The Home-Run Stocks Wall Street Doesn’t Know About

Imagine there’s a stock that’s up more than 30-fold in the last 20 years and it’s not followed by a single Wall Street investment analyst.

This investment has crushed just about every hedge fund out there, yet Wall Street is completely unaware of it.

Worst of all, it’s stock in a company that’s known by many. In fact, it’s a favorite of people who work on Wall Street.

The stock I’m talking about is Nathan’s Famous (NATH).

That’s right, the hotdog stand. Nathan’s is not only a great New York institution; it’s been a big long-term winner for investors.

Nathan’s is what we call an “Orphan Stock.” That means that it has zero or near-zero analyst coverage.

I love Orphan Stocks. They’re a great place to find overlooked values. Some of the big-name stocks on Wall Street are followed by 20, 30, even 50 analysts. These stocks live in glass fishbowls, but that’s not the case with Nathan’s, which, despite its name, apparently isn’t nearly as famous as I thought.

There are lots of great Orphan Stocks. Ever heard of Atrion (ATRI)? Don’t worry. You’re not alone.

Atrion is a medical-products company based in Dallas. Even though it’s small ($1.2 billion market cap), Atrion is strong in some niche markets like soft-contact-lens disinfection cases. Do you wonder who makes valves for life vests? There’s a good chance it’s Atrion.

Twenty-two years ago, you could have picked up one share of ATRI for $7. Recently, the stock got up to $665 per share.

Now I’m going to ask you a very easy question: Guess how many firms on Wall Street cover Atrion? I’ll give you a hint. It’s the same as Nathan’s.

That’s right. Zero.

The S&P 500’s had a good run over the years and it looks like a flat line in comparison to ATRI.

How can a stock rise so much for so long and no one on Wall Street has ever thought to start covering it? Part of the reason is they don’t bring Wall Street any investment banking business.

That’s more of a plus than a minus. It suggests the company hasn’t entered into any unwise mergers. Or taken on too much debt. Or been acquired at a poor price. Not needing a banker is hardly a bad thing.

Let’s also remember how hard the financial crises blew through Wall Street. The big houses simply don’t have the big research departments like they used to. The budgets have been cut back. As a result, there are lots of companies that get no analyst coverage.

Four years ago, Jason Zweig highlighted the best-performing stock of the last 30 years. Far from being a well-known large-cap tech stock, the big winner was Balchem (BCPC) of Wawayanda, NY. The company makes “flavorings, fumigating gases and nutritional additives for animal feed.”

Sexy!

From 1985 to 2015, Balchem gained over 107,000%. Zweig noted that Balchem didn’t attract a single major institutional holder until 1999. That was after it returned an average of 21.3% for the previous decade. Even today, Balchem is followed by a grand total of two analysts. Compare that with Facebook, which is followed by over 50.

Every earnings season, investors gather to see what companies have beaten expectations and what companies have fallen short. But for Nathan’s and other Orphan Stocks, there’s no “Street consensus” because no one follows them. For an investor, that’s another bonus. You don’t have to worry about the quarterly earnings game.

Consider an Orphan stock like Chase Corporation (CCF), which is a specialty-chemical company based in Westwood, MA. Chase is one of those Warren Buffett-style stocks. The only difference is that you have to move the decimal point over a few notches. Chase is a quiet firm that consistently generates strong cash flow. It’s a well-run cyclical, with gross margins typically around 35%. Best of all, Chase doesn’t carry a dime of long-term debt.

Over the last 25 years, Chase has gained nearly 6,000%. That’s enough to beat both Microsoft and Intel. Again, no one follows it.

These aren’t microcaps, either.

How about the wonderfully named U.S. Lime & Minerals (USLM)? Since 2003, it’s returned more than 30-fold (dividends included). Zero analyst coverage it. In 1990, Century Bancorp (CNBKA) hit a low of $1 per share. Today, it’s at $76 per share, and it’s paid dividends all along the way. Number of analysts. Zero.

