CWS Market Review – January 15, 2021

“There is only one boss. The customer. And he can fire everybody in the company from the chairman on down, simply by spending his money somewhere else.” – Sam Walton

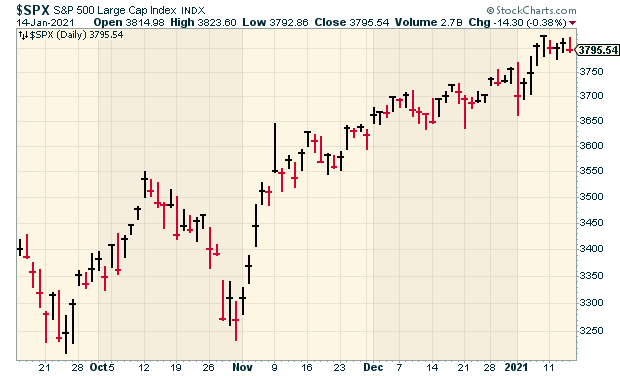

For the fourth time in U.S. history, a president was impeached this week. A Senate trial may not happen for a few more weeks, after President Trump has left office. The financial markets, however, took the news in stride, and stock prices are still close to a new all-time high.

In last week’s issue, I cautioned that the December jobs report might not be a good one. I was right: it wasn’t. That, combined with other evidence, strongly suggests that the economy went into a nasty slide toward the close of 2020. President-elect Biden just unveiled plans for a massive stimulus program.

However, the big news coming our way is the fourth-quarter earnings season. From mid-January through early February, hundreds of companies will tell us how business fared during the final three months of 2020. For Wall Street, earnings season is like Judgment Day. Investors will learn who’s been naughty or nice. On our Buy List, 22 of our 25 stocks follow the March/June/September/December reporting period. That means they’ll be reporting soon. As usual, I’ll provide a complete earnings calendar for you as we get closer to earnings season.

In this issue, I have some Buy List updates for you. Some of our stocks are already up nicely this year. Trex, for example, is up close to 10%. That’s nice to see after last year’s big run. Miller Industries, a newbie this year, is already an 8% winner for us. Of course, it’s still early. Later on, I’ll lift some of our Buy Below prices. I’ll also highlight shares of Thermo Fisher Scientific. But first, let’s take a closer look at some recent economic news.

The U.S. Economy Lost 140,000 Jobs Last Month

Earlier this week, multi-gazillionaire and noted bluntsman Elon Musk tweeted rather mysteriously: “Use Signal.” Investors immediately sprang into action. Shares of Signal Advance (SIGL) skyrocketed from 60 cents per share to $3.76 per share. Within a few days, the stock eventually reached $70 per share.

There was one wee problem. Signal Advance had nothing to do with the company Musk was tweeting about. Signal Advance is a tiny biotech stock that used to be known as Biodyne Development Company. Musk wanted people to use Signal, an encrypted-messaging platform that isn’t publicly traded.

Still, the market took the wrong signal, literally, and the wrong Signal soared. With investing, people often talk of the Greater Fool Theory. This means that someone is overpaying but they’re buying in because they think they can unload it an even higher price. Here the theory became reality.

Well after the Signal mix-up was discovered, shares of SIGL were still frantically bouncing around. On Thursday, shares of SIGL closed at $11.50 per share. That was a 36% gain in one day for a stock that has little true value.

My point is that investing isn’t a rational business. Over the long term, sure, it’s pretty good. But in the short term? No way. The market is little more than a poorly-organized mob.

Last Friday, the government released the December jobs report. Wall Street was expecting a loss of 50,000 jobs. Instead, the economy lost 140,000 jobs. The unemployment rate is now 6.7%. The situation is grim. There are currently more than 110 million people who are either out of work or out of the job market entirely.

After digging into the details of the jobs report, we learned that most of the damage fell on the education sector as well as the leisure and hospitality sectors. In a net-net sense, all of the jobs lost last month were held by women. Male employment increased by 16,000.

