CWS Market Review – June 8, 2021

(This is the free version of CWS Market Review. Don’t forget to sign up for the premium newsletter for $20 per month or $200 for the whole year. The premium version contains more detailed analysis and I cover our Buy List stocks in greater depth. Join us today!)

The “Dangerous” Stock Market

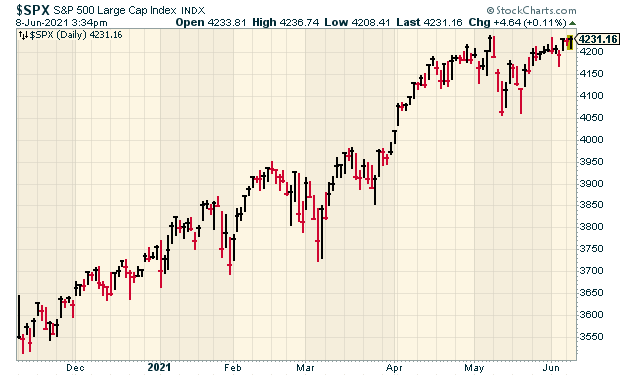

The stock market continues to advance while disregarding any and all concerns for valuation. The latest rally has alarmed veteran market observers, especially the gains we’ve seen in highly-speculative and less-sound areas of the market.

According to Nobel prize-winner Robert Shiller’s cyclically adjusted Price/Earnings Ratio or CAPE, stock valuations have never been higher. Seasoned market observers believe the market is due for a period of rest. Until now, the outlook has been clear, and the buy-it-all strategy has been painless. But newer investors, especially younger investors, have been lured in with the promises of easy wealth. This is dangerous and these newer investors have not experienced a painful bear market. In 1987, the Dow plunged 22% in a single day. It can happen again.

A toxic combination of a cheerleading media and careless politicians have cynically boosted the rally which is increasingly taking the form of a Ponzi scheme. Investors are ignoring fundamentals and are buying to order to quickly sell to a “greater fool.” It’s a dangerous game and no one wants to be the last one holding the bag. This is the hallmark of a casino, not the economy of a responsible country.

The speculation has been aided by a reckless Federal Reserve which seems blind to the threat of inflation and dollar depreciation. Trees don’t grow to the sky and similarly, stock prices don’t rise to the heavens. Moreover, investors aren’t considering geo-political risks. It’s a dangerous world and stability is a mirage. A painful reckoning is at hand.

The lesson is that stocks are dangerous things to own. In case you had forgotten, a little over a year ago, the Dow was at 18,000. If it could be there then, it can be there again and soon. The fact is that we’re entering a period of massive volatility. You, as an individual investor, simply don’t have the risk appetite to deal with that kind of volatility.

The above five paragraphs are nonsense from start to finish. I made it up in about five minutes. Yet it could pass, lightly edited, in the financial press any day of the week. In fact, the last paragraph is almost verbatim from a Felix Salmon video in 2010.

The language is flat. It’s filled with clichés. It ascribes human characteristics to the market. Most importantly, it takes a hectoring and moralizing tone. So much financial commentary is thinly disguised public moralizing. Once you recognize it, you see it everywhere.

Please forgive my unconventional digression, but this needs to be said. Stocks aren’t in any sense “dangerous.” Landmines are dangerous. Any comparison to 1987 is highly misleading. Nor do stocks need to rest, and there’s no such thing as a healthy correction. There won’t be some point in the future when the outlook is clear. I’m afraid it’s never clear.

I don’t mean to attack the media. There’s a lot of excellent financial journalism. But I will point out a certain type of behavior that aims to stoke the fires of righteous indignation. The reason I call it out is because it’s the precise opposite attitude one needs in going about his or her investment decisions. My made-up intro contained zero information that could help an investor.

Investing in the market is business. That’s all. Nothing more. Nothing less. Hopefully, sound judgement will lead you to better returns. Take the meme stocks. They had another strong day today. Will it continue? Beats me. They’re overpriced, but that’s my opinion. They can easily become more overpriced, but I would never say they’re dangerous or that the longs have some moral failing.

A good deal of financial commentary aims to simplify that day’s market action into an easy-to-digest narrative that’s clear, concise and almost always, wrong. The public scolder and the incessant cheerleader will always have a platform, but investors should not confuse their rhetoric with a sober and clear-minded analysis of the market. The media’s agenda is not the same as yours.

The best way to view the markets is to have a long-term focus and an independent mind. The rest is BS.

Heico Raises Its Dividend

Over at the premium service (which you can sign up for here), we’ve been doing very well with Heico (HEI) this year. The stock is up over 12% for us in 2021. The company announced today that it’s raising its semi-annual dividend from eight to nine cents per share.

That’s a tiny part of their earnings, but it’s nice to see a vote of confidence from management. Heico also has an interesting tradition of having frequent yet small stock splits. I count 17 splits since 1995.

