CWS Market Review – February 26, 2021

”The more successful the corporation, the more likely it is to be unique in some of its policies.” – Philip Fisher

The stock market seems to be getting a little nervous lately. On Tuesday, the S&P 500 fell 1.8% during the day. That didn’t last long. The index bounced off its 50-day moving average and rallied strongly into the close. Many of the well-known “high beta” stocks were particularly tossed about.

That rally faded, and on Thursday, the S&P 500 had its second-worst loss this year. The S&P 500 dropped 2.45% on Thursday to finish the day at 3,829.34, which is about 0.6% above its 50-DMA. The S&P 500 has been above its 50-DMA almost continuously for the last four months. Despite the new volatility, in this week’s CWS Market Review, I want to focus on reasons to be optimistic for the overall economy.

We also had a few more earnings reports. Unfortunately, two of our stocks, Trex and Ansys, got dinged hard, even though they reported decent earnings. I’ll explain what happened in a bit. We also got two more dividend hikes this week. Last week it was Moody’s and Sherwin-Williams. This week, it’s Silgan and Thermo Fisher (increases of 17% and 18% respectively). I’ll also preview next week’s Buy List earnings. But first let’s look at why the U.S. economy may be stronger than is commonly believed.

Reasons for Optimism

I want to be careful how I say this, but there are a number of reasons to believe that the U.S. economy is doing better than a lot of people think. Obviously, the economy isn’t doing well in absolute terms. By my estimates, we’re around 10 million people away from full employment.

My point is that we’re doing better than a lot of folks on Wall Street believe. Tied to this is a belief that the battle against the coronavirus is going well. There’s even talk that we can get back to normal by the summer.

The problem is that bad news sells, and bad news sells especially well on Wall Street. To be an optimist, it’s often held, is to be naïve. In this case, I’m taking a sober look at the facts.

Let’s start with some basics. For one, bond yields have gradually worked their way higher over the past few months. That usually means that more economic growth is on the way. At one point on Thursday, the 10-year yield reached 1.6%. That’s more than a 1% increase in about six months. Interestingly, most of the increase is coming from the inflation premium side of the coin. Real yields are still very low (negative, in fact). This suggests that yields have a lot of room to move higher.

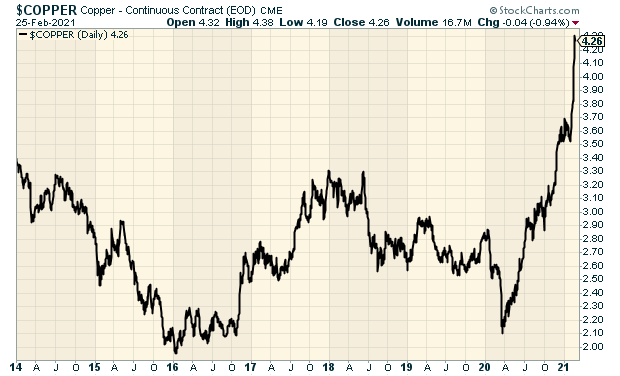

Many commodities have been rallying, which is often another sign of a growing economy. The price for copper recently touched a 10-year high (see below). Additionally, oil prices have been on the upswing. Bank of America recently said that oil could spike to $100 per barrel.

Tied to higher oil is the unsurprising fact that cyclical stocks have been doing well, especially energy and financials. Since late October, the S&P 500 Energy Index is up over 75%. Of course, that’s coming off several terrible years. Energy stocks are still half of what they were seven years ago.

The Federal Reserve is squarely on our side. Jerome Powell testified before Congress this week, and he made it clear that the Fed intends to keep rates low for a long time. According to the most recent economic estimates, most members of the FOMC don’t see a need to raise interest rates this year, next year or the year after.

We’ve also had promising economic reports recently. The recent report on existing-home sales was positive. More interesting is that housing inventory is at a record low (the data go back to 1982). This means that more new homes will have to be built. That means more contractors, more hammers, more wires, more pipes and, importantly, more jobs.

Also, don’t forget shoppers. Last week’s retail-sales report was quite good. The National Retail Federation projects growth this year of 6.5% to 8.2%. That would be the fastest growth in two decades.

The Atlanta Fed’s GDPNow model now sees economic growth of 9.6% for the first quarter. That would be amazing. The New York Fed’s model sees growth of 8.3%. Some of the big investment firms are coming around. Goldman now sees Q1 GDP growth of 6%. Morgan Stanley is at 7.5%, and Bank of America is at 6.5%. Here’s a stunner. According to JPMorgan, the U.S. could outperform China this year.

Not all the numbers are in yet, but it looks like earnings for Q4 will be down about 12% from the year before. Earnings for Q3 are now projected to outpace Q3 of 2018, which is the current record holder. That’s a remarkable recovery in such a short period of time.