As I said in last week’s issue, I had been expecting bad news. Several other economic reports hinted that the economy was slowing down late in 2020. On Thursday, the initial-claims report rose to 965,000. That was the highest since August. It’s still about four times higher than the pre-pandemic average.

On January 28, the government will release its initial estimate for Q4 GDP growth. Again, I’m not expecting good news. The New York Fed’s Nowcast currently estimates Q4 GDP growth of 2.2%. I think that’s too high. President-elect Biden unveiled his $1.9 trillion stimulus package.

To fill the lingering holes in the economic recovery, the plan also includes more than $1 trillion in direct aid to struggling families through $2,000 stimulus checks, extended unemployment insurance, rental protections and nutrition assistance. The Biden proposal also allocates $440 billion to small businesses, local communities and transit systems on the brink.

Well, that’s the proposal. What Congress approves may look quite different.

One concern is inflation. The government has already spent lots of money, and it’s looking to spend ever more. So far, there hasn’t been much evidence of inflation. This week’s CPI report showed that headline inflation rose by 0.4% last month. That matched expectations.

The culprit for higher prices wasn’t hard to find. For December, gasoline prices rose by 8.4%, and that accounted for 60% of the rise in December’s CPI. When we look at the “core rate” of inflation, which excludes food and energy prices, then inflation rose by just 0.1%. I tend to be a pragmatist on this issue. There are far too many folks predicting that massive inflation is just around the bend. Eh…maybe. I prefer to look at the data. We’re just not seeing a big increase yet, but it may soon come.

I can’t help noticing that the bond market is reacting, albeit slowly. In August, the 10-year Treasury yield was as low as 0.5%. This week, it got as high as 1.2%. That’s still low, but I’m keeping an eye on it. Inflation may be back with us.

Small Caps Soar

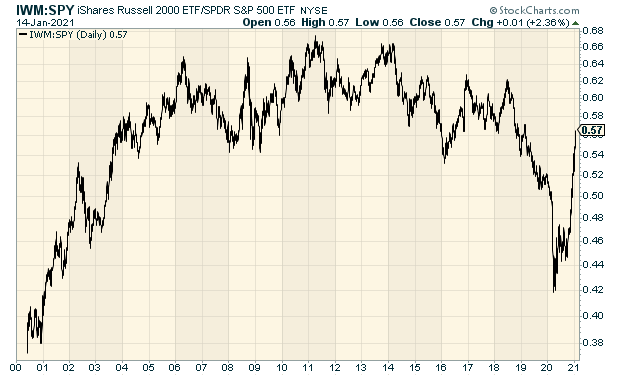

One of the more remarkable events of recent months has been the tremendous rally in small-cap stocks. This comes after nearly a decade of the small-cap Russell 2000 Index’s trailing the overall market, sometimes badly. But not lately. The Russell 2000 ETF (IWM) is up more than 123% from its March low. The relative performance really took off at the end of September. Since then, IWM is up almost 49% while the S&P 500 ETF (SPY) is up “only” 17.5%. That’s a huge gap for that time period.

Here’s a 20-year look at the Russell 2000 ETF divided by the S&P 500 ETF. See how raucous the last year has been.

So what’s driving the little guys? I have a slightly heterodox view on this. I don’t think the Russell 2000 is a good indicator of small-cap performance. Instead, it’s an index that leans heavily towards the cyclical sectors, with some unusual features. Most prominently, the R2000 doesn’t have any of the mega-cap tech stocks. That means that whenever the Apples of the world sour, the R2000, by definition, sees a relative gain.

The Russell 2000 leans towards energy and financial stocks. Those are the ones that have been doing well. This is further evidence of the trend we’ve discussed before. Cyclical and value stocks have been leading the charge, and that may continue. This has been mirrored in the bond market by those yields that we discussed before. What we’re seeing is a large shift from defense to offense. Related to this, consumer staples have been relatively weak, even good ones like Hershey (HSY) and Church & Dwight (CHD).