Another benefit of investing in Orphan Stocks it that with fewer eyes watching a stock, there may be a better chance to finding a mispriced stock. I wouldn’t say the market is efficient, but the inefficiencies have a better chance of showing up where others aren’t looking for it.

Also, these businesses tend to fairly easy to understand. Orphans often don’t have arcane off-balance-sheet items or operating divisions around the world. A hobbyist-investor can invest an afternoon and read through a company’s SEC filings and be well-informed on the business.

If you have more questions, you can do something few investors think of: call the company and ask to speak to someone. Better-run companies are happy to speak with their investors. After all, the shareholders are the owners.

You’ll often hear that the type of value investing that Warren Buffett and Charlie Munger made their fortunes on is no longer possible in the world of mass data and Bloomberg terminals. That may be right in terms of amassing a multi-billion fortune, but there are plenty of companies operating well below Wall Street’s radar.

Here are a few examples of Wall Street Orphans

Miller Industries (MLR) of Ooltewah, Tennessee. Miller Industries makes and sells towing and recovery equipment. The company makes the wreckers used to move disabled vehicles.

They also make those multi-tier car carriers that you often see on the road. If a car or truck needs to be hauled out of something or hauled to somewhere, odds are Miller’s got a vehicle that can do it.

Miller Industries is a good example of a company with a strong “moat.” There are competitors, but it’s the dominant name in the business.

Since its low in 2000, MLR is up 8,000%. Zero analyst coverage.

Simulations Plus (SLP) makes software that lets drug companies simulate tests of their products in the virtual world before using any human or animal test subjects.

This is a big cost-saver for drug companies. Simulations Plus helps streamline the R&D process by making it faster and more efficient. Not only is this cost-effective, but it also helps drug companies deal with time-consuming regulatory hurdles.

Earlier this month, Simulations reported that net revenues rose 23.8% and gross profit increased 26.5%. Two analysts follow it. It was recently added to the S&P SmallCap 600.

The Texas Pacific Land Trust (TPL) has a colorful history. It was born over 130 years ago when the Texas and Pacific Railway went bust. The aim of the T&P was to build a southern transcontinental train route. Despite the name, the T&P never made it to California.

The railway was left with a ton of land of a ton of debt. The trust was formed with 3.5 million acres of land that the railway owned. People who held the railway’s worthless bonds got shares of the new land trust. Some oil came along, the trust made money and everyone was happy. Eventually, the shares started trading on the NYSE in 1927. (On a technical point, Texas Pacific Land Trust is not a REIT. It’s a land trust.)

In 1995, you could have picked up a share for $3.50. Recently, TPL’s been trading at $585. One analyst follows it.

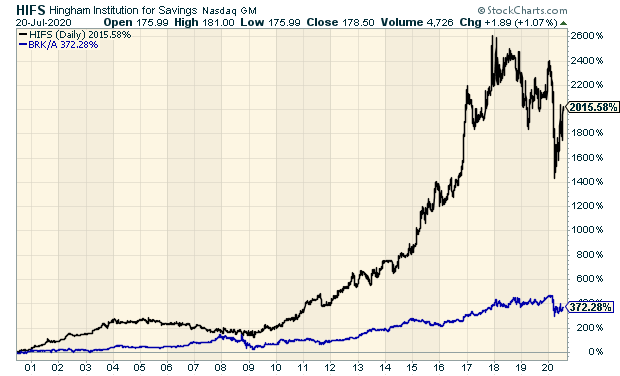

The Hingham Institution for Savings (HIFS) dates back to 1834. In 1990, the stock was going for just over $1 per share, adjusted for splits. Today it’s at $178. Hingham has consistently increased its dividend over the last 25 years. I love how this company treats it shareholders. Last year, Hingham paid out a special dividend of 60 cents per share on top of its regular dividend.

In the chart below, Hingham is the black line. The blue line is Berkshire Hathaway.

Posted by Eddy Elfenbein on July 21st, 2020 at 8:33 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His