That’s my cautious case for reasons to be cautiously optimistic for a cautious recovery. Now let’s look at this week’s earnings.

Earnings from Trex, HEICO and Ansys

We had three more earnings reports this week. Here’s the latest Earnings Calendar:

| Stock | Ticker | Date | Estimate | Result |

| Silgan | SLGN | 26-Jan | $0.53 | $0.60 |

| Abbott Labs | ABT | 27-Jan | $1.35 | $1.45 |

| Stryker | SYK | 27-Jan | $2.55 | $2.81 |

| Danaher | DHR | 28-Jan | $1.87 | $2.08 |

| Sherwin-Williams | SHW | 28-Jan | $4.85 | $5.09 |

| Church & Dwight | CHD | 29-Jan | $0.52 | $0.53 |

| Thermo Fisher | TMO | 1-Feb | $6.56 | $7.09 |

| Broadridge Financial Sol | BR | 2-Feb | $0.70 | $0.73 |

| AFLAC | AFL | 3-Feb | $1.05 | $1.07 |

| Check Point Software | CHKP | 3-Feb | $2.11 | $2.17 |

| Hershey | HSY | 4-Feb | $1.43 | $1.49 |

| Intercontinental Exchange | ICE | 4-Feb | $1.08 | $1.13 |

| Fiserv | FISV | 9-Feb | $1.29 | $1.30 |

| Cerner | CERN | 10-Feb | $0.78 | $0.78 |

| Disney | DIS | 11-Feb | -$0.42 | $0.32 |

| Moody’s | MCO | 12-Feb | $1.97 | $1.91 |

| Zoetis | ZTS | 16-Feb | $0.87 | $0.91 |

| Stepan | SCL | 18-Feb | $1.08 | $1.42 |

| Trex | TREX | 22-Feb | $0.36 | $0.37 |

| Ansys | ANSS | 24-Feb | $2.54 | $2.96 | Middleby | MIDD | 1-Mar | $1.40 |

| Miller Industries | MLR | TBA | n/a |

After the bell on Monday, Trex (TREX) reported Q4 earnings of 37 cents per share. That beat the Street by a penny per share. Sales rose 39% to $228 million. For the year, the company made $1.55 per share.

For Q1, Trex expects sales of $235 million to $245 million. The midpoint is a 20% increase. That’s a pretty good number. Wall Street had been expecting $237.51 million. The company didn’t provide EPS guidance.

I’m mostly pleased with this report, but traders were not impressed by a one-cent earnings beat. The stock fell 9% in Tuesday’s trading, and has since stabilized. I’m not too concerned, because the share price had already run up so much prior to the earnings report. Even with Tuesday’s drop, Trex is up nicely for us this year. Trex remains a buy up to $98 per share.

On Tuesday, HEICO (HEI) reported fiscal Q1 earnings of 51 cents per share. Wall Street had been expecting 48 cents per share. HEICO’s fiscal year ended in January, so it’s the first of our “off-cycle” stocks to report.

This was a good report, but HEICO had a tough year. For last year’s Q1, HEICO made 89 cents per share. HEICO’s operating margin was 19.2%, which is good, but is down from 21.9% from last year.

The pandemic has been hard on the aviation industry. For Q1, sales for HEICO’s commercial-aviation business fell 43%. Still the company has been able to generate an impressive cash flow. For Q1, cash flow from operations increased by 32% to $107.2 million.

HEICO said that it can’t give guidance yet for this year, but a lot will hinge on how well the commercial-aviation business rebounds. I think HEICO will continue to prosper. HEI is a buy up to $140 per share.

Lastly we have Ansys (ANSS), which said on Wednesday that it made $2.96 per share for Q4. That was well ahead of Wall Street’s consensus of $2.54 per share. Still, traders were not pleased with the company’s modest guidance. In Thursday’s trading, ANSS got pounded for a 12% loss. Ouch! Still, Ansys did well last quarter. Revenue adjusted for currency rose by 24%. For all of 2020, Ansys made $6.70 per share.

Maria Shields, Ansys CFO, stated, “We closed out 2020 with the strongest quarterly and annual financial results in the company’s history, with our fourth-quarter results exceeding the high end of guidance across all key metrics. Highlights include record quarterly and annual revenue, with the operating leverage of our business model driving strong margins and earnings. ACV, which grew 20% and 9% in constant currency for the quarter and the year, reached record levels of recurring sources at 83% for the quarter and 82% for the year. Additional notable highlights include both record operating cash flow of $547 million and deferred revenue and backlog of $967 million.”

Now let’s look at guidance. For Q1, Ansys sees earnings between 73 and 90 cents per share on revenue of $335 million to $360 million. Wall Street had been expecting $1.08 per share.

