CWS Market Review – October 30, 2020

“The best profits in the stock market are made by people who get long or short at extremes and stay for months or years before they take their profit.” – Charles Dow

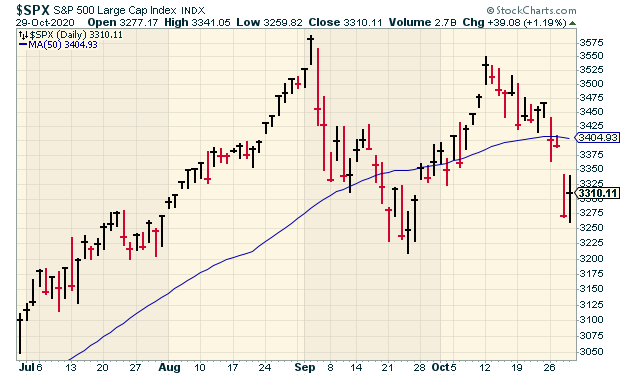

This is certainly an eventful time on Wall Street. On Wednesday, the S&P 500 took its biggest plunge in four months. The drop that started in early September may not have gone away although we got a nice rebound on Thursday.

Right now, we’re right in the heart of earnings season. We had eight Buy List stocks report earnings this week, and the ninth will come later today. We’ve had some impressive results so far. Sherwin-Williams beat estimates by 54 cents per share. The paint folks also raised full-year expectations. (I love it when that happens.)

Moody’s absolutely crushed Wall Street’s forecast (as I predicted in last week’s issue) and raised guidance as well. Stryker, the bone people, also blew past earnings.

So far, all of our stocks except one have beaten expectations. The sole exception, Globe Life, merely met expectations. In this week’s issue, I’ll go over all of this week’s earnings reports. I’ll also highlight the five more we have coming next week.

Before I get to that, I want to briefly mention Thursday’s historic GDP report.

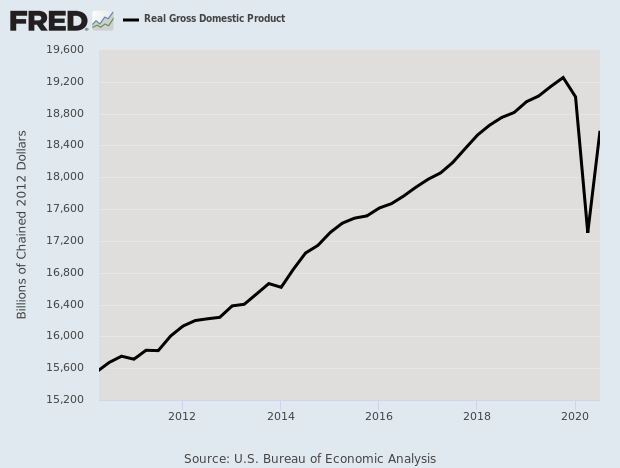

Strongest GDP Report on Record

On Thursday, the government said that the U.S. economy grew in the third quarter at an annualized rate of 33.1%. That’s not merely the best on record (the data goes back more than seven decades), but it’s twice as strong as the second-best quarter.

Of course, it’s not the case that the economy is buzzing along. Far from it. Rather, this is the economy snapping back from being shut down during the second quarter. For the second quarter, the economy shrank at an annualized rate of 31.4%.

So just as the stock market did in March and April, we’re bouncing off a sharp low. The good news is that we’ve gained back some lost ground. The bad news is that there’s still a long way to go.

We did get some good news on Thursday when the initial-jobless claims report came in at 751,000. That’s better than I had expected. Wall Street had been expecting 778,000. The trend of lower claims reports seemed to have stalled out, but that could be over. This week’s report is a good sign.

Eight Buy List Earnings Reports

Now let’s get to earnings because there are a lot. Here’s an updated look at our Earnings Calendar:

| Stock | Ticker | Date | Estimate | Result |

| Eagle Bancorp | EGBN | 21-Oct | $0.81 | $1.28 |

| Globe Life | GL | 21-Oct | $1.75 | $1.75 |

| Silgan | SLGN | 21-Oct | $0.95 | $1.04 |

| Stepan | SCL | 21-Oct | $1.40 | $1.56 |

| Check Point Software | CHKP | 22-Oct | $1.53 | $1.64 |

| Danaher | DHR | 22-Oct | $1.36 | $1.72 |

| AFLAC | AFL | 27-Oct | $1.13 | $1.39 |

| Fiserv | FISV | 27-Oct | $1.16 | $1.20 |

| Sherwin-Williams | SHW | 27-Oct | $7.75 | $8.29 |

| Cerner | CERN | 28-Oct | $0.71 | $0.72 |

| Church & Dwight | CHD | 29-Oct | $0.67 | $0.70 |

| Intercontinental Exchange | ICE | 29-Oct | $0.99 | $1.03 |

| Moody’s | MCO | 29-Oct | $2.10 | $2.69 |

| Stryker | SYK | 29-Oct | $1.40 | $2.14 |

| Broadridge Financial Sol | BR | 30-Oct | $0.63 | |

| Trex | TREX | 2-Nov | $0.38 | |

| Ansys | ANSS | 4-Nov | $1.26 | |

| Becton, Dickinson | BDX | 5-Nov | $2.52 | |

| Middleby | MIDD | 5-Nov | $1.04 | |

| Hershey | HSY | 6-Nov | $1.71 | |

| Disney | DIS | 12-Nov | -$0.68 |

On Monday, Sherwin-Williams (SHW) reported third-quarter earnings of $8.29 per share. That easily beat Wall Street’s forecast of $7.75 per share. Sales rose 5.2% to $5.12 billion.

CEO John G. Morikis said, “Continued and unprecedented strength in our DIY business, solid demand across our residential repaint and new residential segments and improving demand in our industrial coatings businesses and regions drove our strong third quarter results.”

Let’s look at the breakdown by each business segment. Net sales in The Americas Group increased by 2.8% to $2.98 billion. Consumer Brands Group increased its sales by 23.5% to $838.1 million, and Performance Coatings Group’s net sales increased 1.2% to $1.31 billion. All in all, this was a solid quarter. Sherwin generated $2.56 billion so far this year. That’s up 54% over last year.

This is a classic example of a stock rallying strongly on anticipation of good news, then shrugging when the good news is finally announced. Sherwin-Williams is a good buy up to $720 per share.

After the bell on Tuesday, we got earnings reports from AFLAC and Fiserv.

In last week’s issue, I told you that AFLAC (AFL) should be able to beat Wall Street’s forecast, and I was right. For Q3, AFLAC’s earnings rose 19.8% to $1.39 per share. Wall Street had been expecting $1.13 per share. Interestingly, the yen/dollar exchange rate didn’t impact earnings.

The duck stock is managing itself well during a challenging time. AFLAC is usually pretty good at giving earnings guidance. For obvious reasons, they can’t now. The stock dropped after the earnings report, but I’m pleased with what I saw. Given the soggy stock, I’m dropping our Buy Below price to $37 per share. Don’t give up on the duck!

Fiserv (FISV) said it had Q3 earnings of $1.20 per share. That’s a 19% increase over last year. Wall Street had been expecting $1.16 per share.

For the quarter, free cash flow rose by 12%, and it’s up 13% for the year. Operating margin increased 3.1% to 32.9%. In terms of operations, Fiserv is having a good year, but the stock has been in a funk.

Fiserv now expects to see its earnings rise by 11% over last year. This will be their 35th year in a row of double-digit earnings growth. Let’s get mathy. Last year, Fiserv earned $4.00 per share, so an 11% earnings increase translates to full-year earnings of $4.44 per share.

For the first nine months of this year, the company made $3.12 per share. That implies Q4 guidance of $1.32 per share which matches Wall Street’s forecast. Fiserv remains a buy up to $107 per share.

After the closing bell on Wednesday, Cerner (CERN) reported Q3 earnings of 72 cents per share. Previously, Cerner said that it expected earnings of 70 to 74 cents per share, so they’re hitting that range.

Cerner had a good quarter. Operating cash flow was $382 million and free cash flow was $237 million. Total backlog now stands at $13.01 billion.

For Q4, Cerner expects revenue between $1.365 billion and $1.415 billion and earnings between 76 and 80 cents per share. That implies full-year earnings of $2.82 to $2.86 per share which is a narrowing of the previous forecast which was $2.80 to $2.88 per share. Wall Street had been expecting Q4 earnings of 78 cents per share. The bottom line is that Cerner is delivering as expected. Cerner is a buy up to $75 per share.

Thursday was another busy day with four Buy List earnings reports. Let’s start with Church & Dwight (CHD). The household products company reported Q3 earnings of 70 cents per share. That beat estimates by three cents per share. You really can’t go wrong with condoms and baking soda.

C&D’s results were pretty good considering the environment. Q3 net sales grew 13.9% to $1,241.0 million. Covid has actually helped some of C&D’s business.

The company was able to increase its full-year guidance. Before, they saw reported sales rising by 9% to 10%, now they see it up 11%. Not a big increase, but it’s good to see. Most importantly, C&D sees full-year earnings of $2.79 to $2.81 per share. That’s a slight increase over the previous guidance.