Shares of Heico touched another new high today. This was the stock’s ninth consecutive up day. The reason I’m highlighting Heico, in addition to the dividend hike, is that the stock initially fell after its earnings report even though the numbers were quite good.

That’s not uncommon. Traders like to act first and find out the details later. Many times we see stocks fall on earnings news, only to rebound later once the market gets hold of it senses.

This is from Heico’s press release:

Laurans A. Mendelson, HEICO’s Chairman and Chief Executive Officer, along with HEICO’s Co-Presidents, Eric A. Mendelson and Victor H. Mendelson, commented, “This dividend recognizes HEICO’s strong cash flow generation, coupled with our confidence in the future, including for a sustained commercial air travel recovery. Further, as is the case for all HEICO shareholders, the vast majority of HEICO’s Team Members will directly benefit from the dividend increase through their share ownership and we are deeply grateful for our Team Members’ outstanding efforts, especially during the COVID-19 Pandemic.”

Considering the impact of cash dividends, prior stock splits and stock dividends, one share of HEICO worth $8.38 in 1990 has become worth on a combined basis approximately $5,361, representing an increase of approximately 640 times the 1990 value and a compound annual growth rate of approximately 24% as of June 4, 2021.

A gain of 640-fold in 31 years is truly remarkable. That’s why I don’t dismiss a minor dividend hike. Over the years, it adds up. Heico is a wonderful stock.

Workers Needed Everywhere!

Earlier today, the Labor Department released its jobs openings report. According to the report, there are now 9.3 million job openings across the United States.

The report completely floored Wall Street. Not only is it an all-time record, but it’s also over one million more jobs than Wall Street had been expecting.

The economy is reopening at an impressive rate. According to the latest survey, 48% of companies say they have unfilled jobs. Bloomberg notes that hotel and restaurant workers are quitting at the highest pace on record. The New York Times says that for the first time in many years, workers are gaining leverage over employers. Hopefully that will result in higher wages, and that will result in more revenues for business.

According to the May jobs report, which came out on Friday, the U.S. economy created 559,000 net new jobs and the employment rate dropped 5.8%. Wall Street had been expecting 671,000 new jobs.

Private payrolls added 492,000 and manufacturing added 23,000. Average hourly earnings increased by 0.5%. In the last year, average hourly earnings are up 2%.

The average work week was 34.9. The labor force participation rate was 61.6%. The under-employment rate fell to 10.2%. The payroll gain for March was revised to 785,000. The number for April was revised up to 278,000.

If these numbers continue, I think the Federal Reserve could taper its bond purchases before most people think. We’re still probably 18 months from getting back to normal. For now, the labor market appears to be headed in the right direction.

Stock Focus: Raven Industries

If I told you about a stock that’s up 750-fold over the last 40 years, you’d probably assume that it’s very well-known on Wall Street. Instead, Raven Industries (RAVN) is barely a speck on the canyons of Wall Street. The stock has been an amazing winner, yet it’s virtually ignored. Only a handful of Wall Street analysts bother covering it.

What do they do? Raven has picked up where the Montgolfier brothers left off. Raven specializes in balloons. Or to be more specific, as Dun & Bradstreet describes them, “a diversified technology company that caters to the industrial, agricultural, energy, construction, military, and aerospace sectors.”

The company has a few divisions, but what most gets my attention is Raven’s Aerostar division. This group sells high-altitude research balloons as well as parachutes and protective wear used by U.S. agencies. (See this video.)

Raven’s Engineered Films Division makes reinforced plastic sheeting for various applications. Their Applied Technology Division manufactures high-tech agricultural aids, from GPS-based steering devices and chemical spray equipment to field computers.

Check out this long-term chart of Raven (black line) against the S&P 500 (blue line):

Raven has beaten the S&P 500 by such a large margin that the index nearly looks like a flat line. Raven has gained more than 5,200% while the market is up 335%.

What’s also impressive is that Raven is still below its all-time high from three years ago. Notice how the chart shows several downdrafts, but each time, Raven has bounced back.

Raven has a market cap of $1.6 billion and only four analysts cover it. Compare that with Facebook (FB) which has over 50.

Raven’s business got hit hard during the lockdown, but it’s coming back nicely. Raven’s fiscal year ends at the end of January. The Q1 report came out a few weeks ago. In it, Raven said it made 26 cents per share which nearly doubled estimates. That’s up from 11 cents per share one year ago. Quarterly sales rose 30% to $112.5 million.

Raven isn’t on our Buy List this year, but if it were to fall to a decent valuation, like it did a year ago, it would be an attractive addition to our Buy List.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. Don’t forget to sign up for our premium newsletter.

Posted by Eddy Elfenbein on June 8th, 2021 at 5:23 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His