CWS Market Review – November 16, 2021

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

Angry People Shopping

The S&P 500 fell just shy of another new all-time high today. Alas, the index closed at 4,700.90 which is just 0.8 points below last Monday’s close of 4,701.70. This would have been our 66th new high of the year. In 1995, the S&P 500 made 77 new highs. That’s probably a new high bridge too far. Still, when stocks are involved, never say never.

Apparently, higher inflation isn’t scaring away U.S. consumers. This morning, the Census Bureau reported that retail sales rose by 1.7% last month.

That’s a very strong number and it topped Wall Street’s expectation for an increase of 1.5%.

Retail sales is an important report to keep an eye on because it reflects the health of consumers, and consumers appear to be very happy even though that’s not what they’re saying. Last week, we learned that, thanks to inflation, consumer confidence had fallen to a 10-year low.

It’s as if there’s a big disconnect in the minds of consumers. They’re upset and quitting their jobs in record numbers, yet retail sales and the stock market are at all-time highs. At the same time, folks are spending money freely at the mall despite the highest inflation in 30 years. The new economic paradigm appears to be distressed people shopping.

Over the last year, retail sales are up 16.3%. The figures for August and September were revised higher as well.

Of course, the reason companies are raising prices is because they can get away with it. While these numbers are seasonally adjusted, they’re not adjusted for inflation. Even after we adjust for inflation, retail sales are still above trend.

This reminds me of the old joke. A guy says that he just filled up his tank and that prices are way too high. An economist explains that if he filled up his tank, then prices aren’t too high.

Analysts also like to look at the “core” retail sales figure which excludes autos. For October, core retail sales were up 1.7% while Wall Street had been expecting just 1.0%. Simply put, if folks have the money, they’re ready to go shopping. Being cooped up for so long does that.

Obviously, inflation is impacting how Americans shop and that’s very evident at the pump. During October, gasoline sales rose by 3.9%. In the last year, sales at gas stations are up more than 46%. That’s eating away at a lot of the wage gains we’ve seen.

In the last year, sales at bars and restaurants are up close to 30% and sales at clothing stores are up more than 25%.

This morning, we also got another retail sales report that’s nearly as important—Walmart (WMT) reported earnings.

For its fiscal Q3, the retail giant had sales of $140.5 billion. Dear Lord, that’s huge. That works out to more than $1 million every minute of every hour for the entire quarter.

It’s interesting to note that Walmart grew its business rapidly during the 1960s and 70s as it became known as an inflation fighter.

For the quarter, Walmart made $1.45 per share. That beat the Street’s forecast of $1.40 per share. For last year’s Q3, Walmart rang up sales of $134.7 billion and had earnings of $1.34 per share. In the U.S., Walmart’s same-store sales rose by 11.1%.

Walmart also raised its full-year earnings guidance to $6.40 per share. The previous range was $6.20 to $6.35 per share. My apologies to the folks who compile the government’s retail sales report, but if Walmart is happy, that means that average American shopper is happy.

The dynamics of the labor market are changing. The WSJ wrote, “In January 2019, 42% of employment ads for insurance sales agents called for a bachelor’s degree, the data show. In September 2021, 26% did.” Goldman Sachs said that low-wage workers are seeing “eye-popping” wage gains. Amazon is looking to hire 150,000 seasonal workers starting at $18 per hour, with sign-up bonuses of up to $3,000.

The report on homebuilder confidence also came out this morning, and it showed many of the same trends. It’s especially noteworthy that homebuilders are so buoyant because home prices have risen so sharply.

On top of that, the homebuilders are facing a labor shortage and supply chain issues. That’s not slowing them down. In October, the homebuilder confidence index rose to 83. That’s the highest since May. In fact, homebuilders have had to increase wait times for new homes. There’s not much they can do.

Keeping with homebuilders, Home Depot (HD) also had a very impressive earnings report today. Like Walmart, HD’s report reflects broader optimism for the economy. For its Q3, Home Depot made $3.92 per share and sales rose nearly 10% to $36.82 billion. Expectations were for earnings of $3.41 per share on revenue of $24.8 billion.

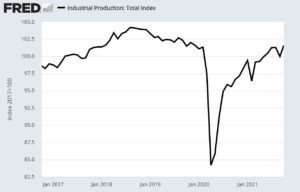

The government said that industrial production rose 1.6% last month. That’s another strong number and it beat estimates for 1% growth. Much of the gain was due to the recovery from Hurricane Ida. Still, this morning’s report signaled an important event. Industrial production is back to where it was before the pandemic.

Abbott Labs Hits New All-Time High

I want to say a few words about Abbott Labs (ABT), one of our Buy List stocks. In June, the stock got slammed after the company lowered its earnings guidance for this year. The shares lost 9.3% in one day.

As we know, the stock market loves to sell first and ask questions later. But if people had bothered to look at the news, they would have seen that Abbott was in fine shape. In the premium issue, I wrote, “Don’t let this week’s drop scare you. Abbott is a very sound company.”

We were right. Since then, Abbott has made back everything it lost, and the shares made a new all-time high today.

So much of good investing is simply waiting for bad news to hit good stocks. People panic at the sign of bad news, and that gives patient investors a nice bargain. Wall Street is the only place where they announce a sale and everyone heads for the exits.

Let’s go back to January when Abbott projected earnings for this year of at least $5 per share. That was a bold forecast as Wall Street had only been expecting earnings of $4.37 per share. For context, Abbott made $3.65 per share last year.

In June, the company lowered its full-year forecast to a range of $4.30 to $4.50 per share. While that’s lower guidance, it’s still impressive growth over last year.

Abbott had been doing very well during the pandemic. In January, the company said it expected full-year 2021 earnings of $5 per share. That’s growth of 35%. But on Tuesday, Abbott said it now sees 2021 earnings ranging between $4.30 and $4.50 per share.

At the time, Abbott said:

The updated guidance is due to significantly lower recent and projected COVID-19 diagnostic testing demand. This has been driven by several factors, including significant reductions in cases in the U.S. and other major developed countries, accelerated rollout of COVID-19 vaccines globally and, most recently, U.S. health authority guidance on testing for fully vaccinated individuals.

While it’s positive that these external events and trends signal an accelerated return to normalcy for many countries, they have suddenly and fundamentally impacted market demand for COVID-19 testing, particularly for surveillance and screening with rapid testing.

This was a great time to buy. Ever since, the news from Abbott has been very positive. In July, Abbott reported strong earnings ($1.17 vs $1.02). Quarterly sales rose 39.5% to $10.2 billion.

On October 20, Abbott released its Q3 earnings report, and the results were outstanding. For the quarter, Abbott made $1.40 per share on sales of $10.9 billion. That was a huge beat. Wall Street had been expecting 94 cents per share.

But the best news is that Abbott raised its full-year guidance to a range of $5.00 to $5.10 per share. In other words, their earnings guidance is higher now than it was before the downgrade.

This is exactly why we stick with high-quality stocks. As Peter Lynch said, “the real key to making money in stocks is not to get scared out of them.”

The new range translates to Q4 earnings guidance of $1.11 to $1.21 per share. Wall Street had been expecting $1.02 per share. By the way, Abbott has increased its dividend every year for the last 49 years in a row. Expect to see #50 in a few weeks. Last year, Abbott increased its dividend by 25%.

Shares of Abbott reached an all-time high today of $131.60 per share. That’s 25% above the June low.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. Don’t forget to sign up for our premium newsletter.

Posted by Eddy Elfenbein on November 16th, 2021 at 6:08 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His