It’s not so much that cyclicals are getting high valuations. It’s that they’re fed up with trailing for so many years. Not that long ago, Apple was worth more than the entire Russell 2000. That’s not the case anymore. I wasn’t surprised by this rotation, but the quickness with which it occurred did get my attention. I expect this rotation to continue on for at least several more weeks.

Profile of Thermo Fisher Scientific

I promised to go into greater depth on our new stocks. This week, it’s Thermo Fisher Scientific’s (TMO) turn. The best way to think of TMO is to know that they make all the stuff that makes labs run. That means all matter of scientific instruments. The company is also involved with diagnostics consumables and life-sciences reagents.

This is a good business to be in, and a very good business to dominate, because customers buy the initial base of equipment. As that expands and upgrades, TMO gets a steady stream of recurring revenue. I didn’t select it as a Covid stock, but Thermo will certainly be an important player in the fight against the pandemic. In fact, the company recently launched two antibody tests. Wherever research money is spent, Thermo will get its beak wet. It’s simply the arms dealer to the pharma industry.

In many respects, TMO has a business model similar to that of razors and razor blades. Once you get the customer to buy the razor, they’re tied in to buying many more blades. Nearly 80% of TMO’s revenue is recurring. Importantly, the company strives to have the best instruments out there. Thermo spends about $1 billion a year on R&D, and about 40% of TMO’s revenue comes from pharma and biotech.

Last year. TMO offered to buy Qiagen (QGEN) for $11.5 billion. That was a lot of money, but QGEN shareholders shot down the deal. Wisely, TMO walked away. That impressed me.

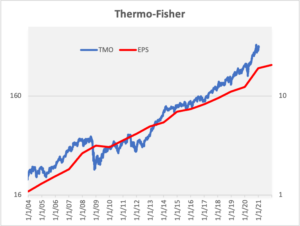

The stock is currently going for 24 times this year’s earnings estimate. That’s not cheap, but given TMO’s historic valuation, it’s not bad. The company’s ability to grow earnings consistently is truly impressive. Check out the long-term chart below.

The share price is in blue, and it follows the left scale. The red line is EPS, and it follows the right scale. The two lines are scaled at a ratio of 16-to-1.

The next earnings report is due out on February 1. Wall Street is expecting earnings of $6.47 per share. Thermo Fisher Scientific is a buy up to $490 per share. I may adjust that soon, but I want to see earnings first.

Buy List Updates

Our Buy List is up on the year. Thanks to the recent rally, a few of our stocks have jumped above their Buy Below prices. Right now is the quiet before the storm. There’s not much news about our stocks, but that will change soon. This week, I’m raising our Buy Below on Ansys (ANSS) to $390 per share.

I’m also raising AFLAC’s (AFL) to $50 per share. The duck stock is due to report earnings on February 3. The current estimate on Wall Street is operating earnings of $1.05 per share. Since October 30, AFLAC has rallied 38%.

I’m also raising our Buy Below on Intercontinental Exchange (ICE) to $123 per share. This week, ICE said it’s going to sell its Bakkt unit. The division will enter the public markets via a SPAC. That’s a special purpose acquisition company. It’s basically a shell company that’s listed on the exchange. It can buy up a company like Bakkt in order to avoid all the headache of going public.

Bakkt focuses on digital markets. Initially, it made a big splash by having Bitcoin futures. Now it lets people trade all sorts of digital assets. The deal values Bakkt at $2.1 billion.

As I mentioned earlier, Trex (TREX) is up nearly 10% this year after a spectacular 2020. I’m raising our Buy Below on Trex to $98 per share.

Stepan (SCL) got out of the gate very strongly this year. At one point last week, shares of Stepan broke above $131, but they pulled back some this week. I’m lifting our Buy Below on Stepan to $134 per share.

That’s all for now. The stock market will be closed on Monday is honor of Dr. Martin Luther King’s birthday. The civil rights leader would have been 92. On Wednesday, Joe Biden will be inaugurated as our 46th president. On Thursday, we’ll get another jobless-claims report. On Friday, the existing-home sales report is due out. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on January 15th, 2021 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His