For all of 2021, the company projects earnings of $6.44 per share to $6.92 per share, and revenue of $1.79 billion to 1.875 billion. The Street was looking for $7.08 per share.

So what gives? I think this is a combination of the company low-balling us, plus genuine uncertainty surrounding Covid. I’m not concerned about Ansys. To reflect the selloff, this week I’m dropping my Buy Below on Ansys to $360 per share.

Earnings Preview for Middleby, Miller and Ross Stores

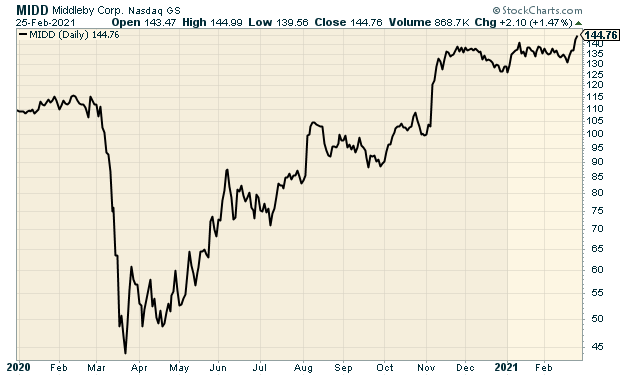

In last week’s newsletter, I said that I wasn’t sure when Middleby (MIDD) was going to report its Q4 earnings. Now we know. The company said the earnings will be out on Monday, March 1, before the market opens.

Middleby had a very strong Q3 earnings report in November. Wall Street had been expecting $1.04 per share, and Middleby beat that by 30 cents per share. CEO Tim FitzGerald said, “We delivered record cash flows, improved profitability, and enhanced our capital structure for the long-term.” The stock jumped 17% in one day. For Q4, Wall Street expects $1.40 per share.

Ross Stores (ROST) is our second off-cycle stock. Their fiscal Q4 ended in late January. The deep-discounter will report earnings on Tuesday, March 2, after the market closes.

The economic lockdown was very hard on Ross. Many of its customers are lower-income, and they depend on the stores. The third quarter was something resembling normal. Ross made $1.02 per share, which was 41 cents more than expectations.

Q4 is the all-important holiday shopping season. Ross decided not to provide any sales or earnings guidance for Q4.

Ross continues to have a strong financial position, with over $5.2 billion in total liquidity. The company also repaid its $800 million revolving-credit facility.

The consensus on Wall Street is for earnings of $1.00 per share. That’s probably too low.

Miller Industries (MLR) hasn’t said when it will report, but going by previous years, I’m assuming it will be sometime next week. Miller is a new stock for us this year, and it’s by far our smallest company on the Buy List. The current market value is $462 million. Disney is about 750 times larger. No analysts currently follow Miller, which is something I like.

Miller Industries makes and sells towing and recovery equipment. The company makes wreckers that are used to move disabled vehicles. They also make those car carriers that you often see on the road. If a car or truck needs to be hauled out of something and then hauled away somewhere, odds are, Miller’s got a vehicle that can do it.

The company was started by Bill Miller in 1990. His idea was to find well-known brand names in a highly segmented industry. Miller then planned to grow the business by buying up smaller names.

Miller standardized the business so that different parts could fit in any vehicle. Miller Industries now owns several different brands, including Century, Vulcan, Chevron and Holmes. Miller quickly grew to have 40% market share. In fact, it soon got the attention of the anti-trust folks.

Business was going very well until the pandemic. Miller’s annual EPS rose from $2.02 in 2017 to $2.96 in 2018 to $3.43 for 2019. Miller made $1.03 per share for last year’s Q4. I’m expecting earnings between 70 cents and 80 cents per share.

Buy List Updates

We had two more dividend hikes this week. Silgan (SLGN) raised its dividend by 16.7% to 14 cents per share. This is Silgan’s 17th consecutive annual dividend increase. The new dividend is payable on March 31 to the holders of record on March 17. Silgan is a buy up to $40 per share.

The other hike came from Thermo Fisher (TMO). The company raised its dividend by 18% to 26 cents per share. The new dividend is payable on April 16 to shareholders of record as of March 16. TMO is a buy up to $500 per share.

Last month, Stryker (SYK) had an impressive Q4 earnings report. The medical-technology company said it sees earnings this year ranging between $8.80 and $9.20 per share. The shares hit a new all-time high on Thursday. I’m lifting our Buy Below on Stryker to $260 per share.

That’s all for now. Next week is a new month, and we’ll soon get many of the key turn-of-the-month economic reports. On Monday, the ISM Manufacturing Index is released. On Wednesday, ADP will release its report on private payrolls. Then on Thursday, we’ll get another report on jobless claims. Then on Friday, the government will release its jobs report for January. For January, the unemployment rate fell to 6.3%. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on February 26th, 2021 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His