CWS Market Review – November 23, 2021

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

Biden Reappoints Powell

Yesterday, President Biden appointed Jay Powell to another four-year term as Chairman of the Federal Reserve Board. The stock market liked the news, at least at first. Early on Monday, the S&P 500 rallied nearly 1% and it reached an all-time intra-day high. Alas, it was not to last. The market gave back those gains and closed lower. The market gods giveth and the market gods taketh away.

What does the Powell nomination mean for us as investors? It’s definitely a positive, and that was reflected in yesterday’s early rally. Powell has shown himself to be attentive to the mood of Wall Street without being overly deferential. Once Covid broke out, he moved quickly on interest rates. You can’t argue with the market’s performance since the low from last March.

Several weeks ago, the Powell nomination seemed to be a no-brainer. Powell is as institutional-Washington as you can get. Recently, there were growing noises of dissent, especially from liberal Democrats like Senator Elizabeth Warren who favored Fed Governor Lael Brainard. Interestingly, there haven’t been quite the noises of discontent considering the explosion in the Fed’s balance sheet along with the worst inflation in 30 years.

Senator Warren criticized Powell as being weak on bank regulation and for what she perceived to be his distance to a climate change agenda. Perhaps sensing the challenge, President Biden nominated Brainard as the Fed’s Vice-Chair.

From the WSJ:

The president’s decision reflected a desire by Mr. Biden to maintain stability at the central bank amid public concerns about high prices for everything from groceries to fuel, administration officials said. Mr. Biden’s advisers said they want to focus much of their attention on passage of their social spending and climate legislation and believe Mr. Powell will more easily win Senate confirmation, despite objections from progressives.

“Put directly: at this moment both of enormous potential and enormous uncertainty for our economy, we need stability and independence at the Federal Reserve. Jay has proven the independence that I value in a Fed chair,” Mr. Biden said at the White House on Monday.

I suspect that Treasury Secretary Janet Yellen, a former Fed chair herself, pushed for Powell. I think it’s interesting that previous Fed chairs have been professional economists. Powell, instead, is a lawyer and as such, he tends to be much more direct than his predecessors. Previous Congressional appearances often sounded like a professor teaching a remedial econ class. (Actually, it kind of was.)

Alan Greenspan famously told Congress, “I guess I should warn you, if I turn out to be particularly clear, you’ve probably misunderstood what I’ve said.” That’s not an issue with Powell.

For Biden, Powell Is a Safe Choice

There’s a little confusion as to how the Fed is run. Powell actually gets two nominations. One is as a member of the Federal Reserve Board. Another is as chairman of that board. The nomination to the Fed Board is a 14-year term. There are seven spots, so it means the president can add a new member every other year.

In reality, few members of the Fed board serve that long, but Fed chairs tend to stick around. In the last 70 years, there have 14 presidents but only eight Fed chairmen.

Powell was nominated by President Obama to the Federal Reserve Board in 2012 for a term that ended in 2014. He was re-nominated by Obama to that position which lasts all the way to 2028, assuming he wants to hang around that long.

Four years ago, President Trump nominated Powell to be Fed Chair. He was confirmed by the Senate 83-14. Interestingly, one of the dissenting votes came from then-Senator Kamala Harris. I doubt Powell will run into much difficulty in getting approval from the Senate, and that’s probably a reason why Biden went with him. I expect some senators will oppose Powell and cite the Fed’s record on inflation. They certainly have a point. Still, Powell has worked to make the Fed more transparent.

The Federal Reserve Board is different from the rate-setting committee which is the Federal Open Market Committee. My apologies, but this is where things get wonky. The FOMC is a 12-member committee which includes the seven members of the Federal Reserve Board, plus five of the 12 regional bank presidents. One exception is that the president of the New York Fed is always a member. The other seats rotate among the 11 other regional banks.

This may sound surprising to modern ears but the prominence of the Federal Reserve has increased dramatically over the past 40 years. Not that long ago, the Fed wasn’t that big a deal. It wasn’t in the news that much. In fact, the Fed didn’t even announce changes to interest rates. Fed watchers had to figure it out. That’s all changed for the better.

Technically, it’s possible for the Fed chair to be overruled on an interest-rate decision. It’s happened before, but it would a major story if it happened today. Now the Fed aims for consensus and most of the policy statements are bland and uninteresting. It’s not the Fed’s fault. That’s how the market likes it.

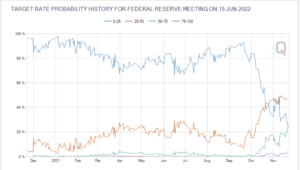

There’s been a big change in the market’s outlook for interest rates. Here’s an interesting chart from the futures market.

Two months ago, traders thought there was less than a 10% chance that the Fed would hike interest rates by June. Now they think there’s a 75%, which is probably about 24.5% too low.

Why the big change? The answer is Jay Powell. This is a good example of the Fed being transparent about its intentions. Powell can be criticized on many levels but he’s not to blame for there being a lack of political will to fight inflation.

The President today released 50 million barrels of oil from the Strategic Petroleum Reserve. While the intentions are good, the effect is probably minimal. Fifty million barrels may sound like a lot, but the U.S. economy will go through that quickly. Some other countries are doing the same to their reserves.

Ultimately, inflation is a political problem not unlike parking in a big city. It’s allowed to grow unchecked until enough people start to complain about it. We’re not there just yet. I’ll give you an example. The inflation-adjusted yield on the 10-year Treasury is now around -1%. That’s crazy low and it shows you why the stock market has been such an obvious alternative for investors.

Not only have valuations improved, but so, too, have the fundamentals for the stock market. At the beginning of this year, Wall Street had been expecting the S&P 500 to report Q4 earnings of $44.27 per share. That’s the index-adjusted number. Now expectations are up to $50.52 per share.

The stock market has been remarkably calm recently. Today was the 28th day in a row in which the S&P 500 closed up or down by less than 1%. Twenty-one of those days were moves of less than 0.5%.

Typically, volatility reflects what the stock market just did rather than being a forecast of what it will do. A rising market tends to be a calm one. A plunging market is a chaotic one. Most of the big swings in stock market history have come when the indexes were well off their highs. The S&P 500 reached an all-time closing high on Thursday and an intra-day high yesterday.

The stock market will be closed on Thursday for Thanksgiving. Due to the holiday, we’re going to get a crush of economic reports tomorrow. The jobless-claims report, which usually comes out each Thursday, will come out on Wednesday. The last report showed another post-Covid low.

The government will also update its Q3 GDP report. The initial report last month indicated growth of just 2%. That’s not that good. It will be interesting to see if it gets revised higher.

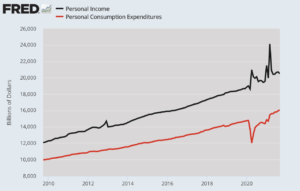

Usually, the day after the GDP report comes out, we get the reports on personal income and spending (see below). This time, they will come out the same day. So far, consumer spending has held up well despite growing dissatisfaction with the economy. If that’s not enough, we’ll also get reports on new-home sales and consumer confidence, and also the minutes to the last Fed meeting are due out.

The stock market will be open on Friday, but it will close at 1 p.m. ET. This is usually the slowest trading day of the year.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. Don’t forget to sign up for our premium newsletter.

Posted by Eddy Elfenbein on November 23rd, 2021 at 7:10 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His