This may alleviate some of the damage, but it won’t stop recession.

Stocks have rallied and crashed nearly every day. The S&P 500 moved by more than 4% over eight straight days. On Monday, the Dow plunged nearly 12.9%. That was its second-largest daily percentage drop in its 124-year history. And this comes on the heels of last Thursday when the Dow had its fifth-largest drop in history.

In fact, Monday’s fall edged out Black Tuesday, the infamous crash from October 28, 1929. You may be familiar with the famous Variety headline, “Wall St. Lays an Egg.” That was in reference to Black Tuesday. Well, this week, we laid an even bigger egg.

The numbers are staggering. The S&P 500 moved by over 9% over three straight days. Over 18 trading days, the S&P 500 lost 29.5%. In one six-day stretch, the S&P 500 fell 20.7%. Here’s a great stat via Callie Cox. Since 1990, there have been 56 trading days when the S&P 500 has posted an intraday range of more than 5%. We’ve had seven of those this year, and five in the last five trading days.

The Federal Reserve has now announced multiple programs in an effort to keep the financial system from cracking. Near where I live, and I’m sure it’s similar in your region, too, all the bars and restaurants are closed. Some are doing takeout. This is a devastating time for workers in the hospitality industries. (If you can, buy yourself a gift card from a local restaurant. That will keep the revenue stream going and you can cash it whenever you want.)

This Drop Is Different. Here’s Why.

Some of the recent market action has been so severe that it’s nearly impossible to keep up with which stocks have been punished and why. On Tuesday, the utility sector rose by nearly 13%. That just leaves me stunned. The whole idea of owning utes is to avoid such gyrations. Some stocks are jumping or falling 20% each day. Ansys (ANSS), which is a fairly staid company, saw its stock change by more than 12% on three straight days.

But here’s the key point I want to get across: the recent selloff in the market is quite different from previous ones. This time, the threat to the market is external. It’s not the excesses of a bubble that pulled down the market (though there are excesses). Most businesses were in fine shape before the social-isolation policy caused the economy to grind to a halt. There was little wrong with the fundamentals of the economy.

Here’s a thought exercise. Imagine the stock market is like betting on runners in a race. What drives who wins or loses is the skill of each runner, his or her training, exercise, nutrition and strategy. Those would be like the fundamentals we talk about like dividends and P/E Ratios.

But what’s happened is that in the middle of the race, a heavy weight is placed on the backs of each of the runners. The weight is so heavy that it brings all the runners to a halt. Note that there’s nothing wrong with the runners. Once the weight goes, they’ll be back to normal.

That’s similar to what we’re dealing with here. The structure of the U.S. economy is (mostly) sound. Things will change once there’s clear evidence that the virus is losing. There’s little substitute for victory.

I often urge investors is to avoid one-dimensional thinking. People always ask me if the president or the Fed is going to harm the market. I explain that the market is far more complicated than one variable can affect.

In this case, though, it really is all about one variable. As soon as there’s clear evidence that we’re winning the war against the coronavirus, the financial markets will respond. Until further notice, all vaccine and treatments news is economic and financial news.

The Doolittle Raid of 1942

There are no similar historic examples, but I want to mention what happened to the U.S. in 1941 and 1942. After Pearl Harbor, the U.S. stock market started to fall as investors gradually realized the enormity of the task before them. The entire country had to be mobilized for war from a standing start.

There wasn’t much good news, but that changed dramatically on April 18, 1942 with Jimmy Doolittle’s daring raid over Tokyo. This was the famous “Thirty Seconds Over Tokyo.” For history lovers, it was on the anniversary of Paul Revere’s ride.

Militarily, the Doolittle Raid didn’t do much, but psychologically, the effect was incalculable. It told Americans that we could do this job. That’s what we need to see in the fight against the coronavirus. The market and economy are going to be shaky until we see unmistakable signs of progress. There’s a big “virus discount” hanging over the market. I don’t know how large it is, perhaps 10% to 20%. Once that goes, valuations should respond.