The problem is that Church & Dwight beat earnings by more than the increase to guidance so that implies a softer Q4 than originally believed. I don’t think it will turn out that way, but the shares were soft in Thursday’s trading. Church & Dwight remains a buy up to $100 per share.

Intercontinental Exchange (ICE) has been doing great business lately. The exchange operator recently bought Ellie Mae, and the unit already added to the bottom line during Q3. For the quarter, ICE earned $1.03 which beat estimates by four cents per share.

Financial data revenue rose 6% to $589 million. That’s above their forecast of $575 million to $580 million. ICE’s operating margin runs at 57% which is amazing.

For guidance, the company covers lots of metrics except EPS. The key I like to watch is their forecast for data revenue. For Q4, ICE sees that as ranging between $590 million and $595 million. This is a good company. Intercontinental Exchange is a buy up to $110 per share.

In last week’s issue, I wrote “For Q3, Wall Street expects Moody’s to earn $2.10 per share. I think it will be a lot more.” I was right but even I was floored by Moody’s (MCO) quarter.

For Q3, the ratings agency earned $2.69 per share which creamed estimates by 59 cents per share. Wow. Moody’s Analytics, which is a key business for them, saw a revenue increase of 7% to $531 million.

Moody’s raised its full-year guidance range from $8.80 to $9.20 per share to $9.95 to $10.15 per share. I hope to have more details about Moody’s in upcoming issues. For now, I can say that all is well. Moody’s remains a buy up to $290 per share.

After the bell on Thursday, Stryker (SYK) reported very good numbers. For Q3, the orthopedics company earned $2.14 per share. That was up 12% over last year. Wall Street had been expecting earnings of $1.41 per share. That’s a very big earnings beat. Still, Stryker is down a bit on the year for us.

For the quarter, reported net sales rose by 4.2% to $3.7 billion. Orthopaedics sales rose 4.4% to $1.3 billion. MedSurg sales were up 3.2% to $1.6 billion. Neurotechnology and Spine sales increased 6% to $0.8 billion.

Due to the pandemic, Stryker can’t offer guidance for Q4. Stryker remains a buy up to $220 per share.

Broadridge Financial Solutions (BR) reports later today. For the new fiscal year, which began on June 30, Broadridge expects earnings growth of 4% to 10%. Since the company made $5.03 per share last year, that implies earnings this year between $5.23 and $5.53 per share.

Broadridge also recently hiked its dividend for the 14th year in a row.

Five Buy List Earnings Reports Next Week

Trex (TREX) is our #1 performer this year. Through Thursday, it’s up 59% this year for us. Trex also gave us a stock split a few weeks ago. The deck company is due to report earnings on Monday, November 2.

For Q3, Trex expects sales between $215 million and $225 million. The midpoint is a 13% increase over last year’s Q3. For earnings, Wall Street expects 38 cents per share.

Ansys (ANSS) id due to report on Wednesday, November 4. The company expects Q3 earnings of $1.10 to $1.34 per share on revenue between $347 million and $377 million. For the full year, Ansys sees earnings ranging between $5.75 and $6.35 per share on revenue of $1.570 billion to $1.645 billion. Ansys now has a backlog of $846 million. That’s up 18% from a year ago. We have a 20% gain this year with Ansys.

I haven’t been happy with Becton, Dickinson (BDX) this year. The company’s fiscal year ended in September so the coming earnings report is for their fiscal Q4. Becton will report on Thursday, November 5. A few weeks ago, Becton’s 15-minute coronavirus test got the green light in Europe.

Becton said it expects earnings for this year to come in between $9.80 and $10.00 per share. Since the company has already made $7.41 for the first nine months of this fiscal year, the guidance implies Q4 earnings of $2.39 to $2.59 per share.

Middleby (MIDD) had a terrible plunge earlier this year, but the stock is now up more than 140% from its low. After Middleby’s last earnings report, the stock jumped 16% on one day. The CEO said he saw more improvments in their business this summer. Interestingly, there’s strong demand from quick-serve and pizza restaurants. Such is the new world of Covid. Middleby also reports on Thursday. Wall Street expects $1.04 per share.

Tomorrow is Halloween which is a big time of year for Hershey (HSY). The chocolatier is due to report earnings next Friday. Three months ago, Hershey had a strong earnings report and the shares gapped higher.

The shares have been in an ugly mood lately. HSY has declined nine times in the last ten days. Thanks to the selloff, HSY yields over 2.5%. That beats a lot of fixed income. Wall Street expects Q3 earnings of $1.71 per share.

That’s all for now. The big news next week will obviously be the election. Don’t get too wrapped up in market movements based on the results. The talking heads are almost always wrong. The ISM report is due out on Monday. The ADP report comes out on Wednesday. Then on Friday, we’ll get the official October jobs report. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on October 30th, 2020 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His