Thursday’s market was interesting because it was the first time in several days that trading looked something like normal. The daily change was one-tenth of the least volatile day of the preceding eight sessions.

If the market hasn’t turned a corner, perhaps the panic phase has. Bear markets tend to be very concentrated. Even long bear markets find that most of the pain happens over the course of a few days. We may see stocks go down some more, but I’m doubtful we’ll see another string of days so frantic.

The Buy List Is Beating the Market

Given how extreme the stock market has been over the last three weeks, I’ve been impressed by the performance of many of our Buy List stocks. Over the last four days, the S&P 500 is down 11.13%, while our Buy List is “only” down 9.33%.

Hormel Foods (HRL) has not only rallied, but the shares hit a new 52-week high on Wednesday.

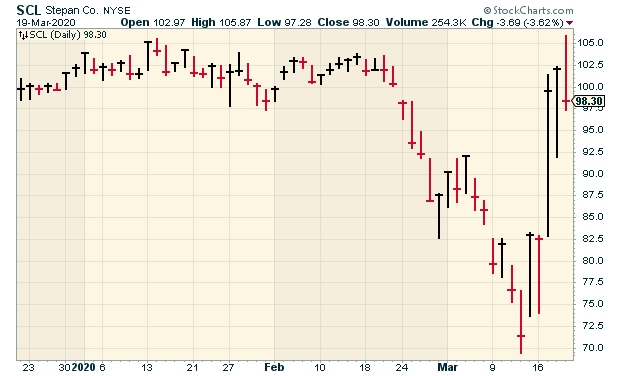

Shares of Stepan (SCL) have been on fire. The stock has gained more than 42% in four trading days. The stock hit another new high on Wednesday.

Church & Dwight (CHD) is another stock that’s managing itself well. For the year, the stock is down about 5%. That makes it the 33rd-best performing stock in the S&P 500.

Sherwin-Williams (SHW) reaffirmed its Q1 guidance and said it saw little disruption to its supply chains.

Ross Stores (ROST) said it’s withdrawing its previous guidance and cutting back on its capex plans.

Intercontinental Exchange (ICE) said it will close the floor of the NYSE and only have electronic trading. Two people tested positive this week.

At the opposite end, some of our stocks have been hit very hard. Shares of AFLAC (AFL) have been cut in half this year. Obviously, as coronavirus spreads, claims will increase. I still have great faith in AFLAC. If you recall, the company handled itself well during the tsunami in 2011.

Moody’s (MCO) is another stock that’s fallen sharply, though shares of MCO had done very well until the market broke. I think Moody’s is one of our top candidates to rally back strongly.

Earnings Preview for FactSet

FactSet (FDS) is due to release its fiscal Q2 earnings on March 26. This is for the quarter that ended on February 29, so the results won’t reflect the coronavirus. In December, FactSet reported fiscal Q1 earnings of $2.58 per share. That was a 9.8% increase over last year, and it easily beat Wall Street’s estimate of $2.42 per share. That was good to see because FDS had alarmed investors in September when it gave rather unimpressive guidance for 2019.

For fiscal Q1, organic revenue grew 4.2% to $367.9 million. Annual Subscription Value (ASV) plus professional services, which is a key metric for FDS, came in at $1.48 billion. I also like that FactSet’s operating margin improved to 33.9% compared with 31.5% last year.

Wall Street expects Q2 earnings of $2.49 per share. That sounds about right. The last we heard, FactSet expects earnings this year of $9.85 to $10.15 per share and revenue between $1.49 and $1.50 billion. Of course, that’s pre-virus. I would expect FactSet to withdraw any guidance.

That’s all for now. Some key economic reports will be coming out next week. The new-homes sales report is due out on Tuesday. On Wednesday, the durable-goods report comes out. On Friday, we’ll get another revision to the Q4 GDP report. The last estimate said that the economy grew in real terms by 2.1% for the final three months of 2019. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on March 20th, 2020 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His